By William Suberg of CoinTelegraph

Nearly half the available Bitcoin supply has not moved in the past six months, onchain data confirms. In the latest edition of its weekly newsletter, “The Week Onchain,” analytics firm Glassnode shows investors did not “sell the top” on BTC.

Bitcoin hodlers double down on reaccumulation

Bitcoin may have put in a new all-time high some five months ago, but a large section of the BTC investor base continues to double down on its holdings.

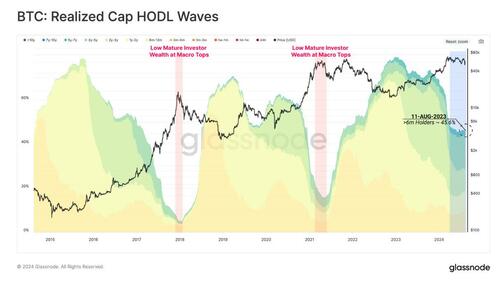

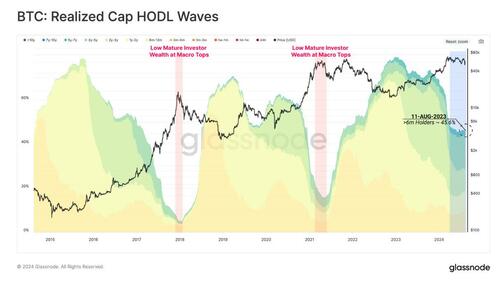

Analyzing the realized cap HODL waves indicator, Glassnode reveals that just over 45% of all bitcoins have remained dormant in their wallets for at least the past half a year.

Despite the record highs and subsequent volatility, a considerable swath of market participants prefer to do nothing.

Long-term holders (LTHs) — entities hodling coins for at least 155 days — distributed to the market both leading up to the all-time high and later on.

“We can also assess the 7-day change in LTH supply as a tool to assess rates of change in their aggregate balance. We can see substantial LTH distribution, typical of macro topping formations, into the March ATH,” Glassnode explains.

“Fewer than 1.7% of trading days have ever recording a larger distribution pressure. More recently, this metric has returned to positive territory, indicating that the LTH cohort are expressing a preference for holding onto their coins.”

That theme speaks to what “The Week Onchain” describes as “a notable slow-down in the distribution pressure by LTHs.”

“This has led to the percentage of network wealth held by this cohort to firstly stabilize, and then recommence growing,” it continues.

“Despite the substantial sell-side pressure by LTHs into the market ATH, wealth held by longer-term investors remains historically elevated when compared to previous all time high breakouts.”

BTC sell-off angst pervades market mood

As Cointelegraph continues to report, sell-side pressure is never far from traders’ minds this month.

After the mass sell-off at the start of August, concerns of a retest of six-month lows have combined with analysis showing “older” coins moving onchain.

Recent fluctuations in the Crypto Fear & Greed Index underscore the uncertainty currently running through crypto as a whole.

Countering this is optimism over global liquidity, with some perspectives seeing crypto benefiting from a move toward financial policy easing.

“Global money supply is exploding up. Plus we just broke out of a massive 4 year consolidation,” Charles Charles Edwards, the founder of quantitative Bitcoin and digital asset fund Capriole Investments, wrote on X this week.

By William Suberg of CoinTelegraph

Nearly half the available Bitcoin supply has not moved in the past six months, onchain data confirms. In the latest edition of its weekly newsletter, “The Week Onchain,” analytics firm Glassnode shows investors did not “sell the top” on BTC.

Bitcoin hodlers double down on reaccumulation

Bitcoin may have put in a new all-time high some five months ago, but a large section of the BTC investor base continues to double down on its holdings.

Analyzing the realized cap HODL waves indicator, Glassnode reveals that just over 45% of all bitcoins have remained dormant in their wallets for at least the past half a year.

Despite the record highs and subsequent volatility, a considerable swath of market participants prefer to do nothing.

Long-term holders (LTHs) — entities hodling coins for at least 155 days — distributed to the market both leading up to the all-time high and later on.

“We can also assess the 7-day change in LTH supply as a tool to assess rates of change in their aggregate balance. We can see substantial LTH distribution, typical of macro topping formations, into the March ATH,” Glassnode explains.

“Fewer than 1.7% of trading days have ever recording a larger distribution pressure. More recently, this metric has returned to positive territory, indicating that the LTH cohort are expressing a preference for holding onto their coins.”

That theme speaks to what “The Week Onchain” describes as “a notable slow-down in the distribution pressure by LTHs.”

“This has led to the percentage of network wealth held by this cohort to firstly stabilize, and then recommence growing,” it continues.

“Despite the substantial sell-side pressure by LTHs into the market ATH, wealth held by longer-term investors remains historically elevated when compared to previous all time high breakouts.”

BTC sell-off angst pervades market mood

As Cointelegraph continues to report, sell-side pressure is never far from traders’ minds this month.

After the mass sell-off at the start of August, concerns of a retest of six-month lows have combined with analysis showing “older” coins moving onchain.

Recent fluctuations in the Crypto Fear & Greed Index underscore the uncertainty currently running through crypto as a whole.

Countering this is optimism over global liquidity, with some perspectives seeing crypto benefiting from a move toward financial policy easing.

“Global money supply is exploding up. Plus we just broke out of a massive 4 year consolidation,” Charles Charles Edwards, the founder of quantitative Bitcoin and digital asset fund Capriole Investments, wrote on X this week.