After yesterday's stellar 3Y auction, moments ago the Treasury sold $39BN in a 10Y reopening of 9Y-11M cusipg LF6, which for the second day in a row, saw remarkable demand.

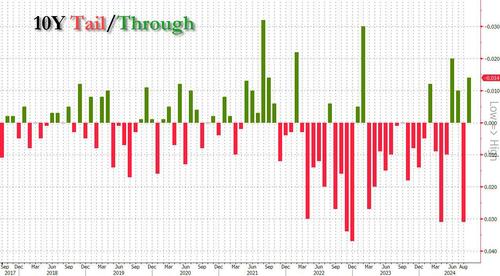

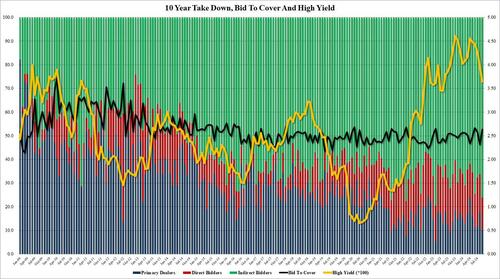

The auction stopped at a high yield of 3.648%, which was 31.2bps below last month's 3.96% and was the lowest since May 2023; it also stopped through the When Issued 3.662 by 1.4bps, the 3rd through in the past 4 auctions, and a clear reversal to last month's ugly 3.1bps tail.

The bid to cover was 2.637, a big jump from the 2.317 in August, and the highest since June's 2.67%.

The internals were even more impressive, with Indirects awarded 76.1%, the biggest award going to foreign buyers since February 2023. And with Directs taking down 13.7%, Dealers were left holding just 10.2%, the lowest since August 2023.

Yet despite the stellar 10Y auction, with yields already trading at 2023 lows earlier in the day only to spike higher after the hotter CPI print, before reversing, and the reversing again after the NVDA stick save sent money chasing risk assets once more, yields actually moved higher on the auction results, and were rapidly approaching session highs of 3.68%.

After yesterday's stellar 3Y auction, moments ago the Treasury sold $39BN in a 10Y reopening of 9Y-11M cusipg LF6, which for the second day in a row, saw remarkable demand.

The auction stopped at a high yield of 3.648%, which was 31.2bps below last month's 3.96% and was the lowest since May 2023; it also stopped through the When Issued 3.662 by 1.4bps, the 3rd through in the past 4 auctions, and a clear reversal to last month's ugly 3.1bps tail.

The bid to cover was 2.637, a big jump from the 2.317 in August, and the highest since June's 2.67%.

The internals were even more impressive, with Indirects awarded 76.1%, the biggest award going to foreign buyers since February 2023. And with Directs taking down 13.7%, Dealers were left holding just 10.2%, the lowest since August 2023.

Yet despite the stellar 10Y auction, with yields already trading at 2023 lows earlier in the day only to spike higher after the hotter CPI print, before reversing, and the reversing again after the NVDA stick save sent money chasing risk assets once more, yields actually moved higher on the auction results, and were rapidly approaching session highs of 3.68%.