As we start a new month, it is set to be a busier week after the lull of Thanksgiving, with a lot of focus on various important US employment data culminating in payrolls on Friday, a number that could influence the fairly tight December 18th Fed decision. As DB's Jim Reid notes, the US ISM indices (today and Wednesday), some global PMIs, and the University of Michigan's consumer survey (Friday) are also due with inflation expectations within the survey fascinating after last month saw the joint highest (3.2%) for the 5-10yr expectations series since 2011. From central banks, speakers include Fed Chair Powell and ECB President Lagarde (both Wednesday).

In terms of the US employment data, Deutsche Bank's forecast for Friday's payrolls is +215k (consensus +200k) with private payrolls at +185k (consensus +200k). Last month the data printed at +12k and -46k, respectively, with weather and strikes impacting the numbers. For private payrolls it was the first negative print since December 2020 during the winter Covid wave. The DB economist forecast assumes 75k of positive payback split equally between weather and returning strikers. DB and consensus expect the unemployment rate to hold at 4.1%. Prior to this we have JOLTS (tomorrow), ADP (Wednesday) and the employment components of today manufacturing ISM and Wednesday's services equivalent. JOLTS is always one month behind payrolls (e.g. October) so it will be influenced by the weather disruptions we had that month.

Over in Europe, a number of economic activity indicators are due for the main economies including factory orders (Thursday), industrial production and the trade balance for Germany (both Friday). Industrial production (Thursday) and the trade balance (Friday) are also due for France. Otherwise there will also be November CPI prints in Switzerland (Tuesday) and Sweden (Thursday).

In Asia, Japan's wages and consumption activity are out on Friday. In Australia, Q3 GDP will be released on Wednesday. Briefly rounding off with geopolitics, South Africa took over the G20 presidency from Italy yesterday and the OPEC and non-OPEC ministerial meeting (online) will be held on Thursday as supply remains in focus.

Also watch France today as the National Assembly starts to review social security within the budget bill. If Barnier uses article 49.3 to push through the bill without a vote, it is feasible a no-confidence motion could come as early as today if the premier doesn't take into account the demands of the far-left and far-right. Le Pen in particular has been very hawkish over the weekend, suggesting that her extra budget demands need to be met today.

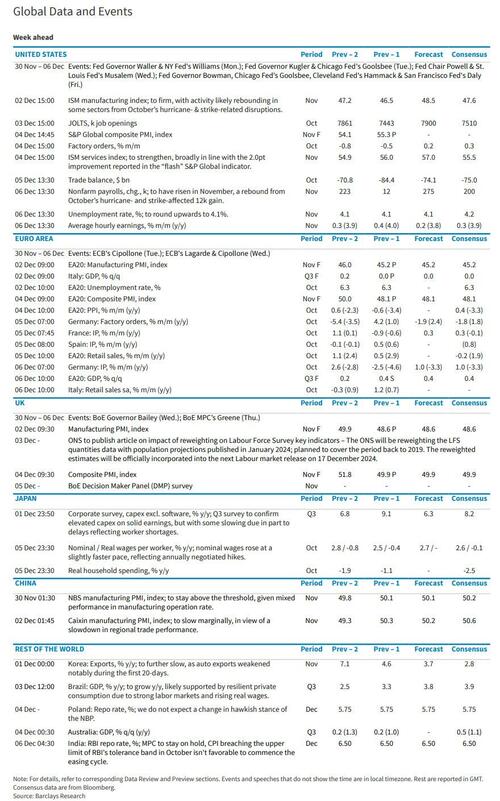

Courtesy of DB, here is a day-by-day calendar of events

Monday December 2

- Data: US November ISM index, October construction spending, China November Caixin manufacturing PMI, UK November Lloyds Business Barometer, Japan November monetary base, Italy November manufacturing PMI, budget balance, new car registrations, October unemployment rate, Eurozone October unemployment rate, Canada November manufacturing PMI

- Central banks: Fed's Waller and Williams speak

Tuesday December 3

- Data: US October JOLTS report, November total vehicle sales, France October budget balance, Switzerland November CPI

- Central banks: Fed's Kugler and Goolsbee speak, ECB's Cipollone speaks

- Earnings: Salesforce, Marvell, Okta

Wednesday December 4

- Data: US November ADP report, ISM services, October factory orders, China November Caixin services PMI, UK November official reserves changes, Italy November services PMI, Eurozone October PPI, Canada Q3 labor productivity, November services PMI, Australia Q3 GDP

- Central banks: Fed's Beige book, Chair Powell and Musalem speak, ECB's President Lagarde, Cipollone and Nagel speak

- Earnings: Synopsis, Dollar Tree, Foot Locker

- Other: OECD economic outlook

Thursday December 5

- Data: US October trade balance, initial jobless claims, UK November new car registrations, construction PMI, Japan October labor cash earnings, household spending, Germany November construction PMI, October factory orders, France October industrial production, Eurozone October retail sales, Canada October international merchandise trade, Sweden November CPI

- Central banks: BoJ's Nakamura speaks, BoE's Greene speaks

- Earnings: Dollar General, Kroger, HPE, Lululemon

Friday December 6

- Data: US November jobs report, December University of Michigan survey, October consumer credit, Japan October leading and coincident index, Germany October trade balance, industrial production, France October current account balance, trade balance, Italy October retail sales, Canada November jobs report

- Central banks: Fed's Bowman, Goolsbee, Hammack and Daly speak

* * *

Focusing just on the US, Goldman writes that the key economic data releases this week are the ISM manufacturing index on Monday, the ISM services index on Wednesday, and the employment report on Friday. There are several speaking engagements from Fed officials this week, including a speech on the economic outlook by Governor Waller on Monday.

Monday, December 2

- 09:45 AM S&P Global US manufacturing PMI, November final (consensus 49.0, last 48.8)

- 10:00 AM Construction spending, October (GS +0.3%, consensus +0.2%, last +0.1%)

- 10:00 AM ISM manufacturing index, November (GS 47.0, consensus 47.6, last 46.5): We estimate the ISM manufacturing index rebounded in November (+0.5pt to 47.0), reflecting convergence toward the level implied by other manufacturing surveys (GS manufacturing survey tracker at 49.1) and neutral seasonality.

- 03:15 PM Fed Governor Waller speaks: Fed Governor Christopher Waller will give the keynote speech at the American Institute for Economic Research Monetary Conference.

- 04:30 PM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will give keynote remarks to the Queens Chamber of Commerce. Speech text and a Q&A are expected. On November 21, Williams said “Based on the cooling of the labor market in the past few years and the disinflationary progress we have made, it is pretty clear that monetary policy is restrictive today. That is why it was very appropriate to cut the federal-funds rate in our past two meetings. My guess is the fed-funds rate will be lower by the end of next year than it is today. It will depend on the data and the progress we make.”

Tuesday, December 3

- 10:00 AM JOLTS job openings, October (GS 7,600k, consensus 7,470k, last 7,443k): We estimate that JOLTS job openings rebounded slightly in October (+0.2mn to 7.6mn), reflecting convergence to the level suggested by online job postings.

- 03:45 PM Chicago Fed President Goolsbee (FOMC non-voter) speaks: Chicago Fed President Austan Goolsbee will give closing remarks at the Midwest Agriculture Conference. A livestream is expected. On November 15, Goolsbee said “I think the throughline is that as long as we continue making progress toward the 2% inflation goal, over the next 12-18 months, rates will be a lot lower than where they are now. That’s where we need to settle.” He went on to say “We’re not in a hurry to automatically get there. And I think if there’s disagreement over what’s the neutral rate, it does make sense at some point to start slowing how rapidly you’re getting there just to figure out, given the lags in monetary policy, are we at neutral? Are we getting close to neutral?”

- 05:00 PM Lightweight motor vehicle sales, November (GS 16.2mn, consensus 16.0mn, last 16.0mn)

Wednesday, December 4

- 08:15 AM ADP employment change, November (GS +135k, consensus +158k, last +233k)

- 08:45 AM St. Louis Fed President Musalem (FOMC non-voter) speaks: St. Louis Fed President Alberto Musalem will give a keynote address at the College of Central Bankers Symposium. Speech text and a Q&A are expected. On November 14, Musalem said “Further easing toward a neutral policy stance will be appropriate to support employment if inflation continues to converge toward 2%,” but cautioned that “recent information suggests that the risk of inflation ceasing to converge toward 2%, or moving higher, has risen, while the risk of an unwelcome deterioration in the labor market has remained unchanged or possibly fallen.”

- 09:45 AM S&P Global US services PMI, November final (consensus 57.0, last 57.0)

- 10:00 AM ISM services index, November (GS 55.0, consensus 55.5, last 56.0): We estimate that the ISM services index declined 1.0pt to 55.0 in November, reflecting sequential softening in our non-manufacturing survey tracker (-0.3pt to 55.0 in November) and payback for an outsized increase in the supplier deliveries component in the prior month.

- 10:00 AM Factory orders, October (GS +0.1%, consensus +0.4%, last -0.5%): Factory orders ex-transportation, October (last +0.1%)

- 02:00 PM Beige Book, December meeting period: The Fed’s Beige Book is a summary of regional economic anecdotes from the 12 Federal Reserve districts. The Beige Book for the November FOMC meeting period noted that economic activity was roughly unchanged since September, although two districts reported modest growth. Hurricanes Helene and Milton were said to have impacted crops and “prompted pauses in business activity and tourism” in the Southeast. In this month’s Beige Book, we look for anecdotes related to the evolution of labor demand and firms’ expectations of activity growth for the remainder of the year.

Thursday, December 5

- 08:30 AM Trade balance, October (GS -$77.0bn, consensus -$74.9bn, last -$84.4bn)

- 08:30 AM Initial jobless claims, week ended November 30 (GS 210k, consensus 215k, last 213k); Continuing jobless claims, week ended November 23 (consensus 1,904k, last 1,907k): We estimate that initial jobless claims edged slightly lower in the week ended November 30th. We would note that initial claims tend to be more volatile in November and December—likely reflecting difficulties with seasonally adjustment around the holidays—and that this week’s reference period coincides with Thanksgiving, which could contribute to additional volatility.

Friday, December 6

- 08:30 AM Nonfarm payroll employment, November (GS +235k, consensus +200k, last +12k); Private payroll employment, November (GS +205k, consensus +200k, last -28k); Average hourly earnings (MoM), November (GS +0.2%, consensus +0.3%, last +0.4%); Average hourly earnings (YoY), November (GS +3.8%, consensus +3.9%, last +4.0%); Unemployment rate, November (GS 4.1%, consensus 4.1%, last 4.1%); Labor force participation rate, November (GS 62.7%, consensus 62.7%, last 62.6%): We estimate nonfarm payrolls rose 235k in November. Big Data indicators indicated a sequentially stronger pace of job creation, and we estimate that the end of the hurricanes that weighed on October job growth will likely boost November job growth by 50k. The Bureau of Labor Statistics indicated that workers returning from strikes, including those at Boeing, will boost November payroll growth by 37.5k on net. We assume above-trend (albeit moderating) contributions from the recent surge in immigration and catch-up hiring. On the negative side, we estimate that a later-than-usual Thanksgiving and Black Friday could weigh on retail hiring by roughly 15k. We estimate that the unemployment rate was unchanged at 4.1%, reflecting a rebound in the labor force participation rate and solid household employment growth. We estimate average hourly earnings rose 0.2% (month-over-month, seasonally adjusted), which would lower the year-over-year rate to 3.8%, reflecting a drag from the reversing impact of the hurricanes.

- 10:00 AM University of Michigan consumer sentiment, December preliminary (GS 72.2, consensus 73.3, last 71.8): University of Michigan 5-10-year inflation expectations, December preliminary (GS 3.1%, last 3.2%)

- 10:30 AM Chicago Fed President Goolsbee (FOMC non-voter) speaks: Chicago Fed President Austan Goolsbee will participate in a fireside chat as part of the Chicago Fed's Annual Economic Outlook Symposium. A Q&A is expected.

- 12:00 PM Cleveland Fed President Hammack (FOMC voter) speaks: Cleveland Fed President Beth Hammack will give a speech on the economic outlook. Speech text and a Q&A are expected.

- 01:00 PM San Francisco Fed President Daly (FOMC voter) speaks: San Francisco Fed President Mary Daly will speak in a moderated conversation at an event hosted by Stanford University's Hoover Institution. A Q&A is expected.

Source: DB, Goldman

As we start a new month, it is set to be a busier week after the lull of Thanksgiving, with a lot of focus on various important US employment data culminating in payrolls on Friday, a number that could influence the fairly tight December 18th Fed decision. As DB's Jim Reid notes, the US ISM indices (today and Wednesday), some global PMIs, and the University of Michigan's consumer survey (Friday) are also due with inflation expectations within the survey fascinating after last month saw the joint highest (3.2%) for the 5-10yr expectations series since 2011. From central banks, speakers include Fed Chair Powell and ECB President Lagarde (both Wednesday).

In terms of the US employment data, Deutsche Bank's forecast for Friday's payrolls is +215k (consensus +200k) with private payrolls at +185k (consensus +200k). Last month the data printed at +12k and -46k, respectively, with weather and strikes impacting the numbers. For private payrolls it was the first negative print since December 2020 during the winter Covid wave. The DB economist forecast assumes 75k of positive payback split equally between weather and returning strikers. DB and consensus expect the unemployment rate to hold at 4.1%. Prior to this we have JOLTS (tomorrow), ADP (Wednesday) and the employment components of today manufacturing ISM and Wednesday's services equivalent. JOLTS is always one month behind payrolls (e.g. October) so it will be influenced by the weather disruptions we had that month.

Over in Europe, a number of economic activity indicators are due for the main economies including factory orders (Thursday), industrial production and the trade balance for Germany (both Friday). Industrial production (Thursday) and the trade balance (Friday) are also due for France. Otherwise there will also be November CPI prints in Switzerland (Tuesday) and Sweden (Thursday).

In Asia, Japan's wages and consumption activity are out on Friday. In Australia, Q3 GDP will be released on Wednesday. Briefly rounding off with geopolitics, South Africa took over the G20 presidency from Italy yesterday and the OPEC and non-OPEC ministerial meeting (online) will be held on Thursday as supply remains in focus.

Also watch France today as the National Assembly starts to review social security within the budget bill. If Barnier uses article 49.3 to push through the bill without a vote, it is feasible a no-confidence motion could come as early as today if the premier doesn't take into account the demands of the far-left and far-right. Le Pen in particular has been very hawkish over the weekend, suggesting that her extra budget demands need to be met today.

Courtesy of DB, here is a day-by-day calendar of events

Monday December 2

- Data: US November ISM index, October construction spending, China November Caixin manufacturing PMI, UK November Lloyds Business Barometer, Japan November monetary base, Italy November manufacturing PMI, budget balance, new car registrations, October unemployment rate, Eurozone October unemployment rate, Canada November manufacturing PMI

- Central banks: Fed's Waller and Williams speak

Tuesday December 3

- Data: US October JOLTS report, November total vehicle sales, France October budget balance, Switzerland November CPI

- Central banks: Fed's Kugler and Goolsbee speak, ECB's Cipollone speaks

- Earnings: Salesforce, Marvell, Okta

Wednesday December 4

- Data: US November ADP report, ISM services, October factory orders, China November Caixin services PMI, UK November official reserves changes, Italy November services PMI, Eurozone October PPI, Canada Q3 labor productivity, November services PMI, Australia Q3 GDP

- Central banks: Fed's Beige book, Chair Powell and Musalem speak, ECB's President Lagarde, Cipollone and Nagel speak

- Earnings: Synopsis, Dollar Tree, Foot Locker

- Other: OECD economic outlook

Thursday December 5

- Data: US October trade balance, initial jobless claims, UK November new car registrations, construction PMI, Japan October labor cash earnings, household spending, Germany November construction PMI, October factory orders, France October industrial production, Eurozone October retail sales, Canada October international merchandise trade, Sweden November CPI

- Central banks: BoJ's Nakamura speaks, BoE's Greene speaks

- Earnings: Dollar General, Kroger, HPE, Lululemon

Friday December 6

- Data: US November jobs report, December University of Michigan survey, October consumer credit, Japan October leading and coincident index, Germany October trade balance, industrial production, France October current account balance, trade balance, Italy October retail sales, Canada November jobs report

- Central banks: Fed's Bowman, Goolsbee, Hammack and Daly speak

* * *

Focusing just on the US, Goldman writes that the key economic data releases this week are the ISM manufacturing index on Monday, the ISM services index on Wednesday, and the employment report on Friday. There are several speaking engagements from Fed officials this week, including a speech on the economic outlook by Governor Waller on Monday.

Monday, December 2

- 09:45 AM S&P Global US manufacturing PMI, November final (consensus 49.0, last 48.8)

- 10:00 AM Construction spending, October (GS +0.3%, consensus +0.2%, last +0.1%)

- 10:00 AM ISM manufacturing index, November (GS 47.0, consensus 47.6, last 46.5): We estimate the ISM manufacturing index rebounded in November (+0.5pt to 47.0), reflecting convergence toward the level implied by other manufacturing surveys (GS manufacturing survey tracker at 49.1) and neutral seasonality.

- 03:15 PM Fed Governor Waller speaks: Fed Governor Christopher Waller will give the keynote speech at the American Institute for Economic Research Monetary Conference.

- 04:30 PM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will give keynote remarks to the Queens Chamber of Commerce. Speech text and a Q&A are expected. On November 21, Williams said “Based on the cooling of the labor market in the past few years and the disinflationary progress we have made, it is pretty clear that monetary policy is restrictive today. That is why it was very appropriate to cut the federal-funds rate in our past two meetings. My guess is the fed-funds rate will be lower by the end of next year than it is today. It will depend on the data and the progress we make.”

Tuesday, December 3

- 10:00 AM JOLTS job openings, October (GS 7,600k, consensus 7,470k, last 7,443k): We estimate that JOLTS job openings rebounded slightly in October (+0.2mn to 7.6mn), reflecting convergence to the level suggested by online job postings.

- 03:45 PM Chicago Fed President Goolsbee (FOMC non-voter) speaks: Chicago Fed President Austan Goolsbee will give closing remarks at the Midwest Agriculture Conference. A livestream is expected. On November 15, Goolsbee said “I think the throughline is that as long as we continue making progress toward the 2% inflation goal, over the next 12-18 months, rates will be a lot lower than where they are now. That’s where we need to settle.” He went on to say “We’re not in a hurry to automatically get there. And I think if there’s disagreement over what’s the neutral rate, it does make sense at some point to start slowing how rapidly you’re getting there just to figure out, given the lags in monetary policy, are we at neutral? Are we getting close to neutral?”

- 05:00 PM Lightweight motor vehicle sales, November (GS 16.2mn, consensus 16.0mn, last 16.0mn)

Wednesday, December 4

- 08:15 AM ADP employment change, November (GS +135k, consensus +158k, last +233k)

- 08:45 AM St. Louis Fed President Musalem (FOMC non-voter) speaks: St. Louis Fed President Alberto Musalem will give a keynote address at the College of Central Bankers Symposium. Speech text and a Q&A are expected. On November 14, Musalem said “Further easing toward a neutral policy stance will be appropriate to support employment if inflation continues to converge toward 2%,” but cautioned that “recent information suggests that the risk of inflation ceasing to converge toward 2%, or moving higher, has risen, while the risk of an unwelcome deterioration in the labor market has remained unchanged or possibly fallen.”

- 09:45 AM S&P Global US services PMI, November final (consensus 57.0, last 57.0)

- 10:00 AM ISM services index, November (GS 55.0, consensus 55.5, last 56.0): We estimate that the ISM services index declined 1.0pt to 55.0 in November, reflecting sequential softening in our non-manufacturing survey tracker (-0.3pt to 55.0 in November) and payback for an outsized increase in the supplier deliveries component in the prior month.

- 10:00 AM Factory orders, October (GS +0.1%, consensus +0.4%, last -0.5%): Factory orders ex-transportation, October (last +0.1%)

- 02:00 PM Beige Book, December meeting period: The Fed’s Beige Book is a summary of regional economic anecdotes from the 12 Federal Reserve districts. The Beige Book for the November FOMC meeting period noted that economic activity was roughly unchanged since September, although two districts reported modest growth. Hurricanes Helene and Milton were said to have impacted crops and “prompted pauses in business activity and tourism” in the Southeast. In this month’s Beige Book, we look for anecdotes related to the evolution of labor demand and firms’ expectations of activity growth for the remainder of the year.

Thursday, December 5

- 08:30 AM Trade balance, October (GS -$77.0bn, consensus -$74.9bn, last -$84.4bn)

- 08:30 AM Initial jobless claims, week ended November 30 (GS 210k, consensus 215k, last 213k); Continuing jobless claims, week ended November 23 (consensus 1,904k, last 1,907k): We estimate that initial jobless claims edged slightly lower in the week ended November 30th. We would note that initial claims tend to be more volatile in November and December—likely reflecting difficulties with seasonally adjustment around the holidays—and that this week’s reference period coincides with Thanksgiving, which could contribute to additional volatility.

Friday, December 6

- 08:30 AM Nonfarm payroll employment, November (GS +235k, consensus +200k, last +12k); Private payroll employment, November (GS +205k, consensus +200k, last -28k); Average hourly earnings (MoM), November (GS +0.2%, consensus +0.3%, last +0.4%); Average hourly earnings (YoY), November (GS +3.8%, consensus +3.9%, last +4.0%); Unemployment rate, November (GS 4.1%, consensus 4.1%, last 4.1%); Labor force participation rate, November (GS 62.7%, consensus 62.7%, last 62.6%): We estimate nonfarm payrolls rose 235k in November. Big Data indicators indicated a sequentially stronger pace of job creation, and we estimate that the end of the hurricanes that weighed on October job growth will likely boost November job growth by 50k. The Bureau of Labor Statistics indicated that workers returning from strikes, including those at Boeing, will boost November payroll growth by 37.5k on net. We assume above-trend (albeit moderating) contributions from the recent surge in immigration and catch-up hiring. On the negative side, we estimate that a later-than-usual Thanksgiving and Black Friday could weigh on retail hiring by roughly 15k. We estimate that the unemployment rate was unchanged at 4.1%, reflecting a rebound in the labor force participation rate and solid household employment growth. We estimate average hourly earnings rose 0.2% (month-over-month, seasonally adjusted), which would lower the year-over-year rate to 3.8%, reflecting a drag from the reversing impact of the hurricanes.

- 10:00 AM University of Michigan consumer sentiment, December preliminary (GS 72.2, consensus 73.3, last 71.8): University of Michigan 5-10-year inflation expectations, December preliminary (GS 3.1%, last 3.2%)

- 10:30 AM Chicago Fed President Goolsbee (FOMC non-voter) speaks: Chicago Fed President Austan Goolsbee will participate in a fireside chat as part of the Chicago Fed's Annual Economic Outlook Symposium. A Q&A is expected.

- 12:00 PM Cleveland Fed President Hammack (FOMC voter) speaks: Cleveland Fed President Beth Hammack will give a speech on the economic outlook. Speech text and a Q&A are expected.

- 01:00 PM San Francisco Fed President Daly (FOMC voter) speaks: San Francisco Fed President Mary Daly will speak in a moderated conversation at an event hosted by Stanford University's Hoover Institution. A Q&A is expected.

Source: DB, Goldman