By Sebastian Bea of Coinbase Asset Management

A pinch of paranoia is an essential ingredient in the risk management toolkit as markets hunt to humiliate hubris. Investors are tasked with monetizing megatrends. Macro risks are seen as a nuisance for growth-focused investment styles. But macro risks can and do derail poorly executed great ideas. So, recession odds should always be in the back of investors’ minds.

Our Macro Pulse is built to bark when the risks of recession rise. Currently, it shows a rare mix of a recessionary economy and overheated prices. Woof, woof. This isn’t driven by a single factor like crude oil as in the past. Demand is being rationed by persistent inflation. When real interest rates were low, the private sector could borrow to smooth higher prices. But with higher real rates now, demand is contracting and economic nowcasts are falling sharply. Recession risk is rising.

Crypto hasn’t lived through many cycles, so there’s no benchmark for how it will respond. There was the 2020 downturn and the near-miss recession after rapid rate hikes in 2022. The latter was far more damaging to crypto markets than the former. Why? Policy proactively eased to avoid a lasting downturn in 2020. When real rates were being reset higher, the flush of leverage led to a correlated decline in stocks, bonds, commodities, and crypto. Today is more like 2020 than 2022.

Excess leverage was the story in 2022, and it prevailed across assets. That’s what drove correlations—not structural factors. Now, rising real rates have curbed excessive risk-taking. Take crypto credit markets. Bitcoin mining saw a surge in rigs, a halving of rewards, and, since March, sideways prices. Miners are now in capitulation. It’s a rare event that signals that the market is resetting, a positive indicator for future bitcoin prices.

Last year’s hiccup in the banking sector leans more to the 2020 lessons. The March 2023 crisis was short-lived and, well, hardly a “crisis.” Crawl, walk, and (bank) run happened in a short few days. Crypto assets were the first responders, dropping by ~20% due to banking uncertainty yet fully recovering within two days. Disaster was averted with policy intervention, and investors flocked to assets like gold and bitcoin. This is the playbook today.

Policy rates have room to ease just by virtue of being higher than they have been for a long time. Don’t ask whether it is the right thing to do—investors don’t get paid to make that decision. Policy rarely seeks recession. Inflation has fallen sharply from its highs, and the risk of a downturn will raise confidence that pricing pressure will further ease. So recession risks may be rising, policy stands prepared to respond. The response is more relevant than the risk.

Bonds were the perfect antidote for rising macro risks in the past, when real rates were high and inflation was falling. Bond prices rose sharply in the recession and didn’t fall much in expansions, greatly improving portfolio characteristics. That’s not the case in an inflationary recession with rising geopolitical risks. World central banks are sending an important signal—not only buying gold at a record pace at the expense of bonds, but also reshoring gold to domestic vaults.

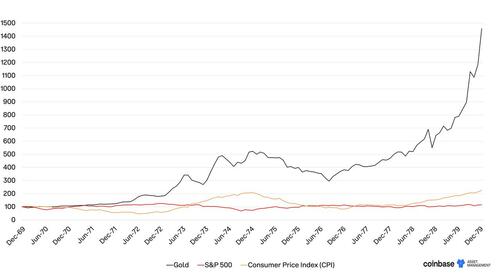

How does crypto perform in an inflationary recession? An all-weather asset akin to gold. In the 1970s, gold's value rose more than ten-fold. Despite painful recessions in the 1970s, where gold fell almost 50%, like in 1974, the asset provided protection that traditional ones couldn’t. The S&P 500 remained largely unchanged in the decade, but a massive real devaluation given the doubling in consumer prices. Gold enhanced buying power for the next cycle.

Figure 1: Lessons of the 1970s – Gold, Stocks and Prices

Investors are always seeking all-weather assets to protect against macro risks and let them survive growth risks germain to their portfolios. Bitcoin miners, option markets, dominance of large protocols, and the availability of leverage are all signaling a disciplined cycle, not a hype cycle. Real rates have room to decline as macro risks rise despite sticky inflation, echoing the 1970s. Commodities—including core crypto assets—are part of the all-weather wallet.

By Sebastian Bea of Coinbase Asset Management

A pinch of paranoia is an essential ingredient in the risk management toolkit as markets hunt to humiliate hubris. Investors are tasked with monetizing megatrends. Macro risks are seen as a nuisance for growth-focused investment styles. But macro risks can and do derail poorly executed great ideas. So, recession odds should always be in the back of investors’ minds.

Our Macro Pulse is built to bark when the risks of recession rise. Currently, it shows a rare mix of a recessionary economy and overheated prices. Woof, woof. This isn’t driven by a single factor like crude oil as in the past. Demand is being rationed by persistent inflation. When real interest rates were low, the private sector could borrow to smooth higher prices. But with higher real rates now, demand is contracting and economic nowcasts are falling sharply. Recession risk is rising.

Crypto hasn’t lived through many cycles, so there’s no benchmark for how it will respond. There was the 2020 downturn and the near-miss recession after rapid rate hikes in 2022. The latter was far more damaging to crypto markets than the former. Why? Policy proactively eased to avoid a lasting downturn in 2020. When real rates were being reset higher, the flush of leverage led to a correlated decline in stocks, bonds, commodities, and crypto. Today is more like 2020 than 2022.

Excess leverage was the story in 2022, and it prevailed across assets. That’s what drove correlations—not structural factors. Now, rising real rates have curbed excessive risk-taking. Take crypto credit markets. Bitcoin mining saw a surge in rigs, a halving of rewards, and, since March, sideways prices. Miners are now in capitulation. It’s a rare event that signals that the market is resetting, a positive indicator for future bitcoin prices.

Last year’s hiccup in the banking sector leans more to the 2020 lessons. The March 2023 crisis was short-lived and, well, hardly a “crisis.” Crawl, walk, and (bank) run happened in a short few days. Crypto assets were the first responders, dropping by ~20% due to banking uncertainty yet fully recovering within two days. Disaster was averted with policy intervention, and investors flocked to assets like gold and bitcoin. This is the playbook today.

Policy rates have room to ease just by virtue of being higher than they have been for a long time. Don’t ask whether it is the right thing to do—investors don’t get paid to make that decision. Policy rarely seeks recession. Inflation has fallen sharply from its highs, and the risk of a downturn will raise confidence that pricing pressure will further ease. So recession risks may be rising, policy stands prepared to respond. The response is more relevant than the risk.

Bonds were the perfect antidote for rising macro risks in the past, when real rates were high and inflation was falling. Bond prices rose sharply in the recession and didn’t fall much in expansions, greatly improving portfolio characteristics. That’s not the case in an inflationary recession with rising geopolitical risks. World central banks are sending an important signal—not only buying gold at a record pace at the expense of bonds, but also reshoring gold to domestic vaults.

How does crypto perform in an inflationary recession? An all-weather asset akin to gold. In the 1970s, gold's value rose more than ten-fold. Despite painful recessions in the 1970s, where gold fell almost 50%, like in 1974, the asset provided protection that traditional ones couldn’t. The S&P 500 remained largely unchanged in the decade, but a massive real devaluation given the doubling in consumer prices. Gold enhanced buying power for the next cycle.

Figure 1: Lessons of the 1970s – Gold, Stocks and Prices

Investors are always seeking all-weather assets to protect against macro risks and let them survive growth risks germain to their portfolios. Bitcoin miners, option markets, dominance of large protocols, and the availability of leverage are all signaling a disciplined cycle, not a hype cycle. Real rates have room to decline as macro risks rise despite sticky inflation, echoing the 1970s. Commodities—including core crypto assets—are part of the all-weather wallet.