Every time we discuss homebuilder sentiment we can't help but be reminded of Upton Sinclair's infamous quote:

"It is difficult to get a man to understand something when his salary depends upon his not understanding it."

But maybe the truth is too hard to ignore now?

NAHB homebuilder sentiment slumped in August to 39 (well below expectations of a rise from prior 41 to 43 - and below the lowest estimate), back near COVID-Lockdown lows...

Source: Bloomberg

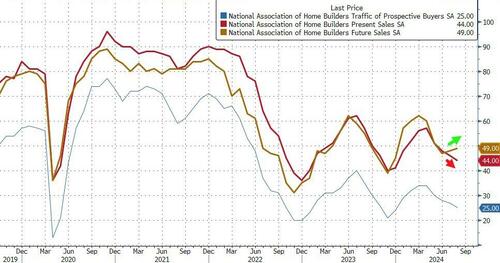

The data indicate downbeat views on present conditions, but (of course, remember Sinclair's quote above) a more optimistic take on the outlook.

Measures of prospective-buyer traffic and of present sales both fell to new low points for 2024, while a gauge of sales expectations for the next six months climbed 1 point to 49.

Source: Bloomberg

That may reflect expectations that mortgage rates are set to fall, NAHB Chief Economist Robert Dietz said in a prepared statement.

“With current inflation data pointing to interest rate cuts from the Federal Reserve and mortgage rates down markedly in the second week of August, buyer interest and builder sentiment should improve in the months ahead,” Dietz said.

The picture is ugly for sure.

This month, 33% of builders reported cutting prices, higher than the 31% who did so in July and the highest this year, according to NAHB.

The average price reduction remained at 6% for the 14th month.

The share of builders reporting using sales incentives, at 64%, was the highest since April 2019.

Finally, we wonder just how far this catch-down for homebuilder sentiment will go...

Source: Bloomberg

...with homebuyer sentiment at record lows.

Every time we discuss homebuilder sentiment we can't help but be reminded of Upton Sinclair's infamous quote:

"It is difficult to get a man to understand something when his salary depends upon his not understanding it."

But maybe the truth is too hard to ignore now?

NAHB homebuilder sentiment slumped in August to 39 (well below expectations of a rise from prior 41 to 43 - and below the lowest estimate), back near COVID-Lockdown lows...

Source: Bloomberg

The data indicate downbeat views on present conditions, but (of course, remember Sinclair's quote above) a more optimistic take on the outlook.

Measures of prospective-buyer traffic and of present sales both fell to new low points for 2024, while a gauge of sales expectations for the next six months climbed 1 point to 49.

Source: Bloomberg

That may reflect expectations that mortgage rates are set to fall, NAHB Chief Economist Robert Dietz said in a prepared statement.

“With current inflation data pointing to interest rate cuts from the Federal Reserve and mortgage rates down markedly in the second week of August, buyer interest and builder sentiment should improve in the months ahead,” Dietz said.

The picture is ugly for sure.

This month, 33% of builders reported cutting prices, higher than the 31% who did so in July and the highest this year, according to NAHB.

The average price reduction remained at 6% for the 14th month.

The share of builders reporting using sales incentives, at 64%, was the highest since April 2019.

Finally, we wonder just how far this catch-down for homebuilder sentiment will go...

Source: Bloomberg

...with homebuyer sentiment at record lows.