Of course, as goes NVDA, so goes the market, and after last night's beat (but disappointing revenue forecast), the giantest of giant tech companies swung around like a penny stock, adding and subtracting $100s of billions in market cap in an instant...

Bear in mind that the vol market had pegged an 8% swing - Jensen's comments helped rescue the stock: "I believe that there will be no digestion until we modernize a trillion dollars with the data centers."

Interestingly, while NVDA managed to hold on to gains, the Mega-Cap tech basket was hit hard and could not bounce back to green...

Source: Bloomberg

... as GOOGL was clubbed like a baby seal...

Source: Bloomberg

All the major indices ended the day green (though Nasdaq lagged), as Small Caps ripped...

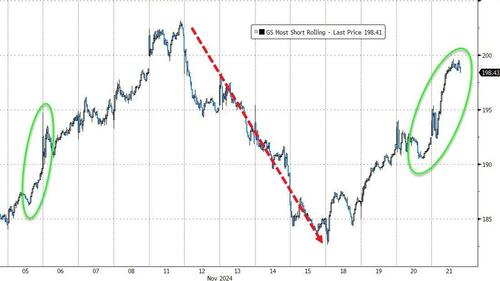

...thanks to a huge short squeeze (again)...

Source: Bloomberg

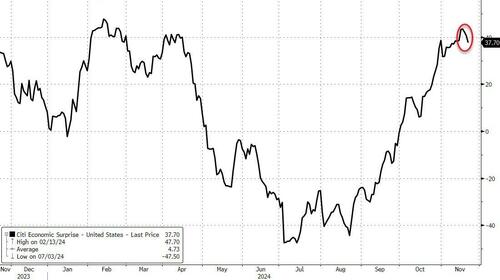

On the macro side, it was 'bad news': Philly Fed fell hard in November (from +10.3 to -5.5 vs +8.0 exp), Continuing Jobless claims topped 1.9mm Americans for the first time in three years (initial claims dropped), and the Leading Index dropped 0.4% (more than expected). Initial claims and existing home sales were positive to offset some of the negative but overall, the US Macro Surprise index actually rolled over...

Source: Bloomberg

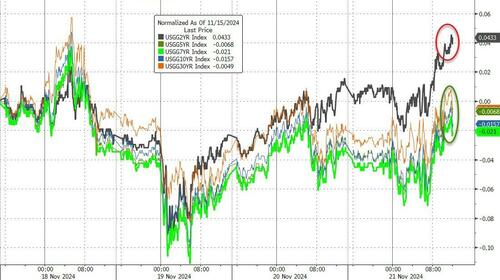

Treasury yields were marginally higher on the day with the short-end lagging (2Y +3bps, 30Y +1bps). That pulled the short-end higher on the week, while the belly is outperforming on the week...

Source: Bloomberg

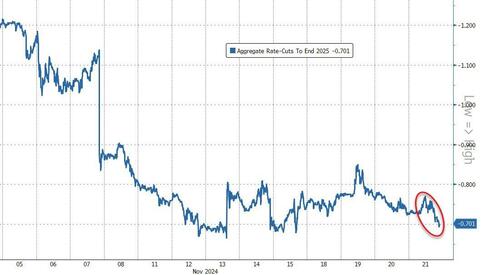

Rate-cut expectations continued to slide with less than three full 25bp cuts now priced-in by the end of 2025...

Source: Bloomberg

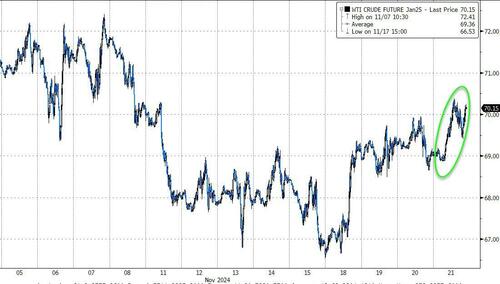

As bond yields rose, so did oil prices with WTI holding back above $70...

Source: Bloomberg

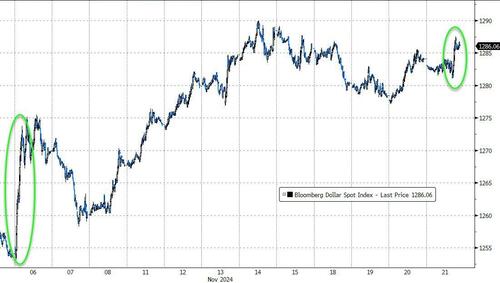

The dollar rallied back up near post-election highs...

Source: Bloomberg

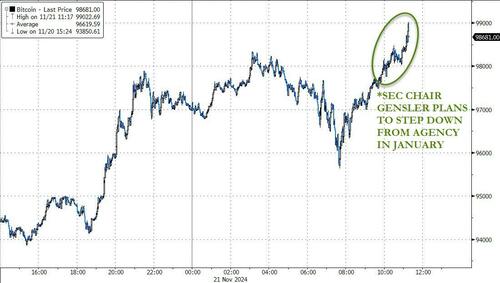

But, the big news of the day was in 'alternate' currencies with bitcoin continuing to charge higher (topping $99k) as Gensler announced his retirement and Trump's crypto council takes shape...

Source: Bloomberg

...and Gold also soared back above its 50DMA...

Source: Bloomberg

...up for the 4th straight day after 6 straight down following the election...

Source: Bloomberg

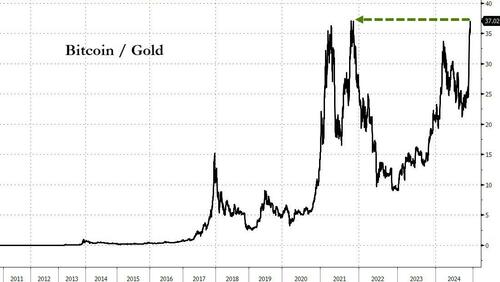

And finally, Bitcoin finally took out its record high relative to gold...

Source: Bloomberg

Do you feel lucky?

Of course, as goes NVDA, so goes the market, and after last night's beat (but disappointing revenue forecast), the giantest of giant tech companies swung around like a penny stock, adding and subtracting $100s of billions in market cap in an instant...

Bear in mind that the vol market had pegged an 8% swing - Jensen's comments helped rescue the stock: "I believe that there will be no digestion until we modernize a trillion dollars with the data centers."

Interestingly, while NVDA managed to hold on to gains, the Mega-Cap tech basket was hit hard and could not bounce back to green...

Source: Bloomberg

... as GOOGL was clubbed like a baby seal...

Source: Bloomberg

All the major indices ended the day green (though Nasdaq lagged), as Small Caps ripped...

...thanks to a huge short squeeze (again)...

Source: Bloomberg

On the macro side, it was 'bad news': Philly Fed fell hard in November (from +10.3 to -5.5 vs +8.0 exp), Continuing Jobless claims topped 1.9mm Americans for the first time in three years (initial claims dropped), and the Leading Index dropped 0.4% (more than expected). Initial claims and existing home sales were positive to offset some of the negative but overall, the US Macro Surprise index actually rolled over...

Source: Bloomberg

Treasury yields were marginally higher on the day with the short-end lagging (2Y +3bps, 30Y +1bps). That pulled the short-end higher on the week, while the belly is outperforming on the week...

Source: Bloomberg

Rate-cut expectations continued to slide with less than three full 25bp cuts now priced-in by the end of 2025...

Source: Bloomberg

As bond yields rose, so did oil prices with WTI holding back above $70...

Source: Bloomberg

The dollar rallied back up near post-election highs...

Source: Bloomberg

But, the big news of the day was in 'alternate' currencies with bitcoin continuing to charge higher (topping $99k) as Gensler announced his retirement and Trump's crypto council takes shape...

Source: Bloomberg

...and Gold also soared back above its 50DMA...

Source: Bloomberg

...up for the 4th straight day after 6 straight down following the election...

Source: Bloomberg

And finally, Bitcoin finally took out its record high relative to gold...

Source: Bloomberg

Do you feel lucky?