Following this morning's shitshow in Europe, US preliminary PMIs for November were expected to inch higher (supported by the surge in positive 'hard data' surprises recently) and they did on a MoM basis.

-

Flash US PMI Composite Output Index: 55.3 (Oct: 54.1). 31-month high.

-

Flash US Services PMI Business Activity Index: 57.0 (Oct: 55.0). 32-month high.

-

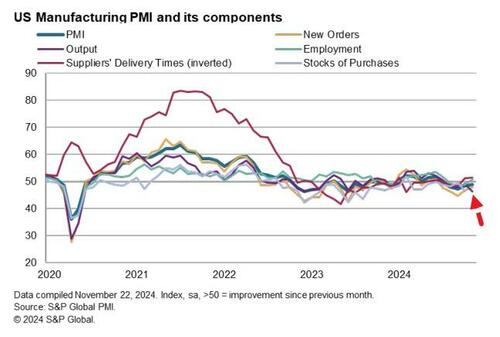

Flash US Manufacturing PMI: 48.8 (Oct: 48.5). 4-month high.

Source: Bloomberg

Under the hood, Flash US Manufacturing Output Index: 46.3 (Oct: 49.2). 23-month low...

Commenting on the flash PMI data, Chris Williamson, Chief Business Economist at S&P Global Market Intelligence said:

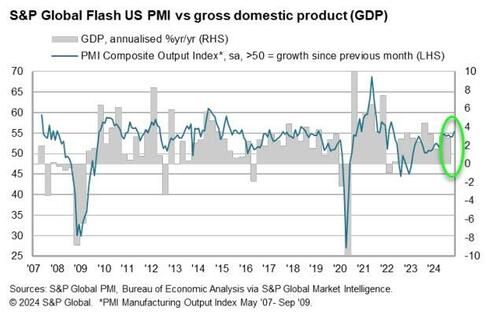

“The business mood has brightened in November, with confidence about the year ahead hitting a two-and-a-half year high. The prospect of lower interest rates and a more probusiness approach from the incoming administration has fueled greater optimism, in turn helping drive output and order book inflows higher in November.

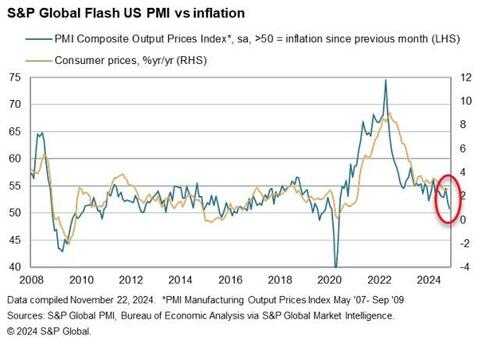

"The rise in the headline flash PMI indicates that economic growth is accelerating in the fourth quarter, while at the same time inflationary pressures are cooling. The survey's price gauge covering goods and services signalled only a marginal increase in prices in November, pointing to consumer inflation running well below the Fed's 2% target.

"A concern is that growth remains heavily reliant on the services economy, with manufacturing production declining at an increased rate. However, the promise of greater protectionism and tariffs has helped lift confidence in the US good producing sector, which is already feeding through to higher factory employment.

"Factories are meanwhile stepping up their purchases of imported inputs as they seek to front-run tariffs, putting pressure on supply chains to a degree not seen for over two years. Any further stretching of these supply lines could see prices move higher as demand outstrips supply.”

Not exactly rate-cutting weather out there, eh?!

Optimism soaring on Trump... but prices also about to soar 'on Trump'.

Following this morning's shitshow in Europe, US preliminary PMIs for November were expected to inch higher (supported by the surge in positive 'hard data' surprises recently) and they did on a MoM basis.

-

Flash US PMI Composite Output Index: 55.3 (Oct: 54.1). 31-month high.

-

Flash US Services PMI Business Activity Index: 57.0 (Oct: 55.0). 32-month high.

-

Flash US Manufacturing PMI: 48.8 (Oct: 48.5). 4-month high.

Source: Bloomberg

Under the hood, Flash US Manufacturing Output Index: 46.3 (Oct: 49.2). 23-month low...

Commenting on the flash PMI data, Chris Williamson, Chief Business Economist at S&P Global Market Intelligence said:

“The business mood has brightened in November, with confidence about the year ahead hitting a two-and-a-half year high. The prospect of lower interest rates and a more probusiness approach from the incoming administration has fueled greater optimism, in turn helping drive output and order book inflows higher in November.

"The rise in the headline flash PMI indicates that economic growth is accelerating in the fourth quarter, while at the same time inflationary pressures are cooling. The survey's price gauge covering goods and services signalled only a marginal increase in prices in November, pointing to consumer inflation running well below the Fed's 2% target.

"A concern is that growth remains heavily reliant on the services economy, with manufacturing production declining at an increased rate. However, the promise of greater protectionism and tariffs has helped lift confidence in the US good producing sector, which is already feeding through to higher factory employment.

"Factories are meanwhile stepping up their purchases of imported inputs as they seek to front-run tariffs, putting pressure on supply chains to a degree not seen for over two years. Any further stretching of these supply lines could see prices move higher as demand outstrips supply.”

Not exactly rate-cutting weather out there, eh?!

Optimism soaring on Trump... but prices also about to soar 'on Trump'.