Authored by Mike Shedlock via MishTalk.com,

Claudia Sahm claims to have invented a recession indicator created by Ed McKelvey. Now she says the indicator is wrong. Let’s investigate.

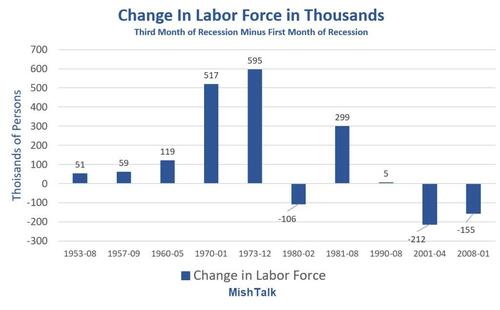

Data from the BLS, chart by Mish

What is the McKelvey Recession Indicator?

Take the current value of the 3-month unemployment rate average, subtract the 12-month low, and if the difference is 0.30 percentage point or more, then a recession has started.

Edward McKelvey, a senior economist at Goldman Sachs, created the indicator.

Claudia Sahm, a former Federal Reserve and White House Economist, modified the indicator from 0.3 to 0.5.

The rule triggered in August but Sahm is in denial.

Sahm Denial

Marketplace discusses Sahm’s Recession Denial.

When the monthly jobs report from the Labor Department was released in August at 8:30 a.m., it packed a punch. Something called the Sahm Rule had been triggered — it was like an economic fire alarm was going off.

“I was live on the radio, and they read the numbers out loud. I said, ‘OK, so the Sahm Rule says we would be in a recession, but Sahm says we’re not,’” said Claudia Sahm.

Sahm discovered the rule when she was studying previous recessions as part of a project to help policymakers prepare for the next one.

So why is Sahm, the economist, discounting Sahm, the rule, now?

The unemployment rate, Sahm explained, has an Achilles’ heel: It doesn’t only go up when people lose their jobs, it can also go up when the number of people looking for jobs goes up.

“When you have people enter the workforce, it can take longer to find a job, even in the best of times,” she said. “That will push up the unemployment rate.”

Sahm certainly did not discover the rule. She modified Ed McKelvey’s rule with no credit given to McKelvey.

And it might behoove Sahm to actually investigate her explanation.

In 7 of 10 recessions, the labor force was higher in the third month of recession than the start of it.

In isolation, that would tend to raise the unemployment rate as Sahm says. But it is also normal behavior.

The Covid recession only lasted 2 months and was so unusual in many other ways that it’s best to remove it for comparison purposes. But if you insist, then call the score 7 of 11.

Recessions Tend to Start Slowly

In two recessions, 1970 and 1973, employment was higher in the third month of recession than the first, by 83,000 and 353,000 respectively.

Nonfarm payrolls were up by 275,000 and 223,000 respectively.

And that is after revisions!

So, don’t claim the labor market is too strong for a recession to have started.

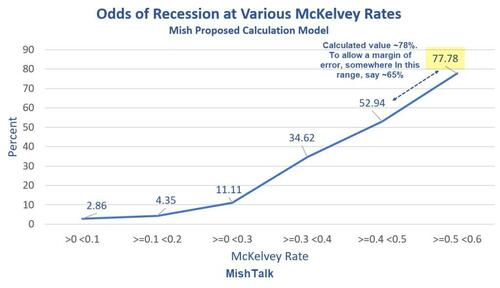

The McKelvey Recession Indicator Triggered, But What Are the Odds?

On September 10, I commented The McKelvey Recession Indicator Triggered, But What Are the Odds?

Many eyes are on the McKelvey recession indicator. Too many?

That would probably be the case if everyone believed it. [But heck, not even Sahm believes it!]

I calculate the odds based on past history of recessions at well over 50 percent. Click on the link for how I arrived at the percentage.

Recession Supporting Factors

September 3: Construction Spending Growth Slows in May, Stops in June, Negative in July

September 6: Payroll Report: Manufacturing Sheds 24,000 Jobs, Government Adds 24,000, Big Negative Revisions

September 7: BLS Negative Job Revisions 15 of Last 21 Months

September 9: Fed Beige Book Conditions Are Worse Now Than the Start of the Great Recession

Authored by Mike Shedlock via MishTalk.com,

Claudia Sahm claims to have invented a recession indicator created by Ed McKelvey. Now she says the indicator is wrong. Let’s investigate.

Data from the BLS, chart by Mish

What is the McKelvey Recession Indicator?

Take the current value of the 3-month unemployment rate average, subtract the 12-month low, and if the difference is 0.30 percentage point or more, then a recession has started.

Edward McKelvey, a senior economist at Goldman Sachs, created the indicator.

Claudia Sahm, a former Federal Reserve and White House Economist, modified the indicator from 0.3 to 0.5.

The rule triggered in August but Sahm is in denial.

Sahm Denial

Marketplace discusses Sahm’s Recession Denial.

When the monthly jobs report from the Labor Department was released in August at 8:30 a.m., it packed a punch. Something called the Sahm Rule had been triggered — it was like an economic fire alarm was going off.

“I was live on the radio, and they read the numbers out loud. I said, ‘OK, so the Sahm Rule says we would be in a recession, but Sahm says we’re not,’” said Claudia Sahm.

Sahm discovered the rule when she was studying previous recessions as part of a project to help policymakers prepare for the next one.

So why is Sahm, the economist, discounting Sahm, the rule, now?

The unemployment rate, Sahm explained, has an Achilles’ heel: It doesn’t only go up when people lose their jobs, it can also go up when the number of people looking for jobs goes up.

“When you have people enter the workforce, it can take longer to find a job, even in the best of times,” she said. “That will push up the unemployment rate.”

Sahm certainly did not discover the rule. She modified Ed McKelvey’s rule with no credit given to McKelvey.

And it might behoove Sahm to actually investigate her explanation.

In 7 of 10 recessions, the labor force was higher in the third month of recession than the start of it.

In isolation, that would tend to raise the unemployment rate as Sahm says. But it is also normal behavior.

The Covid recession only lasted 2 months and was so unusual in many other ways that it’s best to remove it for comparison purposes. But if you insist, then call the score 7 of 11.

Recessions Tend to Start Slowly

In two recessions, 1970 and 1973, employment was higher in the third month of recession than the first, by 83,000 and 353,000 respectively.

Nonfarm payrolls were up by 275,000 and 223,000 respectively.

And that is after revisions!

So, don’t claim the labor market is too strong for a recession to have started.

The McKelvey Recession Indicator Triggered, But What Are the Odds?

On September 10, I commented The McKelvey Recession Indicator Triggered, But What Are the Odds?

Many eyes are on the McKelvey recession indicator. Too many?

That would probably be the case if everyone believed it. [But heck, not even Sahm believes it!]

I calculate the odds based on past history of recessions at well over 50 percent. Click on the link for how I arrived at the percentage.

Recession Supporting Factors

September 3: Construction Spending Growth Slows in May, Stops in June, Negative in July

September 6: Payroll Report: Manufacturing Sheds 24,000 Jobs, Government Adds 24,000, Big Negative Revisions

September 7: BLS Negative Job Revisions 15 of Last 21 Months

September 9: Fed Beige Book Conditions Are Worse Now Than the Start of the Great Recession