US equity futures flipped between gains and losses on Wednesday while European stocks hit an all time high as May’s rally in equities continued amid a clutch of solid earnings reports. As of 7:45am, S&P 500 futures traded down 0.2%, and was near session lows reversing an earlier modest gain after the underlying gauge advanced the previous four sessions. The benchmark Treasury yield rose two basis points to 4.48%. Oil fell to the lowest level since mid-March, after a mildly bearish US stockpile report. The renewed plunge in the yen took the USDJPY as high as 155.5 amid a renewed bout of impotent jawboning by Japanese officials who however have now lost all credibility. Later today the focus will be on comments from Fed officials, including Lisa Cook, and earnings from Uber, Arm and Airbnb.

Among notable premarket movers, Lyft shares rose after the ride-hailing firm’s results and outlook beat estimates. Reddit rises 13% after the social-media company reported first-quarter results that beat expectations and gave an outlook that surpassed estimates even though there is no way in hell the company can ever achieve that forecast but at least it will enjoy a higher stock price for a few months. Here are some other notable premarket movers:

- Arista Networks gains 6.8% after the cloud-networking company posted a 1Q profit that beat estimates amid strong AI demand trends.

- Confluent climbs 7.6% after the application software company reported first-quarter results that beat expectations.

- Coupang falls 7.8% after earnings per share missed estimates, driven mostly by losses attributable to its Farfetch acquisition.

- DoubleVerify plummets 42% after the digital media measurement software company cut its full-year forecast.

- Dutch Bros jumps 7.8% after the drive-thru coffee chain lifted full-year projections for revenue.

- Electronic Arts slips 3.8% after the video-game maker’s first-quarter bookings forecast fell shy of estimates.

- Luminar rises 6% after the LiDAR sensor maker’s results broadly met expectations

- Lyft gains 5% after the ride-hailing firm’s results and outlook beat estimates.

- Rivian drops 6.8% after the EV-maker reported a wider-than-expected adjusted loss for the first quarter.

- Shoals Technologies (SHLS) falls 16% after the solar energy equipment supplier cut its revenue guidance for the year.

- Shopify shares tumble 18% after the Canadian e-commerce company reported a surprise net loss in the first quarter.

- Treace Medical tumbles 59% after the medical device company cut its full-year revenue guidance.

- TripAdvisor drops 16% after management determined that there is no transaction with a third party that is in the best interests of the company and its stockholders.

- Twilio falls 8% after the software company’s second-quarter guidance fell short of the average analyst estimate.

- Uber Technologies falls 6% as gross bookings in the first quarter missed analysts’ estimates.

- Upstart declines 12% after the consumer finance company forecast revenue for the second quarter that missed analysts’ expectations.

- ZoomInfo Technologies slumps 23% after the infrastructure software company’s forecasts for revenue and profit trailed Wall Street’s expectations.

Investors saying goodbye to Q1 earnings season and enjoying a 3% S&P 500 rally in May are now uncertain what comes next, as US policymakers signal bets on a pivot to easier policy may be premature. Minneapolis Fed president Neel Kashkari said it’s likely the central bank will keep rates where they are “for an extended period of time" although Neel is best known for always being wrong about everything so taking the other side my seem prudent.

“We are now crawling through the tail end of earnings season and the market is lapsing into complacency,” said Hugh Grieves, fund manager of the Premier Miton US Opportunities fund. “The economy is ‘okay,’ rate cuts remain on the table and the oil price is declining. Unfortunately that’s not a stable equilibrium.”

The Fed’s stubborn hawkish stance as a result of even more stubborn inflation has put it out of sync with central banks in Europe that have already embarked on easing. Earlier Wednesday, Sweden’s Riksbank kicked off its rate cutting cycle, easing policy for the first time in eight years. That followed the Swiss National Bank’s decision to leapfrog peers with an interest rate cut in March. Meanwhile, Fed Governor Lisa Cook is due to speak later Wednesday.

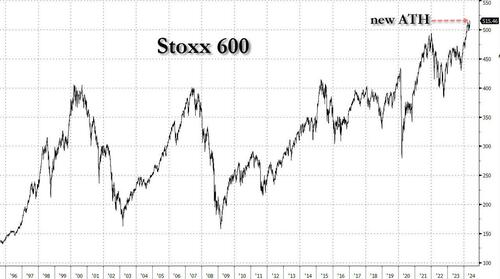

Europe's Stoxx 600 rose 0.4%, sending European stocks rise to a record high after another batch of strong corporate earnings including sold results from Siemens Energy (for once).

Elsewhere, strong earnings from AB InBev lift food and beverages, which leads gains among sectors, while auto stocks and miners lag, with BP notching a second day of losses. Here are the most notable European movers:

- AB InBev shares rise as much as 5%, the most in three months, after reporting stronger organic adjusted Ebitda growth than expected in the first quarter.

- Ahold Delhaize shares rise as much as 4.6% after improvement in US sales momentum and the timing of the Easter holiday drove a beat in 1Q Ebit.

- Fresenius shares gain as much as 5% after the German health-care company increased its organic revenue growth guidance for the full year.

- Siemens Energy shares rise as much as 14% after the company posted forecast-beating orders and boosted its guidance.

- Puma shares rise as much as 6.4% after the apparel retailer delivered a 1Q Ebit beat and reaffirmed its guidance for the full year.

- Alstom shares gain as much as 11% after the French train maker announced plans for a capital increase of around €1 billion.

- Evonik shares climb as much as 2.2% after the chemicals company reported 1Q adjusted Ebitda that beat estimates.

- Auto1 shares jump as much as 25% after the German used-car-dealer raised its gross profit forecast for the full year.

- Grifols shares advance as much as 5.4% after the Spanish blood plasma firm’s board of directors adopted various resolutions to strengthen corporate governance.

- Sabadell shares slip as much as 3.8% after the Spanish bank released a letter sent to its chairman on the weekend from rival BBVA, saying it had no room to improve its takeover offer.

- Continental shares fall as much as 1.8% after the German tiremaker’s 1Q Ebit missed the average analyst estimates.

- Securitas shares fall as much as 4.5% after the firm reported its latest earnings which analysts say were hit by weak cash performance.

- Carl Zeiss Meditec shares drop as much as 6.9%, the most in about a year, after the German medical optics company reported weaker-than-expected results for the second quarter.

“Right now we’re seeing the broadening of performance, especially from the earnings perspective,” Nataliia Lipikhina, head of EMEA equity strategy at JPMorgan Private Bank, said in an interview on Bloomberg TV. “The market wanted to see that earnings in different sectors, not just tech, are delivering.”

Earlier in the session, stocks in Asia were set to halt a four-day winning streak as focus shifted to earnings to validate a recent rally. The MSCI Asia Pacific Index slipped as much as 0.9% after closing at a two-year high in the previous session. Japanese tech firms Sony and Nintendo were among the biggest drags to the gauge, with the latter dropping more than 5% on weak outlook. The country’s benchmarks fell more than 1% in the region’s worst performance. Chinese onshore benchmarks posted their first decline this week amid a warning from Morgan Stanley strategists that the recent rally is likely to abate. Hong Kong stocks also fell. Index heavyweights Tencent and Alibaba are among key tech firms to release earnings next week, and the results will be crucial for the rally to resume.

In FX, the Swedish krona is among the worst performing G-10 currencies, falling 0.4% versus the greenback after the Riksbank cut its benchmark interest rate for the first time in eight years and said it could be reduced twice more in the second half of 2024. The yen weakens 0.5% against the dollar, with USD/JPY around 155.50.

In rates, treasuries were slightly cheaper across the curve with losses led by intermediate- to long-end sectors, steepening curve spreads. US long-end yields are cheaper by 2bps, steepening 2s10s spread by 1.5bp, 5s30s by 0.5bp; the 10-year is around 4.48% with bunds lagging by 1.5bp in the sector amid new record high for Europe’s Stoxx 600 Index after another batch of strong corporate earnings. Supply concession is also a factor for Treasuries with 10-year note sale later Wednesday and 30-year bond auction Thursday. Indeed, the week's refunding auction cycle continues at 1pm New York time with $42b 10-year new issue one day after Tuesday’s 3-year note sale drew good demand, stopping through by 0.3bp. WI 10-year yield at around 4.48% is 8bp richer than April’s, which tailed by 3.1bp in a poor result.

In commodities, oil prices decline, with WTI falling 1.6% to trade near $77.20. Spot gold drops 0.1%.

Looking at today's calendar, the US economic data slate includes March wholesale inventories (10am). Fed members’ scheduled speeches include Jefferson (11am), Collins (11:45am) and Cook (1:30pm) From central banks, the Riksbank was the latest western bank to commence an easing cycle cutting rates to 3.75%. Finally in the US, a 10yr Treasury auction is taking place.

Market Snapshot

- S&P 500 futures little changed at 5,214.75

- STOXX Europe 600 up 0.3% to 515.72

- MXAP down 1.0% to 176.52

- MXAPJ down 0.4% to 550.52

- Nikkei down 1.6% to 38,202.37

- Topix down 1.4% to 2,706.43

- Hang Seng Index down 0.9% to 18,313.86

- Shanghai Composite down 0.6% to 3,128.48

- Sensex little changed at 73,495.37

- Australia S&P/ASX 200 up 0.1% to 7,804.49

- Kospi up 0.4% to 2,745.05

- German 10Y yield little changed at 2.44%

- Euro down 0.1% to $1.0741

- Brent Futures down 1.2% to $82.15/bbl

- Gold spot down 0.4% to $2,305.33

- US Dollar Index up 0.18% to 105.60

Top Overnight News

- Chinese iPhone shipments jumped about 12% in March after Apple Inc. and its retailers slashed prices, official data showed, suggesting efforts to arrest an accelerating decline in sales are yielding early results. BBG

- The BOJ may take monetary policy action if yen falls affect prices significantly, governor Kazuo Ueda said on Wednesday, offering the strongest hint to date the currency's relentless declines could trigger another interest rate hike. Ueda also said the BOJ could raise interest rates sooner than expected if inflation overshoots its forecasts, or risks to the price outlook increases. RTRS

- Germany’s industrial production for Mar was a bit better than anticipated, coming in -0.4% M/M (vs. the Street’s -0.7% forecast), although Feb was revised lower (from +2.1% to +1.7%). BBG

- Sweden’s central bank lowered rates 25bp (from 4% to 3.75%) and said two additional reductions could happen in H2 (the Riksbank is only the second monetary body from an advanced economy to commence easing since the post-COVID inflation surge after Switzerland’s central bank cut in March). RTRS

- Indiana primary results showed Haley performing very well, signaling a large anti-Trump faction of the GOP exists. Politico

- Trump’s classified documents trial in Florida has been postponed indefinitely, raising the odds that the current Stormy Daniels/hush money one underway in NYC is the only verdict voters will receive before the election. WaPo

- Corporate profits are performing very well (firms beat in Q1 and analysts have been raising estimates for Q2), suggesting an economic downturn won’t occur anytime soon. WSJ

- Saudi-backed chip and AI investment firm Alat said it would divest from China if it were asked to do so by the US. The comments came after people familiar said the US revoked licenses allowing Huawei to buy chips from Intel and Qualcomm. BBG

- FTX will amass as much as $16.3 billion in cash once it sells all of its assets, far more than it needs to cover what customers lost. The extra will be used to pay them interest but nothing will be left for equity holders. BBG

Earnings

- BMW (BMW GY) Q1 (EUR): Revenue 36.61bln (exp. 36.82bln). EBIT 4.05bln (exp. 3.96bln). Automotive revenue 30.94bln (exp. 31.01bln). Automotive EBIT Margin 8.8% (exp. 9.05%). EBT Margin 11.4% (exp. 10.6%). BEV sales +28% Y/Y. 2024 outlook confirmed. Shares -4.5% in European trade

- Siemens Energy (ENR GY) Q2 (EUR): FCF 483mln (prev. -294mln Y/Y), Profit before special items 170mln (prev. 41mln Y/Y), Net Profit 108mln (exp. -11mln). Outlook: Expects sales growth 10-12% (exp. +6%), Profit margin of -1% to +1% (prev. guided -2% to +1%). Now expects FCF pretax of up to 1bln (prev. guided negative at up to 1bln). Shares +12.5% in European trade

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly lower after the choppy US performance and in the absence of fresh catalysts. ASX 200 lacked firm direction with gains in industrials and energy offset by weakness in miners and financials. Nikkei 225 underperformed as participants digested earnings including disappointing guidance by Nintendo. Hang Seng & Shanghai Comp were ultimately lower amid trade and tech-related frictions after the US revoked export licences that allowed Intel (INTC) and Qualcomm (QCOM) to supply Huawei with semiconductors.

Top Asian News

- BoJ Governor Ueda said the BoJ will scrutinise the impact of yen moves on the economy in guiding monetary policy and FX moves could have a big impact on the economy and prices, so could warrant a monetary policy response, while he added the BoJ may need to respond via monetary policy if such impact from yen moves affect trend inflation. Ueda said they expect trend inflation to gradually head towards 2% and will adjust monetary policy as appropriate if trend inflation heads toward 2% as projected or if they see a risk of inflation overshooting their forecast. Furthermore, Ueda said they don't see yen moves as having a big impact on trend inflation so far but there is a risk the impact could become more significant in the future and they won't necessarily wait until inflation achieves their forecasts in 1.5 to 2 years to raise rates with the central bank to adjust the degree of monetary support accordingly if trend inflation moves as projected.

- Japanese Finance Minister Suzuki said he is watching FX movements with a sense of urgency and won't comment on forex levels, while he added it is important for currencies to move in a stable manner reflecting fundamentals. Furthermore, he said they will take a thorough response for forex and don't believe that resources for intervention are limited.

- Chinese April Prelim Retail Car Sales -2% Y/Y (vs +6% in March).

- BoJ Governor Ueda says Japan's economy is recovering moderately albeit with some weakness; will guide policy appropriately from perspective of stably and sustainably achieving the price target. Rapid/abrupt and one-sided Yen falls are negative for Japan's economy are undesirable.

European bourses, Stoxx600 (+0.3%) are almost entirely in the green, with indices initially opening tentatively around the unchanged mark before picking up gradually to session highs throughout the morning. European sectors are mixed, with Food Beverage and Tobacco at the top of the pile, lifted by post-earning strength in AB InBev (+4.4%). Basic Resources is the clear underperformer, given the weakness in underlying metals prices; Autos are also hampered by poor BMW (-4.5%) results. US Equity Futures (ES U/C, NQ U/C, RTY -0.3%) are mixed and trading with little direction, continuing the tentative price action seen in the prior session. Apple (+0.6% pre-market) gains amid reports that its China iPhone shipments rose 12% in March.

Top European News

- The BoE should leave rates unchanged at its meeting on Thursday but consider lowering them in June, according to the Times' shadow MPC.

- UK Home Office announced on Tuesday night that it was aware of a technical issue affecting E-gates across the country, while it was working closely with the Border Force and affected airports to resolve the issue. However, Heathrow Airport later stated that all Border Force systems were now running as usual and it did not expect any issues this morning when the operation starts up.

- ECB's Scicluna is to face charges of “fraud and misappropriation,” relating to his time as the Finance Minister of Malta, via Politico citing documents.

- Riksbank cuts its Rate by 25bps to 3.75% (as expected by a majority of respondents); Policy rate is expected to be cut two more times during H2 if inflation outlook cuts (bringing total 2024 cuts to 3 vs prev. guided just over 2).

- Barclays European Equity Strategy; raises Utilities to Market Weight from Underweight; cuts Energy to Market Weight from Overweight

FX

- USD is firmer vs. all peers but to varying degrees. Support for the DXY has in large part been provided by further upside in USD/JPY. Fresh US fundamentals are lacking in what could well be a quiet week ahead of next week's inflation metrics, though a handful of speakers and supply populate today's docket. As such, DXY has continued to consolidate around the mid-point of the 105 handle.

- EUR is softer vs. the USD but less so than peers with some support via the EUR/GBP and EUR/SEK crosses. Fresh fundamental drivers for the Eurozone are lacking and expectations of a June ECB cut remain firmly anchored. Currently trading around 1.074.

- GBP is softer vs. the broadly firmer USD with UK specifics light ahead of tomorrow's BoE which some are framing as a potential dovish hold. Cable has slipped to the 1.24 handle, going as low as 1.2468.

- JPY is losing further ground to the USD with jawboning efforts from Japanese officials futile. 155.41 is the high watermark thus far with the next target a test of 156. CPI next week likely to be the next inflection point for the pair. Commentary from BoJ Governor Ueda sparked some volatility, though was ultimately unreactive to the commentary.

- Antipodeans are both softer vs. the USD with AUD lagging alongside downside in metals prices. AUD/USD has extended on yesterday's downside which has seen the pair dragged from Friday's post-NFP peak at 0.6647 to a current low of 0.6565.

- SEK is losing ground vs. peers as the Riksbank pulls the trigger on a rate reduction and leaves the door open to another two cuts in the second half of the year. Accordingly, EUR/SEK has jumped from 11.691 to a high of 11.7564 but has failed to test the YTD peak at 11.7708.

- PBoC set USD/CNY mid-point at 7.1016 vs exp. 7.2202 (prev. 7.1002).

Fixed Income

- USTs are a touch softer, in-fitting with the narrative outlined for Bunds above but with USTs yet to meaningfully or lastingly deviate from the unchanged mark in narrow 108-28+ to 109-03 bounds. 10yr supply and Fed speak from Cook, Collins and Jefferson scheduled.

- Bunds are under modest pressure as the fixed income complex takes a very slight breather from the bullish action that has been in place since the Payrolls report on Friday. After printing an earlier 131.45 base Bunds have since stabilised around 20 ticks above this.

- Gilts are essentially unchanged, and under some very modest pressure at the open which was softer by 15 ticks given bearish leads elsewhere. UK-specific developments light. Overnight, the Times Shadow MPC said the BoE on Thursday should leave rates unchanged. Currently holding around 97.95 towards Tuesday's close and by extension at the top-end of that session's 97.48-98.08 bounds.

- UK sells GBP 2.5bln 1.50% 2053 Green Gilt: b/c 3.26x (prev. 3.05x), average yield 4.545% (prev. 4.565%), tail 0.6bps (prev. 0.3bps).

Commodities

- A downbeat morning for the crude complex with newsflow rather light and Israel's Rafah operation seemingly not likely to spark a wider conflict as things stand, though the situation remains very fluid. Brent July slipped from USD 83.05/bbl to 81.96/bbl, with some flagging the 200 DMA around USD 81.95/bbl.

- Another soft session for precious metals, likely as Israel's "limited" Rafah operation has failed to spark a regional war, with international efforts also underway to cushion the impact of the incursion. XAU trades towards the bottom of a 2,303.75-2,321.53/oz range.

- Lower across the board for base metals amid a firmer Dollar and following the downbeat mood in Chinese markets overnight.

- US Private Energy Inventory Data (bbls): Crude +0.5mln (exp. -1.1mln), Cushing +1.3mln, Gasoline +1.5mln (exp. -1.3mln), Distillate +1.7mln (exp. -1.1mln).

- Russian Deputy PM Novak said there are no discussions about an oil output increase at OPEC+.

- EU Ambassadors will today be discussing a new package of sanctions against Russia, where the focus will be on restricting LNG profits, via Politico.

- Indonesia's President said copper concentrate export permits for Freeport and Amman will be extended with the details of the extension still being calculated, according to Reuters.

- Morgan Stanley has removed its USD 4/bbl risk premium from Brent forecasts, reverts forecast back to forecast of USD 90/bbl by Q3; expects OPEC to extend current production agreement at June 1st meeting, eventually to year-end, including voluntary cuts.

- China Industry Ministry says the draft rules would guide Lithium battery firms to reduce manufacturing projects that "purely" expand production capacity

Geopolitics: Middle East

- "IDF: We are conducting a precision operation in limited areas east of Rafah in the southern Gaza Strip", according to Asharq News. Additionally, "IDF says it continues operations east of Rafah", via Al Arabiya, "IDF: Hamas military infrastructure destroyed in the Rafah crossing area".

- Israeli artillery shelling was reported east of Rafah in the southern Gaza strip, according to Al Jazeera.

- Hamas said Cairo talks are the 'last chance' for Israel to recover hostage talks, according to Al Arabiya. Furthermore, a Hamas official said the group set red lines in the ceasefire negotiations that cannot be conceded, according to Sky News Arabia.

- White House thinks the Israeli operation to capture the Rafah crossing doesn't cross President Biden's "red line" that could lead to a shift in US policy towards the Gaza war although the US warned that if it broadens or gets out of control and Israeli forces go into the city of Rafah itself, it will be a breaking point, according to US officials cited by Axios.

- CIA Director Burns plans to travel to Israel on Wednesday for talks with Israeli PM Netanyahu and Israeli officials, according to a source cited by Reuters.

Geopolitics: Other

- Ukrainians hit a fuel depot in the Russian-controlled city of Luhansk, according to sources via X.

- Russia launched an air attack on Kyiv, according to Ukraine's military. It was later reported that Russia targeted energy facilities in Kyiv, Poltava, Lviv and other regions, according to Ukraine's Energy Minister. Furthermore, Ukraine's largest private electricity company said the Russian attack caused serious damage at three thermal power plants.

- Taiwan's leader is open to dialogue with Beijing on an equal footing, according to Taipei's de facto envoy to the US under President-elect Lai cited by SCMP.

US Event Calendar

- 07:00: May MBA Mortgage Applications, prior -2.3%

- 10:00: March Wholesale Trade Sales MoM, est. 0.8%, prior 2.3%

- 10:00: March Wholesale Inventories MoM, est. -0.4%, prior -0.4%

Fed speakers

- 11:00: Fed’s Jefferson Speaks About Careers in Economics

- 11:45: Fed’s Collins Speaks to MIT Students

- 13:30: Fed’s Cook Speaks on Financial Stability

DB's Jim Reid concludes the overnight wrap

As summer finally threatens to arrive here in London, even if I'm looking out on fog this morning as I type, markets continued their advance yesterday, with the risk rally continuing post what was deemed to be a very dovish payroll print last Friday. As recently as April 25th, 10yr yields peaked at 4.735% intra-day but a -28bps rally to 4.46% has come alongside a more optimistic view on rate cuts this year again. Obviously Fed Chair Powell helped this by playing down the prospect of further rate hikes at last week’s FOMC. 10yr yields have rallied around 24bps since their peak on FOMC day and yields have now fallen for a 5th consecutive session. That’s the longest run of declines since August.

Those moves on the rates side supported risk assets too, with the STOXX 600 (+1.14%) and the FTSE 100 (+1.22%) both hitting a new record yesterday as UK equities resumed trading after the holiday. The advance was more moderate in the US, but the S&P 500 (+0.13%) still posted a 4th consecutive advance despite underperformance from tech stocks. It now means the S&P has posted its strongest 4-day rally since November, having risen by +3.37% since the close last Wednesday after Powell’s press conference. Moreover, it’s worth noting that the equal-weighted S&P 500 managed to post a stronger +0.28% gain, since the Magnificent 7 (-0.50%) dragged down the rest of the index amidst larger declines from Tesla (-3.76%) and Nvidia (-1.72%). Otherwise, Disney (-9.51%) was a standout after their earnings release, and was the second-worst performer in the S&P 500 yesterday.

Asian markets are running out of a bit of steam this morning though with the Nikkei (-1.43%) the biggest underperformer across the region, slipping from multi-week highs while the CSI (-0.66%), the Shanghai Composite (-0.41%), the Hang Seng (-0.16%) and the KOSPI (-0.12%) are all lower. US stock futures are pretty much flat though with Treasury yields back up 0.5bps-1.5bps across the curve.

In FX, the J apanese yen continues to struggle trading -0.29% lower at 155.16 versus the dollar despite the B OJ Governor Kazuo Ueda stating that the central bank may take appropriate monetary action if yen moves significantly impact Japan’s inflation. Nothing particularly new in those comments but the government's popularity is also under pressure over the weak currency and cost of travelling to, and importing from, abroad. Trade figures for April are out tomorrow.

Back to markets and one asset that continues to struggle is oil. Brent Crude was down another -0.35% to $83.04/bbl yesterday and is trading down at $82.74 this morning. We peaked above $92 in the second week of April after Middle East tensions ramped up. This reversal has been supportive for the broader market, since its helped to ease fears about more persistent inflation. For instance, US 5yr inflation swaps were down another -0.8bps yesterday to 2.49%. This is the first time since March that they’ve closed beneath 2.5%, having fallen for 7 of the past 8 sessions.

We’ll have to wait another week for the next US CPI release and the latest on inflation, but in the meantime, and as discussed at the top, sovereign bonds posted a fresh rally on both sides of the Atlantic yesterday. In the US, that saw yields on 10yr Treasuries (-3.0bps) decline to 4.46%, whilst 2yr yields were -0.2bps to 4.83%. 2yr yields had been as low as 4.80% intra-day, with a modest rise later on in part following some hawkish comments from Minneapolis Fed President Kashkari (a non-voter this year). He said in a blog post that “ with inflation in the most recent quarter moving sideways, it raises questions about how restrictive policy really is.” But Kashkari was already one of the most hawkish-sounding members on the FOMC, so the comments have to be taken in context. Year-end Fed pricing was unchanged on the day, with 44bps of cuts priced in.

Over in Europe, the focus continued to be on the ECB, with anticipation mounting that they’ll cut rates at their next meeting in 4 weeks’ time. That contributed to a fresh rally for sovereign bonds, with the 10yr bund yield (-4.9bps) falling for a 4th consecutive day to 2.42%. That was echoed across the continent, with yields on 10yr OATs (-5.2bps) and BTPs (-2.9bps) also moving lower, whilst those on 10yr gilts (-9.9bps) saw a larger decline as they caught up with the previous day’s moves.

There wasn’t much other data yesterday, although we did get the UK construction PMI for April, which hit a 14-month high of 53.0 (vs. 50.4 expected). By contrast, in Germany the construction PMI fell to 37.5, whilst the factory orders data for March contracted by -0.4% (vs. +0.4% expected). So some negative news after what have been more encouraging recent growth data for Europe’s largest economy of late. Finally, Euro Area retail sales were up +0.8% in March (vs. +0.7% expected).

To the day ahead, and data releases include German industrial production and Italian retail sales for March. From central banks, the Riksbank will be making its latest decision, and we’ll hear from Fed Vice Chair Jefferson, the Fed’s Collins and Cook, and the ECB’s Wunsch and De Cos. Finally in the US, a 10yr Treasury auction is taking place.

US equity futures flipped between gains and losses on Wednesday while European stocks hit an all time high as May’s rally in equities continued amid a clutch of solid earnings reports. As of 7:45am, S&P 500 futures traded down 0.2%, and was near session lows reversing an earlier modest gain after the underlying gauge advanced the previous four sessions. The benchmark Treasury yield rose two basis points to 4.48%. Oil fell to the lowest level since mid-March, after a mildly bearish US stockpile report. The renewed plunge in the yen took the USDJPY as high as 155.5 amid a renewed bout of impotent jawboning by Japanese officials who however have now lost all credibility. Later today the focus will be on comments from Fed officials, including Lisa Cook, and earnings from Uber, Arm and Airbnb.

Among notable premarket movers, Lyft shares rose after the ride-hailing firm’s results and outlook beat estimates. Reddit rises 13% after the social-media company reported first-quarter results that beat expectations and gave an outlook that surpassed estimates even though there is no way in hell the company can ever achieve that forecast but at least it will enjoy a higher stock price for a few months. Here are some other notable premarket movers:

- Arista Networks gains 6.8% after the cloud-networking company posted a 1Q profit that beat estimates amid strong AI demand trends.

- Confluent climbs 7.6% after the application software company reported first-quarter results that beat expectations.

- Coupang falls 7.8% after earnings per share missed estimates, driven mostly by losses attributable to its Farfetch acquisition.

- DoubleVerify plummets 42% after the digital media measurement software company cut its full-year forecast.

- Dutch Bros jumps 7.8% after the drive-thru coffee chain lifted full-year projections for revenue.

- Electronic Arts slips 3.8% after the video-game maker’s first-quarter bookings forecast fell shy of estimates.

- Luminar rises 6% after the LiDAR sensor maker’s results broadly met expectations

- Lyft gains 5% after the ride-hailing firm’s results and outlook beat estimates.

- Rivian drops 6.8% after the EV-maker reported a wider-than-expected adjusted loss for the first quarter.

- Shoals Technologies (SHLS) falls 16% after the solar energy equipment supplier cut its revenue guidance for the year.

- Shopify shares tumble 18% after the Canadian e-commerce company reported a surprise net loss in the first quarter.

- Treace Medical tumbles 59% after the medical device company cut its full-year revenue guidance.

- TripAdvisor drops 16% after management determined that there is no transaction with a third party that is in the best interests of the company and its stockholders.

- Twilio falls 8% after the software company’s second-quarter guidance fell short of the average analyst estimate.

- Uber Technologies falls 6% as gross bookings in the first quarter missed analysts’ estimates.

- Upstart declines 12% after the consumer finance company forecast revenue for the second quarter that missed analysts’ expectations.

- ZoomInfo Technologies slumps 23% after the infrastructure software company’s forecasts for revenue and profit trailed Wall Street’s expectations.

Investors saying goodbye to Q1 earnings season and enjoying a 3% S&P 500 rally in May are now uncertain what comes next, as US policymakers signal bets on a pivot to easier policy may be premature. Minneapolis Fed president Neel Kashkari said it’s likely the central bank will keep rates where they are “for an extended period of time" although Neel is best known for always being wrong about everything so taking the other side my seem prudent.

“We are now crawling through the tail end of earnings season and the market is lapsing into complacency,” said Hugh Grieves, fund manager of the Premier Miton US Opportunities fund. “The economy is ‘okay,’ rate cuts remain on the table and the oil price is declining. Unfortunately that’s not a stable equilibrium.”

The Fed’s stubborn hawkish stance as a result of even more stubborn inflation has put it out of sync with central banks in Europe that have already embarked on easing. Earlier Wednesday, Sweden’s Riksbank kicked off its rate cutting cycle, easing policy for the first time in eight years. That followed the Swiss National Bank’s decision to leapfrog peers with an interest rate cut in March. Meanwhile, Fed Governor Lisa Cook is due to speak later Wednesday.

Europe's Stoxx 600 rose 0.4%, sending European stocks rise to a record high after another batch of strong corporate earnings including sold results from Siemens Energy (for once).

Elsewhere, strong earnings from AB InBev lift food and beverages, which leads gains among sectors, while auto stocks and miners lag, with BP notching a second day of losses. Here are the most notable European movers:

- AB InBev shares rise as much as 5%, the most in three months, after reporting stronger organic adjusted Ebitda growth than expected in the first quarter.

- Ahold Delhaize shares rise as much as 4.6% after improvement in US sales momentum and the timing of the Easter holiday drove a beat in 1Q Ebit.

- Fresenius shares gain as much as 5% after the German health-care company increased its organic revenue growth guidance for the full year.

- Siemens Energy shares rise as much as 14% after the company posted forecast-beating orders and boosted its guidance.

- Puma shares rise as much as 6.4% after the apparel retailer delivered a 1Q Ebit beat and reaffirmed its guidance for the full year.

- Alstom shares gain as much as 11% after the French train maker announced plans for a capital increase of around €1 billion.

- Evonik shares climb as much as 2.2% after the chemicals company reported 1Q adjusted Ebitda that beat estimates.

- Auto1 shares jump as much as 25% after the German used-car-dealer raised its gross profit forecast for the full year.

- Grifols shares advance as much as 5.4% after the Spanish blood plasma firm’s board of directors adopted various resolutions to strengthen corporate governance.

- Sabadell shares slip as much as 3.8% after the Spanish bank released a letter sent to its chairman on the weekend from rival BBVA, saying it had no room to improve its takeover offer.

- Continental shares fall as much as 1.8% after the German tiremaker’s 1Q Ebit missed the average analyst estimates.

- Securitas shares fall as much as 4.5% after the firm reported its latest earnings which analysts say were hit by weak cash performance.

- Carl Zeiss Meditec shares drop as much as 6.9%, the most in about a year, after the German medical optics company reported weaker-than-expected results for the second quarter.

“Right now we’re seeing the broadening of performance, especially from the earnings perspective,” Nataliia Lipikhina, head of EMEA equity strategy at JPMorgan Private Bank, said in an interview on Bloomberg TV. “The market wanted to see that earnings in different sectors, not just tech, are delivering.”

Earlier in the session, stocks in Asia were set to halt a four-day winning streak as focus shifted to earnings to validate a recent rally. The MSCI Asia Pacific Index slipped as much as 0.9% after closing at a two-year high in the previous session. Japanese tech firms Sony and Nintendo were among the biggest drags to the gauge, with the latter dropping more than 5% on weak outlook. The country’s benchmarks fell more than 1% in the region’s worst performance. Chinese onshore benchmarks posted their first decline this week amid a warning from Morgan Stanley strategists that the recent rally is likely to abate. Hong Kong stocks also fell. Index heavyweights Tencent and Alibaba are among key tech firms to release earnings next week, and the results will be crucial for the rally to resume.

In FX, the Swedish krona is among the worst performing G-10 currencies, falling 0.4% versus the greenback after the Riksbank cut its benchmark interest rate for the first time in eight years and said it could be reduced twice more in the second half of 2024. The yen weakens 0.5% against the dollar, with USD/JPY around 155.50.

In rates, treasuries were slightly cheaper across the curve with losses led by intermediate- to long-end sectors, steepening curve spreads. US long-end yields are cheaper by 2bps, steepening 2s10s spread by 1.5bp, 5s30s by 0.5bp; the 10-year is around 4.48% with bunds lagging by 1.5bp in the sector amid new record high for Europe’s Stoxx 600 Index after another batch of strong corporate earnings. Supply concession is also a factor for Treasuries with 10-year note sale later Wednesday and 30-year bond auction Thursday. Indeed, the week's refunding auction cycle continues at 1pm New York time with $42b 10-year new issue one day after Tuesday’s 3-year note sale drew good demand, stopping through by 0.3bp. WI 10-year yield at around 4.48% is 8bp richer than April’s, which tailed by 3.1bp in a poor result.

In commodities, oil prices decline, with WTI falling 1.6% to trade near $77.20. Spot gold drops 0.1%.

Looking at today's calendar, the US economic data slate includes March wholesale inventories (10am). Fed members’ scheduled speeches include Jefferson (11am), Collins (11:45am) and Cook (1:30pm) From central banks, the Riksbank was the latest western bank to commence an easing cycle cutting rates to 3.75%. Finally in the US, a 10yr Treasury auction is taking place.

Market Snapshot

- S&P 500 futures little changed at 5,214.75

- STOXX Europe 600 up 0.3% to 515.72

- MXAP down 1.0% to 176.52

- MXAPJ down 0.4% to 550.52

- Nikkei down 1.6% to 38,202.37

- Topix down 1.4% to 2,706.43

- Hang Seng Index down 0.9% to 18,313.86

- Shanghai Composite down 0.6% to 3,128.48

- Sensex little changed at 73,495.37

- Australia S&P/ASX 200 up 0.1% to 7,804.49

- Kospi up 0.4% to 2,745.05

- German 10Y yield little changed at 2.44%

- Euro down 0.1% to $1.0741

- Brent Futures down 1.2% to $82.15/bbl

- Gold spot down 0.4% to $2,305.33

- US Dollar Index up 0.18% to 105.60

Top Overnight News

- Chinese iPhone shipments jumped about 12% in March after Apple Inc. and its retailers slashed prices, official data showed, suggesting efforts to arrest an accelerating decline in sales are yielding early results. BBG

- The BOJ may take monetary policy action if yen falls affect prices significantly, governor Kazuo Ueda said on Wednesday, offering the strongest hint to date the currency's relentless declines could trigger another interest rate hike. Ueda also said the BOJ could raise interest rates sooner than expected if inflation overshoots its forecasts, or risks to the price outlook increases. RTRS

- Germany’s industrial production for Mar was a bit better than anticipated, coming in -0.4% M/M (vs. the Street’s -0.7% forecast), although Feb was revised lower (from +2.1% to +1.7%). BBG

- Sweden’s central bank lowered rates 25bp (from 4% to 3.75%) and said two additional reductions could happen in H2 (the Riksbank is only the second monetary body from an advanced economy to commence easing since the post-COVID inflation surge after Switzerland’s central bank cut in March). RTRS

- Indiana primary results showed Haley performing very well, signaling a large anti-Trump faction of the GOP exists. Politico

- Trump’s classified documents trial in Florida has been postponed indefinitely, raising the odds that the current Stormy Daniels/hush money one underway in NYC is the only verdict voters will receive before the election. WaPo

- Corporate profits are performing very well (firms beat in Q1 and analysts have been raising estimates for Q2), suggesting an economic downturn won’t occur anytime soon. WSJ

- Saudi-backed chip and AI investment firm Alat said it would divest from China if it were asked to do so by the US. The comments came after people familiar said the US revoked licenses allowing Huawei to buy chips from Intel and Qualcomm. BBG

- FTX will amass as much as $16.3 billion in cash once it sells all of its assets, far more than it needs to cover what customers lost. The extra will be used to pay them interest but nothing will be left for equity holders. BBG

Earnings

- BMW (BMW GY) Q1 (EUR): Revenue 36.61bln (exp. 36.82bln). EBIT 4.05bln (exp. 3.96bln). Automotive revenue 30.94bln (exp. 31.01bln). Automotive EBIT Margin 8.8% (exp. 9.05%). EBT Margin 11.4% (exp. 10.6%). BEV sales +28% Y/Y. 2024 outlook confirmed. Shares -4.5% in European trade

- Siemens Energy (ENR GY) Q2 (EUR): FCF 483mln (prev. -294mln Y/Y), Profit before special items 170mln (prev. 41mln Y/Y), Net Profit 108mln (exp. -11mln). Outlook: Expects sales growth 10-12% (exp. +6%), Profit margin of -1% to +1% (prev. guided -2% to +1%). Now expects FCF pretax of up to 1bln (prev. guided negative at up to 1bln). Shares +12.5% in European trade

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly lower after the choppy US performance and in the absence of fresh catalysts. ASX 200 lacked firm direction with gains in industrials and energy offset by weakness in miners and financials. Nikkei 225 underperformed as participants digested earnings including disappointing guidance by Nintendo. Hang Seng & Shanghai Comp were ultimately lower amid trade and tech-related frictions after the US revoked export licences that allowed Intel (INTC) and Qualcomm (QCOM) to supply Huawei with semiconductors.

Top Asian News

- BoJ Governor Ueda said the BoJ will scrutinise the impact of yen moves on the economy in guiding monetary policy and FX moves could have a big impact on the economy and prices, so could warrant a monetary policy response, while he added the BoJ may need to respond via monetary policy if such impact from yen moves affect trend inflation. Ueda said they expect trend inflation to gradually head towards 2% and will adjust monetary policy as appropriate if trend inflation heads toward 2% as projected or if they see a risk of inflation overshooting their forecast. Furthermore, Ueda said they don't see yen moves as having a big impact on trend inflation so far but there is a risk the impact could become more significant in the future and they won't necessarily wait until inflation achieves their forecasts in 1.5 to 2 years to raise rates with the central bank to adjust the degree of monetary support accordingly if trend inflation moves as projected.

- Japanese Finance Minister Suzuki said he is watching FX movements with a sense of urgency and won't comment on forex levels, while he added it is important for currencies to move in a stable manner reflecting fundamentals. Furthermore, he said they will take a thorough response for forex and don't believe that resources for intervention are limited.

- Chinese April Prelim Retail Car Sales -2% Y/Y (vs +6% in March).

- BoJ Governor Ueda says Japan's economy is recovering moderately albeit with some weakness; will guide policy appropriately from perspective of stably and sustainably achieving the price target. Rapid/abrupt and one-sided Yen falls are negative for Japan's economy are undesirable.

European bourses, Stoxx600 (+0.3%) are almost entirely in the green, with indices initially opening tentatively around the unchanged mark before picking up gradually to session highs throughout the morning. European sectors are mixed, with Food Beverage and Tobacco at the top of the pile, lifted by post-earning strength in AB InBev (+4.4%). Basic Resources is the clear underperformer, given the weakness in underlying metals prices; Autos are also hampered by poor BMW (-4.5%) results. US Equity Futures (ES U/C, NQ U/C, RTY -0.3%) are mixed and trading with little direction, continuing the tentative price action seen in the prior session. Apple (+0.6% pre-market) gains amid reports that its China iPhone shipments rose 12% in March.

Top European News

- The BoE should leave rates unchanged at its meeting on Thursday but consider lowering them in June, according to the Times' shadow MPC.

- UK Home Office announced on Tuesday night that it was aware of a technical issue affecting E-gates across the country, while it was working closely with the Border Force and affected airports to resolve the issue. However, Heathrow Airport later stated that all Border Force systems were now running as usual and it did not expect any issues this morning when the operation starts up.

- ECB's Scicluna is to face charges of “fraud and misappropriation,” relating to his time as the Finance Minister of Malta, via Politico citing documents.

- Riksbank cuts its Rate by 25bps to 3.75% (as expected by a majority of respondents); Policy rate is expected to be cut two more times during H2 if inflation outlook cuts (bringing total 2024 cuts to 3 vs prev. guided just over 2).

- Barclays European Equity Strategy; raises Utilities to Market Weight from Underweight; cuts Energy to Market Weight from Overweight

FX

- USD is firmer vs. all peers but to varying degrees. Support for the DXY has in large part been provided by further upside in USD/JPY. Fresh US fundamentals are lacking in what could well be a quiet week ahead of next week's inflation metrics, though a handful of speakers and supply populate today's docket. As such, DXY has continued to consolidate around the mid-point of the 105 handle.

- EUR is softer vs. the USD but less so than peers with some support via the EUR/GBP and EUR/SEK crosses. Fresh fundamental drivers for the Eurozone are lacking and expectations of a June ECB cut remain firmly anchored. Currently trading around 1.074.

- GBP is softer vs. the broadly firmer USD with UK specifics light ahead of tomorrow's BoE which some are framing as a potential dovish hold. Cable has slipped to the 1.24 handle, going as low as 1.2468.

- JPY is losing further ground to the USD with jawboning efforts from Japanese officials futile. 155.41 is the high watermark thus far with the next target a test of 156. CPI next week likely to be the next inflection point for the pair. Commentary from BoJ Governor Ueda sparked some volatility, though was ultimately unreactive to the commentary.

- Antipodeans are both softer vs. the USD with AUD lagging alongside downside in metals prices. AUD/USD has extended on yesterday's downside which has seen the pair dragged from Friday's post-NFP peak at 0.6647 to a current low of 0.6565.

- SEK is losing ground vs. peers as the Riksbank pulls the trigger on a rate reduction and leaves the door open to another two cuts in the second half of the year. Accordingly, EUR/SEK has jumped from 11.691 to a high of 11.7564 but has failed to test the YTD peak at 11.7708.

- PBoC set USD/CNY mid-point at 7.1016 vs exp. 7.2202 (prev. 7.1002).

Fixed Income

- USTs are a touch softer, in-fitting with the narrative outlined for Bunds above but with USTs yet to meaningfully or lastingly deviate from the unchanged mark in narrow 108-28+ to 109-03 bounds. 10yr supply and Fed speak from Cook, Collins and Jefferson scheduled.

- Bunds are under modest pressure as the fixed income complex takes a very slight breather from the bullish action that has been in place since the Payrolls report on Friday. After printing an earlier 131.45 base Bunds have since stabilised around 20 ticks above this.

- Gilts are essentially unchanged, and under some very modest pressure at the open which was softer by 15 ticks given bearish leads elsewhere. UK-specific developments light. Overnight, the Times Shadow MPC said the BoE on Thursday should leave rates unchanged. Currently holding around 97.95 towards Tuesday's close and by extension at the top-end of that session's 97.48-98.08 bounds.

- UK sells GBP 2.5bln 1.50% 2053 Green Gilt: b/c 3.26x (prev. 3.05x), average yield 4.545% (prev. 4.565%), tail 0.6bps (prev. 0.3bps).

Commodities

- A downbeat morning for the crude complex with newsflow rather light and Israel's Rafah operation seemingly not likely to spark a wider conflict as things stand, though the situation remains very fluid. Brent July slipped from USD 83.05/bbl to 81.96/bbl, with some flagging the 200 DMA around USD 81.95/bbl.

- Another soft session for precious metals, likely as Israel's "limited" Rafah operation has failed to spark a regional war, with international efforts also underway to cushion the impact of the incursion. XAU trades towards the bottom of a 2,303.75-2,321.53/oz range.

- Lower across the board for base metals amid a firmer Dollar and following the downbeat mood in Chinese markets overnight.

- US Private Energy Inventory Data (bbls): Crude +0.5mln (exp. -1.1mln), Cushing +1.3mln, Gasoline +1.5mln (exp. -1.3mln), Distillate +1.7mln (exp. -1.1mln).

- Russian Deputy PM Novak said there are no discussions about an oil output increase at OPEC+.

- EU Ambassadors will today be discussing a new package of sanctions against Russia, where the focus will be on restricting LNG profits, via Politico.

- Indonesia's President said copper concentrate export permits for Freeport and Amman will be extended with the details of the extension still being calculated, according to Reuters.

- Morgan Stanley has removed its USD 4/bbl risk premium from Brent forecasts, reverts forecast back to forecast of USD 90/bbl by Q3; expects OPEC to extend current production agreement at June 1st meeting, eventually to year-end, including voluntary cuts.

- China Industry Ministry says the draft rules would guide Lithium battery firms to reduce manufacturing projects that "purely" expand production capacity

Geopolitics: Middle East

- "IDF: We are conducting a precision operation in limited areas east of Rafah in the southern Gaza Strip", according to Asharq News. Additionally, "IDF says it continues operations east of Rafah", via Al Arabiya, "IDF: Hamas military infrastructure destroyed in the Rafah crossing area".

- Israeli artillery shelling was reported east of Rafah in the southern Gaza strip, according to Al Jazeera.

- Hamas said Cairo talks are the 'last chance' for Israel to recover hostage talks, according to Al Arabiya. Furthermore, a Hamas official said the group set red lines in the ceasefire negotiations that cannot be conceded, according to Sky News Arabia.

- White House thinks the Israeli operation to capture the Rafah crossing doesn't cross President Biden's "red line" that could lead to a shift in US policy towards the Gaza war although the US warned that if it broadens or gets out of control and Israeli forces go into the city of Rafah itself, it will be a breaking point, according to US officials cited by Axios.

- CIA Director Burns plans to travel to Israel on Wednesday for talks with Israeli PM Netanyahu and Israeli officials, according to a source cited by Reuters.

Geopolitics: Other

- Ukrainians hit a fuel depot in the Russian-controlled city of Luhansk, according to sources via X.

- Russia launched an air attack on Kyiv, according to Ukraine's military. It was later reported that Russia targeted energy facilities in Kyiv, Poltava, Lviv and other regions, according to Ukraine's Energy Minister. Furthermore, Ukraine's largest private electricity company said the Russian attack caused serious damage at three thermal power plants.

- Taiwan's leader is open to dialogue with Beijing on an equal footing, according to Taipei's de facto envoy to the US under President-elect Lai cited by SCMP.

US Event Calendar

- 07:00: May MBA Mortgage Applications, prior -2.3%

- 10:00: March Wholesale Trade Sales MoM, est. 0.8%, prior 2.3%

- 10:00: March Wholesale Inventories MoM, est. -0.4%, prior -0.4%

Fed speakers

- 11:00: Fed’s Jefferson Speaks About Careers in Economics

- 11:45: Fed’s Collins Speaks to MIT Students

- 13:30: Fed’s Cook Speaks on Financial Stability

DB's Jim Reid concludes the overnight wrap

As summer finally threatens to arrive here in London, even if I'm looking out on fog this morning as I type, markets continued their advance yesterday, with the risk rally continuing post what was deemed to be a very dovish payroll print last Friday. As recently as April 25th, 10yr yields peaked at 4.735% intra-day but a -28bps rally to 4.46% has come alongside a more optimistic view on rate cuts this year again. Obviously Fed Chair Powell helped this by playing down the prospect of further rate hikes at last week’s FOMC. 10yr yields have rallied around 24bps since their peak on FOMC day and yields have now fallen for a 5th consecutive session. That’s the longest run of declines since August.

Those moves on the rates side supported risk assets too, with the STOXX 600 (+1.14%) and the FTSE 100 (+1.22%) both hitting a new record yesterday as UK equities resumed trading after the holiday. The advance was more moderate in the US, but the S&P 500 (+0.13%) still posted a 4th consecutive advance despite underperformance from tech stocks. It now means the S&P has posted its strongest 4-day rally since November, having risen by +3.37% since the close last Wednesday after Powell’s press conference. Moreover, it’s worth noting that the equal-weighted S&P 500 managed to post a stronger +0.28% gain, since the Magnificent 7 (-0.50%) dragged down the rest of the index amidst larger declines from Tesla (-3.76%) and Nvidia (-1.72%). Otherwise, Disney (-9.51%) was a standout after their earnings release, and was the second-worst performer in the S&P 500 yesterday.

Asian markets are running out of a bit of steam this morning though with the Nikkei (-1.43%) the biggest underperformer across the region, slipping from multi-week highs while the CSI (-0.66%), the Shanghai Composite (-0.41%), the Hang Seng (-0.16%) and the KOSPI (-0.12%) are all lower. US stock futures are pretty much flat though with Treasury yields back up 0.5bps-1.5bps across the curve.

In FX, the J apanese yen continues to struggle trading -0.29% lower at 155.16 versus the dollar despite the B OJ Governor Kazuo Ueda stating that the central bank may take appropriate monetary action if yen moves significantly impact Japan’s inflation. Nothing particularly new in those comments but the government's popularity is also under pressure over the weak currency and cost of travelling to, and importing from, abroad. Trade figures for April are out tomorrow.

Back to markets and one asset that continues to struggle is oil. Brent Crude was down another -0.35% to $83.04/bbl yesterday and is trading down at $82.74 this morning. We peaked above $92 in the second week of April after Middle East tensions ramped up. This reversal has been supportive for the broader market, since its helped to ease fears about more persistent inflation. For instance, US 5yr inflation swaps were down another -0.8bps yesterday to 2.49%. This is the first time since March that they’ve closed beneath 2.5%, having fallen for 7 of the past 8 sessions.

We’ll have to wait another week for the next US CPI release and the latest on inflation, but in the meantime, and as discussed at the top, sovereign bonds posted a fresh rally on both sides of the Atlantic yesterday. In the US, that saw yields on 10yr Treasuries (-3.0bps) decline to 4.46%, whilst 2yr yields were -0.2bps to 4.83%. 2yr yields had been as low as 4.80% intra-day, with a modest rise later on in part following some hawkish comments from Minneapolis Fed President Kashkari (a non-voter this year). He said in a blog post that “ with inflation in the most recent quarter moving sideways, it raises questions about how restrictive policy really is.” But Kashkari was already one of the most hawkish-sounding members on the FOMC, so the comments have to be taken in context. Year-end Fed pricing was unchanged on the day, with 44bps of cuts priced in.

Over in Europe, the focus continued to be on the ECB, with anticipation mounting that they’ll cut rates at their next meeting in 4 weeks’ time. That contributed to a fresh rally for sovereign bonds, with the 10yr bund yield (-4.9bps) falling for a 4th consecutive day to 2.42%. That was echoed across the continent, with yields on 10yr OATs (-5.2bps) and BTPs (-2.9bps) also moving lower, whilst those on 10yr gilts (-9.9bps) saw a larger decline as they caught up with the previous day’s moves.

There wasn’t much other data yesterday, although we did get the UK construction PMI for April, which hit a 14-month high of 53.0 (vs. 50.4 expected). By contrast, in Germany the construction PMI fell to 37.5, whilst the factory orders data for March contracted by -0.4% (vs. +0.4% expected). So some negative news after what have been more encouraging recent growth data for Europe’s largest economy of late. Finally, Euro Area retail sales were up +0.8% in March (vs. +0.7% expected).

To the day ahead, and data releases include German industrial production and Italian retail sales for March. From central banks, the Riksbank will be making its latest decision, and we’ll hear from Fed Vice Chair Jefferson, the Fed’s Collins and Cook, and the ECB’s Wunsch and De Cos. Finally in the US, a 10yr Treasury auction is taking place.