China may have failed once again to stabilize its moribund housing market and flagging economy, with its latest superficial attempt to stimulate consumer demand by releasing another modest trickle of overdue but insufficient monetary and fiscal stimulus measures, but it is certainly not giving up on hopes to prop up the market at almost any cost.

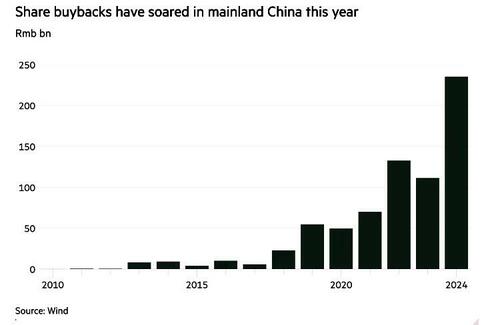

Following relentless prodding from the central government, share buybacks on mainland China’s biggest exchanges have soared to a record high this year as Beijing pushes for companies to return cash to shareholders as part of its efforts to revive a flagging stock market.

According to the FT, there have been Rmb235bn ($33bn) in buybacks across mainland-listed shares so far in 2024, more than double last year’s total and far surpassing the previous record of Rmb133bn in 2022, according to financial data provider Wind.

The scramble to repurchase shares comes as China’s government unleashes its biggest round of economic stimulus since the Covid-19 pandemic, which however has again been seen as insufficient by the market. Beijing is keen to boost investor sentiment, underscoring growing urgency to restore confidence in an economy hit hard by a property sector crisis and weak consumer demand. The government is stepping up efforts to hit its year-end GDP growth target of 5%.

While the benchmark CSI 300 index had risen as much as 20% over the past month amid Beijing’s bid to breathe new life into its equity market after years of dismal performance, it has since given up much of the gains as expectations of even more stimulus measures did not materialize.

Goldman's China strategist Kinger Lau argued that buybacks made “economic sense” for companies with cash to spare given how far Chinese share prices had fallen, and added that such a move could also bolster the government’s coffers when it held big stakes in companies.

The surge in buybacks began even before the Chinese authorities announced Rmb300bn in central bank loans to fund share repurchases last week; that news however will surely supercharge the buybacks even more.

More than 20 Chinese companies, including state oil group Sinopec, have announced share buyback plans exceeding Rmb10bn since the announcement of the central bank scheme on Friday, according to a Financial Times calculation based on exchange filings.

Jason Bedford, a China banking analyst formerly at UBS and asset manager Bridgewater, said Beijing was seeking an equity rally by encouraging buybacks. “Clearly, the government has been pushing this throughout the year,” he said.

Kin Chan, chief investment officer at Argyle Street Management in Hong Kong, said that China was following “a Japanese approach, which is telling companies to do share buybacks”.

“As a stock market player, this is wonderful, but does this solve the economic problem? I have no idea,” he said.

Meanwhile, as China is coming up with feat of financial engineering to prop up its flagging stocks in hopes of creating a virtuous wealth effect cycle, in the US insiders are doing just the opposite.

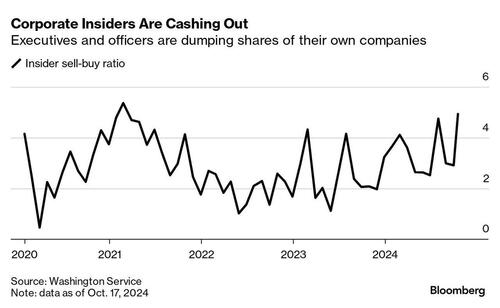

At a time when stocks have had no shortage of buyers, as even formerly bearish hedge funds capitulate and unleash the biggest buying spree of stocks since 2021, joining retail investors and record US buybacks, all helping propel US stocks to a sixth straight up week, US company insiders are dumping in near record amounts.

As Bloomberg notes, while business leaders were busy last week offering reassuring earnings guidance, underneath the rosy outlook was a different trend: They were selling stock... which has traditionally been a major red flag as these are the people who best know the inner workings of the companies they run.

As shown below, a gauge of insider sentiment, one that tallies the number of sellers versus buyers, is poised to hit the highest monthly reading in more than three years, data compiled by the Washington Service show.

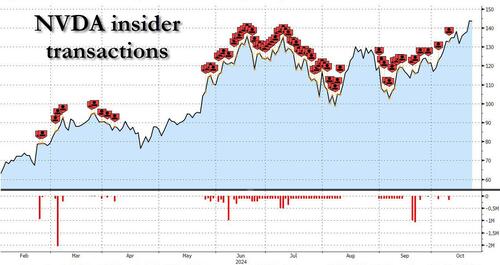

The figures chime with various high-profile sales that have made headlines recently, including Warren Buffett’s unloading of Apple and Bank of America stock, as well as sales by Nvidia insiders, including CEO Jensen Huang.

Granted, some of the exits no doubt have nothing to do with the business outlook, driven instead by the need for cash to buy a house or pay for kids’ tuition. And the stock rally has been mostly invulnerable for months amid Federal Reserve interest rate cuts and generally good tidings on the economy and earnings.

Still, the last time the insider indicator shot up, in July, it was a precursor to market pain, with the S&P 500 subsequently falling 8%.

China may have failed once again to stabilize its moribund housing market and flagging economy, with its latest superficial attempt to stimulate consumer demand by releasing another modest trickle of overdue but insufficient monetary and fiscal stimulus measures, but it is certainly not giving up on hopes to prop up the market at almost any cost.

Following relentless prodding from the central government, share buybacks on mainland China’s biggest exchanges have soared to a record high this year as Beijing pushes for companies to return cash to shareholders as part of its efforts to revive a flagging stock market.

According to the FT, there have been Rmb235bn ($33bn) in buybacks across mainland-listed shares so far in 2024, more than double last year’s total and far surpassing the previous record of Rmb133bn in 2022, according to financial data provider Wind.

The scramble to repurchase shares comes as China’s government unleashes its biggest round of economic stimulus since the Covid-19 pandemic, which however has again been seen as insufficient by the market. Beijing is keen to boost investor sentiment, underscoring growing urgency to restore confidence in an economy hit hard by a property sector crisis and weak consumer demand. The government is stepping up efforts to hit its year-end GDP growth target of 5%.

While the benchmark CSI 300 index had risen as much as 20% over the past month amid Beijing’s bid to breathe new life into its equity market after years of dismal performance, it has since given up much of the gains as expectations of even more stimulus measures did not materialize.

Goldman's China strategist Kinger Lau argued that buybacks made “economic sense” for companies with cash to spare given how far Chinese share prices had fallen, and added that such a move could also bolster the government’s coffers when it held big stakes in companies.

The surge in buybacks began even before the Chinese authorities announced Rmb300bn in central bank loans to fund share repurchases last week; that news however will surely supercharge the buybacks even more.

More than 20 Chinese companies, including state oil group Sinopec, have announced share buyback plans exceeding Rmb10bn since the announcement of the central bank scheme on Friday, according to a Financial Times calculation based on exchange filings.

Jason Bedford, a China banking analyst formerly at UBS and asset manager Bridgewater, said Beijing was seeking an equity rally by encouraging buybacks. “Clearly, the government has been pushing this throughout the year,” he said.

Kin Chan, chief investment officer at Argyle Street Management in Hong Kong, said that China was following “a Japanese approach, which is telling companies to do share buybacks”.

“As a stock market player, this is wonderful, but does this solve the economic problem? I have no idea,” he said.

Meanwhile, as China is coming up with feat of financial engineering to prop up its flagging stocks in hopes of creating a virtuous wealth effect cycle, in the US insiders are doing just the opposite.

At a time when stocks have had no shortage of buyers, as even formerly bearish hedge funds capitulate and unleash the biggest buying spree of stocks since 2021, joining retail investors and record US buybacks, all helping propel US stocks to a sixth straight up week, US company insiders are dumping in near record amounts.

As Bloomberg notes, while business leaders were busy last week offering reassuring earnings guidance, underneath the rosy outlook was a different trend: They were selling stock... which has traditionally been a major red flag as these are the people who best know the inner workings of the companies they run.

As shown below, a gauge of insider sentiment, one that tallies the number of sellers versus buyers, is poised to hit the highest monthly reading in more than three years, data compiled by the Washington Service show.

The figures chime with various high-profile sales that have made headlines recently, including Warren Buffett’s unloading of Apple and Bank of America stock, as well as sales by Nvidia insiders, including CEO Jensen Huang.

Granted, some of the exits no doubt have nothing to do with the business outlook, driven instead by the need for cash to buy a house or pay for kids’ tuition. And the stock rally has been mostly invulnerable for months amid Federal Reserve interest rate cuts and generally good tidings on the economy and earnings.

Still, the last time the insider indicator shot up, in July, it was a precursor to market pain, with the S&P 500 subsequently falling 8%.