By Sagarika Jaisinghani, Bloomberg Markets Live reporter and analyst

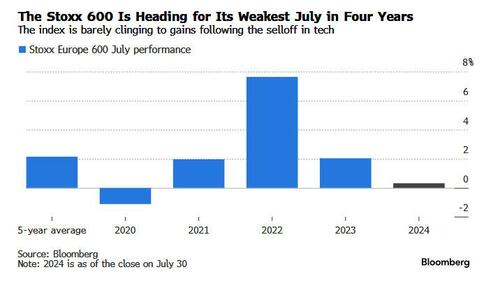

With European equities wrapping up their weakest July performance since 2020, sentiment is fragile just as a big risk event takes the spotlight: the Federal Reserve’s policy meeting.

As the benchmark Stoxx Europe 600 Index clings to gains of about 0.5% this month, investors are keen to hear whether Fed officials are likely to start easing policy shortly. While the central bank isn’t expected to announce a rate cut Wednesday, the market has fully priced in a reduction at September’s meeting.

Any hawkish signals from the Fed could upend the outlook for equities. Positioning in European futures is already bearish following the selloff since mid-July, according to data from Citigroup. Investors have also de-risked more broadly and overall exposure is now less extended in most markets, the figures showed.

As the long positions face losses instead of profits, that “creates short-term pressure ahead of central bank meetings” and other indicators, including the key US jobs report due Friday and big tech earnings, Citi strategist Chris Montagu says.

A major clue for investors will be the Fed’s reading of latest macro indicators. While recent figures showed inflation is indeed cooling, other data suggest some parts of the US economy are cracking — creating pressure on the central bank to act sooner rather than later.

“The very minimal amount of successful soft landings following a Fed hiking cycle demonstrates the dangers of waiting too long before cutting rates,” says Seema Shah, chief global strategist at Principal Asset Management. “There are already signs that consumers are starting to show fatigue and that companies are considering labor costs.”

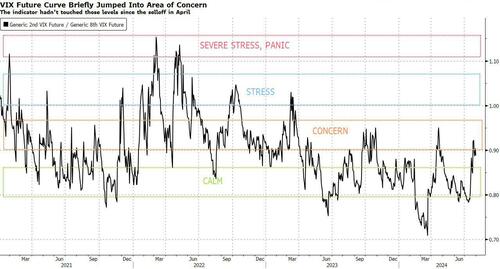

In financial markets, equities have been jolted out of the relative calm that has characterized trading this year. The volatility curve, as measured by the VIX 2-8 spread indicator, briefly surged into an area of concern for the first time since April, when geopolitical and policy uncertainty had sparked a selloff.

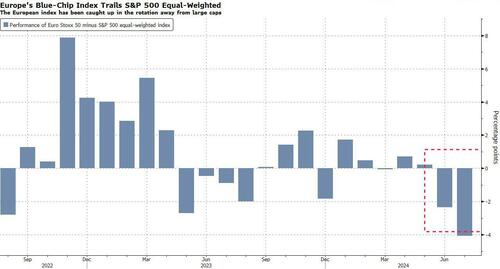

Derivatives strategists at Bank of America say the risk of a further rotation away from big tech and into small caps is elevated ahead of the Fed’s meeting. They recommend funding puts on the blue-chip Euro Stoxx 50 — which is more sensitive to the way US large caps perform — by selling puts on the equal-weighted S&P 500.

“Indeed, if the rotation turns ugly and affects broader US stocks, we do not anticipate the Euro Stoxx 50 to do well in this environment,” BofA strategists led by Benjamin Bowler wrote in a note.

Not everyone agrees that the Fed’s meeting presents a major risk to stocks’ long-term outlook. BlackRock strategists Jean Boivin and Wei Li say the recent pullback had more to do with the fact that momentum trades had run too far, rather than due to weaker signals from corporate earnings or economic growth.

“We see central bank policy expectations, equity factor rotations and currency moves driving the recent market volatility,” they say. “We caution against extrapolating from these moves.”

By Sagarika Jaisinghani, Bloomberg Markets Live reporter and analyst

With European equities wrapping up their weakest July performance since 2020, sentiment is fragile just as a big risk event takes the spotlight: the Federal Reserve’s policy meeting.

As the benchmark Stoxx Europe 600 Index clings to gains of about 0.5% this month, investors are keen to hear whether Fed officials are likely to start easing policy shortly. While the central bank isn’t expected to announce a rate cut Wednesday, the market has fully priced in a reduction at September’s meeting.

Any hawkish signals from the Fed could upend the outlook for equities. Positioning in European futures is already bearish following the selloff since mid-July, according to data from Citigroup. Investors have also de-risked more broadly and overall exposure is now less extended in most markets, the figures showed.

As the long positions face losses instead of profits, that “creates short-term pressure ahead of central bank meetings” and other indicators, including the key US jobs report due Friday and big tech earnings, Citi strategist Chris Montagu says.

A major clue for investors will be the Fed’s reading of latest macro indicators. While recent figures showed inflation is indeed cooling, other data suggest some parts of the US economy are cracking — creating pressure on the central bank to act sooner rather than later.

“The very minimal amount of successful soft landings following a Fed hiking cycle demonstrates the dangers of waiting too long before cutting rates,” says Seema Shah, chief global strategist at Principal Asset Management. “There are already signs that consumers are starting to show fatigue and that companies are considering labor costs.”

In financial markets, equities have been jolted out of the relative calm that has characterized trading this year. The volatility curve, as measured by the VIX 2-8 spread indicator, briefly surged into an area of concern for the first time since April, when geopolitical and policy uncertainty had sparked a selloff.

Derivatives strategists at Bank of America say the risk of a further rotation away from big tech and into small caps is elevated ahead of the Fed’s meeting. They recommend funding puts on the blue-chip Euro Stoxx 50 — which is more sensitive to the way US large caps perform — by selling puts on the equal-weighted S&P 500.

“Indeed, if the rotation turns ugly and affects broader US stocks, we do not anticipate the Euro Stoxx 50 to do well in this environment,” BofA strategists led by Benjamin Bowler wrote in a note.

Not everyone agrees that the Fed’s meeting presents a major risk to stocks’ long-term outlook. BlackRock strategists Jean Boivin and Wei Li say the recent pullback had more to do with the fact that momentum trades had run too far, rather than due to weaker signals from corporate earnings or economic growth.

“We see central bank policy expectations, equity factor rotations and currency moves driving the recent market volatility,” they say. “We caution against extrapolating from these moves.”