'Soft' Survey data today (from Philly and Richmond Feds) were better than expected BUT - and it's a big but - inflation expectations are surging once again...

Source: Bloomberg

...and current and expected spending on software and equipment (cough AI cough) is plunging?

Source: Bloomberg

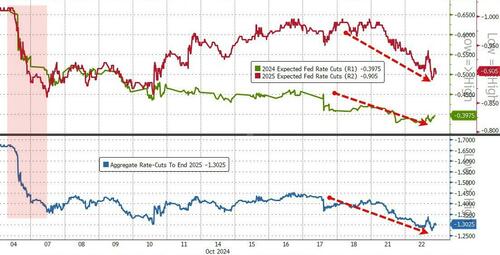

The surge in Prices Paid and Received dominated the downside in capex from the surveys and sent rate-cut expectations (hawkishly) lower again on the day...

Source: Bloomberg

So with all that said - and ignored - the market is now transfixed on the election... and the bets are one-way... on Trump...

Source: Bloomberg

Prediction markets are soaring in Trump's favor and even the polls are swinging higher now...

Source: Bloomberg

Overall the majors spent most of the day under-water but an afternoon drift higher lifted Nasdaq and The Dow into the green for the day but a very late-day selloff spoiled the party...

Mega-Cap tech saved the day (with a new record high for the basket) from being really ugly...

Source: Bloomberg

Treasuries were mixed to flat today with none of the curve ending more than 1bps different close to close (the long-end was slightly more bid)...

Source: Bloomberg

The dollar continued its charge higher - albeit only modestly today...

Source: Bloomberg

Another day, another record high for gold, trading within pennies of $2750...

Source: Bloomberg

Silver also continues to outperform gold...

Source: Bloomberg

Crypto went nowhere fast today, with Bitcoin chopping around $67,000...

Source: Bloomberg

Crude prices rallied on the day, with WTI back above $70...

Source: Bloomberg

Finally, as gold accelerates, global liquidity (proxied by global M2) has turned down...

Source: Bloomberg

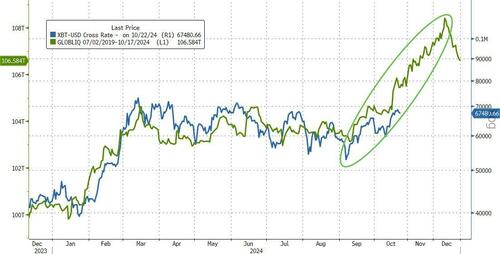

...but bitcoin has only just started to catch up with the tsunami...

Source: Bloomberg

We agree with PTJ on this one - not seeing either as an election trade, but as an inflation trade..."I think all roads lead to inflation. I’m long gold. I’m long Bitcoin. I think commodities are so ridiculously under-owned, so I’m long commodities..."

'Soft' Survey data today (from Philly and Richmond Feds) were better than expected BUT - and it's a big but - inflation expectations are surging once again...

Source: Bloomberg

...and current and expected spending on software and equipment (cough AI cough) is plunging?

Source: Bloomberg

The surge in Prices Paid and Received dominated the downside in capex from the surveys and sent rate-cut expectations (hawkishly) lower again on the day...

Source: Bloomberg

So with all that said - and ignored - the market is now transfixed on the election... and the bets are one-way... on Trump...

Source: Bloomberg

Prediction markets are soaring in Trump's favor and even the polls are swinging higher now...

Source: Bloomberg

Overall the majors spent most of the day under-water but an afternoon drift higher lifted Nasdaq and The Dow into the green for the day but a very late-day selloff spoiled the party...

Mega-Cap tech saved the day (with a new record high for the basket) from being really ugly...

Source: Bloomberg

Treasuries were mixed to flat today with none of the curve ending more than 1bps different close to close (the long-end was slightly more bid)...

Source: Bloomberg

The dollar continued its charge higher - albeit only modestly today...

Source: Bloomberg

Another day, another record high for gold, trading within pennies of $2750...

Source: Bloomberg

Silver also continues to outperform gold...

Source: Bloomberg

Crypto went nowhere fast today, with Bitcoin chopping around $67,000...

Source: Bloomberg

Crude prices rallied on the day, with WTI back above $70...

Source: Bloomberg

Finally, as gold accelerates, global liquidity (proxied by global M2) has turned down...

Source: Bloomberg

...but bitcoin has only just started to catch up with the tsunami...

Source: Bloomberg

We agree with PTJ on this one - not seeing either as an election trade, but as an inflation trade..."I think all roads lead to inflation. I’m long gold. I’m long Bitcoin. I think commodities are so ridiculously under-owned, so I’m long commodities..."