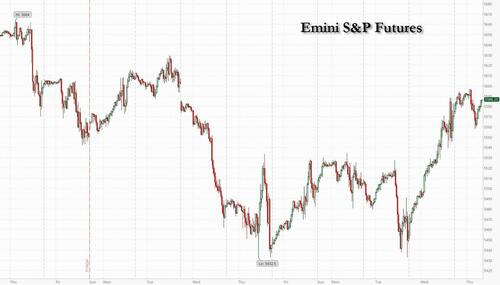

Futures extend on yesterday's post FOMC gains, but are off session highs, with tech outperforming and the Russell in the red, following the same trend seen late day yesterday. Futures have given up some of their earlier gains potentially on geopolitical headlines as fears of another imminent Iran-Israel conflict swirl, pushing oil to new highs. As of 8:00 am S&P futures are up 0.4% after the index recorded its biggest gain since February in the previous session; Nasdaq futures 0.5% higher led by META 7% higher following earnings with AAPL +60bps, AMZN +1.1% ahead of earnings after the close today. Semis are up small with NVDA +20bps. European stocks are mixed while in Asia, Japanese markets plunge as the yen surges following the inexplicably hawkish BOJ announcement even as Japan's economy is once again sinking, setting up the endgame of that particular monetary experiment. Bond yields are higher by 2-3bps which is boosting the USD to its best day in 2 weeks. Commodities are bid with Energy and base metals leading. Today’s macro data focus is on ISM-Mfg, while the market is likely to ignore jobs data ahead of tomorrow's NFP. AMZN/AAPL headline today’s earnings schedule.

In premarket trading, META rose more than 6% and contributed to the buoyant mood, extending the life cycle of the AI bubble after it projected to spend more on capex for the full year even though its actual capex spending for Q2 came below estimates. Expect the company's bullshit to hit a brick wall soon enough. Moderna shares sink 12% in premarket trading after the vaccine maker cut its revenue forecast for the full year. The company also said it expects lower sales of its Covid shot in Europe. Here are some other notable premarket movers:

- Carvana shares soared as much as 14% in premarket trading on Thursday as the online used-car dealer reported revenue for the second quarter that beat the average analyst estimate. Analysts are positive about the company’s strong unit sales growth.

- Alphatec Holdings shares slide 19% in premarket trading after the medical devices maker reported a larger loss per share in the second quarter than Wall Street had expected. Analysts also highlighted higher cash-burn expectations.

- Aurora Innovation is trading lower by 10% premarket Thursday after the developer of autonomous-driving technology offered up to $350 million in class A shares via Goldman Sachs, Allen, Morgan Stanley late Wednesday.

- Hershey shares slide 7.3% after the chocolate bar maker reported adjusted earnings per share and sales for the second quarter that missed estimates. Organic sales in constant currency plunged 17%, while organic volume/mix declined 18%. Management also tweaked annual forecasts lower.

- Qualcomm shares fell as much as 1.6% in premarket trading on Thursday after analysts note some weakness in the chipmaker’s forecast. The reiteration of the company’s full year outlook is also seen as a potential disappointment.

Jobless claims data due later on Thursday and July’s unemployment print will provide further clues on the state of the US labor market. The Fed signaled on Wednesday that officials are on course to ease monetary policy next month unless inflation progress stalls.

“We’ll see tomorrow with payrolls if the Fed is right, but if it is, then the upward trend on equity markets is likely to continue,”said Amelie Derambure, a multi-asset portfolio manager at Amundi in Paris.

Earlier, the Bank of England lowered rates by 25 basis points to 5.0% in a narrow, 5-4 vote, as expected, while signaling further cautious reductions ahead. The pound extended declines to 0.8% while yields on 10-year gilts lowered six basis points. Investors will be watching earnings from Amazon.com Inc. after the close for further clues about returns from investments in AI. A report from Apple will give indicators of how the iPhone 16 is expected to perform in September.

For equities, the bullish mood in the US didn’t extend to Europe, where the regional benchmark dropped on a series of disappointing results from automakers and Societe Generale SA. The Stoxx 600 index dropped 0.2% after BMW’s earnings slowed and German rival Volkswagen AG’s margins declined, with both automakers suffering from weak demand in China. A poor performance in SocGen’s retail unit sent the stock plummeting 7.7%, dragging down European peers such as HSBC Holdings Plc and UniCredit SpA. The disappointing results serve as further evidence of building pressure for European companies on the back of softer demand and a macro backdrop that remains beset by challenges. The European benchmark has been trading sideways for the past two months after rallying in the year through May. Here are all the notable European movers Thursday:

- Rolls-Royce shares jump as much as 11% to hit a new record high after the aerospace and defence supplier beat expectations in the first half and raised its outlook for the full year

- Shell shares rise as much 2% after its profit and cash flow beat expectations in the second quarter, underpinning another resilient quarter for the oil company, according to RBC Capital Markets

- London Stock Exchange Group rises as much as 3.6% to the highest since March 2021, after reporting total income for the first half that matched consensus estimates

- Next shares jump 8.7%, reaching the highest intraday level on record, after the clothing retailer boosted its pretax profit guidance for the year

- AB InBev rises as much as 3.6% after its results, which saw a beat on organic Ebitda growth even as beer volumes missed expectations

- Smith & Nephew shares rise as much as 11%, the steepest since November 2020, after the British provider of medical devices reported half-year figures

- Haleon shares rise as much as 3.1% to a record high after the consumer health company reported sales volume growth in the second quarter which some analysts found reassuring

- Societe Generale shares drop as much as 7.7% after a disappointing performance at the French bank’s domestic retail unit overshadowed a surge in trading revenues

- Worldline shares drop as much as 18%, to the lowest intraday level on record, after the French payment processor cut its guidance for revenue growth and profit, citing weaker consumption trends in Europe

- Syensqo shares drop as much as 7.9%, hitting the lowest level since the company was spun off from Solvay in December, after the chemicals maker narrowed its full-year earnings guidance downward

- Schroders falls as much as 8.6%, most in four years, after the UK asset manager reported adjusted profit or the first half-year that missed estimates, with analysts noting lower revenues that were partly offset by better costs

- Melrose Industries shares fall as much as 6.7% as supply-chain disruption weighed on the aerospace firm’s outlook for 2025, though the company did reiterate guidance for 2024

“People are a bit more concerned that we will see a sharper slowdown than what’s currently priced in,” said Richard Flax, chief investment officer at digital wealth manager Moneyfarm. “We’ve seen downgrades to next quarter’s earnings. There’s also been some notable commentary from macro bellwethers about consumer spending. And that does give you pause.”

Earlier, Asian stocks declined, weighed down by a rout in Japanese shares as the yen soared after the BOJ raised interest rates on Wednesday. Chinese equities also pulled back after strong gains in the previous session. The MSCI Asia Pacific Index fell as much as 0.8%. Japanese stocks including Toyota Motor were among the biggest drags, offsetting gains in tech shares including TSMC that tracked advances in US peers. Benchmarks rose in Taiwan, South Korea and Australia.

Japan’s Topix plunged more than 3%, falling the most since April 2020 in a broad selloff, as the yen’s sharp rally weighed on exporters and the central bank’s interest rate hike dragged down real estate shares. A measure of property stocks led losses in the index plunging 7.3% while automakers slumped 6.6%. Department stores, which had been benefiting from booming tourist spending on the back of a weaker yen, also fell. The Nikkei 225 Stock Average, which entered a technical correction last week, lost 2.5%. The moves came after the Bank of Japan’s tightening was followed by comments from Jerome Powell that the Federal Reserve could cut rates “as soon as” September.

In FX, the dollar rose 0.2% against a basket of currencies after recording its worst day since May on Wednesday. The yen erased earlier gains to trade little changed.

In rates, treasuries are slightly lower across the curve, while gilts outperform after Bank of England cut interest rates by 25 basis points to 5% in a 5-4 vote split. In a close call, policy members were expected to vote for a rate cut. Treasury yields are cheaper by 1.5bp to 2bp across the curve with belly leading losses on the day, giving back some outperformance seen Wednesday. Treasury 10-year yields trade around 4.05%, cheaper by 2bp on the day with gilts outperforming by 6bp in the sector, bunds by 4bp. Leading into the Bank of England rate decision, Treasuries were already slightly lower across the curve, giving back some of Wednesday’s late gains into month-end. For US session, focus will switch back to data with initial jobless claims and manufacturing gauges expected. Following Wednesday’s Fed meeting, OIS markets price in around 27bp of rate cuts into the September policy meeting and roughly 72bp of cuts by the end of the year.

In commodities, oil extended gains after Iran reportedly ordered a retaliatory strike on Israel for killing a Hamas leader on its soil.

Looking at today's calendar, US economic data slate includes July job cuts (7:30am), 2Q preliminary nonfarm productivity and weekly jobless claims (8:30am), July S&P Global US manufacturing PMI (9:45am) and ISM manufacturing (10am). The next scheduled Fed speaker is Barkin on Friday (12pm)

Market snapshot

- S&P 500 futures up 0.1% to 5,565.00

- STOXX Europe 600 down 0.5% to 515.53

- MXAP down 0.7% to 182.35

- MXAPJ up 0.4% to 567.81

- Nikkei down 2.5% to 38,126.33

- Topix down 3.2% to 2,703.69

- Hang Seng Index down 0.2% to 17,304.96

- Shanghai Composite down 0.2% to 2,932.39

- Sensex little changed at 81,771.28

- Australia S&P/ASX 200 up 0.3% to 8,114.67

- Kospi up 0.3% to 2,777.68

- German 10Y yield little changed at 2.29%

- Euro down 0.4% to $1.0785

- Brent Futures up 0.7% to $81.41/bbl

- Gold spot down 0.4% to $2,436.89

- US Dollar Index up 0.26% to 104.37

Top Overnight News

- WSJ's Timiraos wrote the Fed cleared the path for a September rate cut and noted officials held rates steady but made an important pivot of highlighting a more balanced focus on employment and inflation goals.

- The US could impose restrictions on China’s ability to access high-bandwidth memory chips (and the equipment needed to make those chips), potentially limiting Beijing’s ability to build AI infrastructure. BBG

- The US said Venezuela’s Nicolás Maduro lost the presidential election, while he doubled down and said opposition leaders María Corina Machado and Edmundo González should be jailed for at least 30 years. BBG

- BMW shares slump in European trading after the company reported a shortfall on auto margins due to weakness in China. Volkswagen shares also sliding lower after the company’s margins were hurt by restructuring charges while China deliveries witnessed softness (mgmt. said its cost cutting initiatives aren’t over and would persist beyond H2). WSJ

- Iran’s supreme leader, Ayatollah Ali Khamenei, has issued an order for Iran to strike Israel directly, in retaliation for the killing in Tehran of Hamas’s leader, Ismail Haniyeh, according to three Iranian officials briefed on the order. NYT

- Expectations tilted toward the first BOE cut since the start of the pandemic, a 25-bp reduction to 5%, but economists said it’s a close call after months of silence from Governor Andrew Bailey due to the UK election campaign. Officials will also release growth and inflation forecasts today. BBG

- Bill Ackman pressed pause on the initial public offering of a new fund aimed at everyday investors after a lack of investor demand forced him to dramatically shrink his fundraising target. WSJ

- Donald Trump now trails Kamala Harris in the presidential race, PredictIt showed. His odds briefly dropped to just under 50% — they reached 70% at one stage. BBG

- McDonald’s $5 meal deal drove a “notable” bump in diner traffic and is helping to capture customers from rivals, according to a company memo to franchisees. BBG

- META (+7% pre mkt) reported EPS upside at 5.16 (+73% and above the Street’s 4.72 forecast), w/the beat driven by higher sales (+22% to $39.07B vs. the Street $38.33B), cost controls (costs/expenses rose only 7% while op. margins spiked 900bp to 38%), and a low tax rate (11% vs. the Street’s ~15% forecast). Capex ran below the Street at “only” $8.1B (this is more than $1B below the consensus forecast of $9.4B) but despite this, they take up the full-year capex guide slightly (now $37-40B vs. the prior $35-40B) and talk about “significant” capex growth in ‘25. RTRS

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed as participants digested the latest key developments including strong tech earnings, Fed Chair Powell's dovish press conference and disappointing Chinese Caixin Manufacturing PMI data. ASX 200 was led higher by strength in the rate-sensitive sectors amid a softer yield environment. Nikkei 225 suffered heavy losses and briefly dipped beneath the 38,000 level alongside a firmer currency after the recent BoJ rate hike and as participants also digested earnings releases, while Toyota shares were heavily pressured after Japan's Transport Ministry announced that misconduct was discovered in an additional 7 Toyota models. Hang Seng and Shanghai Comp. were subdued after disappointing Caixin Manufacturing PMI which unexpectedly slipped into contraction territory for the first time in 9 months.

Top Asian News

- HKMA maintained its base rate unchanged at 5.75%, as expected.

- China NDRC vice head said there is 'sufficient' room for counter-cyclical policy adjustments and that China has the conditions, ability, and confidence to achieve its full-year growth target. Furthermore, China will actively expand domestic demand and put consumption boost in a more striking position, as well as promote effective investment.

European bourses are lower across the board, Stoxx 600 -0.3%, despite the initial modest optimism of futures overnight. Earnings dominate the breakdown this morning. Sectors are mixed, no overarching theme with earnings dictating; Retail outperforms on Next earnings, followed closely by Real Estate on the back of Vonovia. While Autos lag after BMW, Daimler Truck and Volkswagen with Banks pressured by BNP Paribas, Credit Agricole and ING all post-earnings. DAX 40 lags given the pressure in auto names, CAC 40 hit on SocGen and Credit Ag. While the FTSE 100 is the relative best performer given GBP weakness ahead of the BoE and also as the likes of Rolls-Royce and Shell lift post-earnings. Stateside, futures are mixed post-FOMC and into an after-market session with numerous heavyweights due incl. AAPL, AMZN & INTC; ES +0.2%, NQ +0.3%. Post-earnings, Meta +6.3% while QCOM now resides in the red.

Top European News

- German engineering orders -9% Y/Y in June (Domestic -8%; Orders -10%); Apr-Jun -10% Y/Y (Domestic -20%, Foreign Orders -5%), according to VDMA.

FX

- USD is managing to claw back most of yesterday's FOMC-related selling with DXY up to a 104.37 peak vs. yesterday's 104.53 high.

- USD strength which comes from deteriorating European sentiment, EUR/USD at lows of 1.0779 and Cable below 1.28 to a 1.2764 base into the BoE.

- JPY is one of the best performers across the majors as the combination of a BoJ hike yesterday and Powell paving the way for a September cut acts as a drag on USD/JPY; down to a 148.52 base but since back above 149.00.

- AUD pressured on USD strength and soft Chinese Caixin PMIs, Kiwi also pressured but to a lesser extent.

Fixed Income

- A bullish start for fixed income as the FOMC undertones continue to reverberate through.

- Bunds holding around 134.00 in a 133.85-134.17 band; unreactive to unusually hefty revisions to Final PMIs and a sizeable outlook cut by HCOB on the German economy for the year as a whole.

- Similarly, supply from Spain and France passed with no real reaction.

- Gilts outperform into the BoE, though before this the Manufacturing PMI was revised higher and accompanied by hawkish pricing commentary but not sufficient to knock Gilts which remain at the top-end of 99.49-79 parameters and as such the UK 10yr yield still resides sub-4.0%.

- USTs firmer, and towards the top-end of 112-02+ to 112-10+ parameters, a peak which matches Wednesday’s post-Powell high.

- Spain sells EUR 5.9bln vs exp. EUR 5-6bln 2.50% 2027, 3.45% 2034 & 5.15% 2044 bonds & EUR 0.766bln vs exp. EUR 0.25-0.75bln 0.65% 2027 I/L

- France sells EUR 10.497bln vs exp. EUR 9-10.5bln 3.00% 2034, 1.25% 2038, 2.50% 2043, and 4.00% 2055 OAT Auction

Commodities

- Crude benchmarks continue to climb with geopolitical risk premium keeping the complex afloat heading into the OPEC+ JMMC.

- WTI Sep trades towards the top of a current USD 78.31-78.88/bbl range with Brent Oct around the upper end of a USD 81.13-81.80/bbl parameter.

- Precious metals pressured amid the recent USD strength, XAU at the lower-end of a USD 2,433.29-2,458.47/oz range vs Wednesday's USD 2,403.94-2,451.01/oz. While base peers have also come off best, with 3M LME Copper at the lower-end of parameters given the USD strength and mentioned surprise contraction in the Chinese Caixin Manufacturing PMI.

- OPEC+ is likely to maintain output policy at the meeting, via Reuters citing sources; meeting has been pushed back to 12:00BST/07:00ET.

Geopolitics: Middle East

- Israel sent messages through diplomatic channels to Lebanon and Iran in which it stated that Israel is ready to go to the point of all-out war if Hezbollah and Iran respond in a way that will severely damage Israel, according to Israel's Channel 12 cited by Faytuks News on X.

- US Deputy Representative to the Security Council said a wider war is neither imminent nor inevitable, according to Al Jazeera.

- Hamas said it targeted a gathering of Israeli soldiers at the Salem military checkpoint west of Jenin with machine guns and achieved direct hits, according to Sky News Arabia.

- Israeli military confirmed death of Hamas military leader Deif in a July strike in Gaza, via a statement.

Geopolitics: Other

- Chinese Foreign Ministry said China and India are to speed up the negotiation process for the border situation and continue to maintain peace and tranquillity in border areas.

- Chinese military said a Canadian frigate sailed through the Taiwan Strait, while it added that Canada's actions have disrupted and undermined peace and stability across the Taiwan Strait.

US Event Calendar

- 07:30: July Challenger Job Cuts YoY 9.2%, prior 19.8%

- 08:30: July Initial Jobless Claims, est. 236,000, prior 235,000

- July Continuing Claims, est. 1.86m, prior 1.85m

- 08:30: 2Q Nonfarm Productivity, est. 1.8%, prior 0.2%

- Unit Labor Costs, est. 1.7%, prior 4.0%

- 09:45: July S&P Global US Manufacturing PM, est. 49.6, prior 49.5

- 10:00: June Construction Spending MoM, est. 0.2%, prior -0.1%

- 10:00: July ISM Manufacturing, est. 48.8, prior 48.5

Futures extend on yesterday's post FOMC gains, but are off session highs, with tech outperforming and the Russell in the red, following the same trend seen late day yesterday. Futures have given up some of their earlier gains potentially on geopolitical headlines as fears of another imminent Iran-Israel conflict swirl, pushing oil to new highs. As of 8:00 am S&P futures are up 0.4% after the index recorded its biggest gain since February in the previous session; Nasdaq futures 0.5% higher led by META 7% higher following earnings with AAPL +60bps, AMZN +1.1% ahead of earnings after the close today. Semis are up small with NVDA +20bps. European stocks are mixed while in Asia, Japanese markets plunge as the yen surges following the inexplicably hawkish BOJ announcement even as Japan's economy is once again sinking, setting up the endgame of that particular monetary experiment. Bond yields are higher by 2-3bps which is boosting the USD to its best day in 2 weeks. Commodities are bid with Energy and base metals leading. Today’s macro data focus is on ISM-Mfg, while the market is likely to ignore jobs data ahead of tomorrow's NFP. AMZN/AAPL headline today’s earnings schedule.

In premarket trading, META rose more than 6% and contributed to the buoyant mood, extending the life cycle of the AI bubble after it projected to spend more on capex for the full year even though its actual capex spending for Q2 came below estimates. Expect the company's bullshit to hit a brick wall soon enough. Moderna shares sink 12% in premarket trading after the vaccine maker cut its revenue forecast for the full year. The company also said it expects lower sales of its Covid shot in Europe. Here are some other notable premarket movers:

- Carvana shares soared as much as 14% in premarket trading on Thursday as the online used-car dealer reported revenue for the second quarter that beat the average analyst estimate. Analysts are positive about the company’s strong unit sales growth.

- Alphatec Holdings shares slide 19% in premarket trading after the medical devices maker reported a larger loss per share in the second quarter than Wall Street had expected. Analysts also highlighted higher cash-burn expectations.

- Aurora Innovation is trading lower by 10% premarket Thursday after the developer of autonomous-driving technology offered up to $350 million in class A shares via Goldman Sachs, Allen, Morgan Stanley late Wednesday.

- Hershey shares slide 7.3% after the chocolate bar maker reported adjusted earnings per share and sales for the second quarter that missed estimates. Organic sales in constant currency plunged 17%, while organic volume/mix declined 18%. Management also tweaked annual forecasts lower.

- Qualcomm shares fell as much as 1.6% in premarket trading on Thursday after analysts note some weakness in the chipmaker’s forecast. The reiteration of the company’s full year outlook is also seen as a potential disappointment.

Jobless claims data due later on Thursday and July’s unemployment print will provide further clues on the state of the US labor market. The Fed signaled on Wednesday that officials are on course to ease monetary policy next month unless inflation progress stalls.

“We’ll see tomorrow with payrolls if the Fed is right, but if it is, then the upward trend on equity markets is likely to continue,”said Amelie Derambure, a multi-asset portfolio manager at Amundi in Paris.

Earlier, the Bank of England lowered rates by 25 basis points to 5.0% in a narrow, 5-4 vote, as expected, while signaling further cautious reductions ahead. The pound extended declines to 0.8% while yields on 10-year gilts lowered six basis points. Investors will be watching earnings from Amazon.com Inc. after the close for further clues about returns from investments in AI. A report from Apple will give indicators of how the iPhone 16 is expected to perform in September.

For equities, the bullish mood in the US didn’t extend to Europe, where the regional benchmark dropped on a series of disappointing results from automakers and Societe Generale SA. The Stoxx 600 index dropped 0.2% after BMW’s earnings slowed and German rival Volkswagen AG’s margins declined, with both automakers suffering from weak demand in China. A poor performance in SocGen’s retail unit sent the stock plummeting 7.7%, dragging down European peers such as HSBC Holdings Plc and UniCredit SpA. The disappointing results serve as further evidence of building pressure for European companies on the back of softer demand and a macro backdrop that remains beset by challenges. The European benchmark has been trading sideways for the past two months after rallying in the year through May. Here are all the notable European movers Thursday:

- Rolls-Royce shares jump as much as 11% to hit a new record high after the aerospace and defence supplier beat expectations in the first half and raised its outlook for the full year

- Shell shares rise as much 2% after its profit and cash flow beat expectations in the second quarter, underpinning another resilient quarter for the oil company, according to RBC Capital Markets

- London Stock Exchange Group rises as much as 3.6% to the highest since March 2021, after reporting total income for the first half that matched consensus estimates

- Next shares jump 8.7%, reaching the highest intraday level on record, after the clothing retailer boosted its pretax profit guidance for the year

- AB InBev rises as much as 3.6% after its results, which saw a beat on organic Ebitda growth even as beer volumes missed expectations

- Smith & Nephew shares rise as much as 11%, the steepest since November 2020, after the British provider of medical devices reported half-year figures

- Haleon shares rise as much as 3.1% to a record high after the consumer health company reported sales volume growth in the second quarter which some analysts found reassuring

- Societe Generale shares drop as much as 7.7% after a disappointing performance at the French bank’s domestic retail unit overshadowed a surge in trading revenues

- Worldline shares drop as much as 18%, to the lowest intraday level on record, after the French payment processor cut its guidance for revenue growth and profit, citing weaker consumption trends in Europe

- Syensqo shares drop as much as 7.9%, hitting the lowest level since the company was spun off from Solvay in December, after the chemicals maker narrowed its full-year earnings guidance downward

- Schroders falls as much as 8.6%, most in four years, after the UK asset manager reported adjusted profit or the first half-year that missed estimates, with analysts noting lower revenues that were partly offset by better costs

- Melrose Industries shares fall as much as 6.7% as supply-chain disruption weighed on the aerospace firm’s outlook for 2025, though the company did reiterate guidance for 2024

“People are a bit more concerned that we will see a sharper slowdown than what’s currently priced in,” said Richard Flax, chief investment officer at digital wealth manager Moneyfarm. “We’ve seen downgrades to next quarter’s earnings. There’s also been some notable commentary from macro bellwethers about consumer spending. And that does give you pause.”

Earlier, Asian stocks declined, weighed down by a rout in Japanese shares as the yen soared after the BOJ raised interest rates on Wednesday. Chinese equities also pulled back after strong gains in the previous session. The MSCI Asia Pacific Index fell as much as 0.8%. Japanese stocks including Toyota Motor were among the biggest drags, offsetting gains in tech shares including TSMC that tracked advances in US peers. Benchmarks rose in Taiwan, South Korea and Australia.

Japan’s Topix plunged more than 3%, falling the most since April 2020 in a broad selloff, as the yen’s sharp rally weighed on exporters and the central bank’s interest rate hike dragged down real estate shares. A measure of property stocks led losses in the index plunging 7.3% while automakers slumped 6.6%. Department stores, which had been benefiting from booming tourist spending on the back of a weaker yen, also fell. The Nikkei 225 Stock Average, which entered a technical correction last week, lost 2.5%. The moves came after the Bank of Japan’s tightening was followed by comments from Jerome Powell that the Federal Reserve could cut rates “as soon as” September.

In FX, the dollar rose 0.2% against a basket of currencies after recording its worst day since May on Wednesday. The yen erased earlier gains to trade little changed.

In rates, treasuries are slightly lower across the curve, while gilts outperform after Bank of England cut interest rates by 25 basis points to 5% in a 5-4 vote split. In a close call, policy members were expected to vote for a rate cut. Treasury yields are cheaper by 1.5bp to 2bp across the curve with belly leading losses on the day, giving back some outperformance seen Wednesday. Treasury 10-year yields trade around 4.05%, cheaper by 2bp on the day with gilts outperforming by 6bp in the sector, bunds by 4bp. Leading into the Bank of England rate decision, Treasuries were already slightly lower across the curve, giving back some of Wednesday’s late gains into month-end. For US session, focus will switch back to data with initial jobless claims and manufacturing gauges expected. Following Wednesday’s Fed meeting, OIS markets price in around 27bp of rate cuts into the September policy meeting and roughly 72bp of cuts by the end of the year.

In commodities, oil extended gains after Iran reportedly ordered a retaliatory strike on Israel for killing a Hamas leader on its soil.

Looking at today's calendar, US economic data slate includes July job cuts (7:30am), 2Q preliminary nonfarm productivity and weekly jobless claims (8:30am), July S&P Global US manufacturing PMI (9:45am) and ISM manufacturing (10am). The next scheduled Fed speaker is Barkin on Friday (12pm)

Market snapshot

- S&P 500 futures up 0.1% to 5,565.00

- STOXX Europe 600 down 0.5% to 515.53

- MXAP down 0.7% to 182.35

- MXAPJ up 0.4% to 567.81

- Nikkei down 2.5% to 38,126.33

- Topix down 3.2% to 2,703.69

- Hang Seng Index down 0.2% to 17,304.96

- Shanghai Composite down 0.2% to 2,932.39

- Sensex little changed at 81,771.28

- Australia S&P/ASX 200 up 0.3% to 8,114.67

- Kospi up 0.3% to 2,777.68

- German 10Y yield little changed at 2.29%

- Euro down 0.4% to $1.0785

- Brent Futures up 0.7% to $81.41/bbl

- Gold spot down 0.4% to $2,436.89

- US Dollar Index up 0.26% to 104.37

Top Overnight News

- WSJ's Timiraos wrote the Fed cleared the path for a September rate cut and noted officials held rates steady but made an important pivot of highlighting a more balanced focus on employment and inflation goals.

- The US could impose restrictions on China’s ability to access high-bandwidth memory chips (and the equipment needed to make those chips), potentially limiting Beijing’s ability to build AI infrastructure. BBG

- The US said Venezuela’s Nicolás Maduro lost the presidential election, while he doubled down and said opposition leaders María Corina Machado and Edmundo González should be jailed for at least 30 years. BBG

- BMW shares slump in European trading after the company reported a shortfall on auto margins due to weakness in China. Volkswagen shares also sliding lower after the company’s margins were hurt by restructuring charges while China deliveries witnessed softness (mgmt. said its cost cutting initiatives aren’t over and would persist beyond H2). WSJ

- Iran’s supreme leader, Ayatollah Ali Khamenei, has issued an order for Iran to strike Israel directly, in retaliation for the killing in Tehran of Hamas’s leader, Ismail Haniyeh, according to three Iranian officials briefed on the order. NYT

- Expectations tilted toward the first BOE cut since the start of the pandemic, a 25-bp reduction to 5%, but economists said it’s a close call after months of silence from Governor Andrew Bailey due to the UK election campaign. Officials will also release growth and inflation forecasts today. BBG

- Bill Ackman pressed pause on the initial public offering of a new fund aimed at everyday investors after a lack of investor demand forced him to dramatically shrink his fundraising target. WSJ

- Donald Trump now trails Kamala Harris in the presidential race, PredictIt showed. His odds briefly dropped to just under 50% — they reached 70% at one stage. BBG

- McDonald’s $5 meal deal drove a “notable” bump in diner traffic and is helping to capture customers from rivals, according to a company memo to franchisees. BBG

- META (+7% pre mkt) reported EPS upside at 5.16 (+73% and above the Street’s 4.72 forecast), w/the beat driven by higher sales (+22% to $39.07B vs. the Street $38.33B), cost controls (costs/expenses rose only 7% while op. margins spiked 900bp to 38%), and a low tax rate (11% vs. the Street’s ~15% forecast). Capex ran below the Street at “only” $8.1B (this is more than $1B below the consensus forecast of $9.4B) but despite this, they take up the full-year capex guide slightly (now $37-40B vs. the prior $35-40B) and talk about “significant” capex growth in ‘25. RTRS

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed as participants digested the latest key developments including strong tech earnings, Fed Chair Powell's dovish press conference and disappointing Chinese Caixin Manufacturing PMI data. ASX 200 was led higher by strength in the rate-sensitive sectors amid a softer yield environment. Nikkei 225 suffered heavy losses and briefly dipped beneath the 38,000 level alongside a firmer currency after the recent BoJ rate hike and as participants also digested earnings releases, while Toyota shares were heavily pressured after Japan's Transport Ministry announced that misconduct was discovered in an additional 7 Toyota models. Hang Seng and Shanghai Comp. were subdued after disappointing Caixin Manufacturing PMI which unexpectedly slipped into contraction territory for the first time in 9 months.

Top Asian News

- HKMA maintained its base rate unchanged at 5.75%, as expected.

- China NDRC vice head said there is 'sufficient' room for counter-cyclical policy adjustments and that China has the conditions, ability, and confidence to achieve its full-year growth target. Furthermore, China will actively expand domestic demand and put consumption boost in a more striking position, as well as promote effective investment.

European bourses are lower across the board, Stoxx 600 -0.3%, despite the initial modest optimism of futures overnight. Earnings dominate the breakdown this morning. Sectors are mixed, no overarching theme with earnings dictating; Retail outperforms on Next earnings, followed closely by Real Estate on the back of Vonovia. While Autos lag after BMW, Daimler Truck and Volkswagen with Banks pressured by BNP Paribas, Credit Agricole and ING all post-earnings. DAX 40 lags given the pressure in auto names, CAC 40 hit on SocGen and Credit Ag. While the FTSE 100 is the relative best performer given GBP weakness ahead of the BoE and also as the likes of Rolls-Royce and Shell lift post-earnings. Stateside, futures are mixed post-FOMC and into an after-market session with numerous heavyweights due incl. AAPL, AMZN & INTC; ES +0.2%, NQ +0.3%. Post-earnings, Meta +6.3% while QCOM now resides in the red.

Top European News

- German engineering orders -9% Y/Y in June (Domestic -8%; Orders -10%); Apr-Jun -10% Y/Y (Domestic -20%, Foreign Orders -5%), according to VDMA.

FX

- USD is managing to claw back most of yesterday's FOMC-related selling with DXY up to a 104.37 peak vs. yesterday's 104.53 high.

- USD strength which comes from deteriorating European sentiment, EUR/USD at lows of 1.0779 and Cable below 1.28 to a 1.2764 base into the BoE.

- JPY is one of the best performers across the majors as the combination of a BoJ hike yesterday and Powell paving the way for a September cut acts as a drag on USD/JPY; down to a 148.52 base but since back above 149.00.

- AUD pressured on USD strength and soft Chinese Caixin PMIs, Kiwi also pressured but to a lesser extent.

Fixed Income

- A bullish start for fixed income as the FOMC undertones continue to reverberate through.

- Bunds holding around 134.00 in a 133.85-134.17 band; unreactive to unusually hefty revisions to Final PMIs and a sizeable outlook cut by HCOB on the German economy for the year as a whole.

- Similarly, supply from Spain and France passed with no real reaction.

- Gilts outperform into the BoE, though before this the Manufacturing PMI was revised higher and accompanied by hawkish pricing commentary but not sufficient to knock Gilts which remain at the top-end of 99.49-79 parameters and as such the UK 10yr yield still resides sub-4.0%.

- USTs firmer, and towards the top-end of 112-02+ to 112-10+ parameters, a peak which matches Wednesday’s post-Powell high.

- Spain sells EUR 5.9bln vs exp. EUR 5-6bln 2.50% 2027, 3.45% 2034 & 5.15% 2044 bonds & EUR 0.766bln vs exp. EUR 0.25-0.75bln 0.65% 2027 I/L

- France sells EUR 10.497bln vs exp. EUR 9-10.5bln 3.00% 2034, 1.25% 2038, 2.50% 2043, and 4.00% 2055 OAT Auction

Commodities

- Crude benchmarks continue to climb with geopolitical risk premium keeping the complex afloat heading into the OPEC+ JMMC.

- WTI Sep trades towards the top of a current USD 78.31-78.88/bbl range with Brent Oct around the upper end of a USD 81.13-81.80/bbl parameter.

- Precious metals pressured amid the recent USD strength, XAU at the lower-end of a USD 2,433.29-2,458.47/oz range vs Wednesday's USD 2,403.94-2,451.01/oz. While base peers have also come off best, with 3M LME Copper at the lower-end of parameters given the USD strength and mentioned surprise contraction in the Chinese Caixin Manufacturing PMI.

- OPEC+ is likely to maintain output policy at the meeting, via Reuters citing sources; meeting has been pushed back to 12:00BST/07:00ET.

Geopolitics: Middle East

- Israel sent messages through diplomatic channels to Lebanon and Iran in which it stated that Israel is ready to go to the point of all-out war if Hezbollah and Iran respond in a way that will severely damage Israel, according to Israel's Channel 12 cited by Faytuks News on X.

- US Deputy Representative to the Security Council said a wider war is neither imminent nor inevitable, according to Al Jazeera.

- Hamas said it targeted a gathering of Israeli soldiers at the Salem military checkpoint west of Jenin with machine guns and achieved direct hits, according to Sky News Arabia.

- Israeli military confirmed death of Hamas military leader Deif in a July strike in Gaza, via a statement.

Geopolitics: Other

- Chinese Foreign Ministry said China and India are to speed up the negotiation process for the border situation and continue to maintain peace and tranquillity in border areas.

- Chinese military said a Canadian frigate sailed through the Taiwan Strait, while it added that Canada's actions have disrupted and undermined peace and stability across the Taiwan Strait.

US Event Calendar

- 07:30: July Challenger Job Cuts YoY 9.2%, prior 19.8%

- 08:30: July Initial Jobless Claims, est. 236,000, prior 235,000

- July Continuing Claims, est. 1.86m, prior 1.85m

- 08:30: 2Q Nonfarm Productivity, est. 1.8%, prior 0.2%

- Unit Labor Costs, est. 1.7%, prior 4.0%

- 09:45: July S&P Global US Manufacturing PM, est. 49.6, prior 49.5

- 10:00: June Construction Spending MoM, est. 0.2%, prior -0.1%

- 10:00: July ISM Manufacturing, est. 48.8, prior 48.5