Arabica coffee futures blasted through March 1977 highs into blue sky breakout territory as traders panicked about global supply fears originating in Brazil, the world's top producer.

Arabica beans trading in New York hit $3.26 per pound on Wednesday, exceeding the $3.08 high last reached in March 1977. Bean prices have jumped 123% since September 2023.

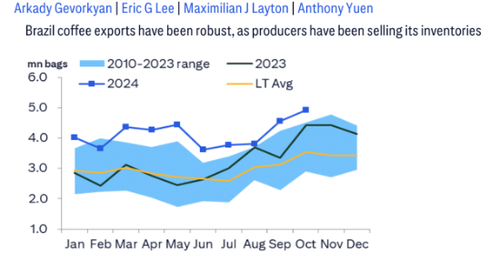

On Monday, we outlined that adverse weather conditions in Brazil spooked agricultural traders as bean stockpiles are being quickly drained ahead of next season.

Carlos Santana Jr., a Brazil-based commercial director at trader Ecom Group, told Bloomberg, "There are about eight months before the start of the next season, and the percentage of coffee sold by Brazilian growers is very high."

"We might not have enough coffee to get to the next season," Santana warned.

Rabobank analyst Carlos Mera pointed out, "The rally is due to a number of complex circumstances," including concerns about Brazil's output next year, plus shipping and logistical challenges.

Mera added that the European Union's deforestation rules and bean front-loading ahead of a potential trade tariff war are other factors pressuring bean prices higher.

Citi commodity strategist Arkady Gevorkyan told clients, "Coffee's bull run [is] likely to continue near term," adding, "We revise up our three-month target for Arabica coffee to $US3.10 a pound, and note a significant upside risk skew to this forecast as supply from Brazil and Vietnam could still underperform."

Here is Gevorkyan's full comment to clients about the bull run in coffee prices:

We revise up our 3M target for Arabica coffee to $3.10/lb, and note a significant upside risk skew to this forecast as supply from Brazil and Vietnam could still underperform. Coffee is up 57% YTD, making it one of the best performing commodities. Such a bull run has been fueled by unfavorable weather in key producing regions in Brazil damaging crops as well as support from the roasting switching demand driving Robusta demand from Vietnam. We project a consecutive three-year deficit in balances will switch to a surplus in 2025 and expect ICE coffee to trade rangebound. We also upgrade our base case 2025 forecast to $2.80/lb, while prices should normalize at $2.65/lb in 2026 (see Figure 1). Nevertheless, we note the large uncertainty on the health of Brazilian crops after the adverse weather and general production issues poses the possibility of falling into a structural deficit.

Vietnam, a major producer of the cheaper Robusta bean, has also faced adverse weather conditions, impacting harvest outputs. In London, Robusta bean prices are currently around $5,200 per metric ton, down from a record high of $5,829 observed in mid-September.

"The increased costs of hedging — due to higher margin calls — and the possibility of producer defaults have contributed to panic buying recently," analysts at coffee trader Sucafina SA wrote earlier this week.

Price action here reminds us of the cocoa squeeze earlier this year...

Anyone know if oil trader Pierre Andurand is buying Arabica coffee futs? He dabbled with cocoa.

Arabica coffee futures blasted through March 1977 highs into blue sky breakout territory as traders panicked about global supply fears originating in Brazil, the world's top producer.

Arabica beans trading in New York hit $3.26 per pound on Wednesday, exceeding the $3.08 high last reached in March 1977. Bean prices have jumped 123% since September 2023.

On Monday, we outlined that adverse weather conditions in Brazil spooked agricultural traders as bean stockpiles are being quickly drained ahead of next season.

Carlos Santana Jr., a Brazil-based commercial director at trader Ecom Group, told Bloomberg, "There are about eight months before the start of the next season, and the percentage of coffee sold by Brazilian growers is very high."

"We might not have enough coffee to get to the next season," Santana warned.

Rabobank analyst Carlos Mera pointed out, "The rally is due to a number of complex circumstances," including concerns about Brazil's output next year, plus shipping and logistical challenges.

Mera added that the European Union's deforestation rules and bean front-loading ahead of a potential trade tariff war are other factors pressuring bean prices higher.

Citi commodity strategist Arkady Gevorkyan told clients, "Coffee's bull run [is] likely to continue near term," adding, "We revise up our three-month target for Arabica coffee to $US3.10 a pound, and note a significant upside risk skew to this forecast as supply from Brazil and Vietnam could still underperform."

Here is Gevorkyan's full comment to clients about the bull run in coffee prices:

We revise up our 3M target for Arabica coffee to $3.10/lb, and note a significant upside risk skew to this forecast as supply from Brazil and Vietnam could still underperform. Coffee is up 57% YTD, making it one of the best performing commodities. Such a bull run has been fueled by unfavorable weather in key producing regions in Brazil damaging crops as well as support from the roasting switching demand driving Robusta demand from Vietnam. We project a consecutive three-year deficit in balances will switch to a surplus in 2025 and expect ICE coffee to trade rangebound. We also upgrade our base case 2025 forecast to $2.80/lb, while prices should normalize at $2.65/lb in 2026 (see Figure 1). Nevertheless, we note the large uncertainty on the health of Brazilian crops after the adverse weather and general production issues poses the possibility of falling into a structural deficit.

Vietnam, a major producer of the cheaper Robusta bean, has also faced adverse weather conditions, impacting harvest outputs. In London, Robusta bean prices are currently around $5,200 per metric ton, down from a record high of $5,829 observed in mid-September.

"The increased costs of hedging — due to higher margin calls — and the possibility of producer defaults have contributed to panic buying recently," analysts at coffee trader Sucafina SA wrote earlier this week.

Price action here reminds us of the cocoa squeeze earlier this year...

Anyone know if oil trader Pierre Andurand is buying Arabica coffee futs? He dabbled with cocoa.