Oil (and gasoline) prices were lower today (WTI sliding back near two-month lows) as the Biden administration said Tuesday it is releasing 1 million barrels of gasoline from a Northeast reserve established after Superstorm Sandy in a bid to lower prices at the pump this summer.

However, the main driver for oil prices right now is "worry about the economy, and the potential that [interest] rates will remain elevated," Michael Lynch, president at Strategic Energy & Economic Research (SEER), told MarketWatch.

Additionally, the market appears to have quickly shrugged off the death of Iranian President Ebrahim Raisi.

Will a third weekly crude draw in a row be enough to re-energize prices ahead of OPEC+'s meetings, where members will "almost certainly roll over" its current quotas when it meets on June 1, "keeping a floor on prices for now," according to SEER's Lynch.

API

-

Crude +2.49mm (-3.1mm exp)

-

Cushing +1.77mm

-

Gasoline +2.09mm

-

Distillates -320k

Crude and Gasoline stock piles grew last week (more than expected) along with inventories at the Cushing hub while Distillates saw a small draw...

Source: Bloomberg

WTI was trading around $78.60 ahead of the API print and slipped lower after...

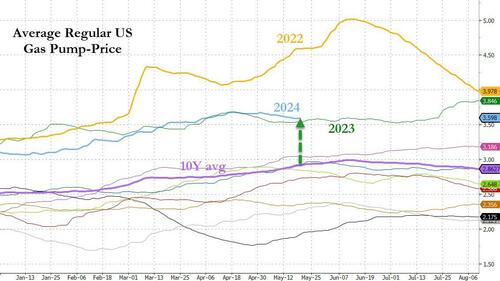

Finally, we note that pump prices are at their second most expensive in a decade ahead of the Memorial Day holiday...

Source: Bloomberg

“As an analyst, this reserve never really made a whole lot of sense to have,'' De Haan said in an Associated Press interview. The reserve is very small and must be frequently rotated, “because gasoline has a shelf life,'' De Haan said.

“That's why there’s really no nation that has an emergency stockpile of gasoline'' other than the U.S.

Patrick De Haan, an analyst for GasBuddy, said sale of the Northeast reserve would have little impact on gasoline prices nationally, although there “may be a slight downward pressure on prices” in the Northeast.

The million-barrel reserve only amounts to about 2.7 hours of total U.S. gasoline consumption, he said.

Finally, Bloomberg notes that for several weeks, oil traders have been confident that OPEC+ will choose to extend supply curbs when the group gathers next month. The latest trend in crude time-spreads probably removes any trace of a doubt.

Oil (and gasoline) prices were lower today (WTI sliding back near two-month lows) as the Biden administration said Tuesday it is releasing 1 million barrels of gasoline from a Northeast reserve established after Superstorm Sandy in a bid to lower prices at the pump this summer.

However, the main driver for oil prices right now is "worry about the economy, and the potential that [interest] rates will remain elevated," Michael Lynch, president at Strategic Energy & Economic Research (SEER), told MarketWatch.

Additionally, the market appears to have quickly shrugged off the death of Iranian President Ebrahim Raisi.

Will a third weekly crude draw in a row be enough to re-energize prices ahead of OPEC+'s meetings, where members will "almost certainly roll over" its current quotas when it meets on June 1, "keeping a floor on prices for now," according to SEER's Lynch.

API

-

Crude +2.49mm (-3.1mm exp)

-

Cushing +1.77mm

-

Gasoline +2.09mm

-

Distillates -320k

Crude and Gasoline stock piles grew last week (more than expected) along with inventories at the Cushing hub while Distillates saw a small draw...

Source: Bloomberg

WTI was trading around $78.60 ahead of the API print and slipped lower after...

Finally, we note that pump prices are at their second most expensive in a decade ahead of the Memorial Day holiday...

Source: Bloomberg

“As an analyst, this reserve never really made a whole lot of sense to have,'' De Haan said in an Associated Press interview. The reserve is very small and must be frequently rotated, “because gasoline has a shelf life,'' De Haan said.

“That's why there’s really no nation that has an emergency stockpile of gasoline'' other than the U.S.

Patrick De Haan, an analyst for GasBuddy, said sale of the Northeast reserve would have little impact on gasoline prices nationally, although there “may be a slight downward pressure on prices” in the Northeast.

The million-barrel reserve only amounts to about 2.7 hours of total U.S. gasoline consumption, he said.

Finally, Bloomberg notes that for several weeks, oil traders have been confident that OPEC+ will choose to extend supply curbs when the group gathers next month. The latest trend in crude time-spreads probably removes any trace of a doubt.