Authored by Lance Roberts via RealInvestmentAdvice.com,

In times of disaster and destruction, a common narrative often emerges that rebuilding efforts will lead to economic growth. The idea that repairing damage and replacing destroyed goods creates jobs that spur consumption and stimulate economic activity is tempting. However, as French economist Frédéric Bastiat explained in his famous “Broken Window Theory,” this reasoning is fundamentally flawed. Rather than generating net economic benefits, destruction diverts resources and wealth that could have been used for more productive purposes, ultimately stifling real economic growth.

Recent events, particularly the devastation caused by Hurricanes Helene and Milton in 2024, provide a clear example of why destruction does not create long-term economic prosperity. Despite the short-term boost in economic activity from rebuilding efforts, the broader economic implications are far more detrimental. In this post, we will delve into Bastiat’s Broken Window Theory, apply it to the aftermath of the hurricanes, and explain why destruction and the need to replace lost goods drag forward future consumption rather than create new economic value.

The Broken Window Theory: A Lesson in Opportunity Cost

Frédéric Bastiat introduced the “Broken Window Theory” in his 1850 essay “That Which is Seen, and That Which is Not Seen.” The theory is illustrated by a simple example: A boy throws a rock through a shopkeeper’s window, breaking it. While some may argue that this destruction benefits the economy—after all, the shopkeeper must now pay a glazier to fix the window, creating work—the key insight lies in what is not seen.

Had the shopkeeper not needed to replace the window, he could have spent that money on something else, perhaps new inventory, equipment, or even personal savings. The repair creates no new wealth; it merely replaces what was lost. The shopkeeper’s forced expenditure on the window diverts resources that could have been used to improve his business or save for the future.

Bastiat’s principle extends beyond a broken window to any form of destruction, whether natural or man-made. Destruction leads to the misallocation of resources, pulling future consumption forward and leaving society no wealthier than before. This is a critical point that often gets overlooked in post-disaster economic analysis.

Hurricanes Helene and Milton: Real-World Examples of Bastiat’s Theory

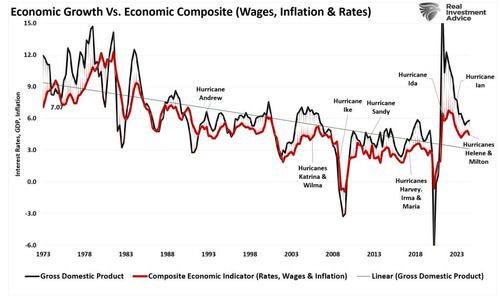

The devastation caused by Hurricane Helene and Hurricane Milton in 2024 offers a stark reminder of why destruction does not foster economic growth. The two hurricanes ravaged communities, destroying homes, businesses, infrastructure, and entire industries across the affected regions. In the wake of these disasters, some economic analysts argued that the rebuilding efforts would boost local economies, creating jobs in construction and stimulating demand for materials, goods, and services. The chart below is an economic composite of wages, inflation, and interest rates compared to economic growth. There are two crucial points.

The first is that inflation, wages, and interest rates track economic growth trends because of their interrelationship. Thus, predictions of higher future inflation are incorrect unless there is a surge in accompanying economic activity. Secondly, while bumps to activity did occur following hurricanes, the long-term downtrend in economic growth was unaffected.

It is correct that there will be a likely surge in economic activity as government, insurance, and private donations support reconstruction efforts. However, the longer-term trend of economic growth will continue to decline. Here’s why:

1. Dragging Forward Future Consumption

As Bastiat’s theory suggests, rebuilding homes, businesses, and infrastructure replaces lost wealth. The destruction caused by the hurricanes forced families, businesses, and local governments to divert future resources toward rebuilding. Such actions divert money from savings, investing for growth, or purchasing new goods and services. In other words, pulling forward future consumption limits future growth.

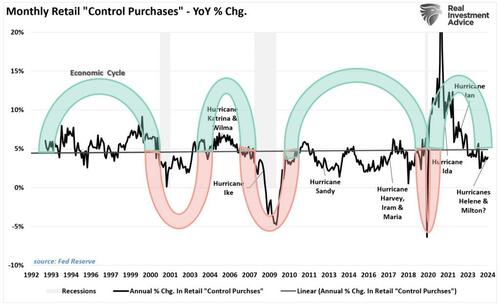

For instance, residents who plan to upgrade their homes or purchase new vehicles in the coming years are now using those funds to repair damages instead. Businesses, particularly small ones, must spend on repairs rather than expansions or new product lines. The chart below shows the annual rate of change in retail spending of control purchases versus hurricanes and the economic cycle. Unsurprisingly, hurricanes did precede bumps in retail spending that quickly faded.

The net result is an economy that’s not growing faster but using its resources inefficiently to return to its pre-hurricane state.

2. Misallocation of Resources

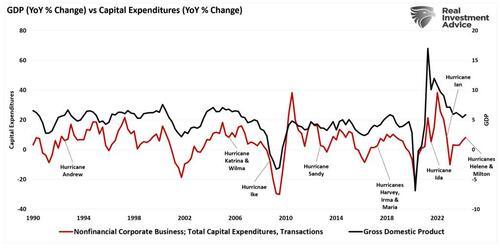

Disasters also lead to the misallocation of economic resources. Economists should want capital invested in productive investments that drive future growth, such as innovation, technology, and infrastructure improvements. The “wealth creation” process depends on capital investment spending that leads to growth. Unsurprisingly, there is often a short-term boost to capital expenditures and economic growth, which fades once spending is complete.

In the case of Hurricane Helene and Milton, local governments will redirect funds to emergency relief and rebuilding. Again, we will see a pickup in economic growth in the short term. However, those actions now deprive funds for future projects like education and infrastructure development without further increases in debt issuance. Private businesses face the same dilemma. While insurance will provide some relief, future companies will redirect future capital expenditure plans to rebuild and repair existing damage. Such actions limit future growth and, thereby, the “wealth creation” process.

3. Destruction of Capital Stock

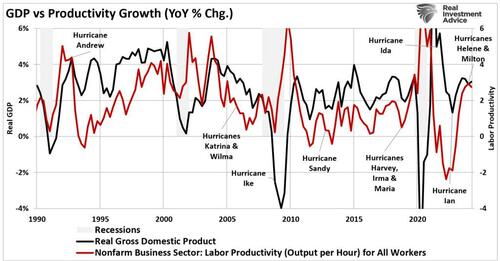

When hurricanes destroy homes, businesses, and infrastructure, they destroy valuable capital stock. This includes everything from machinery and tools to roads, bridges, and factories. The destruction of this capital leads to a significant loss in productivity, as businesses must either shut down temporarily or operate at reduced capacity until they can replace damaged assets. Such is seen in the chart below of productivity versus economic growth.

Consider the industries hit hardest by the hurricanes, such as agriculture, fishing, and manufacturing. Businesses in these sectors often lost physical assets and weeks or even months of productive capacity. While rebuilding may create short-term jobs, the loss of capital stock and the resulting decrease in productivity will have longer-lasting effects on the economy.

The Earnings Illusion

The key takeaway from Bastiat’s “Broken Window Theory” is that destruction creates the illusion of short-term economic growth by shifting resources around. In the case of the recent hurricanes, there will be a temporary uptick in GDP. Notably, the recovery actions will delay the onset of a recession for a while longer. However, that boost to activity merely represents the replacement of lost wealth, not the creation of new wealth.

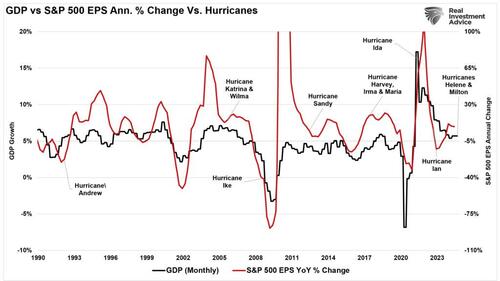

There is an impact on financial markets for investors. Since investors value stocks based on forward earnings, the impact on corporate earnings is generally negative at first, with companies in the path of these storms experiencing production halts, infrastructure damage, and supply chain disruptions. However, the aftermath of these events often reveals a more complex picture.

Immediate Earnings Impact:

-

Negative short-term effects: Companies, particularly those in retail, hospitality, and energy, face sharp revenue declines due to operational shutdowns. For example, after Hurricane Katrina in 2005, several industries along the Gulf Coast saw significant revenue disruptions.

-

Rising costs: Insurance, construction, and raw materials companies often see surges in demand after a hurricane, but rising labor and materials costs can squeeze their margins.

Post-Hurricane Rebuilding Phase:

The economic activity that follows the destruction—rebuilding homes, infrastructure, and businesses—can temporarily boost sectors such as construction, utilities, and consumer goods. For instance, following Hurricanes Harvey and Irma in 2017, rebuilding efforts fueled a temporary rise in construction earnings and increased demand for durable goods.

However, that surge is temporary, not permanent. Once the rebuilding phase concludes, earnings for these companies return to pre-storm levels. Moreover, widespread destruction often diverts resources from more productive investments, dampening long-term growth prospects. As shown, the annual rate of change of earnings tracks economic growth. If economic growth does not receive a long-term benefit from destruction, neither will earnings.

Conclusion

Analysts’ use of Bastiat’s argument that destruction creates economic prosperity rests on a misunderstanding of wealth creation. True economic growth occurs when new goods and services production increases society’s overall wealth. On the other hand, destruction forces the replacement of existing goods and services, leading to no net increase in wealth.

Think about it this way: if destruction is beneficial to economic prosperity, why not have an annual event where the Government carpet bombs a major city? When viewed in this manner, the illogic of the argument of “creative destruction” becomes evident.

While necessary, the rebuilding efforts after Hurricanes Helene and Milton do not represent economic progress. Instead, they highlight the cost of destruction. The resources spent on rebuilding can no longer be available for more productive purposes. In the long run, this diversion of resources stifles economic growth by reducing the capital available for investment, innovation, and future consumption.

Rather than creating prosperity, destruction imposes significant economic costs that hinder long-term growth. Policymakers, business leaders, and investors must recognize that while rebuilding is necessary, it does not represent real economic progress. The same applies to government interventions, welfare increases, and tax credits.

True growth comes from policies that support increases in productive investments, innovation, and the efficient allocation of resources. As investors, we should hope for those policies. As citizens, those are the policies we should demand.

Authored by Lance Roberts via RealInvestmentAdvice.com,

In times of disaster and destruction, a common narrative often emerges that rebuilding efforts will lead to economic growth. The idea that repairing damage and replacing destroyed goods creates jobs that spur consumption and stimulate economic activity is tempting. However, as French economist Frédéric Bastiat explained in his famous “Broken Window Theory,” this reasoning is fundamentally flawed. Rather than generating net economic benefits, destruction diverts resources and wealth that could have been used for more productive purposes, ultimately stifling real economic growth.

Recent events, particularly the devastation caused by Hurricanes Helene and Milton in 2024, provide a clear example of why destruction does not create long-term economic prosperity. Despite the short-term boost in economic activity from rebuilding efforts, the broader economic implications are far more detrimental. In this post, we will delve into Bastiat’s Broken Window Theory, apply it to the aftermath of the hurricanes, and explain why destruction and the need to replace lost goods drag forward future consumption rather than create new economic value.

The Broken Window Theory: A Lesson in Opportunity Cost

Frédéric Bastiat introduced the “Broken Window Theory” in his 1850 essay “That Which is Seen, and That Which is Not Seen.” The theory is illustrated by a simple example: A boy throws a rock through a shopkeeper’s window, breaking it. While some may argue that this destruction benefits the economy—after all, the shopkeeper must now pay a glazier to fix the window, creating work—the key insight lies in what is not seen.

Had the shopkeeper not needed to replace the window, he could have spent that money on something else, perhaps new inventory, equipment, or even personal savings. The repair creates no new wealth; it merely replaces what was lost. The shopkeeper’s forced expenditure on the window diverts resources that could have been used to improve his business or save for the future.

Bastiat’s principle extends beyond a broken window to any form of destruction, whether natural or man-made. Destruction leads to the misallocation of resources, pulling future consumption forward and leaving society no wealthier than before. This is a critical point that often gets overlooked in post-disaster economic analysis.

Hurricanes Helene and Milton: Real-World Examples of Bastiat’s Theory

The devastation caused by Hurricane Helene and Hurricane Milton in 2024 offers a stark reminder of why destruction does not foster economic growth. The two hurricanes ravaged communities, destroying homes, businesses, infrastructure, and entire industries across the affected regions. In the wake of these disasters, some economic analysts argued that the rebuilding efforts would boost local economies, creating jobs in construction and stimulating demand for materials, goods, and services. The chart below is an economic composite of wages, inflation, and interest rates compared to economic growth. There are two crucial points.

The first is that inflation, wages, and interest rates track economic growth trends because of their interrelationship. Thus, predictions of higher future inflation are incorrect unless there is a surge in accompanying economic activity. Secondly, while bumps to activity did occur following hurricanes, the long-term downtrend in economic growth was unaffected.

It is correct that there will be a likely surge in economic activity as government, insurance, and private donations support reconstruction efforts. However, the longer-term trend of economic growth will continue to decline. Here’s why:

1. Dragging Forward Future Consumption

As Bastiat’s theory suggests, rebuilding homes, businesses, and infrastructure replaces lost wealth. The destruction caused by the hurricanes forced families, businesses, and local governments to divert future resources toward rebuilding. Such actions divert money from savings, investing for growth, or purchasing new goods and services. In other words, pulling forward future consumption limits future growth.

For instance, residents who plan to upgrade their homes or purchase new vehicles in the coming years are now using those funds to repair damages instead. Businesses, particularly small ones, must spend on repairs rather than expansions or new product lines. The chart below shows the annual rate of change in retail spending of control purchases versus hurricanes and the economic cycle. Unsurprisingly, hurricanes did precede bumps in retail spending that quickly faded.

The net result is an economy that’s not growing faster but using its resources inefficiently to return to its pre-hurricane state.

2. Misallocation of Resources

Disasters also lead to the misallocation of economic resources. Economists should want capital invested in productive investments that drive future growth, such as innovation, technology, and infrastructure improvements. The “wealth creation” process depends on capital investment spending that leads to growth. Unsurprisingly, there is often a short-term boost to capital expenditures and economic growth, which fades once spending is complete.

In the case of Hurricane Helene and Milton, local governments will redirect funds to emergency relief and rebuilding. Again, we will see a pickup in economic growth in the short term. However, those actions now deprive funds for future projects like education and infrastructure development without further increases in debt issuance. Private businesses face the same dilemma. While insurance will provide some relief, future companies will redirect future capital expenditure plans to rebuild and repair existing damage. Such actions limit future growth and, thereby, the “wealth creation” process.

3. Destruction of Capital Stock

When hurricanes destroy homes, businesses, and infrastructure, they destroy valuable capital stock. This includes everything from machinery and tools to roads, bridges, and factories. The destruction of this capital leads to a significant loss in productivity, as businesses must either shut down temporarily or operate at reduced capacity until they can replace damaged assets. Such is seen in the chart below of productivity versus economic growth.

Consider the industries hit hardest by the hurricanes, such as agriculture, fishing, and manufacturing. Businesses in these sectors often lost physical assets and weeks or even months of productive capacity. While rebuilding may create short-term jobs, the loss of capital stock and the resulting decrease in productivity will have longer-lasting effects on the economy.

The Earnings Illusion

The key takeaway from Bastiat’s “Broken Window Theory” is that destruction creates the illusion of short-term economic growth by shifting resources around. In the case of the recent hurricanes, there will be a temporary uptick in GDP. Notably, the recovery actions will delay the onset of a recession for a while longer. However, that boost to activity merely represents the replacement of lost wealth, not the creation of new wealth.

There is an impact on financial markets for investors. Since investors value stocks based on forward earnings, the impact on corporate earnings is generally negative at first, with companies in the path of these storms experiencing production halts, infrastructure damage, and supply chain disruptions. However, the aftermath of these events often reveals a more complex picture.

Immediate Earnings Impact:

-

Negative short-term effects: Companies, particularly those in retail, hospitality, and energy, face sharp revenue declines due to operational shutdowns. For example, after Hurricane Katrina in 2005, several industries along the Gulf Coast saw significant revenue disruptions.

-

Rising costs: Insurance, construction, and raw materials companies often see surges in demand after a hurricane, but rising labor and materials costs can squeeze their margins.

Post-Hurricane Rebuilding Phase:

The economic activity that follows the destruction—rebuilding homes, infrastructure, and businesses—can temporarily boost sectors such as construction, utilities, and consumer goods. For instance, following Hurricanes Harvey and Irma in 2017, rebuilding efforts fueled a temporary rise in construction earnings and increased demand for durable goods.

However, that surge is temporary, not permanent. Once the rebuilding phase concludes, earnings for these companies return to pre-storm levels. Moreover, widespread destruction often diverts resources from more productive investments, dampening long-term growth prospects. As shown, the annual rate of change of earnings tracks economic growth. If economic growth does not receive a long-term benefit from destruction, neither will earnings.

Conclusion

Analysts’ use of Bastiat’s argument that destruction creates economic prosperity rests on a misunderstanding of wealth creation. True economic growth occurs when new goods and services production increases society’s overall wealth. On the other hand, destruction forces the replacement of existing goods and services, leading to no net increase in wealth.

Think about it this way: if destruction is beneficial to economic prosperity, why not have an annual event where the Government carpet bombs a major city? When viewed in this manner, the illogic of the argument of “creative destruction” becomes evident.

While necessary, the rebuilding efforts after Hurricanes Helene and Milton do not represent economic progress. Instead, they highlight the cost of destruction. The resources spent on rebuilding can no longer be available for more productive purposes. In the long run, this diversion of resources stifles economic growth by reducing the capital available for investment, innovation, and future consumption.

Rather than creating prosperity, destruction imposes significant economic costs that hinder long-term growth. Policymakers, business leaders, and investors must recognize that while rebuilding is necessary, it does not represent real economic progress. The same applies to government interventions, welfare increases, and tax credits.

True growth comes from policies that support increases in productive investments, innovation, and the efficient allocation of resources. As investors, we should hope for those policies. As citizens, those are the policies we should demand.