Update (1502ET):

West Texas Intermediate futures jumped as much as 3%, the biggest gain in two weeks. This temporarily halted a nearly 19% decline since mid-August as short covering kicked in after Gulf of Mexico oil production was partially shuttered ahead of Hurricane Francine, which is set to make landfall near the southeastern Louisiana coast as a high-end Category 1 storm later today.

Short covering in WTI futures was primarily due to oil companies shutting down about 40% of Gulf crude output ahead of the storm. In recent days, Exxon Mobil, Shell, and other offshore drillers have evacuated crews and suspended operations.

39% of Gulf of Mexico oil production shut due to Hurricane Francinehttps://t.co/bIf53HcmIi

— ForexLive (@ForexLive) September 11, 2024

"While global demand has weakened, current US supplies could tighten further if Hurricane Francine causes multiple days of well shut-ins," Dennis Kissler, senior vice president for trading at BOK Financial Securities, told Bloomberg.

Francine has mostly outweighed an earlier bearish EIA report showing an 833,000-barrel build in domestic crude stockpiles. Bloomberg users were expecting a 700,000-barrel draw.

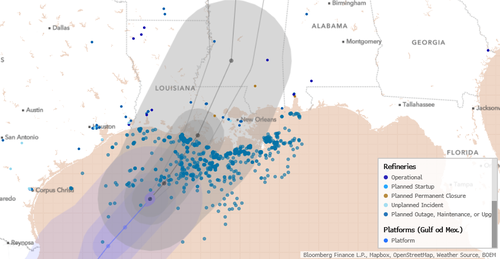

The latest Bloomberg data shows that the storm's trajectory is expected to slice through dozens of offshore oil rigs, and as many as eight onshore refineries are in the cone of uncertainty.

In addition to oil production shut-ins, Criterion Research said NatGas production in the Gulf of Mexico has plunged.

The Gulf of Mexico has rapidly shut in gas volumes as Francine moves towards Louisiana. We currently see around 0.85 Bcf/d offline as output slid to this morning’s 1.18 Bcf/d. The Gulf was not impacted by any major storms in 2023, so it's been a while since we had a sudden drop… pic.twitter.com/00HIHrueHI

— Criterion Research (@PipelineFlows) September 11, 2024

Commodity analyst Giovanni Staunovo wrote on X, "Based on data from offshore operator reports submitted as of 11:30 a.m. CDT today, personnel have been evacuated from a total of 171 production platforms, 46% of the 371 manned platforms in the Gulf of Mexico."

Based on data from offshore operator reports submitted as of 11:30 a.m. CDT today, personnel have been evacuated from a total of 171 production platforms, 46% of the 371 manned platforms in the Gulf of Mexico.

— Giovanni Staunovo🛢 (@staunovo) September 11, 2024

From operator reports, BSEE estimates that approximately 38.56% of… pic.twitter.com/bzyrJ85tZJ

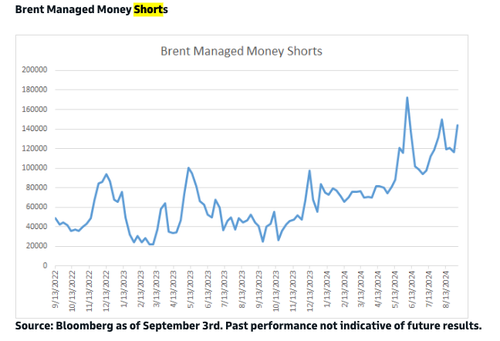

Separately, Goldman's Robert Quinn pointed out that bears have been piling shorts on Brent crude recently "due to underwhelming macroeconomic data and the likely return of Libyan barrels."

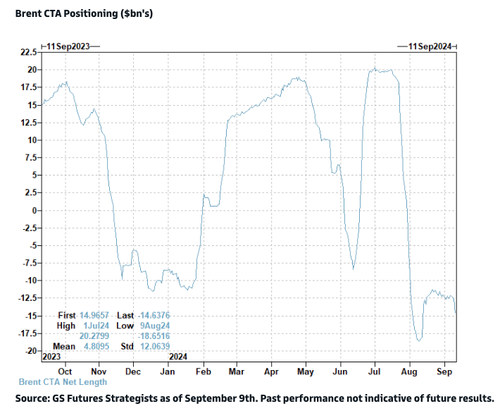

CTAs are bearish on Brent.

A significant portion of oil and gas production in the Gulf of Mexico is temporarily shut down, and if the disruption extends, it could catch bears off-guard in a continued short rally. However, the souring macroeconomic backdrop with sliding energy demand in China and US economies is not a great setup for bulls.

* * *

If ever in doubt whether the Biden admin will rig and manipulate "data" to suit its goals and policies, don't be: moments ago the Biden Dept of Energy published its weekly EIA oil storage report, which was a shocking mirror image of everything the private API reported yesterday.

As a reminder, this is what API said happened to various energy stocks over the past week:

- Crude -2.8MM (9th weekly draw in the past 10 weeks), and well below estimates of a +1.0MM build

- Gasoline -0.5MM

- Distillates +0.2MM

- Cushing -2.6MM (also 9th weekly draw in the past 10 weeks)

The last one was especially notable as it represented the biggest weekly drain in Cushing stocks since August 18, 2023 and sent the oil inventory in Cushing storage low enough to reach the dreaded "tank bottoms."

That's when Kamala's/Biden's department of goalseeking data stepped in, and moments ago reported what can only be described as a laughable mirror image of everything the API indicated yesterday. Here are the details:

- Crude +833K, Exp. +1.05MM

- Gasoline +2.31MM

- Distillates +2.308MM

- Cushing -1.704MM

- Production 13.3MMb/d, unch

That's right: instead of 3 sets of draws, the EIA somehow found builds pretty much across the board, with Crude rising 833K, barely missing the estimate of 1.05MM (and a far cry from the 2.6MM draw per API) except for Cushing, which has emerged as the great source of all the liquidation magic we have observed in the past three months, and as shown below, Cushing has now drawn 9 out of the past 10 weeks!

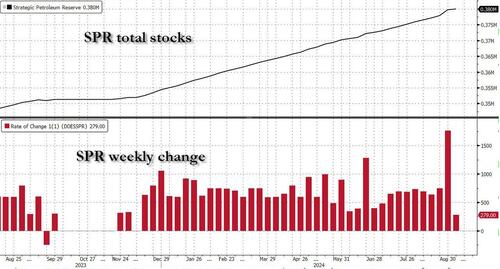

One possible reason for the build is that in the past week, the Biden admin added just 279K to the SPR, the lowest weekly addition this year, and a huge swing from last week's 1.8mm increase to the SPR,, which was the largest increase since June 2020.

The increase in stocks meant that after hitting a one year low, total crude inventory (ex SPR) posted a small gain.

And even though the drop in Cushing was lower according to the EIA vs the API's huge 2.8MM draw, 1-2 more weeks of this drain means that Cushing is still facing tank bottoms.

But there is still some time before we hit the bottom of Cushing: until then the CTAs and shorts are in control, and after staging a modest rebound, oil was slammed by over a buck to session lows, and just shy of the lowest level since 2021 (which in turn preceded a doubling in the price of oil in the next 3 months).

Update (1502ET):

West Texas Intermediate futures jumped as much as 3%, the biggest gain in two weeks. This temporarily halted a nearly 19% decline since mid-August as short covering kicked in after Gulf of Mexico oil production was partially shuttered ahead of Hurricane Francine, which is set to make landfall near the southeastern Louisiana coast as a high-end Category 1 storm later today.

Short covering in WTI futures was primarily due to oil companies shutting down about 40% of Gulf crude output ahead of the storm. In recent days, Exxon Mobil, Shell, and other offshore drillers have evacuated crews and suspended operations.

39% of Gulf of Mexico oil production shut due to Hurricane Francinehttps://t.co/bIf53HcmIi

— ForexLive (@ForexLive) September 11, 2024

"While global demand has weakened, current US supplies could tighten further if Hurricane Francine causes multiple days of well shut-ins," Dennis Kissler, senior vice president for trading at BOK Financial Securities, told Bloomberg.

Francine has mostly outweighed an earlier bearish EIA report showing an 833,000-barrel build in domestic crude stockpiles. Bloomberg users were expecting a 700,000-barrel draw.

The latest Bloomberg data shows that the storm's trajectory is expected to slice through dozens of offshore oil rigs, and as many as eight onshore refineries are in the cone of uncertainty.

In addition to oil production shut-ins, Criterion Research said NatGas production in the Gulf of Mexico has plunged.

The Gulf of Mexico has rapidly shut in gas volumes as Francine moves towards Louisiana. We currently see around 0.85 Bcf/d offline as output slid to this morning’s 1.18 Bcf/d. The Gulf was not impacted by any major storms in 2023, so it's been a while since we had a sudden drop… pic.twitter.com/00HIHrueHI

— Criterion Research (@PipelineFlows) September 11, 2024

Commodity analyst Giovanni Staunovo wrote on X, "Based on data from offshore operator reports submitted as of 11:30 a.m. CDT today, personnel have been evacuated from a total of 171 production platforms, 46% of the 371 manned platforms in the Gulf of Mexico."

Based on data from offshore operator reports submitted as of 11:30 a.m. CDT today, personnel have been evacuated from a total of 171 production platforms, 46% of the 371 manned platforms in the Gulf of Mexico.

— Giovanni Staunovo🛢 (@staunovo) September 11, 2024

From operator reports, BSEE estimates that approximately 38.56% of… pic.twitter.com/bzyrJ85tZJ

Separately, Goldman's Robert Quinn pointed out that bears have been piling shorts on Brent crude recently "due to underwhelming macroeconomic data and the likely return of Libyan barrels."

CTAs are bearish on Brent.

A significant portion of oil and gas production in the Gulf of Mexico is temporarily shut down, and if the disruption extends, it could catch bears off-guard in a continued short rally. However, the souring macroeconomic backdrop with sliding energy demand in China and US economies is not a great setup for bulls.

* * *

If ever in doubt whether the Biden admin will rig and manipulate "data" to suit its goals and policies, don't be: moments ago the Biden Dept of Energy published its weekly EIA oil storage report, which was a shocking mirror image of everything the private API reported yesterday.

As a reminder, this is what API said happened to various energy stocks over the past week:

- Crude -2.8MM (9th weekly draw in the past 10 weeks), and well below estimates of a +1.0MM build

- Gasoline -0.5MM

- Distillates +0.2MM

- Cushing -2.6MM (also 9th weekly draw in the past 10 weeks)

The last one was especially notable as it represented the biggest weekly drain in Cushing stocks since August 18, 2023 and sent the oil inventory in Cushing storage low enough to reach the dreaded "tank bottoms."

That's when Kamala's/Biden's department of goalseeking data stepped in, and moments ago reported what can only be described as a laughable mirror image of everything the API indicated yesterday. Here are the details:

- Crude +833K, Exp. +1.05MM

- Gasoline +2.31MM

- Distillates +2.308MM

- Cushing -1.704MM

- Production 13.3MMb/d, unch

That's right: instead of 3 sets of draws, the EIA somehow found builds pretty much across the board, with Crude rising 833K, barely missing the estimate of 1.05MM (and a far cry from the 2.6MM draw per API) except for Cushing, which has emerged as the great source of all the liquidation magic we have observed in the past three months, and as shown below, Cushing has now drawn 9 out of the past 10 weeks!

One possible reason for the build is that in the past week, the Biden admin added just 279K to the SPR, the lowest weekly addition this year, and a huge swing from last week's 1.8mm increase to the SPR,, which was the largest increase since June 2020.

The increase in stocks meant that after hitting a one year low, total crude inventory (ex SPR) posted a small gain.

And even though the drop in Cushing was lower according to the EIA vs the API's huge 2.8MM draw, 1-2 more weeks of this drain means that Cushing is still facing tank bottoms.

But there is still some time before we hit the bottom of Cushing: until then the CTAs and shorts are in control, and after staging a modest rebound, oil was slammed by over a buck to session lows, and just shy of the lowest level since 2021 (which in turn preceded a doubling in the price of oil in the next 3 months).