Combined with stubbornly-high house prices, higher mortgage interest rates are putting homebuyers behind the 8-ball. Many resourceful house-hunters are doing an end-run around that doubly-daunting dynamic -- by seeking out sellers who have assumable, low-rate mortgages.

As the name implies, an assumable mortgage is one that allows a buyer to essentially step into the shoes of the seller, taking over the loan as it is -- with the same interest rate, payment and schedule. Generally speaking, the only assumable loans are those backed by a federal agency such as the Veterans Affairs Department (VA) or the Federal Housing Administration (FHA). By "backed by," we mean loans where the government -- acting well beyond the bounds of the Constitution -- guarantees lenders they'll be made whole if the borrower defaults.

Roughly 80% of outstanding VA mortgages have a sub-5% rate. Plenty are sub-3%. Together, VA and FHA mortgages account for about 25% of the entire mortgage universe. Of course, only a small fraction of VA- or FHA-backed homes are on the market at any point in time. Nonetheless, the number of assumptions is growing by leaps and bounds. Among FHA mortgages, the number of assumptions rose from 3,825 in all of 2023 to 3,477 in just the first five months of this year.

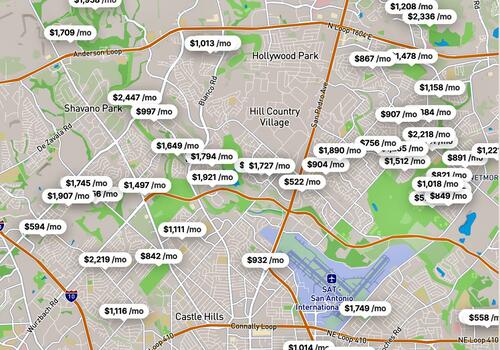

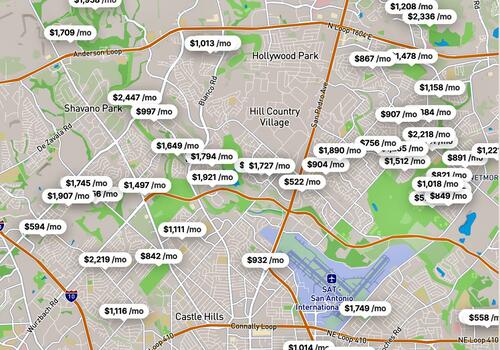

Some firms have emerged to help buyers ferret out assumable loan opportunities. Launched in September, Roam has an online search feature, and offers fee-based services to help buyers navigate the process of assuming a mortgage. Sellers can also use it to capitalize on the extra value-proposition their assumable mortgage presents, by putting themselves on Roam's radar.

Just because a mortgage is assumable doesn't mean anybody can take it over. For example, while you don't have to be a veteran to assume a VA loan, you will have to meet certain credit requirements and come in within a specified debt-to-income ratio. The FHA has similar requirements.

Buyers have to come up with their own money to cover the difference between the purchase price and the amount left on the mortgage. Depending on how long the mortgage has been going -- and the price shift over that time -- buyers might need significant funds to fill the gap. Lenders facilitating the assumption may come through with a second loan -- but at current-market rates.

If you're a veteran, you may have a competitive advantage when bidding on a home with a VA assumption opportunity. If the seller transfers their mortgage to a non-veteran, the seller's VA loan privilege for future purchases could be diminished or suspended altogether until the assuming party pays the mortgage down. On the other hand, a VA-qualified assumer brings their own eligibility to the deal, which means the seller can move on with their VA benefit fully restored.

That said, any assumption -- VA or FHA -- generally means more work and a slower close for the seller, particularly compared to a cash bid. Loan servicers aren't crazy about them. “Servicers have been very reluctant to do them,” Ted Tozer of the Urban Institute’s Housing Finance Policy Center told the New York Times in May. “They are actually losing money on each one that they do because they have substantial costs that are not covered by the fee they can charge.”

Combined with stubbornly-high house prices, higher mortgage interest rates are putting homebuyers behind the 8-ball. Many resourceful house-hunters are doing an end-run around that doubly-daunting dynamic -- by seeking out sellers who have assumable, low-rate mortgages.

As the name implies, an assumable mortgage is one that allows a buyer to essentially step into the shoes of the seller, taking over the loan as it is -- with the same interest rate, payment and schedule. Generally speaking, the only assumable loans are those backed by a federal agency such as the Veterans Affairs Department (VA) or the Federal Housing Administration (FHA). By "backed by," we mean loans where the government -- acting well beyond the bounds of the Constitution -- guarantees lenders they'll be made whole if the borrower defaults.

Roughly 80% of outstanding VA mortgages have a sub-5% rate. Plenty are sub-3%. Together, VA and FHA mortgages account for about 25% of the entire mortgage universe. Of course, only a small fraction of VA- or FHA-backed homes are on the market at any point in time. Nonetheless, the number of assumptions is growing by leaps and bounds. Among FHA mortgages, the number of assumptions rose from 3,825 in all of 2023 to 3,477 in just the first five months of this year.

Some firms have emerged to help buyers ferret out assumable loan opportunities. Launched in September, Roam has an online search feature, and offers fee-based services to help buyers navigate the process of assuming a mortgage. Sellers can also use it to capitalize on the extra value-proposition their assumable mortgage presents, by putting themselves on Roam's radar.

Just because a mortgage is assumable doesn't mean anybody can take it over. For example, while you don't have to be a veteran to assume a VA loan, you will have to meet certain credit requirements and come in within a specified debt-to-income ratio. The FHA has similar requirements.

Buyers have to come up with their own money to cover the difference between the purchase price and the amount left on the mortgage. Depending on how long the mortgage has been going -- and the price shift over that time -- buyers might need significant funds to fill the gap. Lenders facilitating the assumption may come through with a second loan -- but at current-market rates.

If you're a veteran, you may have a competitive advantage when bidding on a home with a VA assumption opportunity. If the seller transfers their mortgage to a non-veteran, the seller's VA loan privilege for future purchases could be diminished or suspended altogether until the assuming party pays the mortgage down. On the other hand, a VA-qualified assumer brings their own eligibility to the deal, which means the seller can move on with their VA benefit fully restored.

That said, any assumption -- VA or FHA -- generally means more work and a slower close for the seller, particularly compared to a cash bid. Loan servicers aren't crazy about them. “Servicers have been very reluctant to do them,” Ted Tozer of the Urban Institute’s Housing Finance Policy Center told the New York Times in May. “They are actually losing money on each one that they do because they have substantial costs that are not covered by the fee they can charge.”