Authored by Tho Bishop via The Mises Institute,

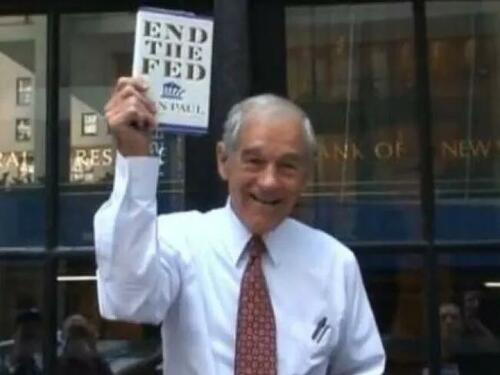

This year marks the 12-year anniversary of Ron Paul’s retirement from Congress, but his legacy continues to display itself on the political scene. On issues like foreign policy, war skepticism has grown, at least concerning American involvement in Europe. Abolishing the Department of Education has become a key tenant of Donald Trump’s education agenda. Eliminating taxes on tips has been adopted by both presidential campaigns.

Less obvious, however, has been growing political support for one of Dr. Paul’s greatest priorities: ending the Federal Reserve.

An illustration of this can be seen most obviously with the bill itself. In 2012, Dr. Paul’s last term in Congress, his End the Fed bill didn’t have a single co-sponsor. In 2024, introduced by Thomas Massie, has 23 co-sponsors, including representatives: Biggs, Boebert, Brecheen, Burchett, Burlison, Cammack, Cloud, Crane, Duncan, Gaetz, Good, Gosar, Greene, Hageman, Norman, Perry, Roy, Self, Spartz, Tiffany, Rosendale, Mills, and Reschenthaler.

This past year, another new precedent was set with Mike Lee being the first senator to introduce the bill in the upper chamber.

Also encouraging still is that members of Congress have actively used their platforms to promote the idea into the political discourse.

End

— Mike Lee (@BasedMikeLee) June 8, 2024

The

Fed https://t.co/MY7R38kLCf

END THE FED‼️

— Matt Rosendale (@RepRosendale) October 21, 2024

The political potency of Federal Reserve skepticism goes beyond simply legislation calling for the elimination of America’s central bank. One of the major stories of Trump’s 2024 campaign has been the rise of a new donor class supporting his efforts, with the crypto industry being among them.

In July, Trump addressed the 2024 Bitcoin Conference to wide applause. With his characteristic transactional style, Trump mixed his typical rally speech talking points with a list of offerings to the audience he was addressing, including firing SEC Chairman Gary Gensler, energy policy to support bitcoin mining, and the proposal of a “bitcoin sovereign wealth fund,” which has been proposed by Wyoming Senator Cynthia Lummis, the industry’s leading advocate in Washington.

The latter proposal has drawn valid skepticism from bitcoin libertarians who view increased federal investment into bitcoin as anathema to the anarchist-inspired politics that has attracted so many to bitcoin. DC as a bitcoin holder, however, would certainly benefit the price of the asset. More importantly, however, it is a demonstration of political power actively attempting to court a uniquely libertarian political constituency for preferential treatment.

Trump’s sales pitch for crypto was assisted in large part due to the political environment of the times. Not only has the inflationary environment of the last four years pushed more Americans into considering crypto, but Washington’s federal addiction to spending - an appetite Trump fed while in office - has pushed large financial managers to speak openly about the unsustainability of DC’s economic policies and the role bitcoin can play as a viable, non-political alternative.

Perhaps most importantly, however, the regulatory environment under the Biden-Harris Administration, pushed from the Senate by Elizabeth Warren, became explicitly hostile to the industry. Various White House agencies have created reports about various “risks” crypto-assets pose, justifying broad moves to cut off access to the banking system, what many have described as “Operation Chokepoint 2.0”, a call back to Obama-era policies that targeted online gambling sites. Biden has also proposed excise taxes for crypto assets and mining.

These hostile regulatory actions have all been pushed with all the usual rhetoric used to justify financial warfare. As was the case for the technocratic pushes for eliminating cash, the stated concerns involve the “financing of terrorism”, “crime”, and other unpleasantries. What is clear, however, is the fear that bitcoin and crypto allow for an end-around from the state-controlled traditional financial system.

The state understands that the control of money means control over the people.

As such, should the crypto industry’s political investments pay off in meaningful policies, it would be a win for liberty generally, regardless of one’s own views on bitcoin or specific crypto projects.

The question, going forward, is where are the most meaningful ways to leverage the current moment for meaningful victories against the state? Here, again, Dr. Paul’s political legacy offers value.

While “End the Fed” was the favorite chant of his presidential campaigns, his legislative agenda included another radical proposal: the competition of currency. Inspired by Hayek, his Free Competition in Currency Act was a simple bill with radical consequences: repealing legal tender laws and federal taxation on gold and silver. By reviving that bill, and expanding it to bitcoin and other crypto assets, one could empower Americans to confidently save in non-political assets free of capital gains taxes.

The political theatre of the 2024 election has been extremely thin in serious policy discussions for the fundamental issues Americans are dealing with. The reality, however, is that the damages of inflation, financialization, and decades of fiscal irresponsibility are more obvious to average Americans than ever before. From that comes opportunity.

The cause of our time is to grow awareness of the fact that the Federal Reserve is the arsonist, not the firefighters, when it comes to our economic crises. Hopefully, our new documentary, Playing with Fire: Money, Banking, and the Federal Reserve will assist in that mission. The solution is the ability for Americans to opt out of their rigged game.

May Ron Paul’s legacy continue to grow...

Authored by Tho Bishop via The Mises Institute,

This year marks the 12-year anniversary of Ron Paul’s retirement from Congress, but his legacy continues to display itself on the political scene. On issues like foreign policy, war skepticism has grown, at least concerning American involvement in Europe. Abolishing the Department of Education has become a key tenant of Donald Trump’s education agenda. Eliminating taxes on tips has been adopted by both presidential campaigns.

Less obvious, however, has been growing political support for one of Dr. Paul’s greatest priorities: ending the Federal Reserve.

An illustration of this can be seen most obviously with the bill itself. In 2012, Dr. Paul’s last term in Congress, his End the Fed bill didn’t have a single co-sponsor. In 2024, introduced by Thomas Massie, has 23 co-sponsors, including representatives: Biggs, Boebert, Brecheen, Burchett, Burlison, Cammack, Cloud, Crane, Duncan, Gaetz, Good, Gosar, Greene, Hageman, Norman, Perry, Roy, Self, Spartz, Tiffany, Rosendale, Mills, and Reschenthaler.

This past year, another new precedent was set with Mike Lee being the first senator to introduce the bill in the upper chamber.

Also encouraging still is that members of Congress have actively used their platforms to promote the idea into the political discourse.

End

— Mike Lee (@BasedMikeLee) June 8, 2024

The

Fed https://t.co/MY7R38kLCf

END THE FED‼️

— Matt Rosendale (@RepRosendale) October 21, 2024

The political potency of Federal Reserve skepticism goes beyond simply legislation calling for the elimination of America’s central bank. One of the major stories of Trump’s 2024 campaign has been the rise of a new donor class supporting his efforts, with the crypto industry being among them.

In July, Trump addressed the 2024 Bitcoin Conference to wide applause. With his characteristic transactional style, Trump mixed his typical rally speech talking points with a list of offerings to the audience he was addressing, including firing SEC Chairman Gary Gensler, energy policy to support bitcoin mining, and the proposal of a “bitcoin sovereign wealth fund,” which has been proposed by Wyoming Senator Cynthia Lummis, the industry’s leading advocate in Washington.

The latter proposal has drawn valid skepticism from bitcoin libertarians who view increased federal investment into bitcoin as anathema to the anarchist-inspired politics that has attracted so many to bitcoin. DC as a bitcoin holder, however, would certainly benefit the price of the asset. More importantly, however, it is a demonstration of political power actively attempting to court a uniquely libertarian political constituency for preferential treatment.

Trump’s sales pitch for crypto was assisted in large part due to the political environment of the times. Not only has the inflationary environment of the last four years pushed more Americans into considering crypto, but Washington’s federal addiction to spending - an appetite Trump fed while in office - has pushed large financial managers to speak openly about the unsustainability of DC’s economic policies and the role bitcoin can play as a viable, non-political alternative.

Perhaps most importantly, however, the regulatory environment under the Biden-Harris Administration, pushed from the Senate by Elizabeth Warren, became explicitly hostile to the industry. Various White House agencies have created reports about various “risks” crypto-assets pose, justifying broad moves to cut off access to the banking system, what many have described as “Operation Chokepoint 2.0”, a call back to Obama-era policies that targeted online gambling sites. Biden has also proposed excise taxes for crypto assets and mining.

These hostile regulatory actions have all been pushed with all the usual rhetoric used to justify financial warfare. As was the case for the technocratic pushes for eliminating cash, the stated concerns involve the “financing of terrorism”, “crime”, and other unpleasantries. What is clear, however, is the fear that bitcoin and crypto allow for an end-around from the state-controlled traditional financial system.

The state understands that the control of money means control over the people.

As such, should the crypto industry’s political investments pay off in meaningful policies, it would be a win for liberty generally, regardless of one’s own views on bitcoin or specific crypto projects.

The question, going forward, is where are the most meaningful ways to leverage the current moment for meaningful victories against the state? Here, again, Dr. Paul’s political legacy offers value.

While “End the Fed” was the favorite chant of his presidential campaigns, his legislative agenda included another radical proposal: the competition of currency. Inspired by Hayek, his Free Competition in Currency Act was a simple bill with radical consequences: repealing legal tender laws and federal taxation on gold and silver. By reviving that bill, and expanding it to bitcoin and other crypto assets, one could empower Americans to confidently save in non-political assets free of capital gains taxes.

The political theatre of the 2024 election has been extremely thin in serious policy discussions for the fundamental issues Americans are dealing with. The reality, however, is that the damages of inflation, financialization, and decades of fiscal irresponsibility are more obvious to average Americans than ever before. From that comes opportunity.

The cause of our time is to grow awareness of the fact that the Federal Reserve is the arsonist, not the firefighters, when it comes to our economic crises. Hopefully, our new documentary, Playing with Fire: Money, Banking, and the Federal Reserve will assist in that mission. The solution is the ability for Americans to opt out of their rigged game.

May Ron Paul’s legacy continue to grow...