Inflation is not 'going gently into that good night'.

Instead, as PPI confirmed today after CPI yesterday, it is 'burning and raging at the dying of the light' of the Biden/Harris days...

Source: Bloomberg

In fact - while he was more ambiguous at The Fed presser, Fed Chair Powell admitted in his remarks today that all is not completely awesome, as he warned The Fed is in "no hurry" to cut rates... and inflation's on a "bumpy path".

"If the data let's us go slower, it seems like the right thing to do..."

Powell's remarks sent rate-cut expectations notably lower - December less than 50-50 now...

Source: Bloomberg

Interestingly, minutes before Powell spoke, JPMorgan CEO Jamie Dimon dropped some tape-bombs of reality:

-

*DIMON: THINK THE CHANCE OF SOFT LANDING LESS THAN OTHERS THINK

-

*DIMON: "NOT SO OPTIMISTIC" THAT INFLATION WILL GO AWAY QUICKLY

-

*DIMON: GROWTH IS BEST POLICY TO FIX DEFICIT PROBLEM

-

*DIMON: TRUMP INHERITING INFLATION THAT MAY NOT GO AWAY QUICKLY

Goldman notes that the background remains bullish for stocks from CTAs / Buybacks / Seasonals:

-

CTA: Update for Equities - buyers of S&P in all short-term scenarios as momentum remains firmly positive and realized vol has reset: flat tape: +$4.8mm to BUY (+$7.5bn SPX to BUY).

-

Buybacks: We are reaching full open window. Back of envelope we estimate ~$6B/day in demand.

-

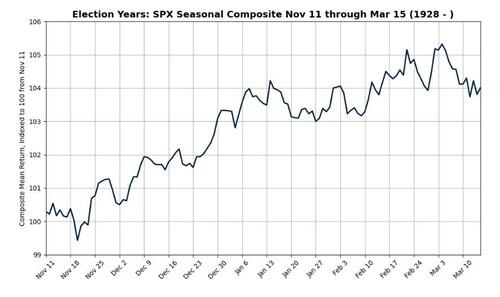

Seasonality: The typical pattern is to rally into the Inauguration (1/20/2025) before topping out in February.

Source: Goldman Sachs

But, Goldman's trading desk notes that there is a lot of selling still:

-

Overall activity levels are down -15% vs. the trailing 2 weeks with market volumes up +8% vs the 10dma

-

Our floor tilts -3% better for sale with both HFs and LOs leaning that way

-

HFs are -7% better for sale, moderating after an earlier sell skew closer to 10% (which ranked in the 95th %-ile). They are heavily for sale in HCare & Industrials with very modest demand for Macro Products, REITs and Energy.

-

LOs are -5% better for sale. Tech supply stands out, on a net basis larger than Comm Svcs & Industrials supply combined. LOs are better to buy across Cons Disc, REITs & HCare

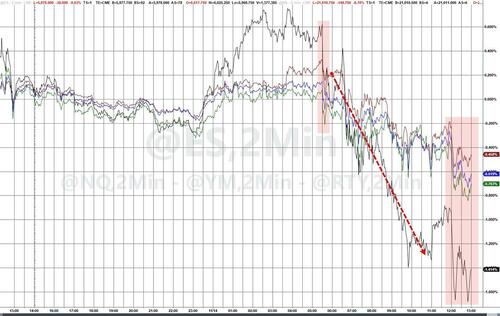

Stocks were already sinking before Powell spoke, but his reality check punched them to the lows with Small Caps clubbed like a baby seal...

The 'Trump Trade' saw some profit-taking today...

Source: Bloomberg

'Most Shorted' stocks fell once again - erasing the entire post-election squeeze higher...

Source: Bloomberg

RIVN was monkeyhammered lower after headlines that the Trump team would remove the EV tax credit

Vaxx makers were all slammed as Trump RFK Jr headlines hit...

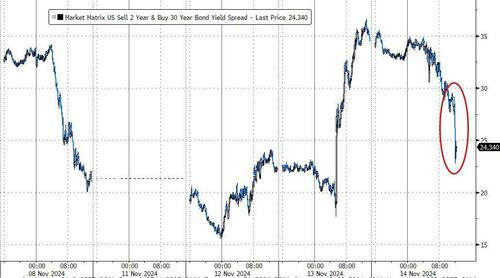

Treasury yields exploded higher on Powell's comments, led by the short-end...

Source: Bloomberg

That prompted a major flattening in the yield curve...

Source: Bloomberg

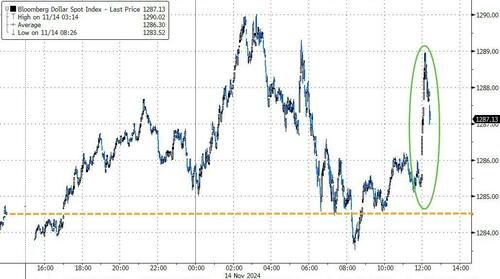

The dollar knee-jerked higher on Powell's comments

Source: Bloomberg

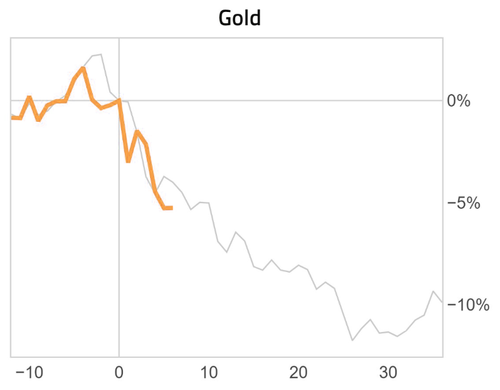

Gold ended the day unchanged, bouncing back back from continued overnight selling in Asia...

Source: Bloomberg

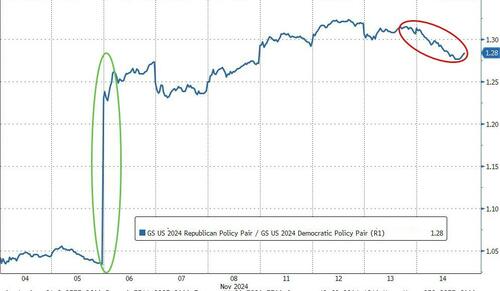

This pattern is similar to that seen in 2016's sweep...

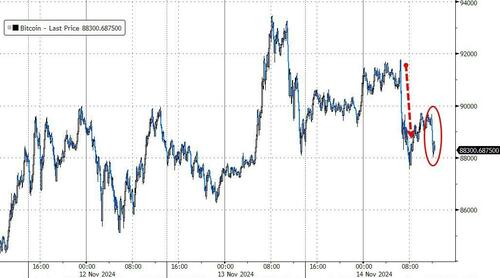

Bitcoin ended the day marginally lower after Powell's comments (pushed down first by PPI), but found support around $88,000...

Source: Bloomberg

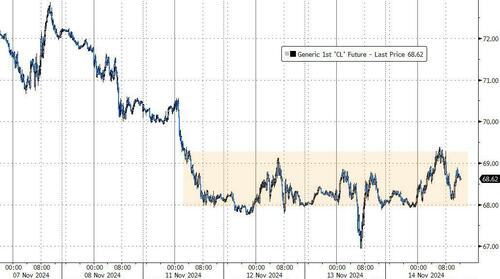

Crude prices also ended unchanged - seemingly running out of fuel for any breakout trades... for now...

Source: Bloomberg

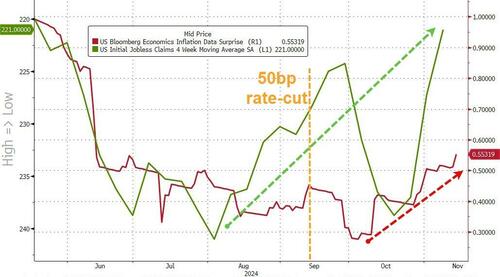

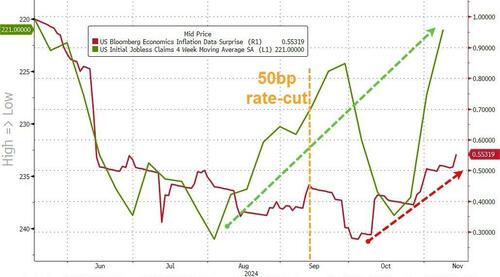

Finally, does this chart - showing initial jobless claims (inverted) tumbling to six-month lows and inflation surprise data soaring - support any kind of rate-cutting cycle?

Source: Bloomberg

How pissed will Trump be if Powell's first action is actually to hike rates?

Inflation is not 'going gently into that good night'.

Instead, as PPI confirmed today after CPI yesterday, it is 'burning and raging at the dying of the light' of the Biden/Harris days...

Source: Bloomberg

In fact - while he was more ambiguous at The Fed presser, Fed Chair Powell admitted in his remarks today that all is not completely awesome, as he warned The Fed is in "no hurry" to cut rates... and inflation's on a "bumpy path".

"If the data let's us go slower, it seems like the right thing to do..."

Powell's remarks sent rate-cut expectations notably lower - December less than 50-50 now...

Source: Bloomberg

Interestingly, minutes before Powell spoke, JPMorgan CEO Jamie Dimon dropped some tape-bombs of reality:

-

*DIMON: THINK THE CHANCE OF SOFT LANDING LESS THAN OTHERS THINK

-

*DIMON: "NOT SO OPTIMISTIC" THAT INFLATION WILL GO AWAY QUICKLY

-

*DIMON: GROWTH IS BEST POLICY TO FIX DEFICIT PROBLEM

-

*DIMON: TRUMP INHERITING INFLATION THAT MAY NOT GO AWAY QUICKLY

Goldman notes that the background remains bullish for stocks from CTAs / Buybacks / Seasonals:

-

CTA: Update for Equities - buyers of S&P in all short-term scenarios as momentum remains firmly positive and realized vol has reset: flat tape: +$4.8mm to BUY (+$7.5bn SPX to BUY).

-

Buybacks: We are reaching full open window. Back of envelope we estimate ~$6B/day in demand.

-

Seasonality: The typical pattern is to rally into the Inauguration (1/20/2025) before topping out in February.

Source: Goldman Sachs

But, Goldman's trading desk notes that there is a lot of selling still:

-

Overall activity levels are down -15% vs. the trailing 2 weeks with market volumes up +8% vs the 10dma

-

Our floor tilts -3% better for sale with both HFs and LOs leaning that way

-

HFs are -7% better for sale, moderating after an earlier sell skew closer to 10% (which ranked in the 95th %-ile). They are heavily for sale in HCare & Industrials with very modest demand for Macro Products, REITs and Energy.

-

LOs are -5% better for sale. Tech supply stands out, on a net basis larger than Comm Svcs & Industrials supply combined. LOs are better to buy across Cons Disc, REITs & HCare

Stocks were already sinking before Powell spoke, but his reality check punched them to the lows with Small Caps clubbed like a baby seal...

The 'Trump Trade' saw some profit-taking today...

Source: Bloomberg

'Most Shorted' stocks fell once again - erasing the entire post-election squeeze higher...

Source: Bloomberg

RIVN was monkeyhammered lower after headlines that the Trump team would remove the EV tax credit

Vaxx makers were all slammed as Trump RFK Jr headlines hit...

Treasury yields exploded higher on Powell's comments, led by the short-end...

Source: Bloomberg

That prompted a major flattening in the yield curve...

Source: Bloomberg

The dollar knee-jerked higher on Powell's comments

Source: Bloomberg

Gold ended the day unchanged, bouncing back back from continued overnight selling in Asia...

Source: Bloomberg

This pattern is similar to that seen in 2016's sweep...

Bitcoin ended the day marginally lower after Powell's comments (pushed down first by PPI), but found support around $88,000...

Source: Bloomberg

Crude prices also ended unchanged - seemingly running out of fuel for any breakout trades... for now...

Source: Bloomberg

Finally, does this chart - showing initial jobless claims (inverted) tumbling to six-month lows and inflation surprise data soaring - support any kind of rate-cutting cycle?

Source: Bloomberg

How pissed will Trump be if Powell's first action is actually to hike rates?