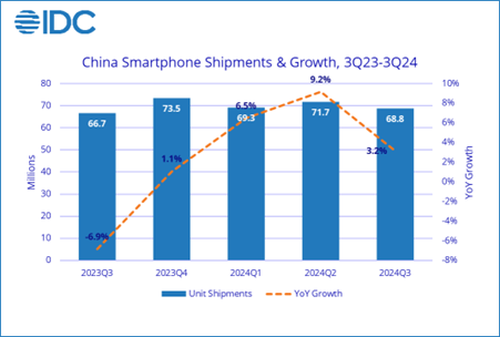

The International Data Corporation released a report Friday morning showing that China's smartphone shipments increased 3.2% year-over-year to 68.8 million units in Q3 2024, marking the fourth consecutive quarter of growth. However, there's more to the story.

Let's begin with the good news for Apple:

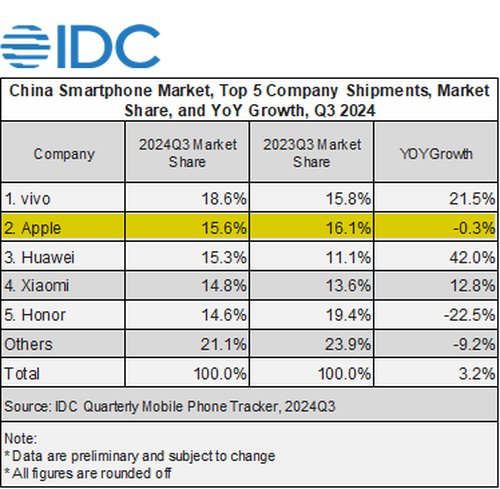

"Apple re-enters the Top 5 smartphone companies at second place with the launch of its new iPhone 16 series. Initial sales figures are on par with its predecessor, and the company anticipates that upcoming promotions and the anticipated launch of Apple Intelligence will drive future demand."

Turning to less favorable details in the report—and confirming our earlier note (read here) on Apple Intelligence's dud in the world's largest handset market—IDC showed Apple's market share in the country fell to 15.6% in the quarter, down from 16.1% in the same quarter one year ago. This indicates that local brands, such as Huawei, are chipping away at CEO Tim Cook's global smartphone empire.

In market share terms, Huawei is third behind Apple, commanding about 15.3% of the country's market share. The domestic brand's smartphone shipments in the country surged 42% year-on-year in the quarter, as its competition with Apple dramatically increased.

"Huawei has staged an impressive comeback, recording four consecutive quarters of at least double-digit growth. The launch of the world's first tri-foldable phone is expected to further drive the foldable market development," IDC wrote in the report.

Huawei's resurgence puts pressure on Apple in China and other international markets. With Apple Intelligence absent in China, consumers will gravitate more towards Oppo, Huawei, and Honor handsets already equipped with AI features.

In a separate report earlier today by Canalys, Apple's China shipments in the third quarter slid 6% year over year compared to the same quarter one year ago. Canalys placed Apple number five in terms of market share. It showed Huawei had the second largest market share, with smartphone shipments in the quarter jumping 24% year over year.

The biggest takeaway is that Apple Intelligence did not unlock what many analysts on Wall Street believed would be an upgrade 'supercycle' for the world's most valuable company.

Apple's market capitalization commands $3.5 trillion...

Meanwhile, a new report suggests that weak demand for the Apple Vision Pro mixed-reality headset in US markets could result in a winding down of series production as soon as next month.

Maybe Apple's problem is that it charges too damn much for its products in a period of elevated inflation and high interest rates.

The International Data Corporation released a report Friday morning showing that China's smartphone shipments increased 3.2% year-over-year to 68.8 million units in Q3 2024, marking the fourth consecutive quarter of growth. However, there's more to the story.

Let's begin with the good news for Apple:

"Apple re-enters the Top 5 smartphone companies at second place with the launch of its new iPhone 16 series. Initial sales figures are on par with its predecessor, and the company anticipates that upcoming promotions and the anticipated launch of Apple Intelligence will drive future demand."

Turning to less favorable details in the report—and confirming our earlier note (read here) on Apple Intelligence's dud in the world's largest handset market—IDC showed Apple's market share in the country fell to 15.6% in the quarter, down from 16.1% in the same quarter one year ago. This indicates that local brands, such as Huawei, are chipping away at CEO Tim Cook's global smartphone empire.

In market share terms, Huawei is third behind Apple, commanding about 15.3% of the country's market share. The domestic brand's smartphone shipments in the country surged 42% year-on-year in the quarter, as its competition with Apple dramatically increased.

"Huawei has staged an impressive comeback, recording four consecutive quarters of at least double-digit growth. The launch of the world's first tri-foldable phone is expected to further drive the foldable market development," IDC wrote in the report.

Huawei's resurgence puts pressure on Apple in China and other international markets. With Apple Intelligence absent in China, consumers will gravitate more towards Oppo, Huawei, and Honor handsets already equipped with AI features.

In a separate report earlier today by Canalys, Apple's China shipments in the third quarter slid 6% year over year compared to the same quarter one year ago. Canalys placed Apple number five in terms of market share. It showed Huawei had the second largest market share, with smartphone shipments in the quarter jumping 24% year over year.

The biggest takeaway is that Apple Intelligence did not unlock what many analysts on Wall Street believed would be an upgrade 'supercycle' for the world's most valuable company.

Apple's market capitalization commands $3.5 trillion...

Meanwhile, a new report suggests that weak demand for the Apple Vision Pro mixed-reality headset in US markets could result in a winding down of series production as soon as next month.

Maybe Apple's problem is that it charges too damn much for its products in a period of elevated inflation and high interest rates.