In news that will act as a headwind for the U.S.'s re-emerging nuclear industry, it was reported last week that Russia is temporarily restricting enriched uranium exports to the U.S., raising supply concerns for reactors that produce nearly 20% of the nation's electricity.

Russia provided no details or timeline for its uranium export restrictions in a Friday Telegram statement, though utilities' advance purchasing likely mitigates immediate effects, Bloomberg wrote in a report on Friday.

Amid global backlash over its war in Ukraine, Russia continues leveraging energy as a geopolitical tool, also cutting gas supplies to Austria—ending a 60-year agreement that fulfills 80% of its demand—citing a legal dispute.

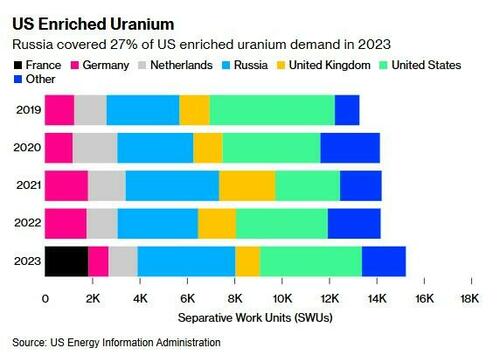

Bloomberg noted that Russia's move targets a key U.S. vulnerability in the nuclear fuel cycle, as it controls nearly half of global uranium enrichment capacity and supplied over a quarter of U.S. enriched fuel last year.

Chris Gadomski, head nuclear analyst for BloombergNEF commented: “We don’t have enough enriched uranium here. They should have been stockpiling enriched uranium in anticipation of this happening.”

While 2023 deliveries are largely complete, a prolonged ban could affect reactor operators by 2025, leaving some without alternative suppliers.

Jonathan Hinze, president of UxC, which tracks uranium-fuel markets, told Bloomberg: “There would be some utilities maybe that would be expecting that material and now might not get it.”

Cameco spokeswoman Veronica Baker added: “To break the dependence on Russia and other state-owned enterprises, coordinated western responses are required.”

The Biden administration has launched a multibillion-dollar initiative to revive domestic uranium enrichment, but progress is limited, with only one U.S. commercial facility, owned by Urenco Ltd., supplying about a third of the enriched uranium for American reactors. U

renco plans a 15% capacity increase by 2027, citing the urgency of reducing reliance on unstable foreign sources.

Major U.S. nuclear operators, including Constellation Energy and Centrus Energy, have waivers to import Russian fuel, but Centrus, the top U.S. trader of Russian uranium, is exploring alternatives in case Russia's supplier, Tenex, fails to meet its obligations.

Russia says the restrictions respond to a U.S. ban on Russian enriched uranium, signed by President Biden in May but allowing shipments until 2028 through waivers.

In news that will act as a headwind for the U.S.'s re-emerging nuclear industry, it was reported last week that Russia is temporarily restricting enriched uranium exports to the U.S., raising supply concerns for reactors that produce nearly 20% of the nation's electricity.

Russia provided no details or timeline for its uranium export restrictions in a Friday Telegram statement, though utilities' advance purchasing likely mitigates immediate effects, Bloomberg wrote in a report on Friday.

Amid global backlash over its war in Ukraine, Russia continues leveraging energy as a geopolitical tool, also cutting gas supplies to Austria—ending a 60-year agreement that fulfills 80% of its demand—citing a legal dispute.

Bloomberg noted that Russia's move targets a key U.S. vulnerability in the nuclear fuel cycle, as it controls nearly half of global uranium enrichment capacity and supplied over a quarter of U.S. enriched fuel last year.

Chris Gadomski, head nuclear analyst for BloombergNEF commented: “We don’t have enough enriched uranium here. They should have been stockpiling enriched uranium in anticipation of this happening.”

While 2023 deliveries are largely complete, a prolonged ban could affect reactor operators by 2025, leaving some without alternative suppliers.

Jonathan Hinze, president of UxC, which tracks uranium-fuel markets, told Bloomberg: “There would be some utilities maybe that would be expecting that material and now might not get it.”

Cameco spokeswoman Veronica Baker added: “To break the dependence on Russia and other state-owned enterprises, coordinated western responses are required.”

The Biden administration has launched a multibillion-dollar initiative to revive domestic uranium enrichment, but progress is limited, with only one U.S. commercial facility, owned by Urenco Ltd., supplying about a third of the enriched uranium for American reactors. U

renco plans a 15% capacity increase by 2027, citing the urgency of reducing reliance on unstable foreign sources.

Major U.S. nuclear operators, including Constellation Energy and Centrus Energy, have waivers to import Russian fuel, but Centrus, the top U.S. trader of Russian uranium, is exploring alternatives in case Russia's supplier, Tenex, fails to meet its obligations.

Russia says the restrictions respond to a U.S. ban on Russian enriched uranium, signed by President Biden in May but allowing shipments until 2028 through waivers.