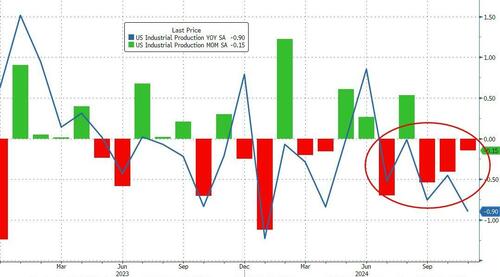

US Industrial Production tumbled for the third straight month in November (and 4th of the last 5). The 0.1% MoM decline (vs +0.3% exp) - following a downwardly revised 0.4% drop the month prior - dragged production down 0.9% YoY (the worst drop since January)...

Source: Bloomberg

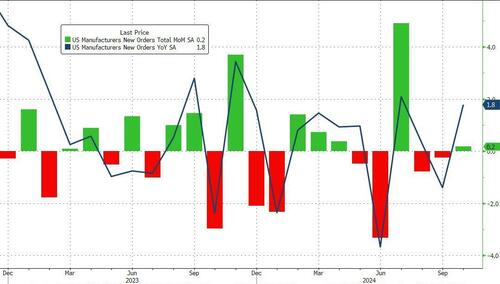

Factory Orders rose 0.2% MoM - after a downwardly revised 0.7% slide a month earlier - (considerably weaker than the +0.5% MoM expected)...

Source: Bloomberg

Ex-Transportation, the picture was a little more rosy with core factory orders up a modest 0.13% MoM rise lifting YoY production by 1.13%...

Source: Bloomberg

Output at utilities fell by the most in four months, while mining posted the largest decline since May.

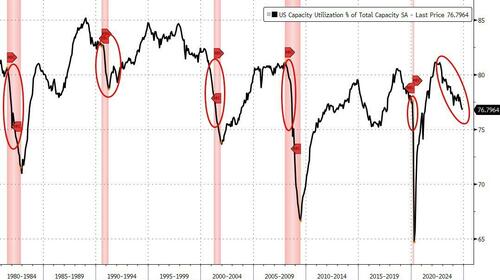

Finally, capacity utilization fell to 76.8% (the lowest since April 2021) and well below expectations...

Source: Bloomberg

...but, but, but it's not a recession!

US Industrial Production tumbled for the third straight month in November (and 4th of the last 5). The 0.1% MoM decline (vs +0.3% exp) - following a downwardly revised 0.4% drop the month prior - dragged production down 0.9% YoY (the worst drop since January)...

Source: Bloomberg

Factory Orders rose 0.2% MoM - after a downwardly revised 0.7% slide a month earlier - (considerably weaker than the +0.5% MoM expected)...

Source: Bloomberg

Ex-Transportation, the picture was a little more rosy with core factory orders up a modest 0.13% MoM rise lifting YoY production by 1.13%...

Source: Bloomberg

Output at utilities fell by the most in four months, while mining posted the largest decline since May.

Finally, capacity utilization fell to 76.8% (the lowest since April 2021) and well below expectations...

Source: Bloomberg

...but, but, but it's not a recession!