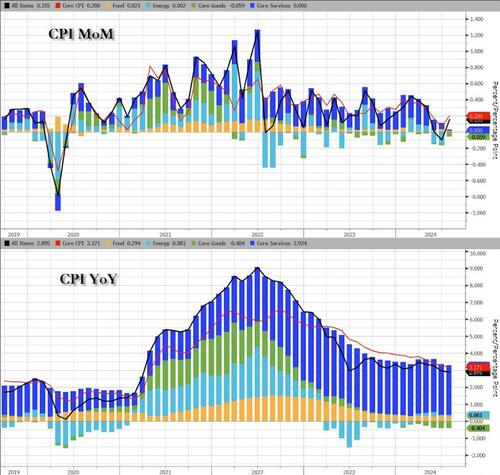

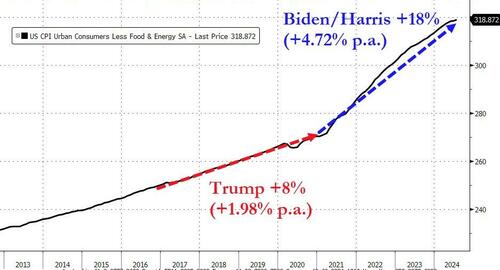

Following last month's 'deflationary' print (-0.1% MoM), analysts expected headline CPI to rise 0.2% MoM and they were spot on, shifting the YoY CPI print to 2.9% (from 3.0%) - the lowest since March 2021...

Source: Bloomberg

Goods deflation continues to drag overall CPI lower...

Source: Bloomberg

For context, Goods prices are down 1.9% YoY - the biggest deflationary impulse since 2004. Services prices continue to rise YoY but at the slowest pace since 2022...

Source: Bloomberg

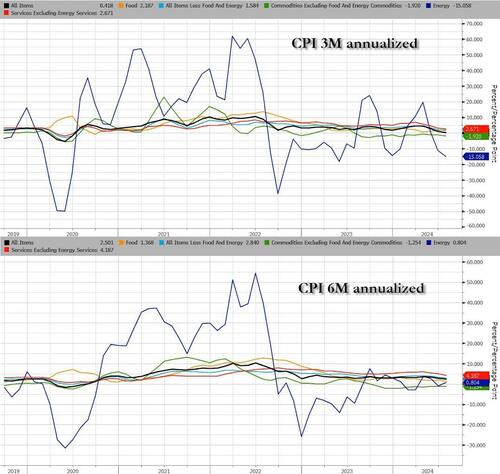

The 3m and 6m annualized CPI rates continue to trend lower (with Energy a particularly volatile factor)....

Source: Bloomberg

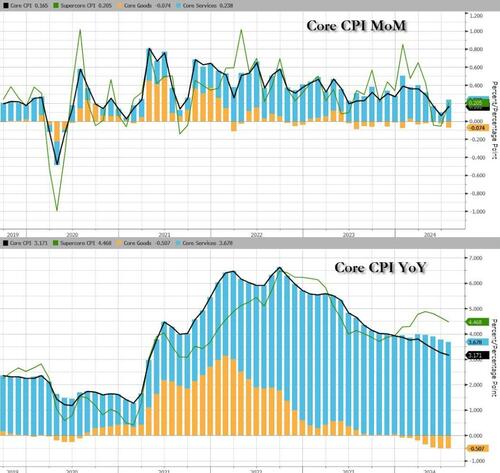

Core CPI also rose 0.2% MoM (as expected), and the YoY rate of inflation slowed to 3.2% (from 3.3%) - the lowest since April 2021...

Source: Bloomberg

While Core CPI is slowing YoY, the Core goods deflation appears to have stalled...

Source: Bloomberg

However, that is the 50th straight month of MoM increases in Core CPI, and a record high...

Source: Bloomberg

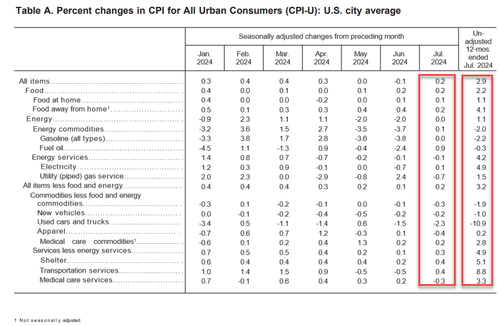

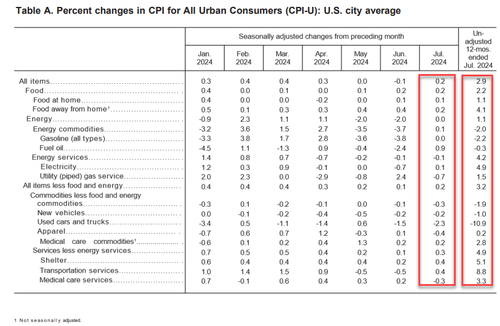

Under the hood, used car prices fell 2.3% along with airline fares (-1.2%) while Car insurance costs jumped 1.2% and furniture prices rose 0.3%...

Source: Bloomberg

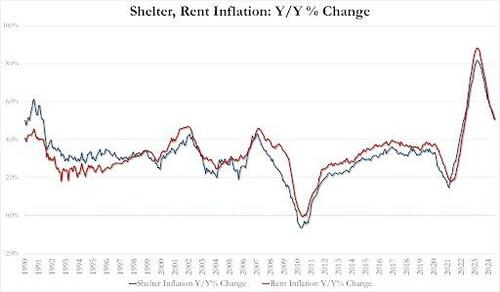

Perhaps more worrying is the fact that rent inflation has stopped falling...

-

July Shelter inflation up 0.33% MoM and up 5.05% YoY vs 5.16% in June

-

July Rent Inflation up 0.42% MoM and up 5.09% YoY vs 5.07% in June

Source: Bloomberg

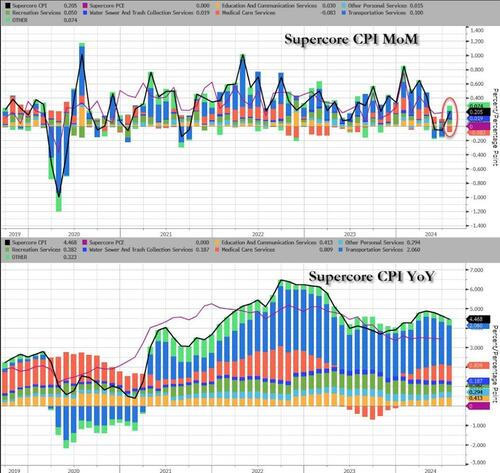

Finally, the so-called SuperCore CPI rose 0.2% MoM (same as the rest), dragging the YoY down to 4.73% (still notably elevated)...

Source: Bloomberg

Transportation Services jumped notably MoM..

Source: Bloomberg

So, is this 'good' news or bad news?

Finally, money supply growth is reaccelerating...

Source: Bloomberg

Is this the trough for CPI?

As Bloomberg notes, while the pace of inflation has come down, its still growing, and consumers in the New York-Newark-Jersey City, NY-NJ-PA metro, and the Dallas area still are dealing with inflation in excess of 4% -- the highest among large metro areas in the US.

Will The Fed really cut rates as rent inflation inflects higher for the first time since 2023?

Following last month's 'deflationary' print (-0.1% MoM), analysts expected headline CPI to rise 0.2% MoM and they were spot on, shifting the YoY CPI print to 2.9% (from 3.0%) - the lowest since March 2021...

Source: Bloomberg

Goods deflation continues to drag overall CPI lower...

Source: Bloomberg

For context, Goods prices are down 1.9% YoY - the biggest deflationary impulse since 2004. Services prices continue to rise YoY but at the slowest pace since 2022...

Source: Bloomberg

The 3m and 6m annualized CPI rates continue to trend lower (with Energy a particularly volatile factor)....

Source: Bloomberg

Core CPI also rose 0.2% MoM (as expected), and the YoY rate of inflation slowed to 3.2% (from 3.3%) - the lowest since April 2021...

Source: Bloomberg

While Core CPI is slowing YoY, the Core goods deflation appears to have stalled...

Source: Bloomberg

However, that is the 50th straight month of MoM increases in Core CPI, and a record high...

Source: Bloomberg

Under the hood, used car prices fell 2.3% along with airline fares (-1.2%) while Car insurance costs jumped 1.2% and furniture prices rose 0.3%...

Source: Bloomberg

Perhaps more worrying is the fact that rent inflation has stopped falling...

-

July Shelter inflation up 0.33% MoM and up 5.05% YoY vs 5.16% in June

-

July Rent Inflation up 0.42% MoM and up 5.09% YoY vs 5.07% in June

Source: Bloomberg

Finally, the so-called SuperCore CPI rose 0.2% MoM (same as the rest), dragging the YoY down to 4.73% (still notably elevated)...

Source: Bloomberg

Transportation Services jumped notably MoM..

Source: Bloomberg

So, is this 'good' news or bad news?

Finally, money supply growth is reaccelerating...

Source: Bloomberg

Is this the trough for CPI?

As Bloomberg notes, while the pace of inflation has come down, its still growing, and consumers in the New York-Newark-Jersey City, NY-NJ-PA metro, and the Dallas area still are dealing with inflation in excess of 4% -- the highest among large metro areas in the US.

Will The Fed really cut rates as rent inflation inflects higher for the first time since 2023?