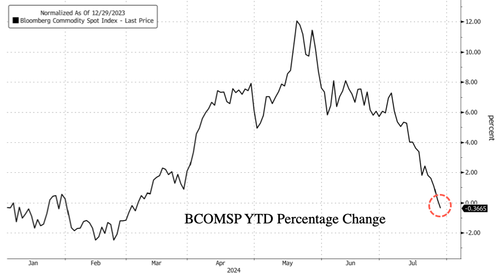

The Bloomberg Commodity Spot Index (BCOMSP) has wiped out all gains so far this year. After peaking in late May (+12%), the index quickly slipped into negative territory by late July. This downward pressure on BCOMSP stems from faltering economic growth in China, which has sparked concerns about falling demand for agricultural goods, crude oil, crude products, copper, iron ore, and other essential commodities. Some traders are on high alert, fearing a potential repeat of a 2015 China slowdown.

"The 'domestic consumption' engine of the Chinese economy seems to be faltering," said Sandeep Rao, senior researcher at exchange-traded product provider Leverage Shares, who MarketWatch quoted.

Rao said, "Real estate interest has been plummeting, and online sales continue needing discounting strategies to prop up values."

Recall that Apple has been discounting its iPhones in the world's largest smartphone market. Yet new data shows that this strategy by Apple has miserably failed.

The People's Bank of China recently surprised the market with interest-rate cuts, a move to prop up faltering growth after the Communist Party's stimulus failed to result in any robust economic recovery.

China's downturn in manufacturing and productivity "does find parallels in the leadup" 2015-16 turmoil, said Rao, adding that the "Chinese economy's vulnerability is simultaneously local, global and strategic."

He pointed out that the US and European economies have been "paring down consumption volumes and the Chinese economy's 'export' engine [faces] competition in the long run from the likes of India and Vietnam."

Interestingly, Rao said the CCP "does not have the incentive to stimulate the economy" until after the US presidential elections in November, when a clear winner is chosen.

According to Bloomberg, "China has been stuck in the longest streak of deflation since 1999, with economy-wide prices dropping for five straight quarters."

The impact of China's downturn has obviously trickled down into commodities. However, there's good news for at least the metals market, as Goldamn's Gabe Tkach noted Tuesday:

Liquidation was the core theme in metals over the past week as we saw weak Western hands enter and exit the Gold market in July and a continued reduction in positioning in copper. We estimate that 60% of the length in copper has been unwound but Gold was positioned lighter as China has been the marginal buyer this year. The focus on this meeting will be on the implicit confirmation of the path forward that Powell could offer given the recent sharp moves in front-end rates. We still think that the beginning of the upcoming cutting cycle will be positive for metals but a fair amount of length has already been deployed this year. (Thank You Ben Binet-Laisne – Metals Trading)

And there are broadening war risks with IDF Forces hitting targets in Beirut. A risk positive for Brent crude prices.

All eyes will be on US monetary policy in September and China's economy after the election for stimulus. These two factors will influence BCOMSP price action.

The Bloomberg Commodity Spot Index (BCOMSP) has wiped out all gains so far this year. After peaking in late May (+12%), the index quickly slipped into negative territory by late July. This downward pressure on BCOMSP stems from faltering economic growth in China, which has sparked concerns about falling demand for agricultural goods, crude oil, crude products, copper, iron ore, and other essential commodities. Some traders are on high alert, fearing a potential repeat of a 2015 China slowdown.

"The 'domestic consumption' engine of the Chinese economy seems to be faltering," said Sandeep Rao, senior researcher at exchange-traded product provider Leverage Shares, who MarketWatch quoted.

Rao said, "Real estate interest has been plummeting, and online sales continue needing discounting strategies to prop up values."

Recall that Apple has been discounting its iPhones in the world's largest smartphone market. Yet new data shows that this strategy by Apple has miserably failed.

The People's Bank of China recently surprised the market with interest-rate cuts, a move to prop up faltering growth after the Communist Party's stimulus failed to result in any robust economic recovery.

China's downturn in manufacturing and productivity "does find parallels in the leadup" 2015-16 turmoil, said Rao, adding that the "Chinese economy's vulnerability is simultaneously local, global and strategic."

He pointed out that the US and European economies have been "paring down consumption volumes and the Chinese economy's 'export' engine [faces] competition in the long run from the likes of India and Vietnam."

Interestingly, Rao said the CCP "does not have the incentive to stimulate the economy" until after the US presidential elections in November, when a clear winner is chosen.

According to Bloomberg, "China has been stuck in the longest streak of deflation since 1999, with economy-wide prices dropping for five straight quarters."

The impact of China's downturn has obviously trickled down into commodities. However, there's good news for at least the metals market, as Goldamn's Gabe Tkach noted Tuesday:

Liquidation was the core theme in metals over the past week as we saw weak Western hands enter and exit the Gold market in July and a continued reduction in positioning in copper. We estimate that 60% of the length in copper has been unwound but Gold was positioned lighter as China has been the marginal buyer this year. The focus on this meeting will be on the implicit confirmation of the path forward that Powell could offer given the recent sharp moves in front-end rates. We still think that the beginning of the upcoming cutting cycle will be positive for metals but a fair amount of length has already been deployed this year. (Thank You Ben Binet-Laisne – Metals Trading)

And there are broadening war risks with IDF Forces hitting targets in Beirut. A risk positive for Brent crude prices.

All eyes will be on US monetary policy in September and China's economy after the election for stimulus. These two factors will influence BCOMSP price action.