Authored by Mike Shedlock via MishTalk.com,

Listen to this silliness from Alan Blinder, Princeton Economics professor and vice chairman of the Federal Reserve, 1994-96.

In Praise of the Great Society

Blinder wants to raise the minimum wage, encourage unions and fight monopsony by handing out a “predistribution” of free money and by making the government the buyer of last resort.

Please consider Alan Blinder’s WSJ op-ed, Shore Up the Social Safety Net With ‘Predistribution’

For nearly a century, we have relied on a suite of programs known as the social safety net. The idea is straightforward: Let the market determine the rewards to capital and labor, and to high- and low-wage earners, but then allow the government to redistribute money through progressive taxation, Social Security, unemployment benefits, and other transfer payments to the needy.

If pursued vigorously, such programs could achieve what Franklin D. Roosevelt called a New Deal and Lyndon B. Johnson called a Great Society. America, however, doesn’t pursue these policies vigorously enough.

Amazingly, Blinder moans …

The Organization for Economic Cooperation and Development tracks member countries’ comparative “social spending”—defined as cash benefits, direct in-kind provision of goods and services, and tax breaks with social purposes—as a percentage of gross domestic product. Benefits may target “low-income households, the elderly, disabled, sick, unemployed or young persons.” By this measure, 22.7% of U.S gross domestic product is social spending, compared with 31.6% in France and 26.7% in Germany.

… Which explains why the EU is the beacon of global leadership, technology, jobs production, and innovation. /not

The Need for Predistribution

“Interest among economists appears to be growing in what Yale professor Jacob Hacker dubs “predistribution” policies: those that reduce inequalities in how markets dish out rewards rather than redistribute income after the fact.

Absolutely! And we even did a comprehensive test proving how well the idea works. When we paid people not to work in the Covid pandemic. They didn’t. Prices soared and companies had a miserable time finding workers.

I see the problem here. Do you? As Blinder suggests, we did not “pursue these policies vigorously enough.” /not

Predistribution How?

The most obvious predistribution policy is the federal minimum wage, which has been stuck at a paltry $7.25 an hour since 2009. It’s time Washington changed that. Polling has long shown that raising the minimum wage commands broad support.

Of course. Polling also suggests people want a chicken in every pot and a free EV to drive. But is there a test of this idea?

Yes!

Please note the Cost of Running a McDonalds Jumps $250,000 in CA Due to Minimum Wage Hikes

Tut! Tut! you might say, and those are indeed harsh words. I sympathize. California must be booming after pursuing policies like those for decades, leading the nation in employment.

Hmm. That might look damning, but I am quite sure you are with me right now.

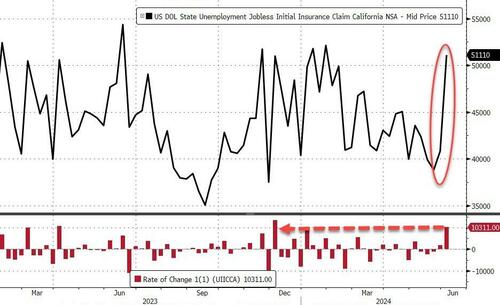

[ZH: this morning's jobless claims data showed a massive surge in California]

The problem is obvious. California is just not doing enough! /not

The Need for Antimonopsony Policies

Many economists have also come to realize that monopsony—a market condition in which there’s only one buyer—is more common in labor markets than originally thought. In a monopsony, employers have more power to set compensation rates, leading to reduced wages. Just as we have antimonopoly policies, we should put in place antimonopsony policies.

The Biden administration has promulgated some good predistributive policies. It has reversed the Trump administration’s approach to unions, choosing to strengthen, not undermine, them. The Federal Trade Commission’s new limits on noncompete agreements, which impair workers’ ability to move to better-paying jobs, will likely boost wages.

This is another promising idea, fully tested in Chicago.

Please note Chicago Teachers’ Union Seeks $50 Billion Despite $700 Million City Deficit

Wait a second. Did Blinder forget to address the public union monopsony where corrupt politicians get in bed with corrupt union leaders, holding the taxpayers hostage?

Well. Tut Tut again. I am sure this is unique to Chicago. /not

Do It Voluntarily (Or Else?)

And here’s an out-of-the-box idea: Perhaps top executives could narrow the gap between their compensation and that of ordinary employees—not because the government mandates it but voluntarily, because doing so would make America better. Wishful thinking, you say, and you’re probably right. But a few CEOs have done so. Some nations manage fine with smaller wage gaps—without destroying capitalism. Maybe America could, too.

In his last op-ed paragraph, Blinder finally gets to the key point. I am sure everyone who is still following along agrees.

We need to voluntarily destroy capitalism to save it. The unfortunate corollary is … otherwise, governments will have to destroy capitalism to save it.

We fully tested this idea in the Vietnam War decades ago with the philosophy “We have to destroy the town to save it.”

Somehow, the idea never quite caught on. The reason is clear. We did not pursue the policy vigorously enough! If only we did, we could be better than the EU and more like Venezuela.

Who wouldn’t want that?

Authored by Mike Shedlock via MishTalk.com,

Listen to this silliness from Alan Blinder, Princeton Economics professor and vice chairman of the Federal Reserve, 1994-96.

In Praise of the Great Society

Blinder wants to raise the minimum wage, encourage unions and fight monopsony by handing out a “predistribution” of free money and by making the government the buyer of last resort.

Please consider Alan Blinder’s WSJ op-ed, Shore Up the Social Safety Net With ‘Predistribution’

For nearly a century, we have relied on a suite of programs known as the social safety net. The idea is straightforward: Let the market determine the rewards to capital and labor, and to high- and low-wage earners, but then allow the government to redistribute money through progressive taxation, Social Security, unemployment benefits, and other transfer payments to the needy.

If pursued vigorously, such programs could achieve what Franklin D. Roosevelt called a New Deal and Lyndon B. Johnson called a Great Society. America, however, doesn’t pursue these policies vigorously enough.

Amazingly, Blinder moans …

The Organization for Economic Cooperation and Development tracks member countries’ comparative “social spending”—defined as cash benefits, direct in-kind provision of goods and services, and tax breaks with social purposes—as a percentage of gross domestic product. Benefits may target “low-income households, the elderly, disabled, sick, unemployed or young persons.” By this measure, 22.7% of U.S gross domestic product is social spending, compared with 31.6% in France and 26.7% in Germany.

… Which explains why the EU is the beacon of global leadership, technology, jobs production, and innovation. /not

The Need for Predistribution

“Interest among economists appears to be growing in what Yale professor Jacob Hacker dubs “predistribution” policies: those that reduce inequalities in how markets dish out rewards rather than redistribute income after the fact.

Absolutely! And we even did a comprehensive test proving how well the idea works. When we paid people not to work in the Covid pandemic. They didn’t. Prices soared and companies had a miserable time finding workers.

I see the problem here. Do you? As Blinder suggests, we did not “pursue these policies vigorously enough.” /not

Predistribution How?

The most obvious predistribution policy is the federal minimum wage, which has been stuck at a paltry $7.25 an hour since 2009. It’s time Washington changed that. Polling has long shown that raising the minimum wage commands broad support.

Of course. Polling also suggests people want a chicken in every pot and a free EV to drive. But is there a test of this idea?

Yes!

Please note the Cost of Running a McDonalds Jumps $250,000 in CA Due to Minimum Wage Hikes

Tut! Tut! you might say, and those are indeed harsh words. I sympathize. California must be booming after pursuing policies like those for decades, leading the nation in employment.

Hmm. That might look damning, but I am quite sure you are with me right now.

[ZH: this morning's jobless claims data showed a massive surge in California]

The problem is obvious. California is just not doing enough! /not

The Need for Antimonopsony Policies

Many economists have also come to realize that monopsony—a market condition in which there’s only one buyer—is more common in labor markets than originally thought. In a monopsony, employers have more power to set compensation rates, leading to reduced wages. Just as we have antimonopoly policies, we should put in place antimonopsony policies.

The Biden administration has promulgated some good predistributive policies. It has reversed the Trump administration’s approach to unions, choosing to strengthen, not undermine, them. The Federal Trade Commission’s new limits on noncompete agreements, which impair workers’ ability to move to better-paying jobs, will likely boost wages.

This is another promising idea, fully tested in Chicago.

Please note Chicago Teachers’ Union Seeks $50 Billion Despite $700 Million City Deficit

Wait a second. Did Blinder forget to address the public union monopsony where corrupt politicians get in bed with corrupt union leaders, holding the taxpayers hostage?

Well. Tut Tut again. I am sure this is unique to Chicago. /not

Do It Voluntarily (Or Else?)

And here’s an out-of-the-box idea: Perhaps top executives could narrow the gap between their compensation and that of ordinary employees—not because the government mandates it but voluntarily, because doing so would make America better. Wishful thinking, you say, and you’re probably right. But a few CEOs have done so. Some nations manage fine with smaller wage gaps—without destroying capitalism. Maybe America could, too.

In his last op-ed paragraph, Blinder finally gets to the key point. I am sure everyone who is still following along agrees.

We need to voluntarily destroy capitalism to save it. The unfortunate corollary is … otherwise, governments will have to destroy capitalism to save it.

We fully tested this idea in the Vietnam War decades ago with the philosophy “We have to destroy the town to save it.”

Somehow, the idea never quite caught on. The reason is clear. We did not pursue the policy vigorously enough! If only we did, we could be better than the EU and more like Venezuela.

Who wouldn’t want that?