Painting a concerning picture, the median retirement savings for Americans stands at a mere $87,000, a figure far lower than what is needed for a comfortable nest egg.

This savings gap—the amount people have actually saved versus what they believe is needed for retirement—is significantly rising. In fact, a recent survey from Northwestern Mutual reveals that $1.46 million is the ideal savings target for retirement, up from $1.27 million last year.

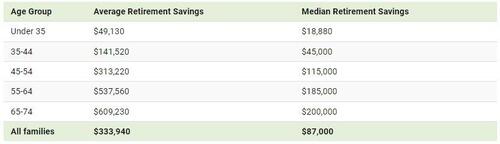

This graphic, via Visual Capitalist's Niccolo Conte, shows the retirement savings that Americans currently hold, based on data from the Federal Reserve’s 2022 Survey of Consumer Finances.

Savings for Retirement Fall Short

Below, we show the average and median retirement savings in the U.S. by age group:

For people aged 35 and under, the median savings were $18,880, while this amount increased to $200,000 for those aged 65 to 74.

At current rates, this means that older generations are living on a mere $10,000 per year in retirement based on these savings alone. Given this shortfall, Americans will need to increasingly rely on Social Security benefits to make ends meet. In fact, it’s estimated that state and federal governments will need $1.4 trillion for public assistance costs by 2040.

One reason behind declining retirement savings is the steep drop in employment-sponsored pension plans over the last several decades. As of 2022, there was $37.8 trillion held in U.S. pension plans and Individual Retirement Accounts (IRAs). Of these, employment-sponsored plans comprised a substantial 70% share of these assets.

However, for many Americans without employer-sponsored plans, saving for retirement has become an increasingly uphill battle. In fact, a separate survey shows that just 58% of Americans aged 55 to 64 have retirement accounts, underscoring the growing challenges faced in preparing for retirement.

Among the most common retirement planning mistakes are underestimating the impact of inflation, one’s life expectancy, and healthcare costs. To combat this problem, 12 states have adopted automated retirement savings accounts for private employees. These programs, impacting up to 56 million people, enroll employees automatically with the choice to opt out, to help encourage Americans to save for the future.

Painting a concerning picture, the median retirement savings for Americans stands at a mere $87,000, a figure far lower than what is needed for a comfortable nest egg.

This savings gap—the amount people have actually saved versus what they believe is needed for retirement—is significantly rising. In fact, a recent survey from Northwestern Mutual reveals that $1.46 million is the ideal savings target for retirement, up from $1.27 million last year.

This graphic, via Visual Capitalist's Niccolo Conte, shows the retirement savings that Americans currently hold, based on data from the Federal Reserve’s 2022 Survey of Consumer Finances.

Savings for Retirement Fall Short

Below, we show the average and median retirement savings in the U.S. by age group:

For people aged 35 and under, the median savings were $18,880, while this amount increased to $200,000 for those aged 65 to 74.

At current rates, this means that older generations are living on a mere $10,000 per year in retirement based on these savings alone. Given this shortfall, Americans will need to increasingly rely on Social Security benefits to make ends meet. In fact, it’s estimated that state and federal governments will need $1.4 trillion for public assistance costs by 2040.

One reason behind declining retirement savings is the steep drop in employment-sponsored pension plans over the last several decades. As of 2022, there was $37.8 trillion held in U.S. pension plans and Individual Retirement Accounts (IRAs). Of these, employment-sponsored plans comprised a substantial 70% share of these assets.

However, for many Americans without employer-sponsored plans, saving for retirement has become an increasingly uphill battle. In fact, a separate survey shows that just 58% of Americans aged 55 to 64 have retirement accounts, underscoring the growing challenges faced in preparing for retirement.

Among the most common retirement planning mistakes are underestimating the impact of inflation, one’s life expectancy, and healthcare costs. To combat this problem, 12 states have adopted automated retirement savings accounts for private employees. These programs, impacting up to 56 million people, enroll employees automatically with the choice to opt out, to help encourage Americans to save for the future.