The Biden Administration’s Consumer Financial Protection Bureau (CFPB) just issued a proposal to ban medical debt from factoring into your credit score. But for free-money socialists and their Keynesian bedfellows, this doesn’t go nearly far enough: short of canceling medical debt entirely, nothing else is acceptable.

The proposal addresses a loophole so that Americans with medical debt aren’t prevented from getting loans or even losing their home due to unpaid medical bills. The announcement has set a chorus into motion from those who believe money grows on trees, and debt can be magically erased. For economically-illiterate, quixotic activists who think money can (and should) be printed out of thin air, hundreds of billions of dollars in debt can just as easily be made to disappear without economic consequences.

Medical debt shouldn’t show up on credit reports. But also, medical debt shouldn’t exist.

— Nina Turner (@ninaturner) June 13, 2024

Seeking medical treatment in America should not saddle people with debt.

It’s time to cancel medical debt and pass Medicare for all.

Even just banning medical debt from credit scores could potentially fuel inflation and lead to higher medical costs - but the one thing the free money advocates have right is that healthcare is too expensive in America.

The system is in dire need of reform.

But we have a very large country with low homogeneity where the socialized healthcare systems of high-trust societies, like some Nordic nations, would be impossible — not only economically, but culturally as well.

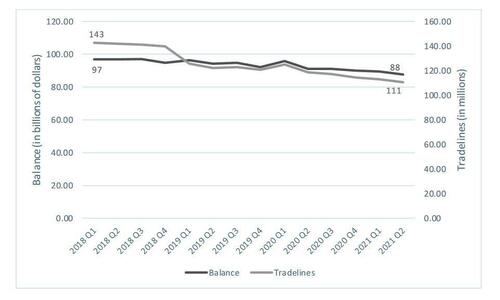

CFPB Data: Medical Debt Collections in Consumer Credit Panel, 2018 – 2021

Medical debt total balance and total tradelines from the CFPB’s Consumer Credit Panel, a 1-in-48 sample of de-identified credit records from one of the three major national consumer reporting agencies

Source: US Consumer Finance Protection Bureau, Medical Debt Burden in the United States. February 2022. Accessed June 2024

We also have an out-of-shape populace locked in a vicious downward cycle of atrocious nutrition, deteriorating health, and compounding pharmaceutical interventions. A “Medicare For All” scheme would inevitably translate to the constant and astronomical (lifestyle-induced) medical costs of the morbidly unhealthy being passed onto Americans who take reasonable steps to stay in decent health. Somewhere around half of adult Americans have totally preventable chronic diseases, and price inflation only worsens this pattern as people turn to cheaper and lower-quality foods to sustain their families.

But in its current form, the system itself is basically devoid of any real free market price discovery mechanism. There’s cartel-ized healthcare pricing where the total on your bill has as much to do with the dynamics of corporate and State monopolies than the cost of the service, materials, and medicines. There isn’t enough competition between giant healthcare providers, and the FDA has created a revolving door system for rubber-stamping products from pharmaceutical giants at the cost of innovation.

There’s little to no incentive to lower costs. Government intervention abounds more than ever with Obama’s Affordable Care Act, and while some are getting affordable insurance who couldn’t before the ACA, it has only achieved this by shoving those costs onto other people.

State intervention, guaranteed loans, and “debt relief” programs in medicine, education, and other industries push up prices for consumers needlessly and arbitrarily by cutting out free market mechanisms, shifting the burden to the rest of us. It’s a political ploy to curry favor to the indebted by selling out the next generation. We need the government involved less, not more, except to the extent that Americans must be protected from entrenched corporate monopolies and public-private cartels. Let the free market speak, let it set the fairest-possible prices through genuine competition, and let it self-regulate.

But a deeper root of the problem is the US dollar itself. Problems ripple outward from this common denominator — when a central bank can set monetary policy and print money on a whim, inflation is inevitable, and costs will go up. If you don’t fix the money, you can’t fix the other issues — and attempts to do so are inevitably trying to address symptoms without addressing foundational causes. From the central bank to the healthcare system, cartels and monopolies and walled gardens abound. It’s Americans who pay the price.

Passing existing debt along to the rest of the country isn’t the answer, and to truly fix healthcare in a lasting way, we must first abolish fiat money.

The Biden Administration’s Consumer Financial Protection Bureau (CFPB) just issued a proposal to ban medical debt from factoring into your credit score. But for free-money socialists and their Keynesian bedfellows, this doesn’t go nearly far enough: short of canceling medical debt entirely, nothing else is acceptable.

The proposal addresses a loophole so that Americans with medical debt aren’t prevented from getting loans or even losing their home due to unpaid medical bills. The announcement has set a chorus into motion from those who believe money grows on trees, and debt can be magically erased. For economically-illiterate, quixotic activists who think money can (and should) be printed out of thin air, hundreds of billions of dollars in debt can just as easily be made to disappear without economic consequences.

Medical debt shouldn’t show up on credit reports. But also, medical debt shouldn’t exist.

— Nina Turner (@ninaturner) June 13, 2024

Seeking medical treatment in America should not saddle people with debt.

It’s time to cancel medical debt and pass Medicare for all.

Even just banning medical debt from credit scores could potentially fuel inflation and lead to higher medical costs - but the one thing the free money advocates have right is that healthcare is too expensive in America.

The system is in dire need of reform.

But we have a very large country with low homogeneity where the socialized healthcare systems of high-trust societies, like some Nordic nations, would be impossible — not only economically, but culturally as well.

CFPB Data: Medical Debt Collections in Consumer Credit Panel, 2018 – 2021

Medical debt total balance and total tradelines from the CFPB’s Consumer Credit Panel, a 1-in-48 sample of de-identified credit records from one of the three major national consumer reporting agencies

Source: US Consumer Finance Protection Bureau, Medical Debt Burden in the United States. February 2022. Accessed June 2024

We also have an out-of-shape populace locked in a vicious downward cycle of atrocious nutrition, deteriorating health, and compounding pharmaceutical interventions. A “Medicare For All” scheme would inevitably translate to the constant and astronomical (lifestyle-induced) medical costs of the morbidly unhealthy being passed onto Americans who take reasonable steps to stay in decent health. Somewhere around half of adult Americans have totally preventable chronic diseases, and price inflation only worsens this pattern as people turn to cheaper and lower-quality foods to sustain their families.

But in its current form, the system itself is basically devoid of any real free market price discovery mechanism. There’s cartel-ized healthcare pricing where the total on your bill has as much to do with the dynamics of corporate and State monopolies than the cost of the service, materials, and medicines. There isn’t enough competition between giant healthcare providers, and the FDA has created a revolving door system for rubber-stamping products from pharmaceutical giants at the cost of innovation.

There’s little to no incentive to lower costs. Government intervention abounds more than ever with Obama’s Affordable Care Act, and while some are getting affordable insurance who couldn’t before the ACA, it has only achieved this by shoving those costs onto other people.

State intervention, guaranteed loans, and “debt relief” programs in medicine, education, and other industries push up prices for consumers needlessly and arbitrarily by cutting out free market mechanisms, shifting the burden to the rest of us. It’s a political ploy to curry favor to the indebted by selling out the next generation. We need the government involved less, not more, except to the extent that Americans must be protected from entrenched corporate monopolies and public-private cartels. Let the free market speak, let it set the fairest-possible prices through genuine competition, and let it self-regulate.

But a deeper root of the problem is the US dollar itself. Problems ripple outward from this common denominator — when a central bank can set monetary policy and print money on a whim, inflation is inevitable, and costs will go up. If you don’t fix the money, you can’t fix the other issues — and attempts to do so are inevitably trying to address symptoms without addressing foundational causes. From the central bank to the healthcare system, cartels and monopolies and walled gardens abound. It’s Americans who pay the price.

Passing existing debt along to the rest of the country isn’t the answer, and to truly fix healthcare in a lasting way, we must first abolish fiat money.