...no, Goldilocks is not back!

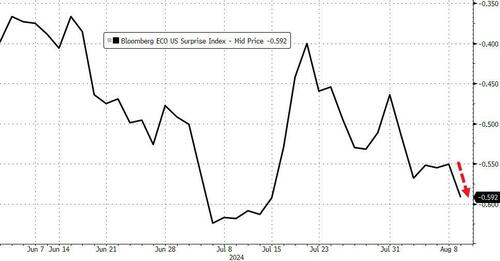

Retail Sales soared in August... thanks to massive historical revisions and a surge in Auto sales... but Auto production crashed by the most since COVID lockdowns (lowering GDP expectations)... and homebuilder sentiment slumped... and the Philly Fed business outlook plunged... and the Empire Fed Manufacturing survey remains in contraction for the 9th straight month... and import and export price inflation was hotter than expected... all of which sent the macro surprise index down to 2024 lows...

Source: Bloomberg

Here's Goldman's Chris Hussey on the 'mixed data':

The weak-to-mixed reading of these prints continue to show the unreliability of surveys in the post pandemic era. And investors continue to look through them as they have been consistently weaker than the hard data - and consistently misleading - since 2020.

...but all the algos cared about was the "beat" in retail sales confirming that the 'soft landing' narrative is back (except it's not), and WMT beating and raising (except consensus was already above their revision) reassuring that the consumer is not in shitsville (except they are because they are trading down to WMT!).

Nevertheless, stocks soared higher with Small Caps leading the charge along with Nasdaq as The Dow lagged (but was still up bigly). Some late day profit-taking spoiled the party but overall, it was a big day...

The Dow is on pace for its best week since Dec 2023... and Nasdaq's best week since November's Powell Pivot

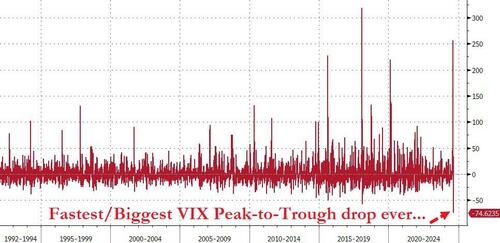

...withd VIX plunging lower...

...at its fastest/largest pace of decline ever...

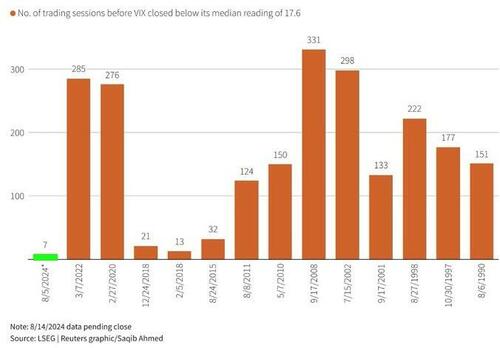

Bear in mind that historically, when the VIX has risen to close above 35, as it did on Aug. 5, the index has taken 170 sessions on average before returning to 17.6, its long-term median... not 7 days!

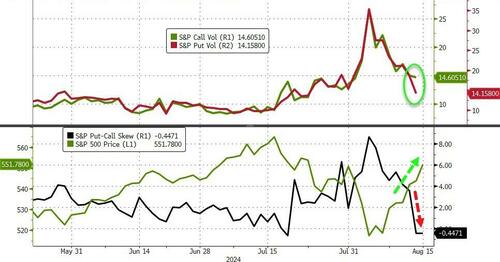

We do note that as the day wore on, VIX shifted back higher as calls were aggressively bid (and puts dumped), crushing the skew...

Source: Bloomberg

While VIX has tumbled, we note that VVIX remains above the scary 100 level still as the market is not fully buying that the panic is over...

Source: Bloomberg

And we also note that implied correlation has collapsed too - which shows that this vol compression is all systemic (index) and not idiosyncratic (single-name) driven...

Source: Bloomberg

Small Caps were lifted by another big short-squeeze...

Goldman - Summer volumes remain challenging (-10% vs 20day avg)... Seeing squeezy px action across the board on this melt higher

Source: Bloomberg

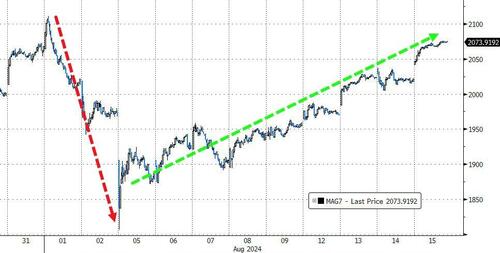

...and Nasdaq surged on the back of an aggressive bid for Mag7 stocks (the basket of Mag7 stocks is up 6 straight days)...

Source: Bloomberg

Here's how Goldman's trading desk describes the day's narrative:

Stocks higher on the back of bullish earnings from WMT, DE, and CSCO and favorable macro data on the growth front (retail sales & weekly claims). EVERYTHING rally with all baskets on our screens green on the day.

Volumes were lower (-10% vs the trailing 20 days but tracking higher compared to the start of the week). Also seeing S&P top of book liquidity start to creep back to better levels after recent weakness (sitting around $10mm today).

- Our floor is skewed 3% better to buy today which feels like a combo of squeezy price action + decent buy tickets across large cap tech. HFs buying consumer vs selling Tech, Industrials, and Fins.

Notably, 0-DTE traders turned decidedly less positive as the day wore on...

Source: SpotGamma

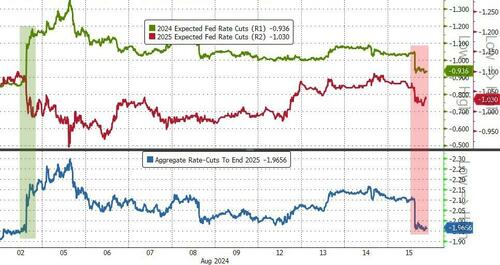

The 'good' data (retail sales) prompted a significant drop in rate-cut expectations - erasing all the dovish shoft post-payrolls...

Source: Bloomberg

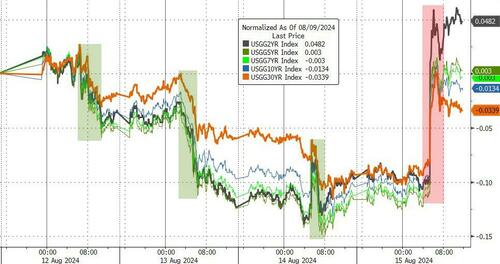

Bonds were battered on the day (2Y +15bps, 30Y +6bps), surging up to unchanged on the week...

Source: Bloomberg

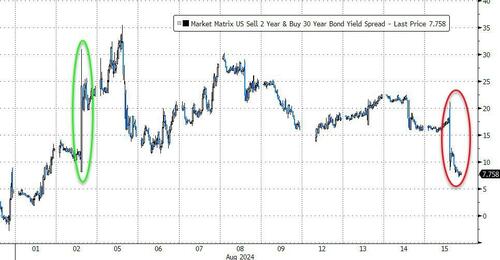

The yield curve flattened significantly today - erasing all the post-payrolls steepening...

Source: Bloomberg

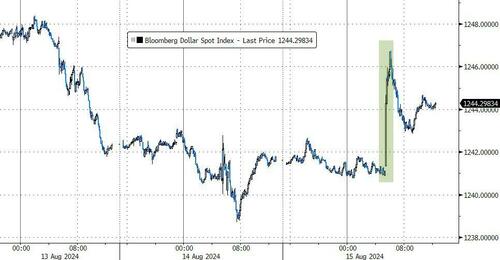

The dollar spiked on the hawkish retail sales data...

Source: Bloomberg

Gold puked on the Retail Sales print but recovered to end higher on the day (despite a strong dollar)

Source: Bloomberg

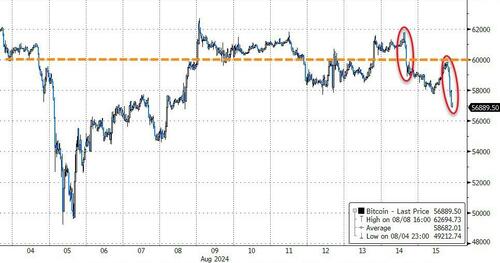

Bitcoin was clubbed like a baby seal again, back below $57,000 (as it seems someone is dumping crypto at $60,000 to chase what little momentum is left in stonks)...

Source: Bloomberg

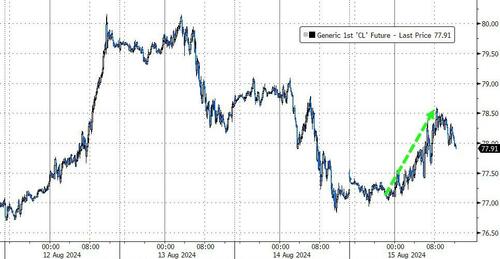

Crude oil prices recovered yesterday's losses with WTI back up to $78...

Source: Bloomberg

Finally, while stocks are soaring back higher (because 'no recession' and 'slow-flation' - goldilocks), bonds and rate-cut expectations are not playing along (flashing recessionary signals)...

Source: Bloomberg

Who will be right in the end (hint look at the first chart above on US macro data).

...no, Goldilocks is not back!

Retail Sales soared in August... thanks to massive historical revisions and a surge in Auto sales... but Auto production crashed by the most since COVID lockdowns (lowering GDP expectations)... and homebuilder sentiment slumped... and the Philly Fed business outlook plunged... and the Empire Fed Manufacturing survey remains in contraction for the 9th straight month... and import and export price inflation was hotter than expected... all of which sent the macro surprise index down to 2024 lows...

Source: Bloomberg

Here's Goldman's Chris Hussey on the 'mixed data':

The weak-to-mixed reading of these prints continue to show the unreliability of surveys in the post pandemic era. And investors continue to look through them as they have been consistently weaker than the hard data - and consistently misleading - since 2020.

...but all the algos cared about was the "beat" in retail sales confirming that the 'soft landing' narrative is back (except it's not), and WMT beating and raising (except consensus was already above their revision) reassuring that the consumer is not in shitsville (except they are because they are trading down to WMT!).

Nevertheless, stocks soared higher with Small Caps leading the charge along with Nasdaq as The Dow lagged (but was still up bigly). Some late day profit-taking spoiled the party but overall, it was a big day...

The Dow is on pace for its best week since Dec 2023... and Nasdaq's best week since November's Powell Pivot

...withd VIX plunging lower...

...at its fastest/largest pace of decline ever...

Bear in mind that historically, when the VIX has risen to close above 35, as it did on Aug. 5, the index has taken 170 sessions on average before returning to 17.6, its long-term median... not 7 days!

We do note that as the day wore on, VIX shifted back higher as calls were aggressively bid (and puts dumped), crushing the skew...

Source: Bloomberg

While VIX has tumbled, we note that VVIX remains above the scary 100 level still as the market is not fully buying that the panic is over...

Source: Bloomberg

And we also note that implied correlation has collapsed too - which shows that this vol compression is all systemic (index) and not idiosyncratic (single-name) driven...

Source: Bloomberg

Small Caps were lifted by another big short-squeeze...

Goldman - Summer volumes remain challenging (-10% vs 20day avg)... Seeing squeezy px action across the board on this melt higher

Source: Bloomberg

...and Nasdaq surged on the back of an aggressive bid for Mag7 stocks (the basket of Mag7 stocks is up 6 straight days)...

Source: Bloomberg

Here's how Goldman's trading desk describes the day's narrative:

Stocks higher on the back of bullish earnings from WMT, DE, and CSCO and favorable macro data on the growth front (retail sales & weekly claims). EVERYTHING rally with all baskets on our screens green on the day.

Volumes were lower (-10% vs the trailing 20 days but tracking higher compared to the start of the week). Also seeing S&P top of book liquidity start to creep back to better levels after recent weakness (sitting around $10mm today).

- Our floor is skewed 3% better to buy today which feels like a combo of squeezy price action + decent buy tickets across large cap tech. HFs buying consumer vs selling Tech, Industrials, and Fins.

Notably, 0-DTE traders turned decidedly less positive as the day wore on...

Source: SpotGamma

The 'good' data (retail sales) prompted a significant drop in rate-cut expectations - erasing all the dovish shoft post-payrolls...

Source: Bloomberg

Bonds were battered on the day (2Y +15bps, 30Y +6bps), surging up to unchanged on the week...

Source: Bloomberg

The yield curve flattened significantly today - erasing all the post-payrolls steepening...

Source: Bloomberg

The dollar spiked on the hawkish retail sales data...

Source: Bloomberg

Gold puked on the Retail Sales print but recovered to end higher on the day (despite a strong dollar)

Source: Bloomberg

Bitcoin was clubbed like a baby seal again, back below $57,000 (as it seems someone is dumping crypto at $60,000 to chase what little momentum is left in stonks)...

Source: Bloomberg

Crude oil prices recovered yesterday's losses with WTI back up to $78...

Source: Bloomberg

Finally, while stocks are soaring back higher (because 'no recession' and 'slow-flation' - goldilocks), bonds and rate-cut expectations are not playing along (flashing recessionary signals)...

Source: Bloomberg

Who will be right in the end (hint look at the first chart above on US macro data).