Polaris shares fell in premarket trading after the company, known for selling ATVs, UTVs, jet skis, and snowmobiles, posted disappointing third-quarter earnings. The company also cut its full-year earnings per share and sales forecast, citing sagging demand for outdoor vehicles due to elevated interest rates.

"As consumer confidence and retail demand remain challenging, we have maintained our focus on managing dealer inventory and delivering better operational efficiency," Polaris CEO Mike Speetzen wrote in a press release.

Polaris reported sales of $1.72 billion, down 23% YoY, missing the Bloomberg estimate of $1.77 billion. Sales were down modestly in off-road vehicles, motorcycles, and pontoons.

Here's a snapshot of third-quarter earnings (courtesy of Bloomberg):

-

Sales $1.72 billion, -23% y/y, estimate $1.77 billion (Bloomberg Consensus)

-

Off Road sales $1.40 billion, -24% y/y, estimate $1.41 billion

-

On Road sales $236.5 million, -13% y/y, estimate $241.6 million

-

Marine sales $85.9 million, -36% y/y, estimate $133.7 million

-

Gross profit margin 20.6% vs. 22.6% y/y, estimate 21%

-

Cash and cash equivalents $291.3 million, -1.4% y/y, estimate $337.8 millio

-

Adjusted EPS from continuing operations 73c, estimate 89c

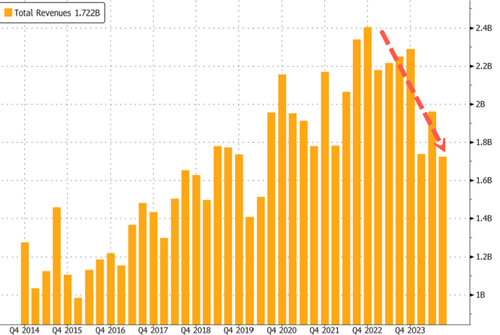

Visualizing Polaris' quarterly revenues... The cheap money era of Covid, plus folks moving out of cities to resort towns and or just rural America, sparked a massive demand for outdoor vehicles. As the Federal Reserve tightened monetary policy, which sent interest rates to the moon, affordability for these outdoor grown-up toys worsened, thus curbing demand.

As a result of a challenging market, one in which high interest rates have curbed consumer spending on jetskis, RZRs, and snowmobiles, Polaris had to lower its full-year earnings per share and sales guidance:

-

Sees adjusted EPS -65%, saw -56% to -62%

-

Sees sales -20%, saw -17% to -20%

Polaris explained more about its reasoning behind lowering its 2024 business outlook:

The company updated its 2024 sales outlook to be down approximately 20 percent relative to 2023 versus its previous outlook of down 17 to 20 percent relative to 2023. The company now expects adjusted diluted EPS attributed to Polaris Inc. common shareholders to be down approximately 65 percent relative to 2023 versus the prior outlook of down 56 to 62 percent.

In markets, Polaris shares in New York are down 7%. On the year, shares are down 15% (as of Monday's close). Shares are hovering at levels last seen since right before the Covid crash.

Also, watch MasterCraft Boat, MarineMax, Camping World, Brunswick, and Malibu Boats.

Polaris is a proxy of consumer health. Certainly, high interest rates and elevated inflation have crimped demand for ATVs, UTVs, and jet skis. The broad theme here is that a consumer slowdown continues to worsen.

Polaris shares fell in premarket trading after the company, known for selling ATVs, UTVs, jet skis, and snowmobiles, posted disappointing third-quarter earnings. The company also cut its full-year earnings per share and sales forecast, citing sagging demand for outdoor vehicles due to elevated interest rates.

"As consumer confidence and retail demand remain challenging, we have maintained our focus on managing dealer inventory and delivering better operational efficiency," Polaris CEO Mike Speetzen wrote in a press release.

Polaris reported sales of $1.72 billion, down 23% YoY, missing the Bloomberg estimate of $1.77 billion. Sales were down modestly in off-road vehicles, motorcycles, and pontoons.

Here's a snapshot of third-quarter earnings (courtesy of Bloomberg):

-

Sales $1.72 billion, -23% y/y, estimate $1.77 billion (Bloomberg Consensus)

-

Off Road sales $1.40 billion, -24% y/y, estimate $1.41 billion

-

On Road sales $236.5 million, -13% y/y, estimate $241.6 million

-

Marine sales $85.9 million, -36% y/y, estimate $133.7 million

-

Gross profit margin 20.6% vs. 22.6% y/y, estimate 21%

-

Cash and cash equivalents $291.3 million, -1.4% y/y, estimate $337.8 millio

-

Adjusted EPS from continuing operations 73c, estimate 89c

Visualizing Polaris' quarterly revenues... The cheap money era of Covid, plus folks moving out of cities to resort towns and or just rural America, sparked a massive demand for outdoor vehicles. As the Federal Reserve tightened monetary policy, which sent interest rates to the moon, affordability for these outdoor grown-up toys worsened, thus curbing demand.

As a result of a challenging market, one in which high interest rates have curbed consumer spending on jetskis, RZRs, and snowmobiles, Polaris had to lower its full-year earnings per share and sales guidance:

-

Sees adjusted EPS -65%, saw -56% to -62%

-

Sees sales -20%, saw -17% to -20%

Polaris explained more about its reasoning behind lowering its 2024 business outlook:

The company updated its 2024 sales outlook to be down approximately 20 percent relative to 2023 versus its previous outlook of down 17 to 20 percent relative to 2023. The company now expects adjusted diluted EPS attributed to Polaris Inc. common shareholders to be down approximately 65 percent relative to 2023 versus the prior outlook of down 56 to 62 percent.

In markets, Polaris shares in New York are down 7%. On the year, shares are down 15% (as of Monday's close). Shares are hovering at levels last seen since right before the Covid crash.

Also, watch MasterCraft Boat, MarineMax, Camping World, Brunswick, and Malibu Boats.

Polaris is a proxy of consumer health. Certainly, high interest rates and elevated inflation have crimped demand for ATVs, UTVs, and jet skis. The broad theme here is that a consumer slowdown continues to worsen.