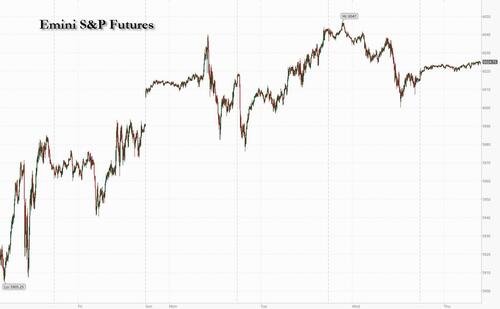

US equity index futures rose on Thursday, with cash markets closed for the Thanksgiving holiday. As of 9am ET, S&P 500 futures gained 0.1% after the key index snapped a seven-day rally on Wednesday; Nasdaq 100 advanced 0.2%.

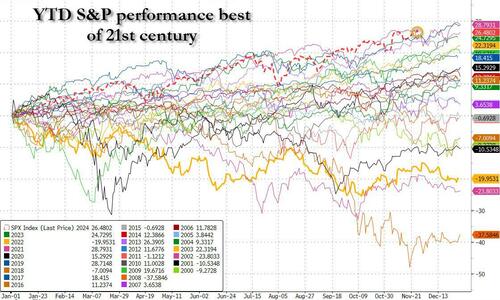

US stocks have been been buoyed by enthusiasm over the return of Donald Trump to the White House, as well as the Federal Reserve cutting interest rates for the second-straight meeting. This has pushed the YTD performance of the S&P back to the highest of the 21st century, once again surpassing 2021's record performance.

“Post-election market activity has been remarkable, with volumes surging and major indices reaching all-time highs,” said Jeff O’Connor, head of market structure at Liquidnet. “However, as we move closer to the year-end, we expect this momentum to subside, with a focus shifting to upcoming macroeconomic data releases.”

One looming gray cloud: inflation is once again picking up rapidly. As CMC Markets analyst Jochen Stanzl said, the monetary policy outlook for the Federal Reserve has “dimmed in recent days,” as the central bank’s preferred indicator, core PCE, accelerated in October rising 2.8% YoY, the biggest increase since April.

“Should prices continue to rise, Jerome Powell would quickly find himself under double pressure,” Stanzl said. “From the growing accusations that he has made a monetary policy mistake, and from the pressure that he is already under from US President Trump, who would prefer to dismiss him altogether.”

Earlier, Bloomberg reported the Biden administration was weighing additional curbs on semiconductor equipment and AI memory chips to China that would escalate the crackdown on Beijing’s tech ambitions, but stop short of stricter measures that were previously considered.

Chip stocks in Asia and Europe jumped on the news, with ASML Holding NV, ASM International NV, and Nvidia Corp. suppliers ISC and TSE all rising. When stocks resume trading in New York, names such as Lam Research Corp., Applied Materials Inc. and KLA Corp. will be ones to watch.

While the US is closed, the rest of the world is open, if subdued, and European stocks bounced after a two-day decline, led by tech shares. The Stoxx 600 is up 0.5% while US equity futures also edge higher.

In open rates markets, French government bonds outperform, narrowing the spread with Germany after Finance Minister Armand said he is prepared to make concessions on the budget bill to avoid opposition parties toppling the government in the coming weeks. French 10-year yields fell 2 bps to 3.01%.

In Fx, the euro weakens 0.2% after showing little reaction to Spanish and German inflation data, and after ECB's Villeroy went full dove, saying that not only should rates drop to Neutral, but wouldn't exclude them dropping below neutral but that NIRP should remain in the ECB's toolkit. The yen, which inexplicably soared in the past few days, was the weakest of the G-10 currencies, falling 0.6% against the greenback and pushing USD/JPY up toward 152. The Mexican peso rallied 1.7% after Trump said he had a productive conversation with Mexico’s president Sheinbaum.

In commodities, oil prices advance while in thin trading after OPEC+ confirmed it will delay Sunday’s online meeting on oil production curbs to Dec. 5. WTI rises 0.6% to $69.10 a barrel. Spot gold climbs $9 to $2645/oz. Bitcoin falls below $95,000.

With the US closed for Thanksgiving today, there is no macro calendar.

US equity index futures rose on Thursday, with cash markets closed for the Thanksgiving holiday. As of 9am ET, S&P 500 futures gained 0.1% after the key index snapped a seven-day rally on Wednesday; Nasdaq 100 advanced 0.2%.

US stocks have been been buoyed by enthusiasm over the return of Donald Trump to the White House, as well as the Federal Reserve cutting interest rates for the second-straight meeting. This has pushed the YTD performance of the S&P back to the highest of the 21st century, once again surpassing 2021's record performance.

“Post-election market activity has been remarkable, with volumes surging and major indices reaching all-time highs,” said Jeff O’Connor, head of market structure at Liquidnet. “However, as we move closer to the year-end, we expect this momentum to subside, with a focus shifting to upcoming macroeconomic data releases.”

One looming gray cloud: inflation is once again picking up rapidly. As CMC Markets analyst Jochen Stanzl said, the monetary policy outlook for the Federal Reserve has “dimmed in recent days,” as the central bank’s preferred indicator, core PCE, accelerated in October rising 2.8% YoY, the biggest increase since April.

“Should prices continue to rise, Jerome Powell would quickly find himself under double pressure,” Stanzl said. “From the growing accusations that he has made a monetary policy mistake, and from the pressure that he is already under from US President Trump, who would prefer to dismiss him altogether.”

Earlier, Bloomberg reported the Biden administration was weighing additional curbs on semiconductor equipment and AI memory chips to China that would escalate the crackdown on Beijing’s tech ambitions, but stop short of stricter measures that were previously considered.

Chip stocks in Asia and Europe jumped on the news, with ASML Holding NV, ASM International NV, and Nvidia Corp. suppliers ISC and TSE all rising. When stocks resume trading in New York, names such as Lam Research Corp., Applied Materials Inc. and KLA Corp. will be ones to watch.

While the US is closed, the rest of the world is open, if subdued, and European stocks bounced after a two-day decline, led by tech shares. The Stoxx 600 is up 0.5% while US equity futures also edge higher.

In open rates markets, French government bonds outperform, narrowing the spread with Germany after Finance Minister Armand said he is prepared to make concessions on the budget bill to avoid opposition parties toppling the government in the coming weeks. French 10-year yields fell 2 bps to 3.01%.

In Fx, the euro weakens 0.2% after showing little reaction to Spanish and German inflation data, and after ECB's Villeroy went full dove, saying that not only should rates drop to Neutral, but wouldn't exclude them dropping below neutral but that NIRP should remain in the ECB's toolkit. The yen, which inexplicably soared in the past few days, was the weakest of the G-10 currencies, falling 0.6% against the greenback and pushing USD/JPY up toward 152. The Mexican peso rallied 1.7% after Trump said he had a productive conversation with Mexico’s president Sheinbaum.

In commodities, oil prices advance while in thin trading after OPEC+ confirmed it will delay Sunday’s online meeting on oil production curbs to Dec. 5. WTI rises 0.6% to $69.10 a barrel. Spot gold climbs $9 to $2645/oz. Bitcoin falls below $95,000.

With the US closed for Thanksgiving today, there is no macro calendar.