One of the big bearish overhangs looming over the oil market is the now conventional wisdom that as a result of accelerating supply and slowing demand, 2025 will see an oil glut potentially as large as 1million bpd, a surplus which will depress prices and prevent OPEC+ from boosting output (of course, conventional wisdom is almost always wrong, especially when it is set by the notorious politicized and wrong International Energy Agency). Yet while many oil traders share the IEA’s view that stockpiles will grow next year, there are reasons to think the expansion could be far smaller than forecast if not disappear outright.

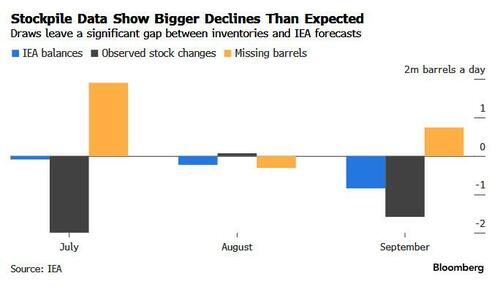

In the last quarter, preliminary data showed that global oil inventories declined by about 1.16 million barrels a day, the agency said. That’s an issue because it’s significantly bigger than the 380,000 barrels a day reduction projected by the IEA in its balances. The gap between the two is the equivalent of Poland’s daily oil demand, and would add up to about 70 million barrels over the three-month period.

As Bloomberg's Alex Longley writes, what happened with those missing barrels over the quarter could shape how the market looks next year. Oil bulls argue that the IEA will likely end up revising its balances to catch up with the bigger stock draws, potentially reducing the size of the surplus next year.

To be sure, this wont be the first time "missing barrels" have impacted the oil market outlook in a bearish direction. Oil forecasting has long had to wrestle with the concept of missing barrels. The IEA as well as the US Energy Information Administration and OPEC constantly benchmark their analysis with changes seen in the real world to make sure their models are reliable, which they never, and furthermore, the imbalances always tend to be in a direction that encourages lower prices.

"There is an ongoing mismatch with the missing barrels," said Giovanni Staunovo, a commodity analyst at UBS Group AG. "My expectation is that the demand forecasts will be revised higher, and that the agency’s balances will look less bearish."

In its defense, and ahead of the coming adjustments, the IEA has said said that the mismatch likely reflects inventory changes in countries where data may not be available or isn’t very good.

The IEA loosened its second-quarter balance, cutting demand and increasing supply estimates, by more than 500,000 barrels a day over the following three months, to capture an increase in stockpiles for which it hadn’t previously accounted. Over that time, inventory figures were also revised up, meaning that they now effectively match the agency balance.

That said, don’t expect the discrepancy to disappear completely any time soon. Historical data revisions are commonplace. Earlier this month, the IEA cut its oil demand estimate for 2022 by 70,000 barrels a day as a result of new data from non-OECD countries in Latin America and Asia. However, now that Trump is in the White House, expect the notoriously pro-"green" and pro-Biden IEA (it is widely expected that Trump will fire IEA head Fatih Birol shortly after the inauguration) to suddenly flip its "error" in the opposite direction.

One of the big bearish overhangs looming over the oil market is the now conventional wisdom that as a result of accelerating supply and slowing demand, 2025 will see an oil glut potentially as large as 1million bpd, a surplus which will depress prices and prevent OPEC+ from boosting output (of course, conventional wisdom is almost always wrong, especially when it is set by the notorious politicized and wrong International Energy Agency). Yet while many oil traders share the IEA’s view that stockpiles will grow next year, there are reasons to think the expansion could be far smaller than forecast if not disappear outright.

In the last quarter, preliminary data showed that global oil inventories declined by about 1.16 million barrels a day, the agency said. That’s an issue because it’s significantly bigger than the 380,000 barrels a day reduction projected by the IEA in its balances. The gap between the two is the equivalent of Poland’s daily oil demand, and would add up to about 70 million barrels over the three-month period.

As Bloomberg's Alex Longley writes, what happened with those missing barrels over the quarter could shape how the market looks next year. Oil bulls argue that the IEA will likely end up revising its balances to catch up with the bigger stock draws, potentially reducing the size of the surplus next year.

To be sure, this wont be the first time "missing barrels" have impacted the oil market outlook in a bearish direction. Oil forecasting has long had to wrestle with the concept of missing barrels. The IEA as well as the US Energy Information Administration and OPEC constantly benchmark their analysis with changes seen in the real world to make sure their models are reliable, which they never, and furthermore, the imbalances always tend to be in a direction that encourages lower prices.

"There is an ongoing mismatch with the missing barrels," said Giovanni Staunovo, a commodity analyst at UBS Group AG. "My expectation is that the demand forecasts will be revised higher, and that the agency’s balances will look less bearish."

In its defense, and ahead of the coming adjustments, the IEA has said said that the mismatch likely reflects inventory changes in countries where data may not be available or isn’t very good.

The IEA loosened its second-quarter balance, cutting demand and increasing supply estimates, by more than 500,000 barrels a day over the following three months, to capture an increase in stockpiles for which it hadn’t previously accounted. Over that time, inventory figures were also revised up, meaning that they now effectively match the agency balance.

That said, don’t expect the discrepancy to disappear completely any time soon. Historical data revisions are commonplace. Earlier this month, the IEA cut its oil demand estimate for 2022 by 70,000 barrels a day as a result of new data from non-OECD countries in Latin America and Asia. However, now that Trump is in the White House, expect the notoriously pro-"green" and pro-Biden IEA (it is widely expected that Trump will fire IEA head Fatih Birol shortly after the inauguration) to suddenly flip its "error" in the opposite direction.