Heading into Amazon's Q1 earnings, we said earlier that the investment thesis will be driven by i) e-commerce share, margin expansion and the potential for AWS growth recovery through the year; ii) directional commentary around AWS growth/optimization; iii) signals of retail margin improvement as suggested by management commentary on “cost to serve”, iv) progress with fulfillment regionalization and broader cost containment efforts, v) directional commentary on fiscal year capex for ecommerce (up with business) and ongoing AWS investments, vI) commentary on adoption of Prime Video with ads and ad industry broadly, and last but not least, 6) positioning around GenAI investments. We also noted that the key bogeys for this extremely popular - among hedge funds - position were the following:

- Q2 Total Sales: $149-150 bn

- Q2 EBIT: $14 bn+

- Q2 AWS Growth: 18%

- Q3 Total Sales: guide high end of the Street at $158 bn

- Q3 EBIT: $15 bn+ (freight rate dynamic)

So with that in mind here is what Amazon - whose stock is sliding after hours - reported moments ago:

- EPS $1.26 vs. 98c q/q, beating estimate $1.04

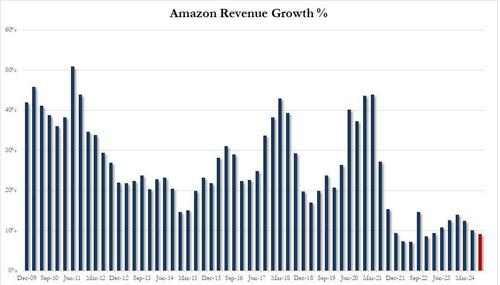

- Net sales $147.98 billion, +10% y/y, but missing estimates of $148.78 billion

- Online stores net sales $55.39 billion, +4.6% y/y, missing estimate $55.55 billion

- Physical Stores net sales $5.21 billion, +3.6% y/y, missing estimate $5.26 billion

- Third-Party Seller Services net sales $36.20 billion, +12% y/y, missing estimate $36.65 billion

- North America net sales $90.03 billion, +9.1% y/y, beating estimate $89.98 billion

- International net sales $31.66 billion, +6.6% y/y, beating estimate $32.87 billion

- Third-party seller services net sales excluding F/X +13% vs. +18% y/y, missing estimate +13.4%

- Amazon Web Services net sales $26.28 billion, +19% y/y, beating estimate $25.98 billion

- Amazon Web Services net sales excluding F/X +19% vs. +12% y/y, beating estimate +17.2%

Turning to operating results we find the following:

- Operating income $14.67 billion, +91% y/y, beating estimate $13.59 billion

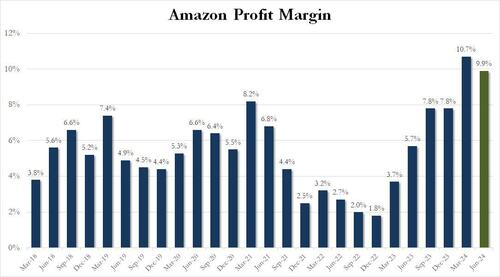

- Operating margin 9.9% vs. 5.7% y/y, beating estimate 9.13%

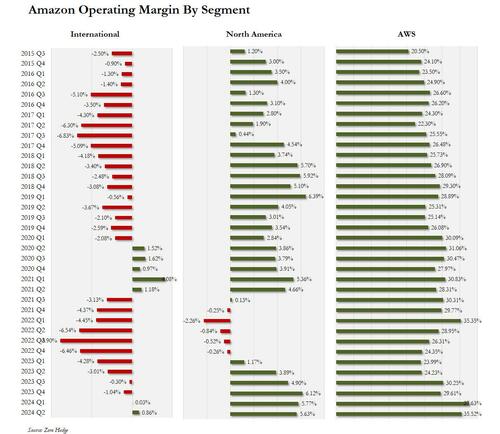

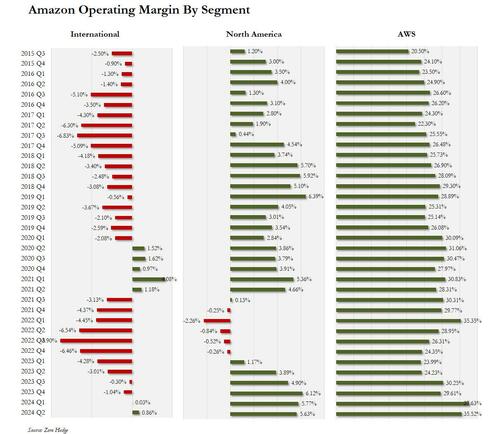

- North America operating margin +5.6% vs. +3.9% y/y, missing estimate +5.78%

- International operating margin 0.9% vs. -3% y/y, beating estimate 0.31%

As for expenses, these were slightly above estimates suggesting the company can use some more cost optimizations:

- Fulfillment expense $23.57 billion, +11% y/y, higher than estimates of $22.96 billion

- Seller unit mix 61% vs. 60% y/y, in line with estimate 60.7%

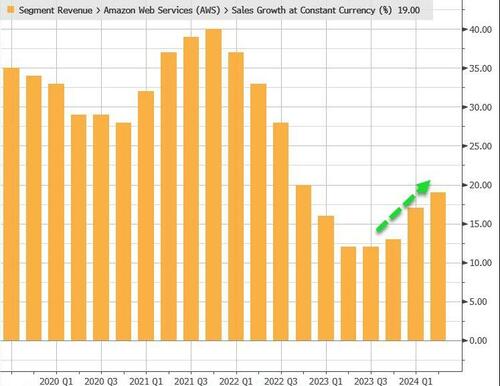

Of the above, the most notable highlight - as per our preview - was AWS which not only grew revenue by a whopping 19% (ex. FX) and 18% including FX, both of which handily beat the buyside estimates of 18%, and were the strongest growth in a a year.

Meanwhile AWS Q2 operating income of $9.34BN on revenue of $26.281BN, meant that margin modestly dropped to 35.52%, a decline which the market may frown upon.

The consolidated operating margin, while not quite as high as last quarter's record 10.7%, was still impressive at 9.9%, and the second highest in AMZN history.

A detailed breakdown of margins shows a slight deterioration sequentially in Sales and AWS, but improvement YoY.

Looking ahead, the company's guidance which was soft on the top line but disappointed on earnings:

- Revenues expected to be between $154.0 billion and $158.5 billion, or grow between 8% and 11% YoY, with the midline of 154.25 billion below the consensus estimate of $158.43 billion.

- Operating income is expected to be between $11.5 billion and $15.0 billion, compared with $11.2 billion in third quarter 2023, and also below the consensus estimate of $15.66

If accurate, that would mean Q3 revenue will grow at the slowest pace sine Dec 2022.

So turning the abovementioned bogeys, this is how AMZN did:

- Q2 Total Sales: $147.89 billion below the whisper range of $149-150 bn,

- Q2 EBIT: $14.67BN, in line with the whisper of $14 bn+

- Q2 AWS Growth 19%, above the consensus estimate of 18%

- Q3 Total Sales: range midline of $156.25, below the high end of the Street at $158 bn

- Q3 EBIT: $15.0BN high end of range, below the whisper of $15 bn+

CEO Andy Jassy has been cutting costs in recent years as he refocused on profitability in Amazon’s central retail business, laying off thousands of people and touting a more efficient warehouse network. At the same time, he’s backed big investments in artificial intelligence services that Amazon expects to generate tens of billions in revenue in the coming years.

In response to the mixed results, which saw revenues mostly miss and guidance disappoint despite strong results from AWS, the stock dumped, and was last trading around $174, down about 4% on the day.

Heading into Amazon's Q1 earnings, we said earlier that the investment thesis will be driven by i) e-commerce share, margin expansion and the potential for AWS growth recovery through the year; ii) directional commentary around AWS growth/optimization; iii) signals of retail margin improvement as suggested by management commentary on “cost to serve”, iv) progress with fulfillment regionalization and broader cost containment efforts, v) directional commentary on fiscal year capex for ecommerce (up with business) and ongoing AWS investments, vI) commentary on adoption of Prime Video with ads and ad industry broadly, and last but not least, 6) positioning around GenAI investments. We also noted that the key bogeys for this extremely popular - among hedge funds - position were the following:

- Q2 Total Sales: $149-150 bn

- Q2 EBIT: $14 bn+

- Q2 AWS Growth: 18%

- Q3 Total Sales: guide high end of the Street at $158 bn

- Q3 EBIT: $15 bn+ (freight rate dynamic)

So with that in mind here is what Amazon - whose stock is sliding after hours - reported moments ago:

- EPS $1.26 vs. 98c q/q, beating estimate $1.04

- Net sales $147.98 billion, +10% y/y, but missing estimates of $148.78 billion

- Online stores net sales $55.39 billion, +4.6% y/y, missing estimate $55.55 billion

- Physical Stores net sales $5.21 billion, +3.6% y/y, missing estimate $5.26 billion

- Third-Party Seller Services net sales $36.20 billion, +12% y/y, missing estimate $36.65 billion

- North America net sales $90.03 billion, +9.1% y/y, beating estimate $89.98 billion

- International net sales $31.66 billion, +6.6% y/y, beating estimate $32.87 billion

- Third-party seller services net sales excluding F/X +13% vs. +18% y/y, missing estimate +13.4%

- Amazon Web Services net sales $26.28 billion, +19% y/y, beating estimate $25.98 billion

- Amazon Web Services net sales excluding F/X +19% vs. +12% y/y, beating estimate +17.2%

Turning to operating results we find the following:

- Operating income $14.67 billion, +91% y/y, beating estimate $13.59 billion

- Operating margin 9.9% vs. 5.7% y/y, beating estimate 9.13%

- North America operating margin +5.6% vs. +3.9% y/y, missing estimate +5.78%

- International operating margin 0.9% vs. -3% y/y, beating estimate 0.31%

As for expenses, these were slightly above estimates suggesting the company can use some more cost optimizations:

- Fulfillment expense $23.57 billion, +11% y/y, higher than estimates of $22.96 billion

- Seller unit mix 61% vs. 60% y/y, in line with estimate 60.7%

Of the above, the most notable highlight - as per our preview - was AWS which not only grew revenue by a whopping 19% (ex. FX) and 18% including FX, both of which handily beat the buyside estimates of 18%, and were the strongest growth in a a year.

Meanwhile AWS Q2 operating income of $9.34BN on revenue of $26.281BN, meant that margin modestly dropped to 35.52%, a decline which the market may frown upon.

The consolidated operating margin, while not quite as high as last quarter's record 10.7%, was still impressive at 9.9%, and the second highest in AMZN history.

A detailed breakdown of margins shows a slight deterioration sequentially in Sales and AWS, but improvement YoY.

Looking ahead, the company's guidance which was soft on the top line but disappointed on earnings:

- Revenues expected to be between $154.0 billion and $158.5 billion, or grow between 8% and 11% YoY, with the midline of 154.25 billion below the consensus estimate of $158.43 billion.

- Operating income is expected to be between $11.5 billion and $15.0 billion, compared with $11.2 billion in third quarter 2023, and also below the consensus estimate of $15.66

If accurate, that would mean Q3 revenue will grow at the slowest pace sine Dec 2022.

So turning the abovementioned bogeys, this is how AMZN did:

- Q2 Total Sales: $147.89 billion below the whisper range of $149-150 bn,

- Q2 EBIT: $14.67BN, in line with the whisper of $14 bn+

- Q2 AWS Growth 19%, above the consensus estimate of 18%

- Q3 Total Sales: range midline of $156.25, below the high end of the Street at $158 bn

- Q3 EBIT: $15.0BN high end of range, below the whisper of $15 bn+

CEO Andy Jassy has been cutting costs in recent years as he refocused on profitability in Amazon’s central retail business, laying off thousands of people and touting a more efficient warehouse network. At the same time, he’s backed big investments in artificial intelligence services that Amazon expects to generate tens of billions in revenue in the coming years.

In response to the mixed results, which saw revenues mostly miss and guidance disappoint despite strong results from AWS, the stock dumped, and was last trading around $174, down about 4% on the day.