By

How The US Dollar Has Performed, By President

https://ift.tt/IbFoXeQ

Since Trump’s inauguration, the U.S. dollar has been highly sensitive to tariff announcements given its role in global trade and economic confidence.

The dollar strengthened after tariff threats against China, Mexico, and Canada, it later fell once they were suspended in January.

While trade policy remains uncertain, some predict the dollar will strengthen over the next few years, but then pullpack amid swelling U.S. debt accelerated by Trump’s tax cuts.

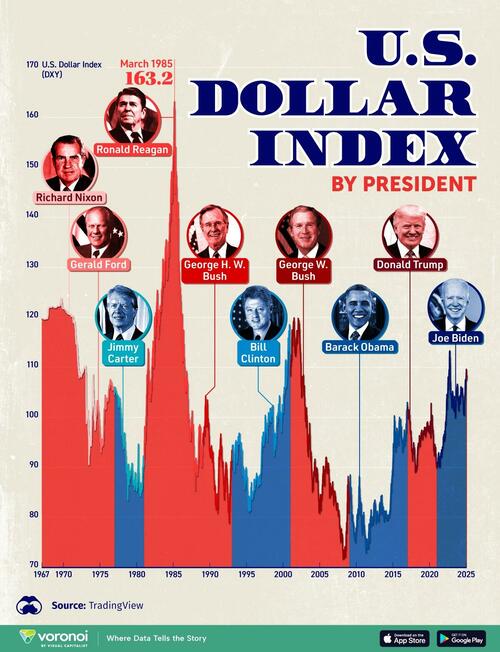

This graphic, via Visual Capitalist's Dorothy Neufeld, shows the performance of the U.S. Dollar Index by president since 1967, based on data from TradingView.

The U.S. Dollar Under Every President Since 1967

Below, we show trends in the U.S. Dollar Index (DXY) across each president since Richard Nixon.

The DXY measures the value of the dollar against six major currencies as a way to track its relative performance or weakness. When the U.S. economy is strong relative to global economies, the value of the DXY often rises, given higher demand for the safe haven asset.

In 1985, the DXY ascended to record highs during Ronald Reagan’s presidency when the federal funds rate reached 18%.

These high rates made holding U.S. dollars more attractive, and America’s relative economic strength played a role in driving investor sentiment.

At the time, the sharp appreciation of the dollar contributed to a substantial trade deficit as American goods became increasingly expensive while imports were cheap. To curb the dollar’s rise, global leaders struck a deal in 1985 called the Plaza Accord, which contributed to its 40% decline over the next two years.

By contrast, the dollar hit all-time lows in 2008 during the global financial crisis under George W. Bush. At the end of 2008, the Federal Reserve cut interest rates to near-zero amid deteriorating labor market conditions. Amid concerns of a slow economic recovery, investors looked to gold and other higher-yielding currencies.

Will the U.S. Dollar Index Continue Rising?

Over 2024, the dollar’s uptrend was underscored by America’s economic dynamism while Europe and China faced muted GDP growth.

This trend could continue if Trump follows through on tariffs for a number of reasons. First, tariffs could rekindle inflation, leading the Federal Reserve to keep interest rates elevated, which could cause the dollar to strengthen. Secondly, tariffs could cause economic weakness in other countries, improving America’s relative strength, creating higher demand for the currency.

However, tariffs run the risk of dampening the U.S. economy, which could weigh on the dollar.

While Trump’s position on the dollar is contradictory—he wants it to maintain its dominance but advocates for competitive weakening to boost U.S. exports—all eyes will be watching if tariffs serve as bargain chips or materialize into new sweeping policies.

To learn more about this topic from a global perspective, check out this graphic on the performance of the U.S. dollar against major currencies in 2024.

Loading...

news

via Government Slaves https://ift.tt/iAyND6o

February 12, 2025 at 07:03AM

February 12, 2025 at 08:06AM

via ZeroHedge News https://ift.tt/IbFoXeQ