We know that by now you are sick of discussions of tomorrow's Fed rate cut - 25 or 50 or whatever... so here's some more.

With Wall Street strategists spent and exhausted, playing out game theory and Martingale scenarios about what the Fed could, should, may, or would do, the big guns have taken the mic and, as expected, they disagree.

We start of with DoubleLine's Jeff Gundlach, who joined the record numbers of traders betting that the Fed will kick off its interest-rate cutting cycle with a half-percentage-point move on Wednesday.

As we showed previously, the barrage of recent dovish media trial balloons in the past week has fueled a sharp bond-market rally that’s driven the yield on two-year Treasuries to less than 3.6%. That’s roughly 1.75 percentage points below the Fed’s target rate, and is the biggest spread between the two rates products on record, surpassing the 2008 pre-crisis chasm (when the bond market turned out right and the Fed would not only cut rates to zero but launch QE for the first time).

probably nothing pic.twitter.com/KkEeneboTu

— zerohedge (@zerohedge) September 14, 2024

Gundlach, long a fan of bond market signaling, said the central bank should close that gap, and he is betting that the Fed is likely to reduce its benchmark by 50 basis points on Wednesday and lower it by a total of 125 basis points by the end of the year. While to many such an aggressive easing cycle would spark panic that the US is about to enter a recession, to Gundlach the Fed is woefully behind the curve as he thinks the US economy is already in a recession and the Fed has kept policy tight for too long.

“I think they’re going to cut 50 — they seem so out of line,” Gundlach said as part of a panel at the Future Proof conference for the wealth management industry in Huntington Beach, California. “The Fed is way behind the curve and they should get their act together."

The problem with such an approach is that as we discussed previously, equities are nowhere near pricing in a recession, and the realization of just how bad it is, will instantly crash the stock market, wiping out trillions in value, and making the resulting recession far worse. Which is precisely why the Fed is unlikely to rush and cut 50, which is why Powell will again disappoint Gundlach, even if that is probably impossible: the DoubleLine CEO said said already he gives the Fed a letter grade of F, adding that they should have cut rates sooner. “We are in a recession already,” Gundlach said. “I see an awful lot of layoffs announcements.”

But if Gundlach sees fire and brimstone, another just as iconic billionaire, Bridgewater founder Ray Dalio disagreed, and said the overall picture of the US economy probably warrants a smaller interest-rate cut by the Federal Reserve this week.

“The Fed has to keep interest rates high enough to satisfy the creditors that they are going to get a real return without having them so high that the debtors have a problem,” Dalio told Bloomberg TV in an interview in Singapore on Wednesday.

"Whether it’s 25 or 50 basis points, 25 basis points would be the right thing to do if you look at the whole picture," Dalio said on the sidelines of the Milken Institute Asia Summit 2024. “If you look at the mortgage situation, which is worse and that affects more people, then it’s probably 50 basis points.”

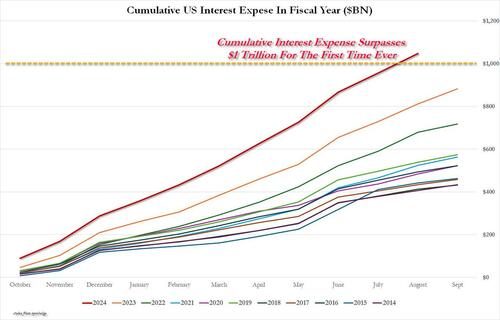

Still, Dalio said that ultimately what the Fed does this week “doesn’t make a difference” over the longer term. Policymakers will need to keep real interest rates low to enable the servicing of mounting debts, he said, and he is correct: as we showed last week, the cumulative interest on US debt in the 11 months of fiscal 2024 has already surpassed $1 trillion, a record high, and it will reach $1.2 trillion for the full year.

And unless the Fed cuts rates - inflation be damned - the implosion resulting from this particular Minsky moment will come that much sooner.

Finally, taking a more aloof position, JPMorgan CEO Jamie Dimon said whether the Federal Reserve cuts interest rates by 25 or 50 basis points, the move is “not going to be earth-shattering.”

“They need to do it,” Dimon said at a conference on Tuesday. But “it’s a minor thing when the Fed’s raising rates and lowering rates because underneath that there’s a real economy.”

Dimon said previously that while he doesn’t “think it matters as much as other people think,” citing ongoing economic uncertainty and inflationary pressures, he is in the opposite camp from Gundlach, warning for more than a year that inflation may be stickier than investors expect, and wrote in his annual letter to shareholders in April that his firm is prepared for interest rates ranging from 2% to 8% or more. To be sure, if the Fed cuts as much as Gundlach expects, the second coming of the inflationary wave will make the head of Arthur Burns' ghost spin faster than the CPI dial.

It's not just inflation as a result of monetary policy that is worrying Dimon: on Tuesday at the Georgetown Psaros Center for Financial Markets and Policy’s annual conference, he said again that geopolitical issues - including wars in Ukraine and the Middle East as well as the US’s relationship with China - are his top concern. It “dwarfs any one I’ve had since I’ve been working,” he said. And you have no idea how fast inflation will explode if Israel nukes Iran's oil production facilities, and 4 million barrels of crude are suddenly pulled from the market.

“People overly focus on, ‘are we going to have a soft landing, a hard landing?’” Dimon said. “Honestly, most of us have been through all that stuff, it doesn’t matter as much.”

Well, Jamie is a billionaire: a hard or soft landing doesn't really matter to him or to those in his social circle. For everyone else, however, it does.

We know that by now you are sick of discussions of tomorrow's Fed rate cut - 25 or 50 or whatever... so here's some more.

With Wall Street strategists spent and exhausted, playing out game theory and Martingale scenarios about what the Fed could, should, may, or would do, the big guns have taken the mic and, as expected, they disagree.

We start of with DoubleLine's Jeff Gundlach, who joined the record numbers of traders betting that the Fed will kick off its interest-rate cutting cycle with a half-percentage-point move on Wednesday.

As we showed previously, the barrage of recent dovish media trial balloons in the past week has fueled a sharp bond-market rally that’s driven the yield on two-year Treasuries to less than 3.6%. That’s roughly 1.75 percentage points below the Fed’s target rate, and is the biggest spread between the two rates products on record, surpassing the 2008 pre-crisis chasm (when the bond market turned out right and the Fed would not only cut rates to zero but launch QE for the first time).

probably nothing pic.twitter.com/KkEeneboTu

— zerohedge (@zerohedge) September 14, 2024

Gundlach, long a fan of bond market signaling, said the central bank should close that gap, and he is betting that the Fed is likely to reduce its benchmark by 50 basis points on Wednesday and lower it by a total of 125 basis points by the end of the year. While to many such an aggressive easing cycle would spark panic that the US is about to enter a recession, to Gundlach the Fed is woefully behind the curve as he thinks the US economy is already in a recession and the Fed has kept policy tight for too long.

“I think they’re going to cut 50 — they seem so out of line,” Gundlach said as part of a panel at the Future Proof conference for the wealth management industry in Huntington Beach, California. “The Fed is way behind the curve and they should get their act together."

The problem with such an approach is that as we discussed previously, equities are nowhere near pricing in a recession, and the realization of just how bad it is, will instantly crash the stock market, wiping out trillions in value, and making the resulting recession far worse. Which is precisely why the Fed is unlikely to rush and cut 50, which is why Powell will again disappoint Gundlach, even if that is probably impossible: the DoubleLine CEO said said already he gives the Fed a letter grade of F, adding that they should have cut rates sooner. “We are in a recession already,” Gundlach said. “I see an awful lot of layoffs announcements.”

But if Gundlach sees fire and brimstone, another just as iconic billionaire, Bridgewater founder Ray Dalio disagreed, and said the overall picture of the US economy probably warrants a smaller interest-rate cut by the Federal Reserve this week.

“The Fed has to keep interest rates high enough to satisfy the creditors that they are going to get a real return without having them so high that the debtors have a problem,” Dalio told Bloomberg TV in an interview in Singapore on Wednesday.

"Whether it’s 25 or 50 basis points, 25 basis points would be the right thing to do if you look at the whole picture," Dalio said on the sidelines of the Milken Institute Asia Summit 2024. “If you look at the mortgage situation, which is worse and that affects more people, then it’s probably 50 basis points.”

Still, Dalio said that ultimately what the Fed does this week “doesn’t make a difference” over the longer term. Policymakers will need to keep real interest rates low to enable the servicing of mounting debts, he said, and he is correct: as we showed last week, the cumulative interest on US debt in the 11 months of fiscal 2024 has already surpassed $1 trillion, a record high, and it will reach $1.2 trillion for the full year.

And unless the Fed cuts rates - inflation be damned - the implosion resulting from this particular Minsky moment will come that much sooner.

Finally, taking a more aloof position, JPMorgan CEO Jamie Dimon said whether the Federal Reserve cuts interest rates by 25 or 50 basis points, the move is “not going to be earth-shattering.”

“They need to do it,” Dimon said at a conference on Tuesday. But “it’s a minor thing when the Fed’s raising rates and lowering rates because underneath that there’s a real economy.”

Dimon said previously that while he doesn’t “think it matters as much as other people think,” citing ongoing economic uncertainty and inflationary pressures, he is in the opposite camp from Gundlach, warning for more than a year that inflation may be stickier than investors expect, and wrote in his annual letter to shareholders in April that his firm is prepared for interest rates ranging from 2% to 8% or more. To be sure, if the Fed cuts as much as Gundlach expects, the second coming of the inflationary wave will make the head of Arthur Burns' ghost spin faster than the CPI dial.

It's not just inflation as a result of monetary policy that is worrying Dimon: on Tuesday at the Georgetown Psaros Center for Financial Markets and Policy’s annual conference, he said again that geopolitical issues - including wars in Ukraine and the Middle East as well as the US’s relationship with China - are his top concern. It “dwarfs any one I’ve had since I’ve been working,” he said. And you have no idea how fast inflation will explode if Israel nukes Iran's oil production facilities, and 4 million barrels of crude are suddenly pulled from the market.

“People overly focus on, ‘are we going to have a soft landing, a hard landing?’” Dimon said. “Honestly, most of us have been through all that stuff, it doesn’t matter as much.”

Well, Jamie is a billionaire: a hard or soft landing doesn't really matter to him or to those in his social circle. For everyone else, however, it does.