By Stefan Koopman, Senior Macro Strategist at Rabobank

Buyer's Market

US producer price inflation was soft in July. Both headline (0.1% m/m and 2.2% y/y) and core (0.0% m/m and 2.4% y/y) PPI inflation came in below expectations. Goods prices rose by 0.6% m/m, while services fell by 0.2% m/m, suggesting that a fall in retail markups drove down this otherwise hotter report. This indicates that retail firms are losing pricing power and are discounting more heavily, as reflected in various company earnings reports.

The components of the PPI that feed into the PCE price gauge, due later this month, were also relatively benign, adding to the case for investors betting on lower interest rates from September onwards. Following this muted report, stocks ended the US session firmly higher, with the S&P 500 and Nasdaq 100 posting 1.5-week highs and adding further to the market’s recovery from the early-month selloff. Bond yields fell, with the 10-year UST yielding 3.84%, down 5 bps from before the report. In Europe, the German 10-year rate has fallen to 2.18%. The dollar softened, with the DXY at 102.69 and EUR/USD just below the 1.10 handle.

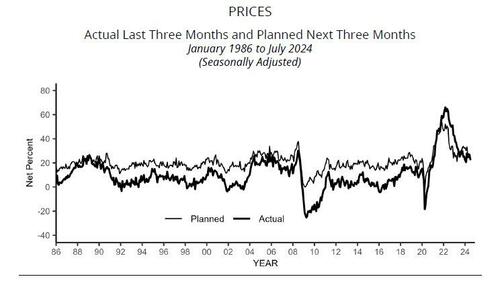

Earlier yesterday, the NFIB small business optimism index surged to a two-year high in July, driven by expectations of an improving economy. This optimism is likely influenced by confidence in a Trump victory following President Biden’s weak performances and the ensuing uncertainty about the Democratic presidential candidate during much of July. However, this optimism may have waned by the time the August survey is conducted. The survey also showed that the share of firms planning price increases fell to 24%, the lowest since April 2023, though still historically elevated. Businesses are increasingly concerned about softening demand amid persistent input price pressures, and less so about labor shortages. This ongoing transition from seller’s markets to buyer’s markets marks a post-COVID priority change. The survey indicates that businesses are dealing with margin squeezes more by slowing wage increases rather than resorting to layoffs.

The UK is also transitioning from seller’s markets to buyer’s markets. The headline CPI ticked up slightly this morning, from 2% to 2.2%, but this was a tenth less than expected. The rise in the annual rate is mainly due to energy prices, which fell less than they did a year ago. This was somewhat offset by hotel prices, which saw a monthly fall of 6.4% compared with a rise of 8.2% a year ago. This print helped lower the services inflation figure, suggesting that June’s elevated services print, which raised doubts about an interest rate cut ahead of the August MPC, was driven by one-offs. Indeed, both core CPI and services CPI, which are more indicative of pricing power, fell more than expected, to 3.3% and 5.2% y/y respectively.

Yesterday’s UK labor market figures showed that regular pay growth slowed to 5.4% y/y, in line with expectations. Total pay growth, including bonuses, slowed significantly to 4.5% from 5.7%, with last year’s one-off NHS bonuses affecting the y/y comparison. Meanwhile, the number of job openings continues to decline and is now at 884,000, barely above pre-COVID levels. This all suggests a labor market that is gradually transitioning into a buyer’s market too. Based on the relationship between vacancies and unemployment, we expect regular wage growth to fall further towards the 4-4.5% range in the coming months.

The MPC welcomes these numbers, as it ex-post validates their narrow decision to cut rates by 25bp. We don't see this immediately leading to another 25bp cut at the forthcoming meeting, as this month’s 5-4 split and the current guidance clearly suggests that the MPC wants to take a gradual approach. It does, however, set us up for another Bank of England cut come November.

Speaking of cuts, the RBNZ today lowered the official cash rate (OCR) by 25 bps to 5.25%. We had previously forecasted a cut this month, but recently pushed this call to October due to resilience in non-tradable inflation. However, the RBNZ indicated that the output gap appears more negative than previously thought, with downside risks to employment and growth becoming more apparent. The RBNZ now forecasts a recession in the second half of this year, with the published OCR track implying a little over two rate cuts before Christmas and a terminal rate of 2.98% in Q3 2027.

We have long held the view that the New Zealand economy is weakening quickly and that rate cuts would need to come sooner rather than later (until recently, the market consensus was for cuts to begin in 2025). Nevertheless, we believe the RBNZ’s estimates of the terminal rate published today look low compared to comparable economies. Our forecast is that the RBNZ will cut rates five times in total, reaching an OCR of 4.25% by July next year. This is partially informed by our belief that the R* is higher than the RBNZ’s estimates and our expectations of persistent supply-side inflationary pressures. However, we agree that the risk skew for this forecast is to the downside.

By Stefan Koopman, Senior Macro Strategist at Rabobank

Buyer's Market

US producer price inflation was soft in July. Both headline (0.1% m/m and 2.2% y/y) and core (0.0% m/m and 2.4% y/y) PPI inflation came in below expectations. Goods prices rose by 0.6% m/m, while services fell by 0.2% m/m, suggesting that a fall in retail markups drove down this otherwise hotter report. This indicates that retail firms are losing pricing power and are discounting more heavily, as reflected in various company earnings reports.

The components of the PPI that feed into the PCE price gauge, due later this month, were also relatively benign, adding to the case for investors betting on lower interest rates from September onwards. Following this muted report, stocks ended the US session firmly higher, with the S&P 500 and Nasdaq 100 posting 1.5-week highs and adding further to the market’s recovery from the early-month selloff. Bond yields fell, with the 10-year UST yielding 3.84%, down 5 bps from before the report. In Europe, the German 10-year rate has fallen to 2.18%. The dollar softened, with the DXY at 102.69 and EUR/USD just below the 1.10 handle.

Earlier yesterday, the NFIB small business optimism index surged to a two-year high in July, driven by expectations of an improving economy. This optimism is likely influenced by confidence in a Trump victory following President Biden’s weak performances and the ensuing uncertainty about the Democratic presidential candidate during much of July. However, this optimism may have waned by the time the August survey is conducted. The survey also showed that the share of firms planning price increases fell to 24%, the lowest since April 2023, though still historically elevated. Businesses are increasingly concerned about softening demand amid persistent input price pressures, and less so about labor shortages. This ongoing transition from seller’s markets to buyer’s markets marks a post-COVID priority change. The survey indicates that businesses are dealing with margin squeezes more by slowing wage increases rather than resorting to layoffs.

The UK is also transitioning from seller’s markets to buyer’s markets. The headline CPI ticked up slightly this morning, from 2% to 2.2%, but this was a tenth less than expected. The rise in the annual rate is mainly due to energy prices, which fell less than they did a year ago. This was somewhat offset by hotel prices, which saw a monthly fall of 6.4% compared with a rise of 8.2% a year ago. This print helped lower the services inflation figure, suggesting that June’s elevated services print, which raised doubts about an interest rate cut ahead of the August MPC, was driven by one-offs. Indeed, both core CPI and services CPI, which are more indicative of pricing power, fell more than expected, to 3.3% and 5.2% y/y respectively.

Yesterday’s UK labor market figures showed that regular pay growth slowed to 5.4% y/y, in line with expectations. Total pay growth, including bonuses, slowed significantly to 4.5% from 5.7%, with last year’s one-off NHS bonuses affecting the y/y comparison. Meanwhile, the number of job openings continues to decline and is now at 884,000, barely above pre-COVID levels. This all suggests a labor market that is gradually transitioning into a buyer’s market too. Based on the relationship between vacancies and unemployment, we expect regular wage growth to fall further towards the 4-4.5% range in the coming months.

The MPC welcomes these numbers, as it ex-post validates their narrow decision to cut rates by 25bp. We don't see this immediately leading to another 25bp cut at the forthcoming meeting, as this month’s 5-4 split and the current guidance clearly suggests that the MPC wants to take a gradual approach. It does, however, set us up for another Bank of England cut come November.

Speaking of cuts, the RBNZ today lowered the official cash rate (OCR) by 25 bps to 5.25%. We had previously forecasted a cut this month, but recently pushed this call to October due to resilience in non-tradable inflation. However, the RBNZ indicated that the output gap appears more negative than previously thought, with downside risks to employment and growth becoming more apparent. The RBNZ now forecasts a recession in the second half of this year, with the published OCR track implying a little over two rate cuts before Christmas and a terminal rate of 2.98% in Q3 2027.

We have long held the view that the New Zealand economy is weakening quickly and that rate cuts would need to come sooner rather than later (until recently, the market consensus was for cuts to begin in 2025). Nevertheless, we believe the RBNZ’s estimates of the terminal rate published today look low compared to comparable economies. Our forecast is that the RBNZ will cut rates five times in total, reaching an OCR of 4.25% by July next year. This is partially informed by our belief that the R* is higher than the RBNZ’s estimates and our expectations of persistent supply-side inflationary pressures. However, we agree that the risk skew for this forecast is to the downside.