By Michael Every of Rabobank

2750 Beeps

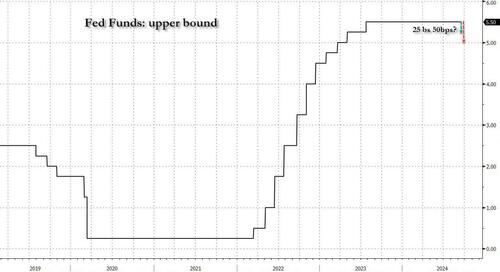

The market is waiting for the Fed to cut rates today for the first time in years: the economist Bloomberg survey expects 25bps; markets are split between pricing 25bps and 50bps, with the most speculation in Fed Funds futures since they began trading in 1988; some joke the Fed should cut 37.5bps to please everyone; others are shifting ”50-50” to mean “fifty then fifty”, i.e., rates can keep being slashed as in crashes and recessions; and Democratic senators want 75bps.

There were hopes US retail sales data could make the case for 25 or 50bps, but they didn’t. The headline was stronger than consensus, but the ex-autos figure was weaker. That said, industrial production soared 0.8% m-o-m vs. 0.2% expected. Yet it would be ironic if that series, a sector neither the Fed nor financial markets have any interest in, derails interest rates falling as fast as they had hoped. Likewise, the Atlanta Fed GDP survey put its current Q3 estimate at 3.0% with only two weeks left of data before end-quarter, when trend US growth is 2%: either that Fed series is unconnected to the real economy, or the FOMC are, or markets are, or all three. Moreover, concerns grow that east coast US ports might see a crippling strike next month. We already had a report of Asia-East Coast routes commanding a $1,500 premium, working against a general softening of freight rates of late.

Meanwhile, in the Middle East we just got 2,750 beeps (Saudi media reporting as many as 4,000). A killer call triggered the simultaneous explosion of thousands of pagers held by members of Iran-backed Lebanese terrorist militia Hezbollah, choking hospitals with men losing fingers, eyes, and other key anatomy. Even the Iranian ambassador was reported to have been lightly injured – though why did he have a Hezbollah pager? The Middle East is on a knife-edge. However, that obvious analysis aside, there are several key facts to draw from this episode, which rightly takes the main headline in the Financial Times today online ahead of the Fed.

First, both the Lebanese government and Hezbollah have blamed Israel for the attack, the latter promising revenge – and not by email.

Second, the US took its now-usual step of denying any involvement. I’m sure that’s correct as nowadays US allies don’t tell it what they want to do ahead of time, given they never want to do anything: it’s far easier to ask for forgiveness than permission. To a Machiavellian, saying ‘non mea culpa’ does not make the US appear an honest broker, but reduces its perceived power - silence was the better option. That this has to be said partly explains why geopolitical tensions are so high, which matters to markets given the FT saying national security is reshaping economic policy.

Third, Israel hasn’t claimed responsibility, but has dealt Hezbollah a hammer blow. The militia had recently switched to low-tech pagers to avoid interceptions of its comms and GPS locations. This has backfired badly, badly injuring thousands of its men, and now leaving it unable to communicate as rumors swirl of a potential Israeli ground incursion ahead.

Fourth, is how this ‘Mission Impossible’ was achieved. Some say the encrypted pagers ordered from Taiwan --bringing in another geopolitical angle-- were interdicted, Mossad injecting a compound into their lithium batteries to allow them to be hacked remotely to then overheat. However, lithium burns and videos show detonations with no flame, suggesting the replacement of some parts with plastic explosives, a far larger supply-chain feat.

This matters for more than the Middle East or pagers. Many of us worry about phone addiction. Others worry about our phones being listened to. Some are pushing for children not to be allowed phones in schools. From now on, we’ll have to be concerned about our devices exploding in our hands or pockets. This will seriously change how some serious business is done.

The weaponisation of common devices within a supply chain opens a Pandora’s box. The US is already trying to remove Chinese technology like Huawei’s 5G as a security threat, and that EVs record all we do is well-known by many. Yet how long will it now be until more banal made-in-China consumer products are also seen as being potentially too risky? If I can make those connections, others paid to worry about such things, and politicians who make money in doing so, will be front-running further national-security onshoring in the near future.

Paging the Fed: that deep China supply-chain deflation helping you consider a 50bps move today may not last long. Things could really overheat at that point. If you think we’ve seen market volatility in the past few years (and weeks on USD/JPY!), imagine normalising 75bps Fed hikes against rising inflation, then 50bps cuts in a fair economy… and then getting that call structurally wrong, and having to U-turn again.

Ironically, as the Fed is considering cutting bigly while some US data looks good, the ECB is playing its hand more cautiously even as the German ZEW survey collapsed like VW’s self-confidence. Relatedly, as the Financial Times editorial says, “Draghi is trying to save Europe from itself”, EU Commission President von der Leyen just named her new team to do that saving. The key thing to note is countries who favour dirigiste market intervention (i.e., France, Spain, and Italy) claimed prime posts like anti-trust, state aid, EU spending, and industrial policy. The outgoing free-market competition commissioner powerlessly warned of allowing pan-EU champions to emerge, as this would also be a “Pandora’s box” for Europe. Just a less explosive one than what we’ve seen in the Middle East; except to free-market purists who don’t understand that violent reality is what much of the world outside their happy bubble looks like.

In Australia, the government and RBA are still at daggers drawn, as a former senior Reserve Bank manager says reform of its board is needed to avoid groupthink: yes, but all the establishment and most of the population daily echo the Aussie TV advert that screamed, “I JUST WANNA SELL RUGS!” (Where for “rugs!”, read “rate cuts!”; or for “sell” read “buy”, and for “rugs!” read “houses!”) The RBA is also going to play with a wholesale banking CBDC for the next three years to try to streamline settlements processes. Nothing for retail or the government yet. But if you want to imagine something truly explosive on the device in your pocket, how about a central-bank controlled digital currency it can print or delete at will as part of an it’s-not-central-planning-when-we-do-it economy. Luckily, one of the last to try and plan the economy will be Australia, we can assume – unless it involves housing.

So, back to waiting for the Fed. Or the next geopolitical bang.

By Michael Every of Rabobank

2750 Beeps

The market is waiting for the Fed to cut rates today for the first time in years: the economist Bloomberg survey expects 25bps; markets are split between pricing 25bps and 50bps, with the most speculation in Fed Funds futures since they began trading in 1988; some joke the Fed should cut 37.5bps to please everyone; others are shifting ”50-50” to mean “fifty then fifty”, i.e., rates can keep being slashed as in crashes and recessions; and Democratic senators want 75bps.

There were hopes US retail sales data could make the case for 25 or 50bps, but they didn’t. The headline was stronger than consensus, but the ex-autos figure was weaker. That said, industrial production soared 0.8% m-o-m vs. 0.2% expected. Yet it would be ironic if that series, a sector neither the Fed nor financial markets have any interest in, derails interest rates falling as fast as they had hoped. Likewise, the Atlanta Fed GDP survey put its current Q3 estimate at 3.0% with only two weeks left of data before end-quarter, when trend US growth is 2%: either that Fed series is unconnected to the real economy, or the FOMC are, or markets are, or all three. Moreover, concerns grow that east coast US ports might see a crippling strike next month. We already had a report of Asia-East Coast routes commanding a $1,500 premium, working against a general softening of freight rates of late.

Meanwhile, in the Middle East we just got 2,750 beeps (Saudi media reporting as many as 4,000). A killer call triggered the simultaneous explosion of thousands of pagers held by members of Iran-backed Lebanese terrorist militia Hezbollah, choking hospitals with men losing fingers, eyes, and other key anatomy. Even the Iranian ambassador was reported to have been lightly injured – though why did he have a Hezbollah pager? The Middle East is on a knife-edge. However, that obvious analysis aside, there are several key facts to draw from this episode, which rightly takes the main headline in the Financial Times today online ahead of the Fed.

First, both the Lebanese government and Hezbollah have blamed Israel for the attack, the latter promising revenge – and not by email.

Second, the US took its now-usual step of denying any involvement. I’m sure that’s correct as nowadays US allies don’t tell it what they want to do ahead of time, given they never want to do anything: it’s far easier to ask for forgiveness than permission. To a Machiavellian, saying ‘non mea culpa’ does not make the US appear an honest broker, but reduces its perceived power - silence was the better option. That this has to be said partly explains why geopolitical tensions are so high, which matters to markets given the FT saying national security is reshaping economic policy.

Third, Israel hasn’t claimed responsibility, but has dealt Hezbollah a hammer blow. The militia had recently switched to low-tech pagers to avoid interceptions of its comms and GPS locations. This has backfired badly, badly injuring thousands of its men, and now leaving it unable to communicate as rumors swirl of a potential Israeli ground incursion ahead.

Fourth, is how this ‘Mission Impossible’ was achieved. Some say the encrypted pagers ordered from Taiwan --bringing in another geopolitical angle-- were interdicted, Mossad injecting a compound into their lithium batteries to allow them to be hacked remotely to then overheat. However, lithium burns and videos show detonations with no flame, suggesting the replacement of some parts with plastic explosives, a far larger supply-chain feat.

This matters for more than the Middle East or pagers. Many of us worry about phone addiction. Others worry about our phones being listened to. Some are pushing for children not to be allowed phones in schools. From now on, we’ll have to be concerned about our devices exploding in our hands or pockets. This will seriously change how some serious business is done.

The weaponisation of common devices within a supply chain opens a Pandora’s box. The US is already trying to remove Chinese technology like Huawei’s 5G as a security threat, and that EVs record all we do is well-known by many. Yet how long will it now be until more banal made-in-China consumer products are also seen as being potentially too risky? If I can make those connections, others paid to worry about such things, and politicians who make money in doing so, will be front-running further national-security onshoring in the near future.

Paging the Fed: that deep China supply-chain deflation helping you consider a 50bps move today may not last long. Things could really overheat at that point. If you think we’ve seen market volatility in the past few years (and weeks on USD/JPY!), imagine normalising 75bps Fed hikes against rising inflation, then 50bps cuts in a fair economy… and then getting that call structurally wrong, and having to U-turn again.

Ironically, as the Fed is considering cutting bigly while some US data looks good, the ECB is playing its hand more cautiously even as the German ZEW survey collapsed like VW’s self-confidence. Relatedly, as the Financial Times editorial says, “Draghi is trying to save Europe from itself”, EU Commission President von der Leyen just named her new team to do that saving. The key thing to note is countries who favour dirigiste market intervention (i.e., France, Spain, and Italy) claimed prime posts like anti-trust, state aid, EU spending, and industrial policy. The outgoing free-market competition commissioner powerlessly warned of allowing pan-EU champions to emerge, as this would also be a “Pandora’s box” for Europe. Just a less explosive one than what we’ve seen in the Middle East; except to free-market purists who don’t understand that violent reality is what much of the world outside their happy bubble looks like.

In Australia, the government and RBA are still at daggers drawn, as a former senior Reserve Bank manager says reform of its board is needed to avoid groupthink: yes, but all the establishment and most of the population daily echo the Aussie TV advert that screamed, “I JUST WANNA SELL RUGS!” (Where for “rugs!”, read “rate cuts!”; or for “sell” read “buy”, and for “rugs!” read “houses!”) The RBA is also going to play with a wholesale banking CBDC for the next three years to try to streamline settlements processes. Nothing for retail or the government yet. But if you want to imagine something truly explosive on the device in your pocket, how about a central-bank controlled digital currency it can print or delete at will as part of an it’s-not-central-planning-when-we-do-it economy. Luckily, one of the last to try and plan the economy will be Australia, we can assume – unless it involves housing.

So, back to waiting for the Fed. Or the next geopolitical bang.