...well that escalated quickly...

Bad (macro) news was bad news today as jobless claims surged, manufacturing surveys slumped, and construction spending tanked, sending rate-cut expectations higher...

Source: Bloomberg

...but apparently prompting growth-scare anxiety that punched US equity markets in the face.

Small Caps crashed 4%, Nasdaq 3% and The Dow and S&P down 2%...

This was the S&P 500's worst start to August since 2002.

The S&P broke back below its 50DMA...

...and the Nasdaq dumped back to its 100DMA...

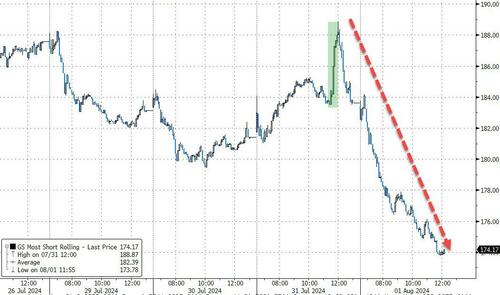

Yesterday's short-squeeze on The Fed was eviscerated as 'most shorted' stocks crashed 8% from yesterday's highs...

Source: Bloomberg

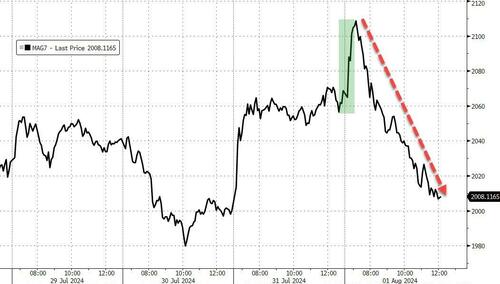

Mag7 stocks lost $430BN in market cap today - a stunning swing from the 2.5% rally out of the gate thanks to META to then dropping almost 5% from the morning highs....

Source: Bloomberg

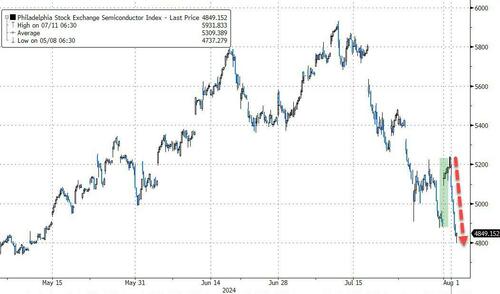

Semis were slaughtered today, erasing all of yesterday's bid surge and then some - dropping to their lowest since mid-May...

Source: Bloomberg

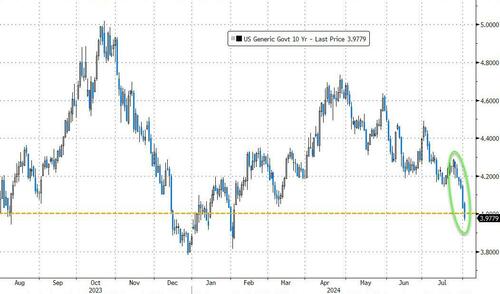

Treasury yields also plunged today - led by the short-end (2Y -9bps, 30Y -3bps) - dragging yields down around 20bps overall on the week so far...

Source: Bloomberg

Notably, the 10Y yield broke back below 4.00% for the first time since February...

Source: Bloomberg

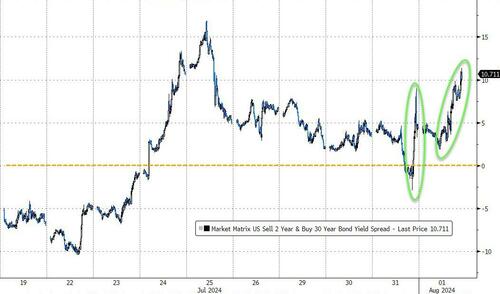

The yield curve steepened dramatically...

Source: Bloomberg

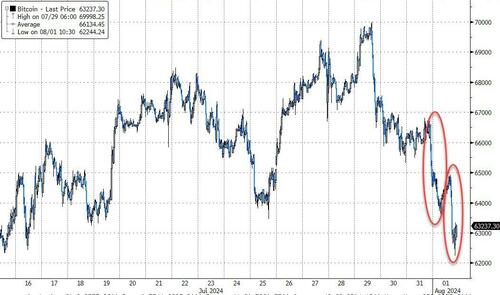

Bitcoin was clubbed like a baby seal again, testing down to $62,000 before bouncing a little...

Source: Bloomberg

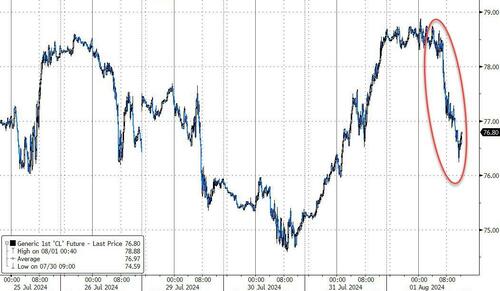

Oil tanked after WTI tested up near $79 on MidEast tensions...

Source: Bloomberg

Gold was relatively quiet today, finding support at $2440...

Source: Bloomberg

Finally, if it has felt like a volatile earnings season, that's because it is...in fact, as Goldman Sachs trader Brian Garrett noted earlier, this has been the most volatile earnings season since the financial crisis...

...by the end of this week we will largely be through earnings and onto a hopefully quiet August (and then the chaos of the lead-up to the election)...

...well that escalated quickly...

Bad (macro) news was bad news today as jobless claims surged, manufacturing surveys slumped, and construction spending tanked, sending rate-cut expectations higher...

Source: Bloomberg

...but apparently prompting growth-scare anxiety that punched US equity markets in the face.

Small Caps crashed 4%, Nasdaq 3% and The Dow and S&P down 2%...

This was the S&P 500's worst start to August since 2002.

The S&P broke back below its 50DMA...

...and the Nasdaq dumped back to its 100DMA...

Yesterday's short-squeeze on The Fed was eviscerated as 'most shorted' stocks crashed 8% from yesterday's highs...

Source: Bloomberg

Mag7 stocks lost $430BN in market cap today - a stunning swing from the 2.5% rally out of the gate thanks to META to then dropping almost 5% from the morning highs....

Source: Bloomberg

Semis were slaughtered today, erasing all of yesterday's bid surge and then some - dropping to their lowest since mid-May...

Source: Bloomberg

Treasury yields also plunged today - led by the short-end (2Y -9bps, 30Y -3bps) - dragging yields down around 20bps overall on the week so far...

Source: Bloomberg

Notably, the 10Y yield broke back below 4.00% for the first time since February...

Source: Bloomberg

The yield curve steepened dramatically...

Source: Bloomberg

Bitcoin was clubbed like a baby seal again, testing down to $62,000 before bouncing a little...

Source: Bloomberg

Oil tanked after WTI tested up near $79 on MidEast tensions...

Source: Bloomberg

Gold was relatively quiet today, finding support at $2440...

Source: Bloomberg

Finally, if it has felt like a volatile earnings season, that's because it is...in fact, as Goldman Sachs trader Brian Garrett noted earlier, this has been the most volatile earnings season since the financial crisis...

...by the end of this week we will largely be through earnings and onto a hopefully quiet August (and then the chaos of the lead-up to the election)...