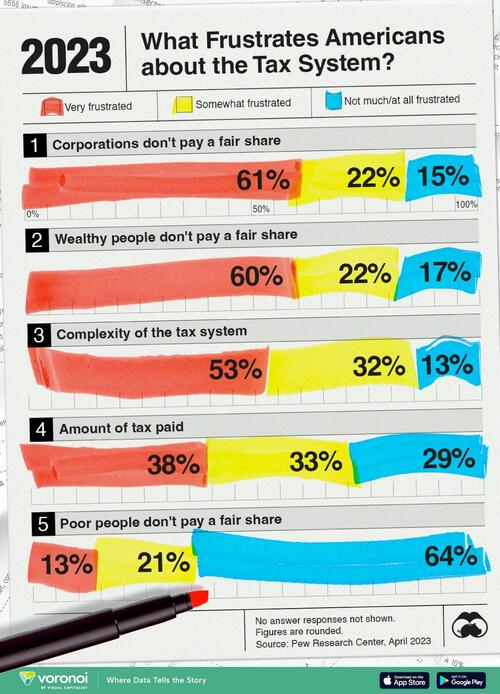

In this visualization, Visual Capitalist's Pallavi Rao shows Pew Research’s findings on what bothers Americans the most about the tax system.

This data was collected after surveying more than 5,000 American adults between the period of March 27-April 2, 2023.

The survey was weighted to be representative of the U.S. adult population. Visit Pew Research’s methodology page for more details.

Americans Want More Taxes for Some

Six in every 10 Americans feel that both corporations and the wealthy don’t pay their 'fair share' in federal taxes.

Their sentiments are not entirely unfounded.

Note: No answer responses are not shown, thus percentages may not sum to 100.

A 2021 ProPublica investigation found some of the wealthiest Americans - also the wealthiest people in the world - did not pay a single penny in federal income taxes in some years.

A significant part of why this is possible is how taxes are collected depending on the source. Since much of the top 1% grow their wealth in equity and property, they are not subject to taxes until they make an actual transaction.

As this Brookings Institution article explains: most Americans make money through their wages, and wages are subject to heavier taxation than capital income.

Thus, the tax share of America’s highest-income households is often lower than America’s middle-income households.

Finally, Pew Research noted that their findings were essentially unchanged since 2021.

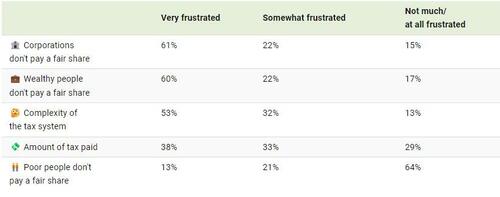

In this visualization, Visual Capitalist's Pallavi Rao shows Pew Research’s findings on what bothers Americans the most about the tax system.

This data was collected after surveying more than 5,000 American adults between the period of March 27-April 2, 2023.

The survey was weighted to be representative of the U.S. adult population. Visit Pew Research’s methodology page for more details.

Americans Want More Taxes for Some

Six in every 10 Americans feel that both corporations and the wealthy don’t pay their 'fair share' in federal taxes.

Their sentiments are not entirely unfounded.

Note: No answer responses are not shown, thus percentages may not sum to 100.

A 2021 ProPublica investigation found some of the wealthiest Americans - also the wealthiest people in the world - did not pay a single penny in federal income taxes in some years.

A significant part of why this is possible is how taxes are collected depending on the source. Since much of the top 1% grow their wealth in equity and property, they are not subject to taxes until they make an actual transaction.

As this Brookings Institution article explains: most Americans make money through their wages, and wages are subject to heavier taxation than capital income.

Thus, the tax share of America’s highest-income households is often lower than America’s middle-income households.

Finally, Pew Research noted that their findings were essentially unchanged since 2021.