Stocks dropped for the third day in a row today (longest streak since early Sept) with the S&P's worst loss in seven weeks, as with a big h/t to Goldman, it seems equity market bulls finally noticed the recent explosion in rates.

Treasury yields rose across the curve again today (with the long-end outperforming - 2Y +5bps, 30Y +2bps)...

Source: Bloomberg

But, the recent 2-sigma move in rates (as we have seen) implies serious drawdowns for stocks...

...and the surge in rates (10Y +55bps in the last three weeks) suddenly hit stocks...

Source: Bloomberg

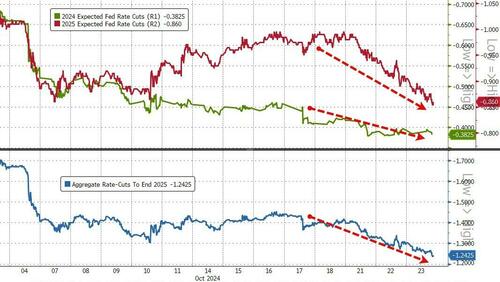

...and 'Trumpflation' has prompted a market-wide rethink of rate-cut expectations (lower/hawkish), especially for next year...

Source: Bloomberg

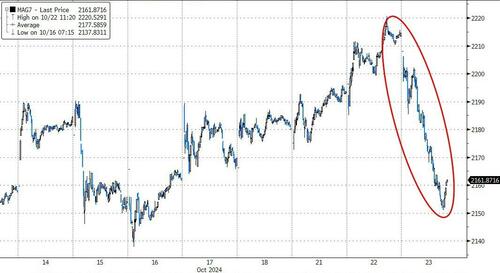

...and that all weighed on stocks bigly today. There was a small comeback after The Beige Book signaled some dovishness, but Nasdaq was the day's biggest loser (down over 2% at one point)...

A big down-day for mega-cap tech today...

Source: Bloomberg

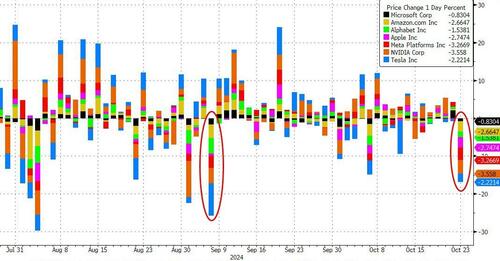

All seven of the Mag7 stocks were down today - that is the first time that's happened since Sept 6th...

Source: Bloomberg

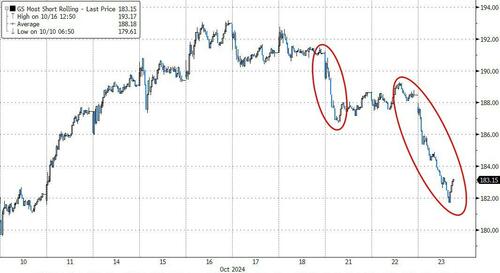

'Most Shorted' stocks were monkeyhammered lower...

Source: Bloomberg

Even the so-called 'Trump Trade' saw selling pressure today (though the "Democratic Victory' basket was hit even harder, so don't get all excited Kamala)...

Source: Bloomberg

Goldman's trading desk noted that overall activity levels are up +5% vs. the trailing 2 weeks with market volumes up +5% vs the 10dma, with their floor basically paired Buy vs. Sell with HFs net to buy and LOs net for sale

-

HFs are +7% better to buy with Demand in Macro Products, Industrials & Tech offsetting supply in Fins, Utes & Comms Svcs

-

LOs are -2% better for sale. Tech supply from them outweighs supply in Staples and Cons Svcs by 3:1. Demand is led by Cons Disc, Mats & HCare.

Meanwhile, the dollar refuses to stop, rallying up to its strongest since early July against its fiat peers...

Source: Bloomberg

Treasury yields are rising as fast as the dollar - also up to three month highs (all above 4.00%)...

Source: Bloomberg

The dollar strength finally smacked gold lower today... but not before the precious metal hit a new intraday record high...

Source: Bloomberg

Silver underperformed gold on the day after a decent run against the barbarous relic...

Source: Bloomberg

Crypto was clubbed like a baby seal also, with Bitcoin fading back towards $65,000....

Source: Bloomberg

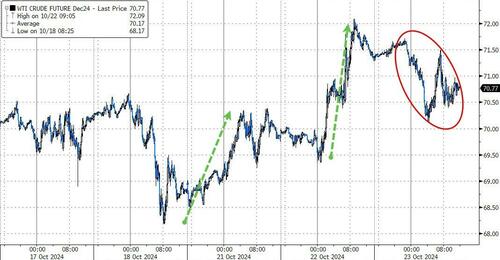

After two strong days, oil prices slipped lower on an inventory build, higher crude production, and no extreme headlines out of the MidEast (yet)...

Source: Bloomberg

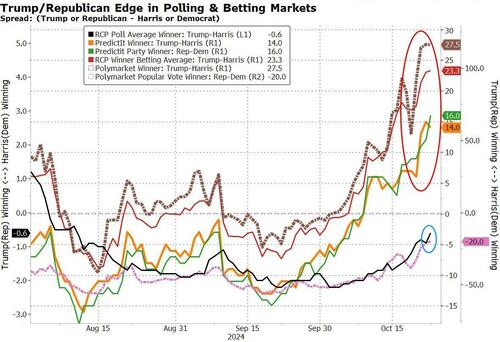

Finally, prediction markets continue to trend in Trump's direction...

Source: Bloomberg

...and even the polls are starting to move in his favor (because there's only so much 'cheat' margin to play with).

Stocks dropped for the third day in a row today (longest streak since early Sept) with the S&P's worst loss in seven weeks, as with a big h/t to Goldman, it seems equity market bulls finally noticed the recent explosion in rates.

Treasury yields rose across the curve again today (with the long-end outperforming - 2Y +5bps, 30Y +2bps)...

Source: Bloomberg

But, the recent 2-sigma move in rates (as we have seen) implies serious drawdowns for stocks...

...and the surge in rates (10Y +55bps in the last three weeks) suddenly hit stocks...

Source: Bloomberg

...and 'Trumpflation' has prompted a market-wide rethink of rate-cut expectations (lower/hawkish), especially for next year...

Source: Bloomberg

...and that all weighed on stocks bigly today. There was a small comeback after The Beige Book signaled some dovishness, but Nasdaq was the day's biggest loser (down over 2% at one point)...

A big down-day for mega-cap tech today...

Source: Bloomberg

All seven of the Mag7 stocks were down today - that is the first time that's happened since Sept 6th...

Source: Bloomberg

'Most Shorted' stocks were monkeyhammered lower...

Source: Bloomberg

Even the so-called 'Trump Trade' saw selling pressure today (though the "Democratic Victory' basket was hit even harder, so don't get all excited Kamala)...

Source: Bloomberg

Goldman's trading desk noted that overall activity levels are up +5% vs. the trailing 2 weeks with market volumes up +5% vs the 10dma, with their floor basically paired Buy vs. Sell with HFs net to buy and LOs net for sale

-

HFs are +7% better to buy with Demand in Macro Products, Industrials & Tech offsetting supply in Fins, Utes & Comms Svcs

-

LOs are -2% better for sale. Tech supply from them outweighs supply in Staples and Cons Svcs by 3:1. Demand is led by Cons Disc, Mats & HCare.

Meanwhile, the dollar refuses to stop, rallying up to its strongest since early July against its fiat peers...

Source: Bloomberg

Treasury yields are rising as fast as the dollar - also up to three month highs (all above 4.00%)...

Source: Bloomberg

The dollar strength finally smacked gold lower today... but not before the precious metal hit a new intraday record high...

Source: Bloomberg

Silver underperformed gold on the day after a decent run against the barbarous relic...

Source: Bloomberg

Crypto was clubbed like a baby seal also, with Bitcoin fading back towards $65,000....

Source: Bloomberg

After two strong days, oil prices slipped lower on an inventory build, higher crude production, and no extreme headlines out of the MidEast (yet)...

Source: Bloomberg

Finally, prediction markets continue to trend in Trump's direction...

Source: Bloomberg

...and even the polls are starting to move in his favor (because there's only so much 'cheat' margin to play with).