By

Is The Fed Asleep At The Wheel, Again?

https://ift.tt/7Tb2XuY

By Dheval Joshi, chief strategist at BCA Research

Suddenly, the fear is not that the Fed is behind the curve to stabilize a downturn. The fear is that the Fed is behind the curve to stabilize prices. Last Friday’s strong US jobs report has allayed any fears of an imminent recession, but it has increased fears that an aggressive easing cycle from the Fed will rekindle inflation.

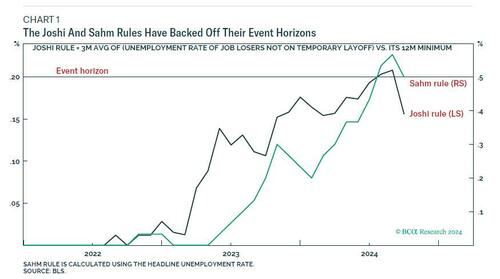

Very unusually, both the Joshi rule and Sahm rule recession indicators have backed off their event horizons (Chart 1).

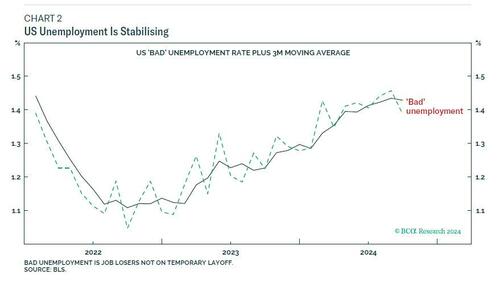

This is very unusual, because once you cross the event horizon you should never come back! Crossing the event horizon typically marks an acceleration in unemployment. But instead of accelerating, US unemployment is stabilising (Chart 2).

The Joshi rule and Sahm rule event horizons are the point at which higher unemployment typically sets off a negative feedback loop. Weak growth gets noticed, causing people to rein in spending, begetting further weakness in sales and profits which takes the economy into recession.

Yet what makes the US economy so unusual right now is that it is ‘inverted’. Meaning that output is being supply-driven instead of the usual demand-driven. Suddenly, the penny drops.

The highly unusual behavior of the US economy is because of its highly unusual, ‘inverted’ configuration.

Crucially, the recent uptrend in unemployment has been juxtaposed with strong supply-driven output growth. This strong supply-driven growth has likely short-circuited the negative feedback loops into sales and profits that typically tip the economy into recession.

The good news is that we should not fear an imminent US recession. The bad news is that victory celebrations in the war against US inflation are premature.

Aggressive Fed Rate Cuts Are Incompatible With 2 Percent Inflation

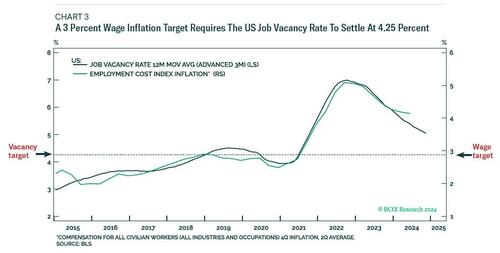

The Fed’s 2 percent price inflation requires the economy’s main price – wages – to inflate at 2 percent plus the assumed growth in productivity. Adding in pre-pandemic average productivity growth of around 1 percent, this means that wage inflation must cool to around 3 percent (from its current 4.1 percent).

Of course, wage inflation could settle at higher than 3 percent if post-pandemic productivity growth has gapped higher, but the Fed admits that this would be a dangerous assumption on which to base policy. I agree.

I also agree with the Fed that the best leading indicator for wage inflation is the job vacancy rate. Based on this very tight leading property, a 3 percent wage inflation target requires the job vacancy rate to settle at 4.25 percent (Chart 3).

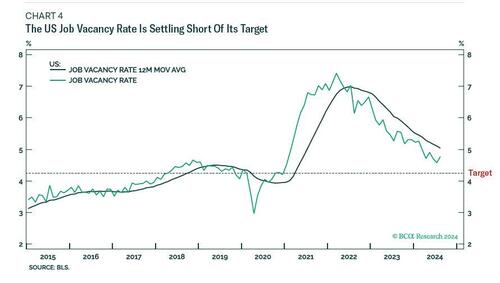

Yet over the last five months the job vacancy rate has been settling at around 4.75 percent, a rate that it never topped during the pre-pandemic years (Chart 4).

Now, you might think that the difference between the job vacancy rate stabilising at 4.25 or 4.75 percent is splitting hairs. But it isn’t. The difference amounts to the difference between price inflation stabilising at 2 percent or at 2.5 percent.

Moreover, this is where inflation is at the start of an assumed aggressive Fed easing cycle, which typically marks the cycle low in inflation. A cycle low that would mean that the cycle average – which is what the Fed targets – would be considerably higher than 2 percent.

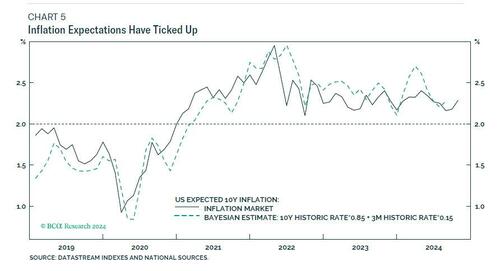

Bear in mind also that inflation expectations, as measured both by the market and by consumer surveys, have ticked up. The so-called 10-year ‘breakeven’ inflation expectation now stands at 2.3 percent

Long-term inflation expectations are driven largely by long-term historic inflation. Unfortunately, long-term historic inflation is going to drift higher as the pandemic’s hump becomes a greater portion of the history. The only way to counter this is by taking inflation as close as possible to 2 percent or, even better, below 2 percent. Otherwise, the danger is that inflation expectations will become unanchored.

The bottom line is that, in the absence of recession, and if the Fed wants to keep inflation and inflation expectations anchored at 2 percent, it cannot cut rates as aggressively as is priced.

The Real Risk Is Not A Profits Recession, The Real Risk Is A Valuation Recession

In the absence of recession, the real risk is not a profits recession. The real risk is a valuation recession.

As I predicted four weeks ago, short-dated US interest rate futures and 2-year T-notes were overpriced for rate cuts, making them compelling underweights. The prediction proved prescient. Following the strong jobs report, our recommended short position in the Feb 2025 Fed funds future contract (ZQH5) is comfortably in profit.

But to repeat, absent a recession, the pricing for Fed easing is still too aggressive.

Stay short the Feb 2025 Fed funds future until it reaches a price target of 95.5.

Stay short 2-year T-notes. Both absolutely, and relative to 2-year European government bonds, specifically 2-year UK gilts.

The Fed is still priced for almost 100 bps of rate cuts from now through March, whereas the BoE is priced for just 50 bps. Yet the reality is likely to be a much smaller difference, one way or the other.

An excellent way to play this is to be long USD/GBP, especially as the complexity of the preceding sell-off in the dollar reached the point of collapse that reliably signals an imminent change of trend.

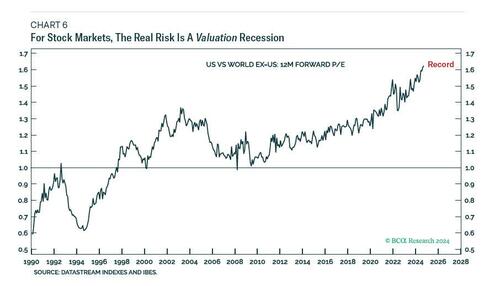

Turning to stock markets, the absence of recession means that the real risk is not a profits recession. The real risk is a valuation recession that stems from the Fed funds rate not falling as fast or as far as is priced.

This supports two of my high conviction stock market views on a cyclical (6-12 month) and longer horizon:

Overweight undervalued small caps (Russell 2000) versus overvalued mega-cap tech (Nasdaq). And overweight the undervalued non-US versus the overvalued US (Chart 6).

Gold Is A Counterintuitive Short

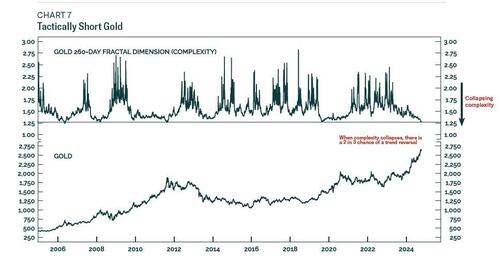

Finally, a counterintuitive recommendation on gold. On the face of it, a Fed that is behind the curve to stabilise prices should be good for the inflation hedge, gold. Yet if Fed reacts by cutting rates much less than is priced, as I strongly believe, then it will boost the dollar. Which is bad for gold.

Moreover, the near-50 percent rally in gold through the past year has taken its 260-day price complexity to the point of collapse that has reliably marked previous rally exhaustions in 2006, 2008, 2009, 2011, 2019, and 2020 (Chart 7).

Given gold’s spectacular rally has reached this point of fragility, combined with expected dollar strength, I am downgrading gold to underweight on a cyclical horizon. And a recommended 6-month tactical trade is to short gold, setting the profit target and symmetrical stop-loss at 8 percent.

Loading...

news

via Government Slaves https://ift.tt/GlxybJT

October 10, 2024 at 09:04AM

October 10, 2024 at 09:06AM

via ZeroHedge News https://ift.tt/7Tb2XuY