We warned yesterday that the BoJ has boxed itself into a corner - forced to decide between a crashing currency or a crashing stock market - and overnight it appears traders put policymakers to the test to see what their reaction function might be.

Yen strength exacerbated an ugly US session and dragged Japanese stocks down further overnight as Japan’s Topix Index entered a technical correction in its worst two-day rout since 2011...

“The recent strengthening of the Japanese yen coupled with tech sector weakness is poised to significantly impact the Asian stock market,” said Manish Bhargava, a fund manager at Straits Investment Holdings in Singapore.

“Given the substantial weight of tech stocks in Asian indices, disappointing results from tech giants could trigger a broader market downturn in Asian markets.”

So which will the policymakers choose to save?

Source: Bloomberg

Nicholas Smith, Japan equity strategist at CLSA, said, "I think markets globally are having a headless chicken moment," with investors excessively worried about the change in currency rates.

"Stocks getting hit hardest are the ones that surged this year," he said.

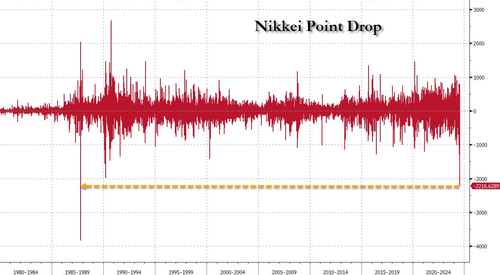

Japan's benchmark Nikkei Stock Average on Friday recorded the second biggest daily drop in its history, as stocks extended losses following a sell-off in New York overnight.

The index plunged to 35,909.70, down 2,216.63 points, or 5.81%, marking its lowest close since Jan. 26.

Friday's decline was the second largest in the index's history after the Black Monday crash of October 1987, when global markets sank and the index cratered by 3,836.48 points.

“I didn’t expect stocks to fall this much - it’s a disaster,” said Kiyoshi Ishigane, chief fund manager at Mitsubishi UFJ Asset Management Co. in Tokyo.

“This might be temporary, but Japanese stocks are in their worst situation.”

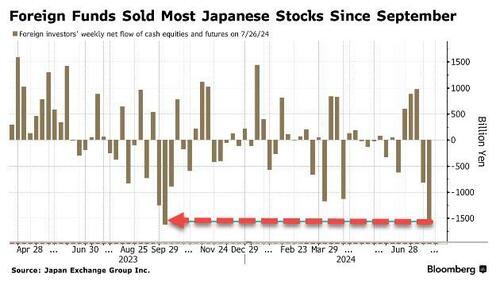

Once the main drivers of the market’s ascent, foreign investors sold net ¥1.56 trillion Japanese cash equities and futures combined in the week that ended July 26, according to data from Japan Exchange Group.

"Speculative players are expanding a lot of their short positions in Japanese equities this morning, especially in the futures market, and they are buying U.S. equities," said Yoshitaka Suda, a quantitative strategist at Nomura Securities.

"The magnitude of macro hedge funds shorting Japanese equities is shocking."

He said macro hedge funds were net selling Japanese equities and net buying U.S. ones because "where earnings are concerned, U.S. equities look better able to ride out a global economic downturn, whereas Japanese equities are more cyclical."

The question is - how much more pain will policymakers allow before they step in (contrary-wise to their recent interventions) to save the market?

Stocks it is:

— zerohedge (@zerohedge) August 2, 2024

*SUZUKI: STOCKS ARE IMPACTED BY YIELDS, FX

*SUZUKI: WILL CONTINUE TO MONITOR FX MARKET MOVES

The only thing people hate more than a collapsing currency is a collapsing stock portfolio https://t.co/CHNOMlXcHT

We warned yesterday that the BoJ has boxed itself into a corner - forced to decide between a crashing currency or a crashing stock market - and overnight it appears traders put policymakers to the test to see what their reaction function might be.

Yen strength exacerbated an ugly US session and dragged Japanese stocks down further overnight as Japan’s Topix Index entered a technical correction in its worst two-day rout since 2011...

“The recent strengthening of the Japanese yen coupled with tech sector weakness is poised to significantly impact the Asian stock market,” said Manish Bhargava, a fund manager at Straits Investment Holdings in Singapore.

“Given the substantial weight of tech stocks in Asian indices, disappointing results from tech giants could trigger a broader market downturn in Asian markets.”

So which will the policymakers choose to save?

Source: Bloomberg

Nicholas Smith, Japan equity strategist at CLSA, said, "I think markets globally are having a headless chicken moment," with investors excessively worried about the change in currency rates.

"Stocks getting hit hardest are the ones that surged this year," he said.

Japan's benchmark Nikkei Stock Average on Friday recorded the second biggest daily drop in its history, as stocks extended losses following a sell-off in New York overnight.

The index plunged to 35,909.70, down 2,216.63 points, or 5.81%, marking its lowest close since Jan. 26.

Friday's decline was the second largest in the index's history after the Black Monday crash of October 1987, when global markets sank and the index cratered by 3,836.48 points.

“I didn’t expect stocks to fall this much - it’s a disaster,” said Kiyoshi Ishigane, chief fund manager at Mitsubishi UFJ Asset Management Co. in Tokyo.

“This might be temporary, but Japanese stocks are in their worst situation.”

Once the main drivers of the market’s ascent, foreign investors sold net ¥1.56 trillion Japanese cash equities and futures combined in the week that ended July 26, according to data from Japan Exchange Group.

"Speculative players are expanding a lot of their short positions in Japanese equities this morning, especially in the futures market, and they are buying U.S. equities," said Yoshitaka Suda, a quantitative strategist at Nomura Securities.

"The magnitude of macro hedge funds shorting Japanese equities is shocking."

He said macro hedge funds were net selling Japanese equities and net buying U.S. ones because "where earnings are concerned, U.S. equities look better able to ride out a global economic downturn, whereas Japanese equities are more cyclical."

The question is - how much more pain will policymakers allow before they step in (contrary-wise to their recent interventions) to save the market?

Stocks it is:

— zerohedge (@zerohedge) August 2, 2024

*SUZUKI: STOCKS ARE IMPACTED BY YIELDS, FX

*SUZUKI: WILL CONTINUE TO MONITOR FX MARKET MOVES

The only thing people hate more than a collapsing currency is a collapsing stock portfolio https://t.co/CHNOMlXcHT