Despite the Israel-Lebanon truce holding (for now), oil prices inched higher overnight after API reported a sizable crude draw and on speculation that OPEC+ will delay restoring output.

“On one hand, OPEC+ appears to be reluctant to unwind, given concerns over weak oil demand and market consensus that 2025 looks like a surplus year for oil balances,” Citigroup Inc. analysts including Eric Lee wrote in a note.

“On the other hand, deeper cuts also seem unlikely, with prices still above $70 Brent, global observable oil inventories relatively low, and some geopolitical risk still in the market.”

Will the official data confirm API's?

API

-

Crude -5.9mm

-

Cushing -734k

-

Gasoline +1.8mm

-

Distillates +2.5mm

DOE

-

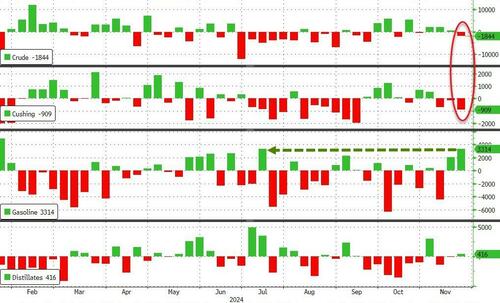

Crude -1.844mm

-

Cushing -909k

-

Gasoline +3.314mm

-

Distillates +416k

The official data confirmed a drawdown in crude stocks and at the Cushing hub while Gasoline inventories rose the most since July...

Source: Bloomberg

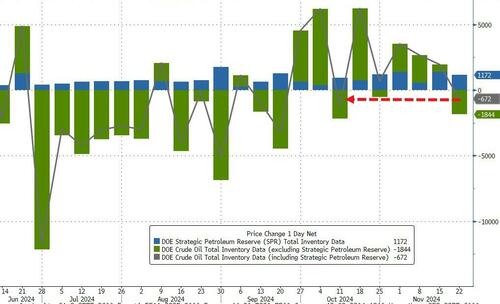

Overall, including a 1.17mm barrel add to SPR, crude inventories declined 672k barrels - the most since the second week of October...

Source: Bloomberg

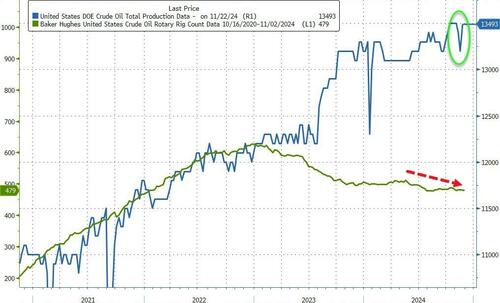

After last week' dip, US crude production ramped back up to record highs this week...

Source: Bloomberg

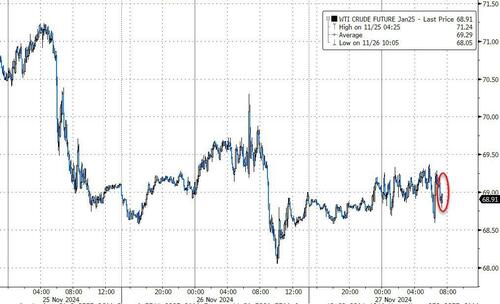

WTI dipped on the smaller than expected crude draw..

Source: Bloomberg

Price moves were exacerbated by thin pre-holiday trading, with open interest hovering near monthly lows.

Despite the Israel-Lebanon truce holding (for now), oil prices inched higher overnight after API reported a sizable crude draw and on speculation that OPEC+ will delay restoring output.

“On one hand, OPEC+ appears to be reluctant to unwind, given concerns over weak oil demand and market consensus that 2025 looks like a surplus year for oil balances,” Citigroup Inc. analysts including Eric Lee wrote in a note.

“On the other hand, deeper cuts also seem unlikely, with prices still above $70 Brent, global observable oil inventories relatively low, and some geopolitical risk still in the market.”

Will the official data confirm API's?

API

-

Crude -5.9mm

-

Cushing -734k

-

Gasoline +1.8mm

-

Distillates +2.5mm

DOE

-

Crude -1.844mm

-

Cushing -909k

-

Gasoline +3.314mm

-

Distillates +416k

The official data confirmed a drawdown in crude stocks and at the Cushing hub while Gasoline inventories rose the most since July...

Source: Bloomberg

Overall, including a 1.17mm barrel add to SPR, crude inventories declined 672k barrels - the most since the second week of October...

Source: Bloomberg

After last week' dip, US crude production ramped back up to record highs this week...

Source: Bloomberg

WTI dipped on the smaller than expected crude draw..

Source: Bloomberg

Price moves were exacerbated by thin pre-holiday trading, with open interest hovering near monthly lows.