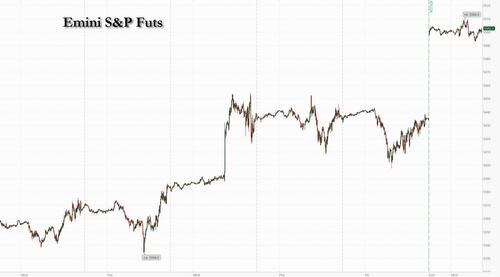

Futures are flat to start the holiday-shortened week (markets are closed Wednesday for Juneteenth). As of 8:00am, S&P futures are unchanged just above 5500, while Nasdaq futures rose 0.2%; France’s CAC 40 benchmark erased most of its opening 1% advance and global stocks ceded most of their early gains sparked by French far-right leader Marine le Pen’s pledge to respect political institutions if she wins the upcoming snap parliamentary election. Bond yields are slightly higher amid a bear steepening: JPM's rates strategist sees yields range-bound for the summer with the 10Y being fairly valued at current levels. Euro-area bond yields edged higher, with France’s yield premium over Germany staying near the widest in years. The Bloomberg Dollar Spot Index is up 0.1%, while the euro was modestly firmer against the dollar, after shedding almost 1% last week. Commodities are mixed with energy higher ex-natgas but Ags and metals are coming for sale; metals potentially dragged by weaker than expected data from China overnight. Today’s macro data focus is on Empire Manufacturing but tomorrow’s Retail Sales is the key release this week with additional focus on Friday’s Flash PMIs.

In premarket trading, semis are higher led by NVDA +0.7%, AVGO +2.8%, and MU +1.7%. AAPL is +0.7% with the balance of Mag7 more muted. Here are some other notable premarket movers:

- Aaron’s soars 31% after agreeing to be acquired by IQVentures for $10.10 per share in cash.

- AMC Networks slides 10% after the entertainment company said it intends to offer $125 million in convertible senior notes due 2029 in a private offering.

- Autodesk gains 4% after the Wall Street Journal reported that activist investor Starboard Value has taken a $500 million stake in the design-software maker.

- Ollie’s Bargain Outlet climbs 3.7% after JPMorgan upgraded the retailer to overweight, saying its fieldwork suggests second quarter-to-date comparable sales are trending above the company’s guidance.

- Zymeworks rises 8% after saying the FDA has cleared the investigational new drug application for ZW171.

Global markets are struggling to recover from a selloff sparked last week by Emmanuel Macron’s call for a snap election, that could result in gains for far-right groups, including Le Pen’s National Rally. European assets were lifted initially as Le Pen appeared to soothe investors with comments that she won’t try to push out Macron if she wins the election, but the gains fizzled quickly.

“It’s fair to say that foreign investors are nervous about the heightened political risk that the situation in France brings,” said Frédérique Carrier, head of investment strategy at RBC Wealth Management. “The market still has a lot of difficulty pricing in these sorts of events.”

Still, she noted populist politicians do have a history of moving closer to the center once they reach power and Le Pen’s comments had fueled hopes for that outcome in France. “It’s possible that these signs of them being a little bit less radical and wanting to play nice might encourage the market a little bit,” Carrier said. But with the first election round on June 30, investors are likely to stay wary of Europe. Citigroup analysts warned that a potential far-right majority in France is among the risk factors for European equities and said they favor the US market.

European stocks were in the green but well off session highs, while the CAC 40 erased most of its initial 1% gain as investors monitor signs of stabilization in French bonds. The Stoxx 600 advanced 0.6% after rising more than 1% earlier before erasing all gains and rebounding, with gains led by info tech and energy sector. OAT yields have steadied across the curve after Marine le Pen said over the weekend she won’t try to push out President Emmanuel Macron if she wins in an appeal to moderates.

Earlier in the session, Asian stocks fell, with Japanese equities the session’s biggest laggard, as concerns over France’s political crisis stoked anxiety in global markets. Trading was thin amid holidays in a number of countries. The MSCI Asia Pacific Index fell as much as 1%, on track for a third-straight daily loss, with Toyota, Samsung and Sony among the biggest drags Monday. Benchmarks also fell in South Korea, New Zealand and Thailand, while Chinese equities were mixed after a slew of disappointing economic data. Markets in Singapore, India, Indonesia, Malaysia and the Philippines were closed.

- Hang Seng and Shanghai Comp. were mixed as the Hang Seng attempts to buck the trend amid tech strength and with the mainland pressured after soft data releases from China including the miss on loans and financing data, while Industrial Production and Retail Sales were mixed and House Prices showed a further deterioration with the steepest M/M drop in nearly a decade.

- Nikkei 225 underperformed and dipped below 38,000 in the fallout of last week's BoJ meeting and press conference, while Machinery Orders for April were better than expected with surprise Y/Y growth of 0.7% (exp. -0.1%) and the M/M figure showed a narrower than feared decline at -2.9% (exp. -3.1%) although printed its first contraction in 3 months.

- ASX 200 was rangebound as weakness in tech and mining-related sectors offset the gains in defensives and financials, with trade contained ahead of tomorrow's RBA announcement and after Australia and China signed MOUs on the economy, trade and education.

The flight to haven assets came as France’s snap parliamentary election renewed investors’ focus on political volatility worldwide. Japanese stocks more than erased Friday’s gains in the immediate wake of the latest policy decision from the nation’s central bank. “The sentiment shifter is the political uncertainty in Europe,” said Kyle Rodda, a market analyst at Capital.com. “Couple that with no fresh news on the earnings front and a market that’s pricing in a higher chance of two Fed cuts this year.”

In FX, the Bloomberg Dollar Spot Index is up 0.1%. The euro tops G-10 FX, rising 0.1% against the greenback. The Norwegian krone and New Zealand dollar lag peers. Oil prices are steady, with WTI trading near $78.50 a barrel. Spot gold falls ~$11 to around $2,322/oz. Iron ore falls 2%.

In rates, treasury yields are higher led by the long-end amid similar bear-steepening in German bonds, while French bonds stabilize as investors weighed assurances from far-right leader Marine Le Pen that she’d work with President Emmanuel Macron. US long-end yields cheaper by nearly 3bp with 2s10s, 5s30s spreads steeper by ~2bp on the day; 10-year around 4.246% is about 3bps higher than Friday’s close with bunds underperforming by additional 2bp in the sector. Coupon issuance this week includes $13b 20-year bond reopening Tuesday and $21b 5-year TIPS reopening Thursday. US session includes three Fed speakers and June Empire manufacturing gauge.

In commodities, oil prices are steady, with WTI trading near $78.50 a barrel. Spot gold falls ~$11 to around $2,322/oz. Iron ore falls 2%.

Looking to today's calendar, US economic data slate includes June Empire manufacturing at 8:30am. Ahead this week are retail sales, industrial production and manufacturing and services PMIs. Fed officials scheduled to speak include Williams (12pm), Harker (1pm) and Cook (9pm). This week we get lots of central bank action, including decisions in the UK, Australia and Brazil, with investors looking for hints on when each will join the rate-cutting cycle.

Market Snapshot

- S&P 500 futures little changed at 5,436.00

- STOXX Europe 600 up 0.2% to 511.86

- MXAP down 0.8% to 178.17

- MXAPJ down 0.2% to 562.20

- Nikkei down 1.8% to 38,102.44

- Topix down 1.7% to 2,700.01

- Hang Seng Index little changed at 17,936.12

- Shanghai Composite down 0.6% to 3,015.89

- Sensex up 0.2% to 76,992.77

- Australia S&P/ASX 200 down 0.3% to 7,700.27

- Kospi down 0.5% to 2,744.10

- German 10Y yield little changed at 2.40%

- Euro little changed at $1.0712

- Brent Futures up 0.4% to $82.97/bbl

- Gold spot down 0.6% to $2,319.01

- US Dollar Index little changed at 105.53

Top Overnight News

- China’s President Xi Jinping told European Commission president Ursula von der Leyen that Washington was trying to goad Beijing into attacking Taiwan, according to people familiar with the matter. FT

- China’s industrial production for May falls short of expectations (+5.6% vs. the Street +6.2%) and property investment exhibits softness too while retail sales were a bright spot (+3.7% vs. the Street +3%). BBG

- China's new home prices fell at the fastest pace in more than 9-1/2 years in May, with the property sector struggling to find a bottom despite government efforts to rein in oversupply and support debt-laden developers. Prices were down 0.7% in May from the previous month, marking the 11th straight month-on-month decline and steepest drop since October 2014. RTRS

- BOJ to begin dialing back its pace of QE but will hold off on hiking rates until at least Sept according to a former board member. RTRS

- French political anxiety calms slightly as Le Pen said she would cooperate with Macron if her party wins the upcoming election. BBG

- Russia and Ukraine appear further from peace today than at any other time since the full-scale invasion commenced in Feb of 2022, with both sides making unrealistic demands as conditions for ending the war. NYT

- Apparel retailers are discovering that weight loss is their gain. While blockbuster drugs like Ozempic that lead to significant weight loss have dented demand for diet plans and caused food companies to prepare for people eating less, clothing sellers are finding that millions of slimmed-down Americans want to buy new clothes. WSJ

- Tesla has been granted approval to test its advanced driver-assistance system on some Shanghai streets, a person familiar said. The company halted Cybertruck deliveries over a windshield wiper issue, according to Electrek. BBG

- Tesla (TSLA) reduces the price of its Model 3 Long-Range AWD vehicles in the US by USD 250, taking it to USD 47,490, according to Reuters

- Fed's Goolsbee (non-voter) said on Friday that recent CPI data was very good and they would be feeling very good if they got a lot of months like May's CPI data, while he added they have to see more progress and his feeling was relief.

- Fed’s Kashkari (non-voter) said they need to see more evidence to convince them inflation is heading to 2% and they are in a good position to take their time and get more data before deciding on rates. Kashkari also stated it is reasonable that a rate cut could occur in December and the median projection is for one cut which is likely to be towards the end of the year, according to CBS' Face the Nation.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly negative as markets reflected on the latest soft Chinese data releases. ASX 200 was rangebound as weakness in tech and mining-related sectors offset the gains in defensives and financials, with trade contained ahead of tomorrow's RBA announcement and after Australia and China signed MOUs on the economy, trade and education. Nikkei 225 underperformed and dipped below 38,000 in the fallout of last week's BoJ meeting and press conference, while Machinery Orders for April were better than expected with surprise Y/Y growth of 0.7% (exp. -0.1%) and the M/M figure showed a narrower than feared decline at -2.9% (exp. -3.1%) although printed its first contraction in 3 months. Hang Seng and Shanghai Comp. were mixed as the Hang Seng attempts to buck the trend amid tech strength and with the mainland pressured after soft data releases from China including the miss on loans and financing data, while Industrial Production and Retail Sales were mixed and House Prices showed a further deterioration with the steepest M/M drop in nearly a decade.

Top Asian News

- PBoC conducted CNY 182bln (vs CNY 237bln maturing) in 1-year MLF with the rate kept at 2.50%.

- China's NBS spokesperson said domestic demand is insufficient despite efforts and the property market shows positive changes but is still in the middle of adjustments, while she added that more time was needed to see the effect of property measures and China's economy likely to continue to recover despite the complex external environment.

- China still has room to lower interest rates but the ability to adjust monetary policy faces internal and external constraints, according to PBoC-backed Financial News.

- China Securities Regulatory Commission announced in a statement that it'll further evaluate and refine rules for margin trading and securities lending, while it will increase regulation of "illicit" short-selling as it aims to ensure market stability.

- Australia and China signed memorandums of understanding on the economy, trade and education in Canberra, while Australian PM Albanese said they aim to strengthen the relationship with China and Chinese Premier Li announced that China will include Australia in its visa waiver program, according to Reuters.

- China's Commerce Ministry is conducting anti-dumping investigation on pork and its by-products which are imported from the EU, investigation begins immediatelyInvestigation should end within 12-months, could be extended by another 6-months under special conditions.

- BoJ Governor Ueda says service prices continue to rise moderately reflecting wage rises; will scrutinise FX moves and impact on import prices.

- Japanese PM Kishida says Government and BoJ share view consumption lacks strength as wage growth fails to catch up to pace of inflation.

European bourses, Stoxx 600 (+0.1%) began the session on a strong footing in a paring of Friday's pronounced downside, though some modest selling pressure has been seen in recent trade. European sectors hold a strong positive tilt, though with little clear bias; Tech takes the top spot, next to Travel & Leisure, whilst Healthcare lags. US Equity Futures (ES -0.1%, NQ +0.1%, RTY -0.1%) are mixed, and with price action tentative thus far.

Top European News

- UK PM Sunak’s Conservative Party is headed for a historic wipeout in the July 4th general election, according to three new polls by Survation, Opinium and Savanta published in Sunday newspapers cited by Bloomberg.

- ECB's Lane says we are seeing significant wage increases in some countries; cost pressures to be muted next year. (regarding France) Need to distinguish between markets repricing fundamentals and disorderly dynamics; current situation is not disorderly. We need to see domestic services inflation momentum come down.

- ECB is in no rush to discuss a French bond rescue and policymakers have not discussed emergency bond purchases for France, according to sources. Furthermore, sources said ECB policymakers have no immediate plan to debate using the Transmission Protection Instrument for France and some policymakers would wait until a new French government is formed before any discussion about TPI, according to Reuters.

- Italian PM Meloni said G7 leaders agreed on the need for a fairer international taxation system and global minimum tax.

FX

- DXY is trading within a tight but busy 105.49-64 range ahead of a quiet session, with focus on US Retail Sales on Tuesday. Currently trading within the confines of Friday’s 105.17-80 range. Downside levels include its 50 DMA at 105.20, just above the trough from Friday.

- EUR is flat on the session and trading on either side of the 1.07 mark, following some of the hefty selling seen on Friday. Political uncertainty in France still looms large, although some of the fears have seemingly fizzled out in today’s trade after ECB sources suggest that the Bank is in no rush to discuss a French bond rescue.

- GBP is incrementally softer vs the Dollar, largely a factor of slight strength in the EUR/GBP cross, given the lack of UK-specific newsflow thus far.

- JPY is very slightly softer against the Dollar and ultimately unreactive to commentary from BoJ’s Ueda at his parliamentary hearing. Thus far, the Governor has echoed very familiar commentary from the Bank. Currently trading just above 157.50 and towards the upper end of today’s 157.17-66 range.

- Antipodeans (particularly the Kiwi) are the G10 underperformers, following the mixed Chinese data overnight, with focus on the weaker-than-expected Chinese Industrial Output data.

Fixed Income

- USTs are incrementally softer, paring some of the pronounced gains seen on Friday. Today's focus will be on Fed's Williams, Harker & Cook, where remarks will be scrutinised to see where they place their dots and how much sway, if at all, May's CPI had on them. In narrow 6 tick parameters; yields bid across the curve which is ever so slightly flatter thus far.

- Bund pullback is more pronounced than peers, though the OAT-Bund yield spread remains elevated around 75bps. ECB sources drew focus on TPI and France but nothing immediate coming from this while Chief Economist Lane made clear the current situation "is not disorderly".

- Gilts are also subdued, as attention turns to UK CPI on Wednesday and the BoE a day later. At the low-end of 98.55-98.86 bounds, pulling back from Friday's 99.05 best.

Commodities

- Crude is flat in what has been a choppy session thus far. The complex was subdued overnight following the weak Chinese industrial data, though caught a slight bid at the European cash open, and then taking another leg higher after PM Netanyahu disbanded his war cabinet.

- Precious metals are pressured despite the strong Chinese retail data with the metrics overall pointing to a sluggish May for China, metrics the likes of ING believe will increase calls for rate cuts from the PBoC. XAU is holding at the lower end of USD 2315-2332/oz bounds.

- Base metals are weighed on by the poor Chinese industrial production number, strength in the USD and only modestly constructive risk tone after Friday's pronounced pressure.

- US President Biden is ready to reopen US oil stockpile if petrol price surge again, according to FT.

- Ukraine planned record power imports on Saturday after significant energy infrastructure damage. In relevant news, US Vice President Harris announced over USD 1.5bln to bolster Ukraine’s energy sector, according to Reuters.

Geopolitics: Middle East

- Israel's military said it will hold a tactical pause of military activity for humanitarian purposes between 06:00BST-17:00BST daily along the road from the Kerem Shalom Crossing to Salah Al-Din Road and then northwards, according to Reuters. However, it was separately reported that Israeli PM Netanyahu denounced as ‘unacceptable’ the plans by Israel’s military for a limited pause in operation near a crossing into Gaza intended to help aid distribution, according to FT.

- Israel Defence Forces said intensified cross-border fire from Hezbollah on Israel could lead to dangerous escalation and is bringing them to the brink of what could be a wider escalation that could have devastating consequences for Lebanon and the entire region, according to a video statement cited by Reuters.

- Hamas leader Haniyeh said the group’s response to the latest Gaza ceasefire proposal is consistent with the principles of US President Biden’s plan, according to Reuters. It was also reported that the Palestinian Islamic Jihad armed wing said the only way to return Israeli hostages is through withdrawing from Gaza and reaching a hostages-for-prisoners deal.

- White House said Qatar and Egypt plan talks with Hamas on a Gaza ceasefire, while the White House later said that President Biden's senior adviser Amos Hochstein will be in Israel on Monday for meetings.

- US National Security Adviser Sullivan said President Biden wants to see a cessation of hostilities in Gaza and see hostages return home, while he added that they work tirelessly with Israelis to ensure unhindered humanitarian access.

- UK, France, and Germany’s governments condemned Iran’s latest steps as reported by the IAEA to further expand its nuclear program which they said is especially concerning, while they remain committed to a diplomatic solution preventing Iran from developing nuclear weapons, according to Reuters.

- Iranian Foreign Ministry spokesperson Kanaani said the G7 should distance itself from destructive policies in the past. It was also separately reported that Iran’s Foreign Ministry condemned the ‘invalid’ E3 statement on its nuclear program, according to IRNA.

- US naval forces rescued a crew from a Greek-owned ship that was struck by Houthis in the Red Sea, while Yemen’s Houthis said they carried out three military operations against an American destroyer and two ships in the Red and Arabian Seas, according to Reuters.

Geopolitics: Other

- Russia’s Kremlin said President Putin is not ruling out talks with Ukraine but wants guarantees and a legitimate record of their outcome is needed, according to Russian agencies including TASS. In relevant news, Russian forces took control of the village in Ukraine’s Zaporizhzhia region, according to Ifax citing the Defence Ministry.

- Ukrainian peace summit communiqué stated that Russia’s ongoing war against Ukraine continues to cause large-scale human suffering and destruction, as well as creates risks and crises with global repercussions, while it stated that any threat or use of nuclear weapons in the context of the ongoing war against Ukraine is inadmissible.

- Ukrainian Foreign Minister said the peace summit communiqué text is complete and Kyiv’s positions have been addressed, while there were no alternative peace plans discussed at the summit in Switzerland and Kyiv won’t let Russia speak in the language of ultimatums. Furthermore, the Austrian Chancellor said there is a desire for a follow-up Ukraine conference although it is too early to say what the format will be and have to see whether Russians can be there.

- US National Security Adviser Sullivan said Russia’s latest peace proposal for Ukraine would lead to further domination of Ukraine and is a completely absurd vision.

- Swedish armed forces spokesperson said a Russian air plane violated Swedish airspace on Friday and was met by Swedish fighter jets, according to TT news agency.

- China's Coast Guard said a Philippine supply ship illegally intruded into waters adjacent to Second Thomas Shoal on June 17th and the vessel deliberately approached the Chinese ship in an unprofessional and dangerous manner which resulted in a collision, while it added that the Philippine transport and replenishment ship ignored China's repeated solemn warnings.

- China is expanding its nuclear arsenal faster than any other country but still lags behind the US and Russia, according to a report cited by SCMP.

- US, South Korea and Japan are to lock in security ties and will sign a deal this year to formalise a security partnership against threats from North Korea's nuclear weapons before the inauguration of the next US President in January, according to Bloomberg.

US Event Calendar

- 08:30: June Empire Manufacturing, est. -11.3, prior -15.6

Central Bank Speakers

- 12:00: Fed’s Williams Moderates Discussion at Economic Club of NY

- 13:00: Fed’s Harker Speaks on Economic Outlook

- 21:00: Fed’s Cook Gives Acceptance Remarks

DB's Jim Reid concludes the overnight wrap

I must admit that when we showed a graph at the start of the year highlighting that 2024 would see the biggest percentage share of the global population going to national election polls in history, with over 200 years of data, I did wonder whether we were slightly over sensationalising the story. However, even before we get to the US election fun and games, the l ast 2-3 weeks have been seismic in terms of election results. South Africa, Mexico, India and Europe have seen varying degrees of fallout as a result. However, as we know by now it's the French market currently in the eye of the storm with the rest of Europe being sucked into the vortex.

The reason this is important is that last week the Franco-German 10yr spread rose +28.6bps over the week (and +6.9bps on Friday). This brings it to its highest level since November 2012, and its largest weekly increase since late 2011 during the Euro crisis, and during German reunification in August 1990. The spread is now +76.7bps with our rates strategists targeting +90bps. They think +90-100bps would be the equivalent to the 2017 Presidential election peak of +80bps when adjusting for today's French fundamentals. See their latest note on this here with various links to their latest pieces on the topic contained within.

In equity risk, the CAC 40 fell -6.23% last week (-2.66% on Friday), its largest weekly move down since March 2022 and apart from another big differential in the early Covid period you’d have to go back to the aftermath of 9/11 in 2001 to see such extremes. We'll review the full week just gone as usual at the end.

Suffice to say that this uncertainty will be with us until at least the second round of the election on July 7th and likely beyond. The polls haven't narrowed in Macron's favour in the first week of the campaign with the far right and left outpacing the President's centrist party.

In terms of the week ahead, the main data highlights are US retail sales tomorrow, UK CPI on Wednesday, and with Japanese inflation and the global flash PMIs on Friday. For central banks, we have meetings concluding in Australia (tomorrow), UK, Switzerland and Norway (Thursday) with a few additional EM meetings spread through the week. There is also a fair degree of Fed and ECB speak to throw into the mix.

Tomorrow's US retail sales will likely be the focal point in the US and even with a pretty poor UoM consumer sentiment figure from Friday, our economists think we'll see a decent tick up in retail control (+0.5% vs. -0.3% last month) which would equate to around 3.5% annualized for Q2 (vs. 1.5% in Q1). There have been some signs recently that the US consumer is starting to show some fatigue so this will be an important data point. Also keep a watchful eye on initial jobless claims on Thursday. A further rise from 242k to 250k is expected by our economists but so far it seems the rise is concentrated in similar states to that seen last year and is likely to be due to difficulties seasonally adjusting to the end of the school year. For more on the week ahead, the full day-by-day week ahead calendar is at the end as usual.

This morning, Asian equity markets are struggling at the start of the week with majority of the region’s markets trading lower this morning. Across the region, the Nikkei (-1.82%) is the biggest underperformer dragged down by energy and real estate stocks while the KOSPI (-0.40%), the Shanghai Composite (-0.56%) and the CSI (-0.13%) also trading trade in negative territory. However, the Hang Seng (+0.50%) is the notable exception, having reversed its opening losses. In overnight trading, US equity futures are struggling to gain momentum with those on the S&P 500 (-0.05%) just below flat and those tied to the NASDAQ 100 (+0.06%) just above flickering near the flatline. Meanwhile, yields on the 10yr USTs (+2.32 bps) have moved upwards to trade at 4.24% as we go to print.

In monetary policy, the People’s Bank of China (PBOC) kept its one-year medium term lending facility rate unchanged at 2.5% on 182 billion yuan worth of loans as expected, indicating that the central bank will likely hold on the benchmark lending rate later this month.

Staying on China retail sales rose +3.7% y/y in May, exceeding market expectations for a +3.0% gain and increasing pace from a +2.3% increase in the previous month. However, other economic metrics failed to surpass market forecasts with industrial output growing +5.6% y/y in May (v/s +6.2% expected), down from an increase of +6.7% in April. Meanwhile, the nation’s real estate crisis continued to weigh on investment in fixed assets with the overall YTD investment figures expanding +4.0%, just shy of Bloomberg forecast of +4.2% gain. Additionally, new home prices dropped at the fastest pace since October 2014, falling -0.7% m/m in May (v/s -0.58% in April) and marking the 11th straight decline despite the government’s stimulus to support the property market.

Now recapping last week in full and it was a tale of two continents with European markets weighed down by increased political uncertainty emanating from France, while US ones saw a solid week amid encouraging inflation data. The divergence was clearly visible in the relative equity performance with the weekly gap between the S&P 500 (+1.58%) and France CAC 40 (-6.23%) the largest since early March 2022, just after Russia’s full scale invasion of Ukraine.

In more detail, on Wednesday we had one of the best US CPI prints in a long time from the Fed’s point of view. The downside surprise, which put monthly core CPI at its slowest since August 2021 was followed by a lower-than-expected PPI print on Thursday, with markets increasing their expectations of rate cuts despite a somewhat hawkish FOMC meeting. The number of cuts priced in by Fed futures by December rose +12.8bps (-0.6bps on Friday). Off the back of this, 2yr yields fell -18.3bps (+0.7bps on Friday). Similarly, 10yr yields fell -21.2bps last week (and -2.3bps on Friday), their largest decline since December and down to their lowest level since March at 4.22%.

In Europe, France clearly stole the spotlight last week, after President Macron announced a snap election in response to his party performing poorly in the EU parliamentary elections. The announcement triggered a surge in the risk premium on French assets, with the spread between 10yr French OATs and 10yr bunds rising +28.6bps over the week (and +6.9bps on Friday). This brings it to its highest level since November 2012, and is the largest weekly rise since the peak of the euro crisis in late 2011 (and the second largest rise since Germany’s reunification in 1990). However, with 10yr German bund yields falling -25.9bps (and -11.0bps on Friday), the 10yr OAT yield rose by a modest +2.7bps (-4.1bps on Friday). The euro also weakened off the back of the growing French election risk, falling -0.91% (and -0.30% on Friday). The US dollar gained from the political risk-off tone, with the broad dollar index up +0.63% (and +0.34% on Friday).

There was a significant selloff elsewhere in French assets, as the CAC 40 fell -6.23% (and -2.66% on Friday), its largest weekly decline since March 2022. In turn, this more than wiped out all its gains year-to-date, leaving the index down -0.53% on the year. The selloff was not contained to France, as European equities suffered across the board. There were sizeable losses for the DAX (-2.99%), FSTE MIB (-5.76%) and the FTSE 100 (-1.19%). The STOXX 600 fell -2.39% (and -0.97% on Friday), its largest weekly decline since October. On a sector level, banks struggled as the Stoxx Banks index fell -8.07% (-2.17% Friday).

By contrast, the S&P 500 surged ahead by +1.58%, even if a marginal -0.04% decline on Friday prevented it from posting record highs on all five days of the week. The rally was led by the technology sector, with the NASDAQ gaining +3.24% (and +0.12% on Friday), and the Magnificent 7 up +3.82% (+0.01% on Friday). However, the gains were not enjoyed more broadly, with the equal-weighted S&P 500 down -0.57% (-0.70% Friday) and the small cap Russell 2000 down -1.01% (-1.61% on Friday).

Finally in commodities, oil prices rebounded last week after OPEC+ clarified that it could pause or reverse the planed rollback of production cuts if needed. Brent crude gained +3.77% (-0.16% on Friday) to $82.62/bbl. European natural gas futures also rose +6.31% last week (0.00% on Friday) amid various global supply disruptions.

Futures are flat to start the holiday-shortened week (markets are closed Wednesday for Juneteenth). As of 8:00am, S&P futures are unchanged just above 5500, while Nasdaq futures rose 0.2%; France’s CAC 40 benchmark erased most of its opening 1% advance and global stocks ceded most of their early gains sparked by French far-right leader Marine le Pen’s pledge to respect political institutions if she wins the upcoming snap parliamentary election. Bond yields are slightly higher amid a bear steepening: JPM's rates strategist sees yields range-bound for the summer with the 10Y being fairly valued at current levels. Euro-area bond yields edged higher, with France’s yield premium over Germany staying near the widest in years. The Bloomberg Dollar Spot Index is up 0.1%, while the euro was modestly firmer against the dollar, after shedding almost 1% last week. Commodities are mixed with energy higher ex-natgas but Ags and metals are coming for sale; metals potentially dragged by weaker than expected data from China overnight. Today’s macro data focus is on Empire Manufacturing but tomorrow’s Retail Sales is the key release this week with additional focus on Friday’s Flash PMIs.

In premarket trading, semis are higher led by NVDA +0.7%, AVGO +2.8%, and MU +1.7%. AAPL is +0.7% with the balance of Mag7 more muted. Here are some other notable premarket movers:

- Aaron’s soars 31% after agreeing to be acquired by IQVentures for $10.10 per share in cash.

- AMC Networks slides 10% after the entertainment company said it intends to offer $125 million in convertible senior notes due 2029 in a private offering.

- Autodesk gains 4% after the Wall Street Journal reported that activist investor Starboard Value has taken a $500 million stake in the design-software maker.

- Ollie’s Bargain Outlet climbs 3.7% after JPMorgan upgraded the retailer to overweight, saying its fieldwork suggests second quarter-to-date comparable sales are trending above the company’s guidance.

- Zymeworks rises 8% after saying the FDA has cleared the investigational new drug application for ZW171.

Global markets are struggling to recover from a selloff sparked last week by Emmanuel Macron’s call for a snap election, that could result in gains for far-right groups, including Le Pen’s National Rally. European assets were lifted initially as Le Pen appeared to soothe investors with comments that she won’t try to push out Macron if she wins the election, but the gains fizzled quickly.

“It’s fair to say that foreign investors are nervous about the heightened political risk that the situation in France brings,” said Frédérique Carrier, head of investment strategy at RBC Wealth Management. “The market still has a lot of difficulty pricing in these sorts of events.”

Still, she noted populist politicians do have a history of moving closer to the center once they reach power and Le Pen’s comments had fueled hopes for that outcome in France. “It’s possible that these signs of them being a little bit less radical and wanting to play nice might encourage the market a little bit,” Carrier said. But with the first election round on June 30, investors are likely to stay wary of Europe. Citigroup analysts warned that a potential far-right majority in France is among the risk factors for European equities and said they favor the US market.

European stocks were in the green but well off session highs, while the CAC 40 erased most of its initial 1% gain as investors monitor signs of stabilization in French bonds. The Stoxx 600 advanced 0.6% after rising more than 1% earlier before erasing all gains and rebounding, with gains led by info tech and energy sector. OAT yields have steadied across the curve after Marine le Pen said over the weekend she won’t try to push out President Emmanuel Macron if she wins in an appeal to moderates.

Earlier in the session, Asian stocks fell, with Japanese equities the session’s biggest laggard, as concerns over France’s political crisis stoked anxiety in global markets. Trading was thin amid holidays in a number of countries. The MSCI Asia Pacific Index fell as much as 1%, on track for a third-straight daily loss, with Toyota, Samsung and Sony among the biggest drags Monday. Benchmarks also fell in South Korea, New Zealand and Thailand, while Chinese equities were mixed after a slew of disappointing economic data. Markets in Singapore, India, Indonesia, Malaysia and the Philippines were closed.

- Hang Seng and Shanghai Comp. were mixed as the Hang Seng attempts to buck the trend amid tech strength and with the mainland pressured after soft data releases from China including the miss on loans and financing data, while Industrial Production and Retail Sales were mixed and House Prices showed a further deterioration with the steepest M/M drop in nearly a decade.

- Nikkei 225 underperformed and dipped below 38,000 in the fallout of last week's BoJ meeting and press conference, while Machinery Orders for April were better than expected with surprise Y/Y growth of 0.7% (exp. -0.1%) and the M/M figure showed a narrower than feared decline at -2.9% (exp. -3.1%) although printed its first contraction in 3 months.

- ASX 200 was rangebound as weakness in tech and mining-related sectors offset the gains in defensives and financials, with trade contained ahead of tomorrow's RBA announcement and after Australia and China signed MOUs on the economy, trade and education.

The flight to haven assets came as France’s snap parliamentary election renewed investors’ focus on political volatility worldwide. Japanese stocks more than erased Friday’s gains in the immediate wake of the latest policy decision from the nation’s central bank. “The sentiment shifter is the political uncertainty in Europe,” said Kyle Rodda, a market analyst at Capital.com. “Couple that with no fresh news on the earnings front and a market that’s pricing in a higher chance of two Fed cuts this year.”

In FX, the Bloomberg Dollar Spot Index is up 0.1%. The euro tops G-10 FX, rising 0.1% against the greenback. The Norwegian krone and New Zealand dollar lag peers. Oil prices are steady, with WTI trading near $78.50 a barrel. Spot gold falls ~$11 to around $2,322/oz. Iron ore falls 2%.

In rates, treasury yields are higher led by the long-end amid similar bear-steepening in German bonds, while French bonds stabilize as investors weighed assurances from far-right leader Marine Le Pen that she’d work with President Emmanuel Macron. US long-end yields cheaper by nearly 3bp with 2s10s, 5s30s spreads steeper by ~2bp on the day; 10-year around 4.246% is about 3bps higher than Friday’s close with bunds underperforming by additional 2bp in the sector. Coupon issuance this week includes $13b 20-year bond reopening Tuesday and $21b 5-year TIPS reopening Thursday. US session includes three Fed speakers and June Empire manufacturing gauge.

In commodities, oil prices are steady, with WTI trading near $78.50 a barrel. Spot gold falls ~$11 to around $2,322/oz. Iron ore falls 2%.

Looking to today's calendar, US economic data slate includes June Empire manufacturing at 8:30am. Ahead this week are retail sales, industrial production and manufacturing and services PMIs. Fed officials scheduled to speak include Williams (12pm), Harker (1pm) and Cook (9pm). This week we get lots of central bank action, including decisions in the UK, Australia and Brazil, with investors looking for hints on when each will join the rate-cutting cycle.

Market Snapshot

- S&P 500 futures little changed at 5,436.00

- STOXX Europe 600 up 0.2% to 511.86

- MXAP down 0.8% to 178.17

- MXAPJ down 0.2% to 562.20

- Nikkei down 1.8% to 38,102.44

- Topix down 1.7% to 2,700.01

- Hang Seng Index little changed at 17,936.12

- Shanghai Composite down 0.6% to 3,015.89

- Sensex up 0.2% to 76,992.77

- Australia S&P/ASX 200 down 0.3% to 7,700.27

- Kospi down 0.5% to 2,744.10

- German 10Y yield little changed at 2.40%

- Euro little changed at $1.0712

- Brent Futures up 0.4% to $82.97/bbl

- Gold spot down 0.6% to $2,319.01

- US Dollar Index little changed at 105.53

Top Overnight News

- China’s President Xi Jinping told European Commission president Ursula von der Leyen that Washington was trying to goad Beijing into attacking Taiwan, according to people familiar with the matter. FT

- China’s industrial production for May falls short of expectations (+5.6% vs. the Street +6.2%) and property investment exhibits softness too while retail sales were a bright spot (+3.7% vs. the Street +3%). BBG

- China's new home prices fell at the fastest pace in more than 9-1/2 years in May, with the property sector struggling to find a bottom despite government efforts to rein in oversupply and support debt-laden developers. Prices were down 0.7% in May from the previous month, marking the 11th straight month-on-month decline and steepest drop since October 2014. RTRS

- BOJ to begin dialing back its pace of QE but will hold off on hiking rates until at least Sept according to a former board member. RTRS

- French political anxiety calms slightly as Le Pen said she would cooperate with Macron if her party wins the upcoming election. BBG

- Russia and Ukraine appear further from peace today than at any other time since the full-scale invasion commenced in Feb of 2022, with both sides making unrealistic demands as conditions for ending the war. NYT

- Apparel retailers are discovering that weight loss is their gain. While blockbuster drugs like Ozempic that lead to significant weight loss have dented demand for diet plans and caused food companies to prepare for people eating less, clothing sellers are finding that millions of slimmed-down Americans want to buy new clothes. WSJ

- Tesla has been granted approval to test its advanced driver-assistance system on some Shanghai streets, a person familiar said. The company halted Cybertruck deliveries over a windshield wiper issue, according to Electrek. BBG

- Tesla (TSLA) reduces the price of its Model 3 Long-Range AWD vehicles in the US by USD 250, taking it to USD 47,490, according to Reuters

- Fed's Goolsbee (non-voter) said on Friday that recent CPI data was very good and they would be feeling very good if they got a lot of months like May's CPI data, while he added they have to see more progress and his feeling was relief.

- Fed’s Kashkari (non-voter) said they need to see more evidence to convince them inflation is heading to 2% and they are in a good position to take their time and get more data before deciding on rates. Kashkari also stated it is reasonable that a rate cut could occur in December and the median projection is for one cut which is likely to be towards the end of the year, according to CBS' Face the Nation.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly negative as markets reflected on the latest soft Chinese data releases. ASX 200 was rangebound as weakness in tech and mining-related sectors offset the gains in defensives and financials, with trade contained ahead of tomorrow's RBA announcement and after Australia and China signed MOUs on the economy, trade and education. Nikkei 225 underperformed and dipped below 38,000 in the fallout of last week's BoJ meeting and press conference, while Machinery Orders for April were better than expected with surprise Y/Y growth of 0.7% (exp. -0.1%) and the M/M figure showed a narrower than feared decline at -2.9% (exp. -3.1%) although printed its first contraction in 3 months. Hang Seng and Shanghai Comp. were mixed as the Hang Seng attempts to buck the trend amid tech strength and with the mainland pressured after soft data releases from China including the miss on loans and financing data, while Industrial Production and Retail Sales were mixed and House Prices showed a further deterioration with the steepest M/M drop in nearly a decade.

Top Asian News

- PBoC conducted CNY 182bln (vs CNY 237bln maturing) in 1-year MLF with the rate kept at 2.50%.

- China's NBS spokesperson said domestic demand is insufficient despite efforts and the property market shows positive changes but is still in the middle of adjustments, while she added that more time was needed to see the effect of property measures and China's economy likely to continue to recover despite the complex external environment.

- China still has room to lower interest rates but the ability to adjust monetary policy faces internal and external constraints, according to PBoC-backed Financial News.

- China Securities Regulatory Commission announced in a statement that it'll further evaluate and refine rules for margin trading and securities lending, while it will increase regulation of "illicit" short-selling as it aims to ensure market stability.

- Australia and China signed memorandums of understanding on the economy, trade and education in Canberra, while Australian PM Albanese said they aim to strengthen the relationship with China and Chinese Premier Li announced that China will include Australia in its visa waiver program, according to Reuters.

- China's Commerce Ministry is conducting anti-dumping investigation on pork and its by-products which are imported from the EU, investigation begins immediatelyInvestigation should end within 12-months, could be extended by another 6-months under special conditions.

- BoJ Governor Ueda says service prices continue to rise moderately reflecting wage rises; will scrutinise FX moves and impact on import prices.

- Japanese PM Kishida says Government and BoJ share view consumption lacks strength as wage growth fails to catch up to pace of inflation.

European bourses, Stoxx 600 (+0.1%) began the session on a strong footing in a paring of Friday's pronounced downside, though some modest selling pressure has been seen in recent trade. European sectors hold a strong positive tilt, though with little clear bias; Tech takes the top spot, next to Travel & Leisure, whilst Healthcare lags. US Equity Futures (ES -0.1%, NQ +0.1%, RTY -0.1%) are mixed, and with price action tentative thus far.

Top European News

- UK PM Sunak’s Conservative Party is headed for a historic wipeout in the July 4th general election, according to three new polls by Survation, Opinium and Savanta published in Sunday newspapers cited by Bloomberg.

- ECB's Lane says we are seeing significant wage increases in some countries; cost pressures to be muted next year. (regarding France) Need to distinguish between markets repricing fundamentals and disorderly dynamics; current situation is not disorderly. We need to see domestic services inflation momentum come down.

- ECB is in no rush to discuss a French bond rescue and policymakers have not discussed emergency bond purchases for France, according to sources. Furthermore, sources said ECB policymakers have no immediate plan to debate using the Transmission Protection Instrument for France and some policymakers would wait until a new French government is formed before any discussion about TPI, according to Reuters.

- Italian PM Meloni said G7 leaders agreed on the need for a fairer international taxation system and global minimum tax.

FX

- DXY is trading within a tight but busy 105.49-64 range ahead of a quiet session, with focus on US Retail Sales on Tuesday. Currently trading within the confines of Friday’s 105.17-80 range. Downside levels include its 50 DMA at 105.20, just above the trough from Friday.

- EUR is flat on the session and trading on either side of the 1.07 mark, following some of the hefty selling seen on Friday. Political uncertainty in France still looms large, although some of the fears have seemingly fizzled out in today’s trade after ECB sources suggest that the Bank is in no rush to discuss a French bond rescue.

- GBP is incrementally softer vs the Dollar, largely a factor of slight strength in the EUR/GBP cross, given the lack of UK-specific newsflow thus far.

- JPY is very slightly softer against the Dollar and ultimately unreactive to commentary from BoJ’s Ueda at his parliamentary hearing. Thus far, the Governor has echoed very familiar commentary from the Bank. Currently trading just above 157.50 and towards the upper end of today’s 157.17-66 range.

- Antipodeans (particularly the Kiwi) are the G10 underperformers, following the mixed Chinese data overnight, with focus on the weaker-than-expected Chinese Industrial Output data.

Fixed Income

- USTs are incrementally softer, paring some of the pronounced gains seen on Friday. Today's focus will be on Fed's Williams, Harker & Cook, where remarks will be scrutinised to see where they place their dots and how much sway, if at all, May's CPI had on them. In narrow 6 tick parameters; yields bid across the curve which is ever so slightly flatter thus far.

- Bund pullback is more pronounced than peers, though the OAT-Bund yield spread remains elevated around 75bps. ECB sources drew focus on TPI and France but nothing immediate coming from this while Chief Economist Lane made clear the current situation "is not disorderly".

- Gilts are also subdued, as attention turns to UK CPI on Wednesday and the BoE a day later. At the low-end of 98.55-98.86 bounds, pulling back from Friday's 99.05 best.

Commodities

- Crude is flat in what has been a choppy session thus far. The complex was subdued overnight following the weak Chinese industrial data, though caught a slight bid at the European cash open, and then taking another leg higher after PM Netanyahu disbanded his war cabinet.

- Precious metals are pressured despite the strong Chinese retail data with the metrics overall pointing to a sluggish May for China, metrics the likes of ING believe will increase calls for rate cuts from the PBoC. XAU is holding at the lower end of USD 2315-2332/oz bounds.

- Base metals are weighed on by the poor Chinese industrial production number, strength in the USD and only modestly constructive risk tone after Friday's pronounced pressure.

- US President Biden is ready to reopen US oil stockpile if petrol price surge again, according to FT.

- Ukraine planned record power imports on Saturday after significant energy infrastructure damage. In relevant news, US Vice President Harris announced over USD 1.5bln to bolster Ukraine’s energy sector, according to Reuters.

Geopolitics: Middle East

- Israel's military said it will hold a tactical pause of military activity for humanitarian purposes between 06:00BST-17:00BST daily along the road from the Kerem Shalom Crossing to Salah Al-Din Road and then northwards, according to Reuters. However, it was separately reported that Israeli PM Netanyahu denounced as ‘unacceptable’ the plans by Israel’s military for a limited pause in operation near a crossing into Gaza intended to help aid distribution, according to FT.

- Israel Defence Forces said intensified cross-border fire from Hezbollah on Israel could lead to dangerous escalation and is bringing them to the brink of what could be a wider escalation that could have devastating consequences for Lebanon and the entire region, according to a video statement cited by Reuters.

- Hamas leader Haniyeh said the group’s response to the latest Gaza ceasefire proposal is consistent with the principles of US President Biden’s plan, according to Reuters. It was also reported that the Palestinian Islamic Jihad armed wing said the only way to return Israeli hostages is through withdrawing from Gaza and reaching a hostages-for-prisoners deal.

- White House said Qatar and Egypt plan talks with Hamas on a Gaza ceasefire, while the White House later said that President Biden's senior adviser Amos Hochstein will be in Israel on Monday for meetings.

- US National Security Adviser Sullivan said President Biden wants to see a cessation of hostilities in Gaza and see hostages return home, while he added that they work tirelessly with Israelis to ensure unhindered humanitarian access.

- UK, France, and Germany’s governments condemned Iran’s latest steps as reported by the IAEA to further expand its nuclear program which they said is especially concerning, while they remain committed to a diplomatic solution preventing Iran from developing nuclear weapons, according to Reuters.

- Iranian Foreign Ministry spokesperson Kanaani said the G7 should distance itself from destructive policies in the past. It was also separately reported that Iran’s Foreign Ministry condemned the ‘invalid’ E3 statement on its nuclear program, according to IRNA.

- US naval forces rescued a crew from a Greek-owned ship that was struck by Houthis in the Red Sea, while Yemen’s Houthis said they carried out three military operations against an American destroyer and two ships in the Red and Arabian Seas, according to Reuters.

Geopolitics: Other

- Russia’s Kremlin said President Putin is not ruling out talks with Ukraine but wants guarantees and a legitimate record of their outcome is needed, according to Russian agencies including TASS. In relevant news, Russian forces took control of the village in Ukraine’s Zaporizhzhia region, according to Ifax citing the Defence Ministry.

- Ukrainian peace summit communiqué stated that Russia’s ongoing war against Ukraine continues to cause large-scale human suffering and destruction, as well as creates risks and crises with global repercussions, while it stated that any threat or use of nuclear weapons in the context of the ongoing war against Ukraine is inadmissible.

- Ukrainian Foreign Minister said the peace summit communiqué text is complete and Kyiv’s positions have been addressed, while there were no alternative peace plans discussed at the summit in Switzerland and Kyiv won’t let Russia speak in the language of ultimatums. Furthermore, the Austrian Chancellor said there is a desire for a follow-up Ukraine conference although it is too early to say what the format will be and have to see whether Russians can be there.

- US National Security Adviser Sullivan said Russia’s latest peace proposal for Ukraine would lead to further domination of Ukraine and is a completely absurd vision.

- Swedish armed forces spokesperson said a Russian air plane violated Swedish airspace on Friday and was met by Swedish fighter jets, according to TT news agency.

- China's Coast Guard said a Philippine supply ship illegally intruded into waters adjacent to Second Thomas Shoal on June 17th and the vessel deliberately approached the Chinese ship in an unprofessional and dangerous manner which resulted in a collision, while it added that the Philippine transport and replenishment ship ignored China's repeated solemn warnings.

- China is expanding its nuclear arsenal faster than any other country but still lags behind the US and Russia, according to a report cited by SCMP.

- US, South Korea and Japan are to lock in security ties and will sign a deal this year to formalise a security partnership against threats from North Korea's nuclear weapons before the inauguration of the next US President in January, according to Bloomberg.

US Event Calendar

- 08:30: June Empire Manufacturing, est. -11.3, prior -15.6

Central Bank Speakers

- 12:00: Fed’s Williams Moderates Discussion at Economic Club of NY

- 13:00: Fed’s Harker Speaks on Economic Outlook

- 21:00: Fed’s Cook Gives Acceptance Remarks

DB's Jim Reid concludes the overnight wrap

I must admit that when we showed a graph at the start of the year highlighting that 2024 would see the biggest percentage share of the global population going to national election polls in history, with over 200 years of data, I did wonder whether we were slightly over sensationalising the story. However, even before we get to the US election fun and games, the l ast 2-3 weeks have been seismic in terms of election results. South Africa, Mexico, India and Europe have seen varying degrees of fallout as a result. However, as we know by now it's the French market currently in the eye of the storm with the rest of Europe being sucked into the vortex.

The reason this is important is that last week the Franco-German 10yr spread rose +28.6bps over the week (and +6.9bps on Friday). This brings it to its highest level since November 2012, and its largest weekly increase since late 2011 during the Euro crisis, and during German reunification in August 1990. The spread is now +76.7bps with our rates strategists targeting +90bps. They think +90-100bps would be the equivalent to the 2017 Presidential election peak of +80bps when adjusting for today's French fundamentals. See their latest note on this here with various links to their latest pieces on the topic contained within.

In equity risk, the CAC 40 fell -6.23% last week (-2.66% on Friday), its largest weekly move down since March 2022 and apart from another big differential in the early Covid period you’d have to go back to the aftermath of 9/11 in 2001 to see such extremes. We'll review the full week just gone as usual at the end.

Suffice to say that this uncertainty will be with us until at least the second round of the election on July 7th and likely beyond. The polls haven't narrowed in Macron's favour in the first week of the campaign with the far right and left outpacing the President's centrist party.

In terms of the week ahead, the main data highlights are US retail sales tomorrow, UK CPI on Wednesday, and with Japanese inflation and the global flash PMIs on Friday. For central banks, we have meetings concluding in Australia (tomorrow), UK, Switzerland and Norway (Thursday) with a few additional EM meetings spread through the week. There is also a fair degree of Fed and ECB speak to throw into the mix.

Tomorrow's US retail sales will likely be the focal point in the US and even with a pretty poor UoM consumer sentiment figure from Friday, our economists think we'll see a decent tick up in retail control (+0.5% vs. -0.3% last month) which would equate to around 3.5% annualized for Q2 (vs. 1.5% in Q1). There have been some signs recently that the US consumer is starting to show some fatigue so this will be an important data point. Also keep a watchful eye on initial jobless claims on Thursday. A further rise from 242k to 250k is expected by our economists but so far it seems the rise is concentrated in similar states to that seen last year and is likely to be due to difficulties seasonally adjusting to the end of the school year. For more on the week ahead, the full day-by-day week ahead calendar is at the end as usual.

This morning, Asian equity markets are struggling at the start of the week with majority of the region’s markets trading lower this morning. Across the region, the Nikkei (-1.82%) is the biggest underperformer dragged down by energy and real estate stocks while the KOSPI (-0.40%), the Shanghai Composite (-0.56%) and the CSI (-0.13%) also trading trade in negative territory. However, the Hang Seng (+0.50%) is the notable exception, having reversed its opening losses. In overnight trading, US equity futures are struggling to gain momentum with those on the S&P 500 (-0.05%) just below flat and those tied to the NASDAQ 100 (+0.06%) just above flickering near the flatline. Meanwhile, yields on the 10yr USTs (+2.32 bps) have moved upwards to trade at 4.24% as we go to print.

In monetary policy, the People’s Bank of China (PBOC) kept its one-year medium term lending facility rate unchanged at 2.5% on 182 billion yuan worth of loans as expected, indicating that the central bank will likely hold on the benchmark lending rate later this month.

Staying on China retail sales rose +3.7% y/y in May, exceeding market expectations for a +3.0% gain and increasing pace from a +2.3% increase in the previous month. However, other economic metrics failed to surpass market forecasts with industrial output growing +5.6% y/y in May (v/s +6.2% expected), down from an increase of +6.7% in April. Meanwhile, the nation’s real estate crisis continued to weigh on investment in fixed assets with the overall YTD investment figures expanding +4.0%, just shy of Bloomberg forecast of +4.2% gain. Additionally, new home prices dropped at the fastest pace since October 2014, falling -0.7% m/m in May (v/s -0.58% in April) and marking the 11th straight decline despite the government’s stimulus to support the property market.

Now recapping last week in full and it was a tale of two continents with European markets weighed down by increased political uncertainty emanating from France, while US ones saw a solid week amid encouraging inflation data. The divergence was clearly visible in the relative equity performance with the weekly gap between the S&P 500 (+1.58%) and France CAC 40 (-6.23%) the largest since early March 2022, just after Russia’s full scale invasion of Ukraine.

In more detail, on Wednesday we had one of the best US CPI prints in a long time from the Fed’s point of view. The downside surprise, which put monthly core CPI at its slowest since August 2021 was followed by a lower-than-expected PPI print on Thursday, with markets increasing their expectations of rate cuts despite a somewhat hawkish FOMC meeting. The number of cuts priced in by Fed futures by December rose +12.8bps (-0.6bps on Friday). Off the back of this, 2yr yields fell -18.3bps (+0.7bps on Friday). Similarly, 10yr yields fell -21.2bps last week (and -2.3bps on Friday), their largest decline since December and down to their lowest level since March at 4.22%.

In Europe, France clearly stole the spotlight last week, after President Macron announced a snap election in response to his party performing poorly in the EU parliamentary elections. The announcement triggered a surge in the risk premium on French assets, with the spread between 10yr French OATs and 10yr bunds rising +28.6bps over the week (and +6.9bps on Friday). This brings it to its highest level since November 2012, and is the largest weekly rise since the peak of the euro crisis in late 2011 (and the second largest rise since Germany’s reunification in 1990). However, with 10yr German bund yields falling -25.9bps (and -11.0bps on Friday), the 10yr OAT yield rose by a modest +2.7bps (-4.1bps on Friday). The euro also weakened off the back of the growing French election risk, falling -0.91% (and -0.30% on Friday). The US dollar gained from the political risk-off tone, with the broad dollar index up +0.63% (and +0.34% on Friday).

There was a significant selloff elsewhere in French assets, as the CAC 40 fell -6.23% (and -2.66% on Friday), its largest weekly decline since March 2022. In turn, this more than wiped out all its gains year-to-date, leaving the index down -0.53% on the year. The selloff was not contained to France, as European equities suffered across the board. There were sizeable losses for the DAX (-2.99%), FSTE MIB (-5.76%) and the FTSE 100 (-1.19%). The STOXX 600 fell -2.39% (and -0.97% on Friday), its largest weekly decline since October. On a sector level, banks struggled as the Stoxx Banks index fell -8.07% (-2.17% Friday).

By contrast, the S&P 500 surged ahead by +1.58%, even if a marginal -0.04% decline on Friday prevented it from posting record highs on all five days of the week. The rally was led by the technology sector, with the NASDAQ gaining +3.24% (and +0.12% on Friday), and the Magnificent 7 up +3.82% (+0.01% on Friday). However, the gains were not enjoyed more broadly, with the equal-weighted S&P 500 down -0.57% (-0.70% Friday) and the small cap Russell 2000 down -1.01% (-1.61% on Friday).

Finally in commodities, oil prices rebounded last week after OPEC+ clarified that it could pause or reverse the planed rollback of production cuts if needed. Brent crude gained +3.77% (-0.16% on Friday) to $82.62/bbl. European natural gas futures also rose +6.31% last week (0.00% on Friday) amid various global supply disruptions.