AMC Entertainment Holdings announced on Monday that it achieved the highest domestic revenue in its 104-year history during the pre-Thanksgiving weekend - mainly because millions of Americans flocked to theaters nationwide to watch WICKED and GLADIATOR II.

In a press release, AMC reported its "highest domestic revenue (admissions revenue plus food and beverage, including merchandise) on the weekend before Thanksgiving in AMC's 104-year history." It also noted this marked "highest domestic admissions revenue on the weekend before Thanksgiving since 2019, and the third highest domestic admissions revenue on the weekend before Thanksgiving in AMC's history."

AMC recorded 4.6 million moviegoers across its US and international theaters from Thursday to Sunday. The world's largest movie theater chain operates 900 theaters with 10,000 screens globally, including 660 theaters and 8,200 screens in the US.

"Naturally, we are pleased that at our US theatres, AMC just recorded our highest revenues for a pre-Thanksgiving weekend in AMC's entire history. Similarly, it is thoroughly satisfying that fully 4.6 million people graced our AMC Theatres in the US and Odeon Cinemas abroad over the just completed four days Thursday to Sunday. What a wonderful way to head into what we expect will be a busy and entertaining holiday moviegoing season," AMC Chairman and CEO Adam Aron wrote in a statement.

With the Goldman Most Shorted Index in a bull market year-to-date, up 27% as of Monday afternoon, everyone who cares asks whether the Reddit Army of Apes jumps back into 'meme' stock AMC...

AMC has over $4 billion in long-term debt on the books and has refinanced and extended its maturities to 2029 and beyond. However, interest payments remain a massive burden on its bottom line.

Eric Wold, analyst at B. Riley, recently noted, "They've taken moves to reduce their debt, but they still have a lot of debt and they're still paying pretty high interest rates on it."

In the third quarter, AMC's revenue exceeded spending, but around $100 million in interest payments pushed the movie chain $21 million into the red for the period.

Wold said, "I don't think it'll be consistently profitable for a number of years."

However, the latest weekend performance highlights an improving box office environment.

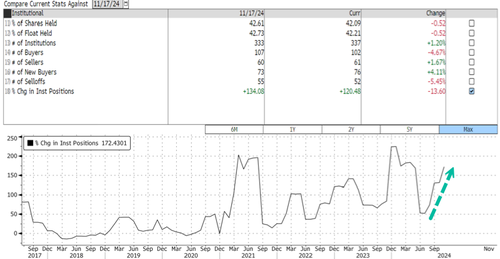

And what do hedge funds know? Instutional ownership is on the rise.

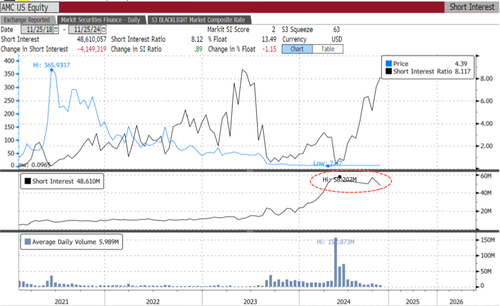

Short interest has plateaued since mid-year. Current Bloomberg data shows about 13.5% of the float is short, equivalent to 48.6 million shares. The short-interest ratio jumped to 2023 highs above 8.

Shares have been trading laterally for much of the year after the company took advantage of retail traders and completed ATM and debt-for-equity exchanges (see here & here).

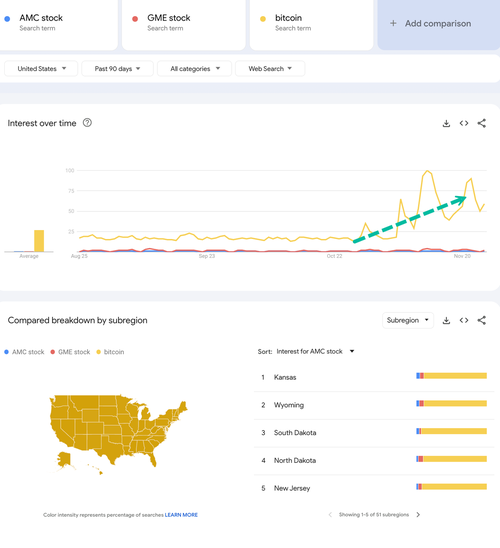

Meanwhile, Google searches show the apes are more focused on crypto than 'meme' stocks...

Will that all change?

AMC Entertainment Holdings announced on Monday that it achieved the highest domestic revenue in its 104-year history during the pre-Thanksgiving weekend - mainly because millions of Americans flocked to theaters nationwide to watch WICKED and GLADIATOR II.

In a press release, AMC reported its "highest domestic revenue (admissions revenue plus food and beverage, including merchandise) on the weekend before Thanksgiving in AMC's 104-year history." It also noted this marked "highest domestic admissions revenue on the weekend before Thanksgiving since 2019, and the third highest domestic admissions revenue on the weekend before Thanksgiving in AMC's history."

AMC recorded 4.6 million moviegoers across its US and international theaters from Thursday to Sunday. The world's largest movie theater chain operates 900 theaters with 10,000 screens globally, including 660 theaters and 8,200 screens in the US.

"Naturally, we are pleased that at our US theatres, AMC just recorded our highest revenues for a pre-Thanksgiving weekend in AMC's entire history. Similarly, it is thoroughly satisfying that fully 4.6 million people graced our AMC Theatres in the US and Odeon Cinemas abroad over the just completed four days Thursday to Sunday. What a wonderful way to head into what we expect will be a busy and entertaining holiday moviegoing season," AMC Chairman and CEO Adam Aron wrote in a statement.

With the Goldman Most Shorted Index in a bull market year-to-date, up 27% as of Monday afternoon, everyone who cares asks whether the Reddit Army of Apes jumps back into 'meme' stock AMC...

AMC has over $4 billion in long-term debt on the books and has refinanced and extended its maturities to 2029 and beyond. However, interest payments remain a massive burden on its bottom line.

Eric Wold, analyst at B. Riley, recently noted, "They've taken moves to reduce their debt, but they still have a lot of debt and they're still paying pretty high interest rates on it."

In the third quarter, AMC's revenue exceeded spending, but around $100 million in interest payments pushed the movie chain $21 million into the red for the period.

Wold said, "I don't think it'll be consistently profitable for a number of years."

However, the latest weekend performance highlights an improving box office environment.

And what do hedge funds know? Instutional ownership is on the rise.

Short interest has plateaued since mid-year. Current Bloomberg data shows about 13.5% of the float is short, equivalent to 48.6 million shares. The short-interest ratio jumped to 2023 highs above 8.

Shares have been trading laterally for much of the year after the company took advantage of retail traders and completed ATM and debt-for-equity exchanges (see here & here).

Meanwhile, Google searches show the apes are more focused on crypto than 'meme' stocks...

Will that all change?