Since the last FOMC meeting - on November 7th - the dollar and stocks have rallied while gold and oil have lagged as the dollar flatlined (amid significant volatility on the way from various macro data surprises)...

Source: Bloomberg

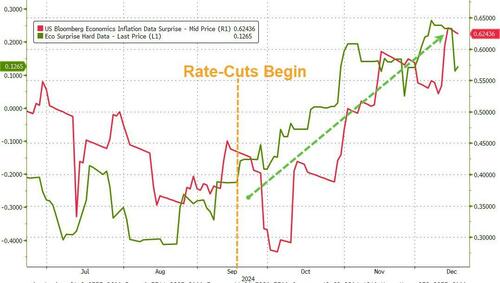

Most notable is the fact that inflation data has dramatically surprised to the upside and 'hard' data (excluding sentiment/surveys) has also soared since The Fed started its rate-cutting cycle...

Source: Bloomberg

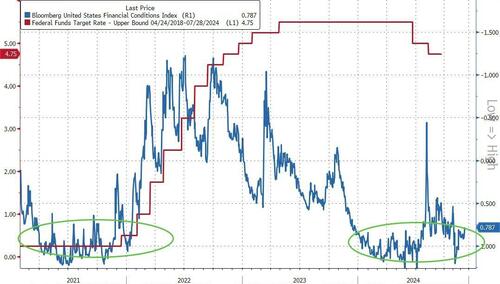

Bear in mind that financial conditions are at around the same 'looseness' or 'easiness' as they were before the Fed started the rate-hiking cycle...

Source: Bloomberg

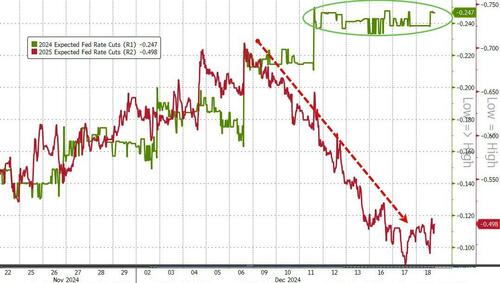

The market is fully priced for a cut today but as the chart below shows, expectations for 2025 cuts have collapsed...

Source: Bloomberg

...prompting many to expect a so-called 'hawkish cut' today.

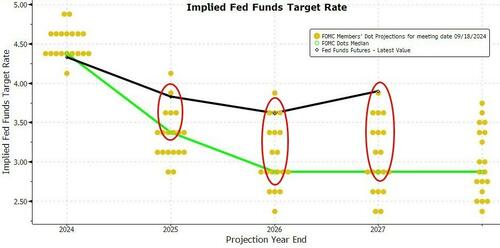

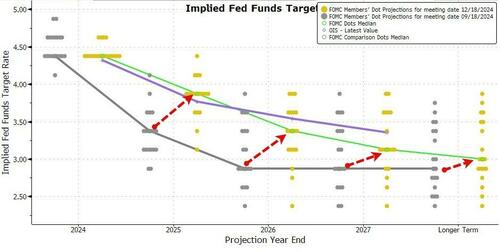

Fed members will also release a new Dot Plot today - we assume they will, as always, adjust towards the market which is currently dramatically more hawkish than the dots...

Source: Bloomberg

So what did The Fed do?

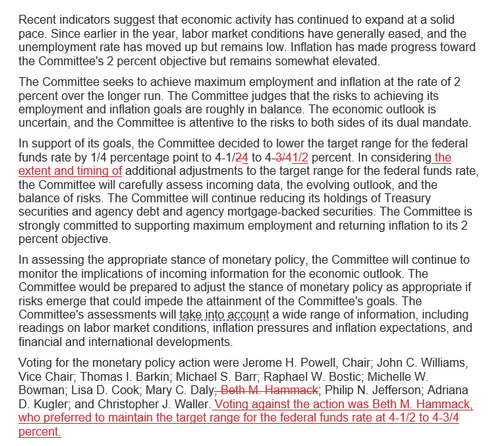

As expected and fully priced in, The Fed cut its benchmark rate by 25bps to 4.25%-4.50% target range.

The Fed also cut its overnight reverse repo facility rate from 4.55% to 4.25%.

Key highlights

-

*FED TO ASSESS DATA REGARDING EXTENT, TIMING OF FUTURE MOVES

-

*FED SAYS CLEVELAND'S HAMMACK DISSENTED IN FAVOR OF NO RATE CUT

The Fed's dots spiked significantly (as we warned), catching up to the market's more hawkish views:

The Fed also hiked its inflation forecast:

- *FOMC MEDIAN 2025 PCE INFLATION FORECAST RISES TO 2.5% VS 2.1%

The Fed has clearly decided that Trump's policies will be inflationary.

Now the question is - how will Powell spin this?

Read the redline of the statement below:

Since the last FOMC meeting - on November 7th - the dollar and stocks have rallied while gold and oil have lagged as the dollar flatlined (amid significant volatility on the way from various macro data surprises)...

Source: Bloomberg

Most notable is the fact that inflation data has dramatically surprised to the upside and 'hard' data (excluding sentiment/surveys) has also soared since The Fed started its rate-cutting cycle...

Source: Bloomberg

Bear in mind that financial conditions are at around the same 'looseness' or 'easiness' as they were before the Fed started the rate-hiking cycle...

Source: Bloomberg

The market is fully priced for a cut today but as the chart below shows, expectations for 2025 cuts have collapsed...

Source: Bloomberg

...prompting many to expect a so-called 'hawkish cut' today.

Fed members will also release a new Dot Plot today - we assume they will, as always, adjust towards the market which is currently dramatically more hawkish than the dots...

Source: Bloomberg

So what did The Fed do?

As expected and fully priced in, The Fed cut its benchmark rate by 25bps to 4.25%-4.50% target range.

The Fed also cut its overnight reverse repo facility rate from 4.55% to 4.25%.

Key highlights

-

*FED TO ASSESS DATA REGARDING EXTENT, TIMING OF FUTURE MOVES

-

*FED SAYS CLEVELAND'S HAMMACK DISSENTED IN FAVOR OF NO RATE CUT

The Fed's dots spiked significantly (as we warned), catching up to the market's more hawkish views:

The Fed also hiked its inflation forecast:

- *FOMC MEDIAN 2025 PCE INFLATION FORECAST RISES TO 2.5% VS 2.1%

The Fed has clearly decided that Trump's policies will be inflationary.

Now the question is - how will Powell spin this?

Read the redline of the statement below: