$87,000...and counting!!

Bitcoin is up over 25% since the election results started limping and it appeared Trump would win. Today's massive surge took the major cryptocurrency above $87,000 for the first time ever.

Source: Bloomberg

...and it's going higher...

Source: Bloomberg

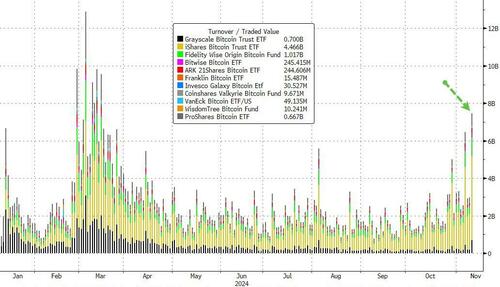

Bitcoin ETF trading volumes exploded today...

Source: Bloomberg

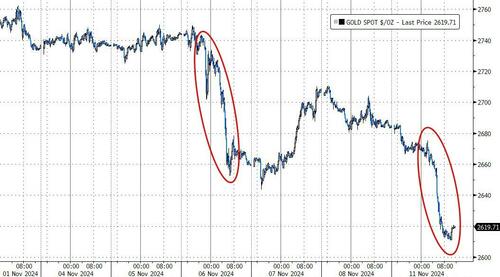

Gold, on the other hand, has been hammered lower since the election...

Source: Bloomberg

..but in the broader context, Gold is just shy of its all-time inflation-adjusted high still...

Source: Bloomberg

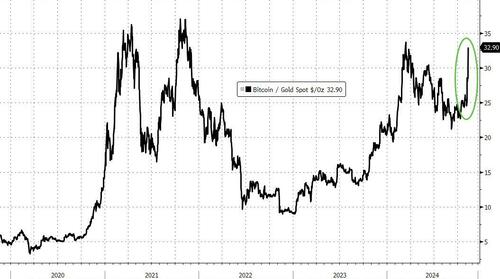

But Bitcoin/Gold is soaring back near recent highs...

Source: Bloomberg

...and silver has been underperforming gold in the last week or so...

Source: Bloomberg

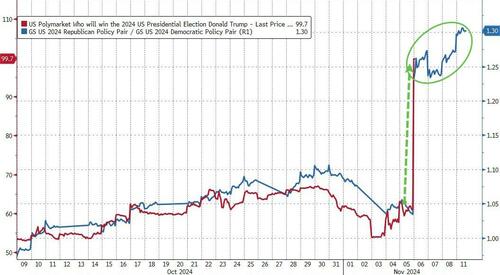

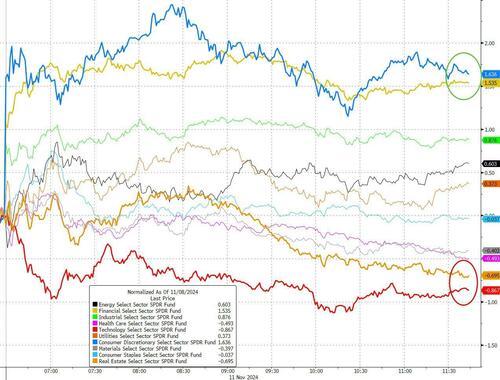

In stock-land, Democratic Party policy baskets losers kept losing as the 'Trump Trade' continues to be bid...

Source: Bloomberg

As UBS Trading Desk notes, The Republicans Versus Democrats Winners basket is up 2.2%, extending its rally to 60% so far this year.

Low quality and cyclical pockets continue their post-election rally whilst shorts squeeze higher:

Hedge Fund Holdings vs High Short Interest is down dramatically since election day.

Financials are the top sector today as Trump Financials rallies another 2.8% and M&A Banks are up 2%. Historically expensive valuations make it difficult to chase the sector higher, though with price and earnings momentum intact it is too early to fade the move. Keep an eye also on Trump Tariff Losers which is up 85bp (unusually outperforming alongside the Republican Winners basket) as the market digests the extent to which Trump 2.0 will implement tariffs and spur inflation.

Notable also today is the underperformance of AI Winners, despite a continued rally in Tesla, driven mostly by AI Semis, which is down 2.1% after the US ordered TSMC to cease sending advanced AI chips to China. Meanwhile, the AI Software Pioneers basket is up 1.5%.

The next major AI catalyst is Nvidia earnings.

Overall, Small Caps were the big winners while Nasdaq was the biggest loser. The S&P clung to unchanged while The Dow managed decent gains...

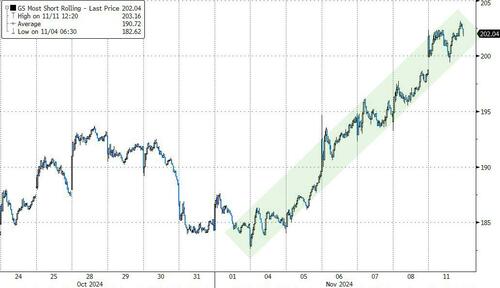

"Most Shorted" stocks squeezed higher for the 5th straight day (up 10% - the biggest sqaueeze since July's Fed flip-flop)...

Source: Bloomberg

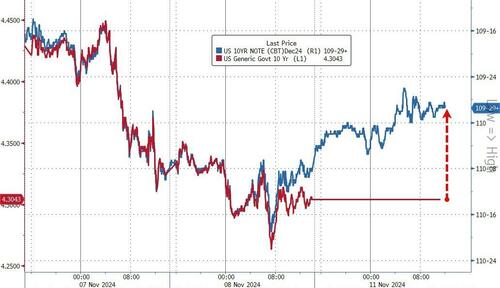

The cash bond market was closed today for Veterans Day but futures signaled some notable selling pressure. 10Y Futs imply around an 8bps surge in 10Y yields today...

Source: Bloomberg

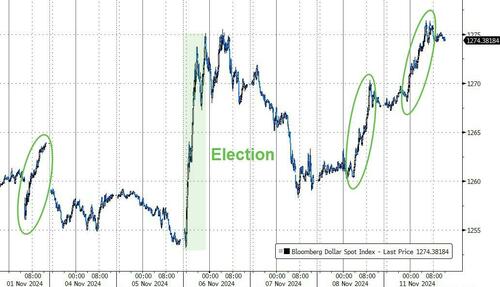

The dollar rallied back up to post-Trump highs...

Source: Bloomberg

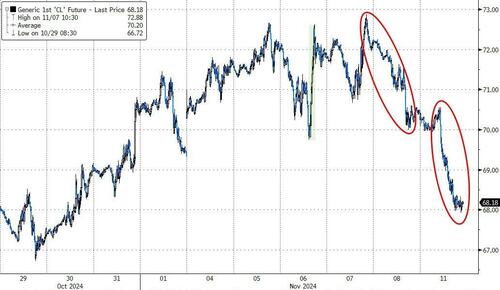

Crude prices fell once again, back near two-week lows...

Source: Bloomberg

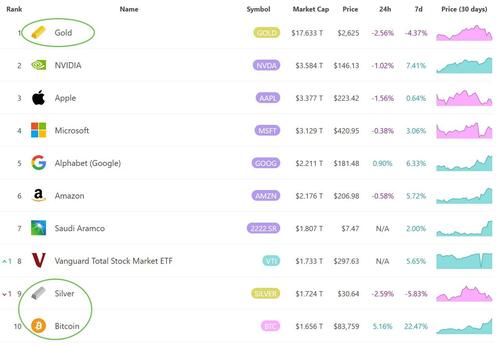

Finally, while gold remains the top of the tree for global assets, Bitcoin is quickly accelerating up on Silver's total stock (and Ethereum is now bigger than BofA)...

...imagine where bitcoin goes if Trump enacts the Lummis' Strategic Reserve?

For one thing, the market's perception of USA Sovereign Risk has collapsed since Trump won...

Source: Bloomberg

We wonder what would have happened if Kamala won?

$87,000...and counting!!

Bitcoin is up over 25% since the election results started limping and it appeared Trump would win. Today's massive surge took the major cryptocurrency above $87,000 for the first time ever.

Source: Bloomberg

...and it's going higher...

Source: Bloomberg

Bitcoin ETF trading volumes exploded today...

Source: Bloomberg

Gold, on the other hand, has been hammered lower since the election...

Source: Bloomberg

..but in the broader context, Gold is just shy of its all-time inflation-adjusted high still...

Source: Bloomberg

But Bitcoin/Gold is soaring back near recent highs...

Source: Bloomberg

...and silver has been underperforming gold in the last week or so...

Source: Bloomberg

In stock-land, Democratic Party policy baskets losers kept losing as the 'Trump Trade' continues to be bid...

Source: Bloomberg

As UBS Trading Desk notes, The Republicans Versus Democrats Winners basket is up 2.2%, extending its rally to 60% so far this year.

Low quality and cyclical pockets continue their post-election rally whilst shorts squeeze higher:

Hedge Fund Holdings vs High Short Interest is down dramatically since election day.

Financials are the top sector today as Trump Financials rallies another 2.8% and M&A Banks are up 2%. Historically expensive valuations make it difficult to chase the sector higher, though with price and earnings momentum intact it is too early to fade the move. Keep an eye also on Trump Tariff Losers which is up 85bp (unusually outperforming alongside the Republican Winners basket) as the market digests the extent to which Trump 2.0 will implement tariffs and spur inflation.

Notable also today is the underperformance of AI Winners, despite a continued rally in Tesla, driven mostly by AI Semis, which is down 2.1% after the US ordered TSMC to cease sending advanced AI chips to China. Meanwhile, the AI Software Pioneers basket is up 1.5%.

The next major AI catalyst is Nvidia earnings.

Overall, Small Caps were the big winners while Nasdaq was the biggest loser. The S&P clung to unchanged while The Dow managed decent gains...

"Most Shorted" stocks squeezed higher for the 5th straight day (up 10% - the biggest sqaueeze since July's Fed flip-flop)...

Source: Bloomberg

The cash bond market was closed today for Veterans Day but futures signaled some notable selling pressure. 10Y Futs imply around an 8bps surge in 10Y yields today...

Source: Bloomberg

The dollar rallied back up to post-Trump highs...

Source: Bloomberg

Crude prices fell once again, back near two-week lows...

Source: Bloomberg

Finally, while gold remains the top of the tree for global assets, Bitcoin is quickly accelerating up on Silver's total stock (and Ethereum is now bigger than BofA)...

...imagine where bitcoin goes if Trump enacts the Lummis' Strategic Reserve?

For one thing, the market's perception of USA Sovereign Risk has collapsed since Trump won...

Source: Bloomberg

We wonder what would have happened if Kamala won?