The theme for the week was the good (macro outperformance), the bad (dovish rate-cut expectations plunging), and the ugly (Kamala Harris victory expectations gagged as markets bet on Trump).

The 'good' news this was that macro data continued to outperform expectations...

Source: Bloomberg

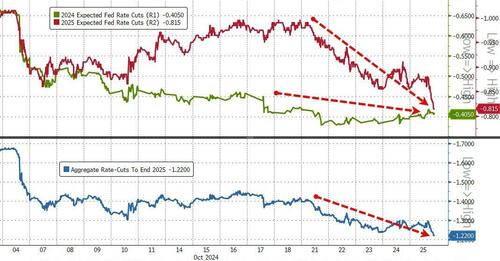

...raising ever more doubts about the pace of The Fed's new easing cycle as rate-cut expectations tumbled this week - especially for 2025 (because that's when Trump will be in office, so why would we cut rates for him?)...

Source: Bloomberg

"if that's all true, maybe they're not data-dependent."

"I do not want to be the person accusing them of politics ... but when you don't have a theory of the case and you don't follow it, it is easy to get that accusation and it is harder ... to defend them."

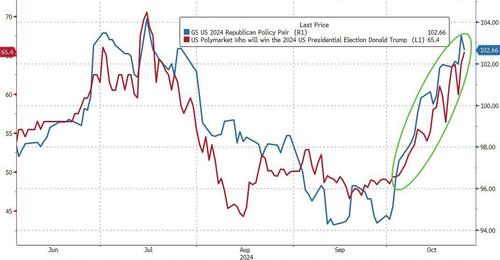

And the ugly theme (for some) was the Trump-Trade taking off in stocks and prediction markets (as well as bonds, bullion, and bitcoin)...

Source: Bloomberg

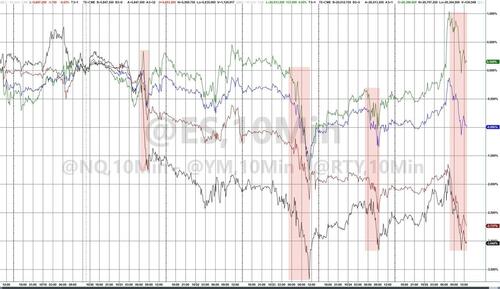

While 'Trump Trade' stock baskets outperformed, the broad market was lower (especially The Dow and Small Caps). Nasdaq had an epic gamma squeeze today which lifted it into the green for the week (but gave most of that back by the close). The S&P 500 closed down around 1% on the week, ending a six-week win-streak...

Mega-Cap tech had a wild week with the Mag7 basket whipsawing down hard and then a big squeeze higher thanks to NVDA and TSLA...

Source: Bloomberg

TSLA ended the week up over 20% to its highest weekly close since Sept 2023...

NVDA refuses to stop going up - up 5 straight weeks to a new record high today...

Nvidia briefly surpassed Apple as the world's most valuable company on Friday with a $3.53 trillion valuation...

Source: Bloomberg

VIX had a wild ride this week too, ending back above 20...

Source: Bloomberg

Bonds were a bloodbath this week with the belly of the curve underperforming bigly...

Source: Bloomberg

Notice that today saw yields spike notably after WaPo refused to endorse Kamala...

Source: Bloomberg

The dollar rallied for the 4th straight week to its highest weekly close since June...

Source: Bloomberg

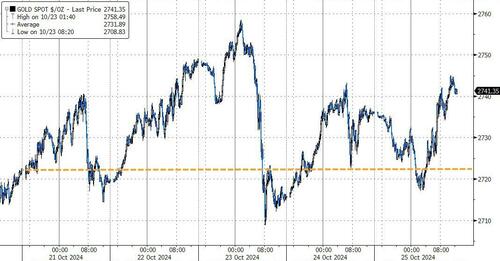

Gold rallied for the 6th week in the last 7, hitting a new intraday record high during the week...

Source: Bloomberg

Bitcoin ended the week lower thanks to a big puke today as Tether headlines (and the tech wreck) weighed on the whole crypto ecosystem...

Source: Bloomberg

Crude prices were higher this week (but chopped around in a narrow band - WTI between $70 and $72)...

Source: Bloomberg

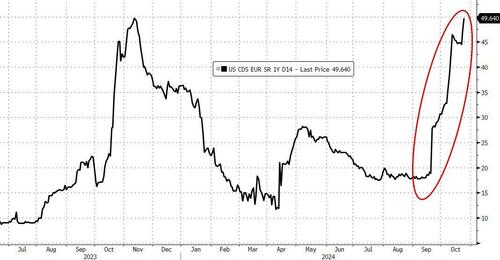

Finally, is the ultimate hedge trade on the USA (US CDS) signaling a "sweep"...

Source: Bloomberg

Gridlock - good; Red or Blue Sweep - bad!

The theme for the week was the good (macro outperformance), the bad (dovish rate-cut expectations plunging), and the ugly (Kamala Harris victory expectations gagged as markets bet on Trump).

The 'good' news this was that macro data continued to outperform expectations...

Source: Bloomberg

...raising ever more doubts about the pace of The Fed's new easing cycle as rate-cut expectations tumbled this week - especially for 2025 (because that's when Trump will be in office, so why would we cut rates for him?)...

Source: Bloomberg

"if that's all true, maybe they're not data-dependent."

"I do not want to be the person accusing them of politics ... but when you don't have a theory of the case and you don't follow it, it is easy to get that accusation and it is harder ... to defend them."

And the ugly theme (for some) was the Trump-Trade taking off in stocks and prediction markets (as well as bonds, bullion, and bitcoin)...

Source: Bloomberg

While 'Trump Trade' stock baskets outperformed, the broad market was lower (especially The Dow and Small Caps). Nasdaq had an epic gamma squeeze today which lifted it into the green for the week (but gave most of that back by the close). The S&P 500 closed down around 1% on the week, ending a six-week win-streak...

Mega-Cap tech had a wild week with the Mag7 basket whipsawing down hard and then a big squeeze higher thanks to NVDA and TSLA...

Source: Bloomberg

TSLA ended the week up over 20% to its highest weekly close since Sept 2023...

NVDA refuses to stop going up - up 5 straight weeks to a new record high today...

Nvidia briefly surpassed Apple as the world's most valuable company on Friday with a $3.53 trillion valuation...

Source: Bloomberg

VIX had a wild ride this week too, ending back above 20...

Source: Bloomberg

Bonds were a bloodbath this week with the belly of the curve underperforming bigly...

Source: Bloomberg

Notice that today saw yields spike notably after WaPo refused to endorse Kamala...

Source: Bloomberg

The dollar rallied for the 4th straight week to its highest weekly close since June...

Source: Bloomberg

Gold rallied for the 6th week in the last 7, hitting a new intraday record high during the week...

Source: Bloomberg

Bitcoin ended the week lower thanks to a big puke today as Tether headlines (and the tech wreck) weighed on the whole crypto ecosystem...

Source: Bloomberg

Crude prices were higher this week (but chopped around in a narrow band - WTI between $70 and $72)...

Source: Bloomberg

Finally, is the ultimate hedge trade on the USA (US CDS) signaling a "sweep"...

Source: Bloomberg

Gridlock - good; Red or Blue Sweep - bad!