As part of the latest in the Western allies' (some of them at least) controversial push to confiscate Russian sovereign assets and give them to Ukraine, the Biden administration is leading talks among G7 nations to commit to a new military aid package for Kiev worth up to $50 billion.

"Ideally, this is something we would like the entire G7 to participate in, be part of, not just have the United States doing it alone," US Treasury Secretary Janet Yellen told Bloomberg. She further confirmed that Group of Seven countries are currently "discussing" the plan.

The package would be funded from interest accrued via investments utilizing the some $300 billion in Russian assets currently frozen in Western banks. The bulk of the frozen funds are in European banks, and some EU leaders fear devastating backlash and global distrust in its banking system would be the end result.

These frozen assets within the European Union (some $280 billion) are currently said to generate about 5 billion euros ($5.3 billion) in windfall profits annually.

According to more details via Bloomberg:

Some €159 billion of frozen Russian assets have generated net profit of €557 million ($601 million) from Feb. 15, according to Euroclear’s first quarter financial results. Since last year, the assets have generated about €3.9 billion in net profit.

Russian sovereign assets held by the company could grow to as much as €190 billion by 2028 as they mature into cash, one of the people said.

The US is hoping that consensus agreement can be achieved for its plan by the time of the G7 June meeting in Italy, where it could be signed off on. Biden officials have recently floated concepts like "freedom bonds" to sell the idea among allies.

In response, the Kremlin has vowed to be "extremely tough" on "thieves" who appropriate what belongs to Russia. "Considering that our country has qualified this as theft, the attitude will be towards thieves," Foreign Ministry Spokeswoman Maria Zakharova earlier stated. "Not as political manipulators, not as overplayed technologists, but as thieves," she emphasized.

The Western allies have out of recent desperation over Ukraine's diminished ammo been getting creative, and seeking to find loopholes in order to free up extra funds that could be used in the war effort.

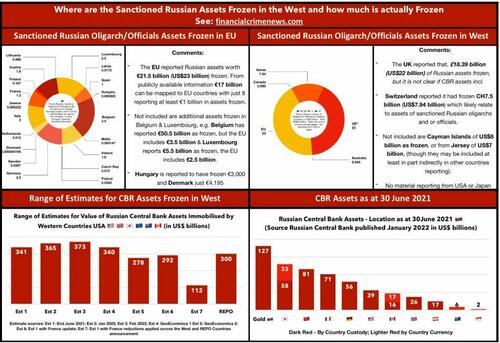

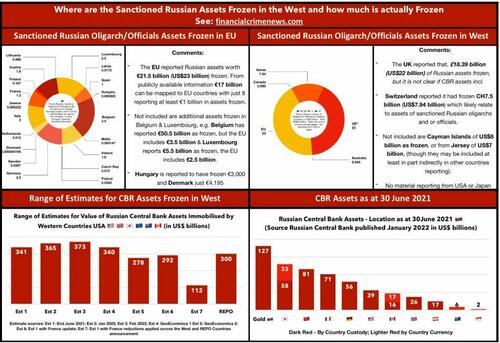

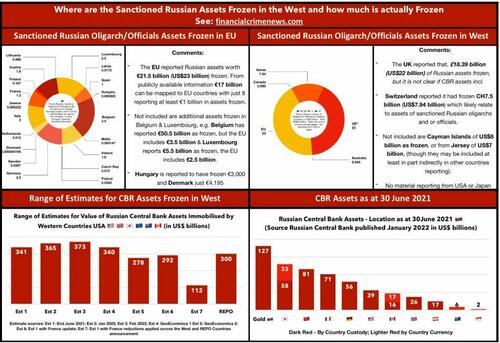

Which Russian assets are sanctioned and where are they held... (click image for bigger):

Britain has meanwhile been at the forefront of countries arguing that the total of all underlying Russian assets should be fully confiscated and used for Ukraine.

"Our view is simple: One day, Russia will have to pay reparations and it doesn’t make sense to wait for those reparations. It makes better sense to use the frozen assets and to make that money available now," UK Foreign Secretary David Cameron said in March. The UK has since stuck by the position, also jumping on board with Washington's ambitious asset seizure plan.

As part of the latest in the Western allies' (some of them at least) controversial push to confiscate Russian sovereign assets and give them to Ukraine, the Biden administration is leading talks among G7 nations to commit to a new military aid package for Kiev worth up to $50 billion.

"Ideally, this is something we would like the entire G7 to participate in, be part of, not just have the United States doing it alone," US Treasury Secretary Janet Yellen told Bloomberg. She further confirmed that Group of Seven countries are currently "discussing" the plan.

The package would be funded from interest accrued via investments utilizing the some $300 billion in Russian assets currently frozen in Western banks. The bulk of the frozen funds are in European banks, and some EU leaders fear devastating backlash and global distrust in its banking system would be the end result.

These frozen assets within the European Union (some $280 billion) are currently said to generate about 5 billion euros ($5.3 billion) in windfall profits annually.

According to more details via Bloomberg:

Some €159 billion of frozen Russian assets have generated net profit of €557 million ($601 million) from Feb. 15, according to Euroclear’s first quarter financial results. Since last year, the assets have generated about €3.9 billion in net profit.

Russian sovereign assets held by the company could grow to as much as €190 billion by 2028 as they mature into cash, one of the people said.

The US is hoping that consensus agreement can be achieved for its plan by the time of the G7 June meeting in Italy, where it could be signed off on. Biden officials have recently floated concepts like "freedom bonds" to sell the idea among allies.

In response, the Kremlin has vowed to be "extremely tough" on "thieves" who appropriate what belongs to Russia. "Considering that our country has qualified this as theft, the attitude will be towards thieves," Foreign Ministry Spokeswoman Maria Zakharova earlier stated. "Not as political manipulators, not as overplayed technologists, but as thieves," she emphasized.

The Western allies have out of recent desperation over Ukraine's diminished ammo been getting creative, and seeking to find loopholes in order to free up extra funds that could be used in the war effort.

Which Russian assets are sanctioned and where are they held... (click image for bigger):

Britain has meanwhile been at the forefront of countries arguing that the total of all underlying Russian assets should be fully confiscated and used for Ukraine.

"Our view is simple: One day, Russia will have to pay reparations and it doesn’t make sense to wait for those reparations. It makes better sense to use the frozen assets and to make that money available now," UK Foreign Secretary David Cameron said in March. The UK has since stuck by the position, also jumping on board with Washington's ambitious asset seizure plan.

As part of the latest in the Western allies' (some of them at least) controversial push to confiscate Russian sovereign assets and give them to Ukraine, the Biden administration is leading talks among G7 nations to commit to a new military aid package for Kiev worth up to $50 billion.

"Ideally, this is something we would like the entire G7 to participate in, be part of, not just have the United States doing it alone," US Treasury Secretary Janet Yellen told Bloomberg. She further confirmed that Group of Seven countries are currently "discussing" the plan.

The package would be funded from interest accrued via investments utilizing the some $300 billion in Russian assets currently frozen in Western banks. The bulk of the frozen funds are in European banks, and some EU leaders fear devastating backlash and global distrust in its banking system would be the end result.

These frozen assets within the European Union (some $280 billion) are currently said to generate about 5 billion euros ($5.3 billion) in windfall profits annually.

According to more details via Bloomberg:

Some €159 billion of frozen Russian assets have generated net profit of €557 million ($601 million) from Feb. 15, according to Euroclear’s first quarter financial results. Since last year, the assets have generated about €3.9 billion in net profit.

Russian sovereign assets held by the company could grow to as much as €190 billion by 2028 as they mature into cash, one of the people said.

The US is hoping that consensus agreement can be achieved for its plan by the time of the G7 June meeting in Italy, where it could be signed off on. Biden officials have recently floated concepts like "freedom bonds" to sell the idea among allies.

In response, the Kremlin has vowed to be "extremely tough" on "thieves" who appropriate what belongs to Russia. "Considering that our country has qualified this as theft, the attitude will be towards thieves," Foreign Ministry Spokeswoman Maria Zakharova earlier stated. "Not as political manipulators, not as overplayed technologists, but as thieves," she emphasized.

The Western allies have out of recent desperation over Ukraine's diminished ammo been getting creative, and seeking to find loopholes in order to free up extra funds that could be used in the war effort.

Which Russian assets are sanctioned and where are they held... (click image for bigger):

Britain has meanwhile been at the forefront of countries arguing that the total of all underlying Russian assets should be fully confiscated and used for Ukraine.

"Our view is simple: One day, Russia will have to pay reparations and it doesn’t make sense to wait for those reparations. It makes better sense to use the frozen assets and to make that money available now," UK Foreign Secretary David Cameron said in March. The UK has since stuck by the position, also jumping on board with Washington's ambitious asset seizure plan.