Working-poor households are still under pressure in a weak demand environment because of persistent inflation and high interest rates. Goldman's latest note on the consumer shows a continued mixed picture, with the holiday shopping season of Black Friday just weeks away.

Goldman's Michelle Cheng and Xinyu Ruan pointed out the continued weak consumer demand environment:

US: recent data points to a weak demand backdrop. US October TRE (The Weekly Chain Store Sales Index) was -0.9% vs -0.6% in Sep; same-store ShopperTrak traffic was -5.0% in the last week of Oct.

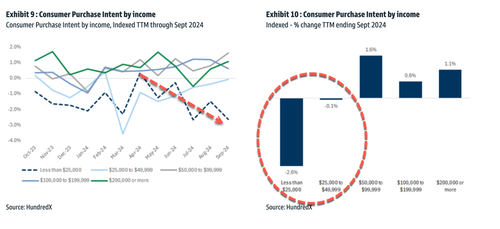

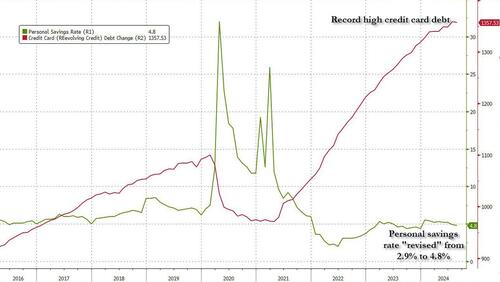

Our US colleagues find a mixed picture of consumer credit health, with household balance sheets remaining largely unlevered but personal savings rates declining well below long-term averages, credit delinquency rates rising yoy across cards, personal loans and auto loans, credit origination volumes at historically depressed levels and average FICO scores ticking lower for the first time in years - with pressure concentrated among subprime consumers. Softer consumer credit trends among subprime consumers are also translating into reduced spending activity among lower-income cohorts.

Similar to past quarters, consumers have remained careful in their spending decisions, as discretionary spend has continued to be soft. Below data points show recent sentiment for the lowest income consumer continues to be under pressure, with both purchase intent and consumer confidence below historical levels. That said, consumer confidence trends have recently improved across income demographics, which could potentially be reflective of a change in consumer sentiment and expectations.

The trend shows that working-poor households have been dialing back spending—or have hit a proverbial brick wall since the spring, as many financially drown in Biden-Harris' inflation storm.

Not a great combo here...

In recent weeks, we have noted:

-

US Working Poor Hit By "Weaker Credit Metrics & Mixed Confidence" As Black Friday Nears

-

Goldman Finds "Trade-Down Phenomenon" Strikes Rich & Poor Consumers

One of the biggest drivers for voters backing Trump was inflation. AP found that high prices were the number one concern for about half of all Trump voters.

Meanwhile, Democrats were trying to make the election theme all about women's rights. Now comes the hard part for Trump in solving the nightmare inflation storm sparked by far-left liberals.

Working-poor households are still under pressure in a weak demand environment because of persistent inflation and high interest rates. Goldman's latest note on the consumer shows a continued mixed picture, with the holiday shopping season of Black Friday just weeks away.

Goldman's Michelle Cheng and Xinyu Ruan pointed out the continued weak consumer demand environment:

US: recent data points to a weak demand backdrop. US October TRE (The Weekly Chain Store Sales Index) was -0.9% vs -0.6% in Sep; same-store ShopperTrak traffic was -5.0% in the last week of Oct.

Our US colleagues find a mixed picture of consumer credit health, with household balance sheets remaining largely unlevered but personal savings rates declining well below long-term averages, credit delinquency rates rising yoy across cards, personal loans and auto loans, credit origination volumes at historically depressed levels and average FICO scores ticking lower for the first time in years - with pressure concentrated among subprime consumers. Softer consumer credit trends among subprime consumers are also translating into reduced spending activity among lower-income cohorts.

Similar to past quarters, consumers have remained careful in their spending decisions, as discretionary spend has continued to be soft. Below data points show recent sentiment for the lowest income consumer continues to be under pressure, with both purchase intent and consumer confidence below historical levels. That said, consumer confidence trends have recently improved across income demographics, which could potentially be reflective of a change in consumer sentiment and expectations.

The trend shows that working-poor households have been dialing back spending—or have hit a proverbial brick wall since the spring, as many financially drown in Biden-Harris' inflation storm.

Not a great combo here...

In recent weeks, we have noted:

-

US Working Poor Hit By "Weaker Credit Metrics & Mixed Confidence" As Black Friday Nears

-

Goldman Finds "Trade-Down Phenomenon" Strikes Rich & Poor Consumers

One of the biggest drivers for voters backing Trump was inflation. AP found that high prices were the number one concern for about half of all Trump voters.

Meanwhile, Democrats were trying to make the election theme all about women's rights. Now comes the hard part for Trump in solving the nightmare inflation storm sparked by far-left liberals.